Not Boring by Packy McCormick - Capital & Taste

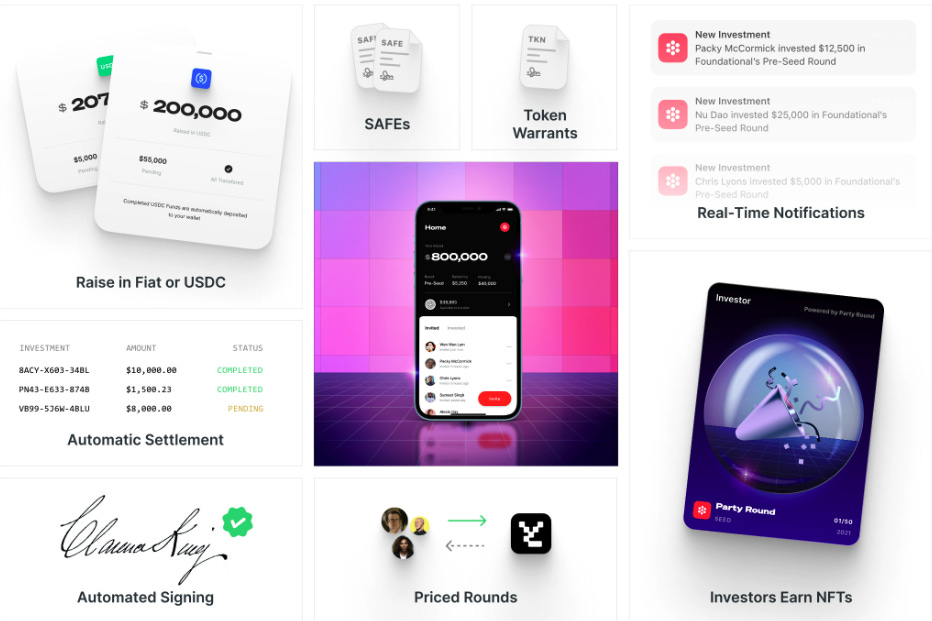

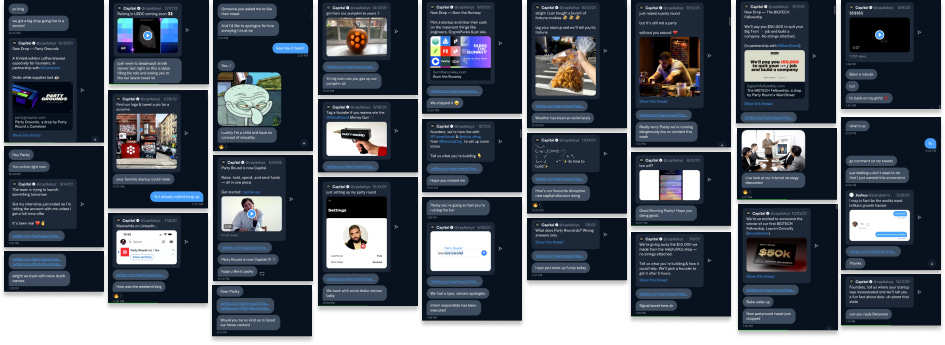

Welcome to the 2,139 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 162,527 smart, curious folks by subscribing here: 🎧 For the audio version, listen on Spotify or Apple Podcasts Today’s Not Boring, the whole thing, is brought to you by… Capital Capital is banking built for founders. If that sounds like you, sign up for a Capital account today, whether you’re just raising your first million or doing millions in ARR. Hi friends 👋 , Happy Monday! The Phillies are tied 1-1 in the World Series and the Eagles are still undefeated. How could the week start any better? A deep dive on one of my favorite companies, Capital. This is a piece that I’ve wanted to write for a very long time, pretty much since I met then-Party Round founder Jordi Hays in early 2021. The plan Jordi laid out to me back then seemed crazy, but it hit close to home: build a media business focused on founders, monetize through financial services. In the intervening year and a half, I’ve become more and more impressed with both Jordi and the company that he’s building. It’s like a reverse mullet: party in the front, business in the back. Or like an onion that looks like candy on the outside but becomes healthier and healthier each layer you peel off. I’m not great at short analogies. Please allow me ~6,000 words to explain. This essay is a Sponsored Deep Dive on a company I’ve invested in every time I had the chance. I’ve been retweeting Party Round into your Twitter feeds for a while; this is my opportunity to explain why I’m so bullish. You can read more about how I choose which companies to do deep dives on, and how I write them here. Let’s get to it. Capital & Taste"The relationship between capital and taste is complex and often contradictory." - Pierre Bourdieu Think about your bank. Really bring it to mind. Swim in it. Picture the website: the sign-on flow, transferring money, finding your account information, downloading transaction histories. Transport yourself into one of the brick-and-mortar locations: the faux-wood desks, the blue carpet, the line for the teller, the swipe-ATM-to-access after it’s been locked up for the day at like 5pm. Recall the last time you saw its marketing: smiling multicultural friends, exhortations to use the app anywhere and anytime, the big blue or red logo at the end. Would you say that your bank has taste? In his book, Distinction: A Social Critique of the Judgement of Taste, French sociologist Pierre Bourdieu argues that taste isn’t just a matter of personal preference; it’s shaped by our social position. (Admission: I’d never heard of Pierre Bourdieu before last week, but LEX recommended him when I fed it everything up to “Would you say that your bank has taste?” AI, man…) Anyway, Bourdieu believed that to have good taste is to have the capital – economic, social, and cultural – to acquire it. Hence the complex relationship between capital and taste. Capital of some form is necessary to acquire taste, but it’s clearly not sufficient. Think of the gaudy nouveau-riche. Think, again, of your bank. So much capital. So little taste. I don’t mean to pick on banks. They do their job. They make a lot of money. And they’re already under attack from dozens or hundreds of well-funded startup neobanks. Neobanks attack incumbent banks on a number of vectors. They ditch brick-and-mortar and pass savings on to customers. They do away with usurious ATM and overdraft fees. They make it dead simple to send a wire. They serve increasingly small demographic niches with tailor-made features. They benefit from a race among banking APIs to arm the rebels with sophisticated add-ons. But as the feature set gets commoditized, there’s one vector that’s remained untapped because it’s so ineffable and hard to pin down that it’s strategically risky to pursue: taste. Taste is difficult to even define. Like Justice Potter Stewart’s definition of porn, you know it when you see it. It’s about doing things that others wouldn’t dare do, and pulling them off in style. A good test might be: when someone tells you they have a marketing drop coming, do you cringe in pre-embarrassment or get excited knowing for a fact it’s going to be great? By that test, Capital has taste in spades. Taste is in its DNA, and taste permeates its strategy. Capital started its life as Party Round, the easiest way for founders to raise money from investors. If you follow me on Twitter, you’ve likely heard of Party Round. Every time Party Round launched a new drop, or really tweeted anything at all in the past two years since Not Boring Capital first invested, sure as night follows day, a DM popped into my Twitter inbox, demanding amplification. And I’m always happy to amplify, because they’re always so damn good. The only thing wilder than the volume of their drops is their consistent quality. From Helpful VCs, CryptoPunk-style NFTs of top VCs, to the Monopoly-inspired VC Puzzle in partnership with Shrug Capital, to Party Grounds in partnership with Cometeer, to Party Round Mag, each unhinged-seeming drop built the brand with a niche community: fundraising startup founders. Party Round was like fintech MSCHF. But Party Round was just an appetizer for the company’s main course. The most recent DM in my inbox from Party Round wasn’t from @PartyRound. It was from @capitalxyz, sharing this tweet:  Party Round is now Capital.

Raise, hold, spend, and send funds — all in one place.

Get started: capital.xyz Watch that video. It celebrates Capital’s customers – founders – balancing inspiration with shitposting, Steve Jobs with Adam Neumann. Taste. Capital expands Party Round’s offering from fundraising to a full suite of financial services focused on startups. Today, that’s banking – so you can hold, spend, and send the money you’ve raised with their flagship fundraising tool (fka Party Round). In the future, it might be treasury management, payroll, credit, software, and services. Capital is a big name for a small company. It hints at big ambitions. There’s a very long way between here and there, and myriad well-funded competitors lurking on the path, but if Capital lives up to its name, it will be because of its taste. Along with the launch video, and a related Nike-style video series featuring three (Not Boring Capital) founders, Capital’s first foray onto the scene was something that few Seed stage companies could even think about pulling off: with a couple of tweets (sent from LA, no less) and a website, Capital floated NYC Tech Week in August. By October, two months later, the “decentralized conference” was a real thing with hundreds of real events that thousands of founders and investors alike came to NYC to attend. Normally, throwing a big event with a bunch of otherwise busy people takes a lot of financial capital. In this case, it took taste. After a year and a half of building a brand targeted at exactly this audience, almost entirely through tech Twitter, Capital had built up enough trust to acquire peoples’ most valuable resource: their time. And that’s the bet with Capital: that leveraging its taste, and the distribution and trust it’s built up with the target customer, is the right way to compete for startups’ capital. That’s the bet that husband and wife co-founders Jordi Hays and Sarah Chase have been making from day one, when it seemed crazy. But the insight is sneaky brilliant, grounded in the reality of the competitive landscape. As The Diff author and all-around genius Byrne Hobart emailed me in a reply to a Not Boring essay a couple years ago: “For any fintech product the question always comes down to: do they have a sustainable advantage in low CAC?” With the proliferation of banking APIs in the two years since, and the fierce competition in the financial services startup space, that question has become even more relevant. When everyone wants to acquire the same customers with similar-ish products, how do you acquire them without killing your economics? Byrne’s question has stuck with me ever since, and it’s a reason that I’ve invested much more in fintech infrastructure than applications. But I invested in Capital, and doubled down when given the opportunity, because I believe they have an answer. Capital’s answer centers on three interlinked strategies:

Today, we’ll dive into Capital’s strategy, and much much more:

Capital is funny on Twitter, but its ambitions are no joke. Jordi and Sarah have their sights set on SVB, Chase, and history’s biggest financial institutions. That’s going to take some explaining. Capital’s BetsTo understand why Capital believes it can land among history’s great financial institutions, you need to understand the bets it’s making. Everything about the company is opinionated, and it will thrive or fail based on whether those opinions are correct. The foundational bet that Capital is making is one that we strongly agree with at Not Boring: startups are the engine of innovation and value creation, and will only get bigger and more important over time. Put another way, over the next century, more value will be created by companies that don’t exist yet than by ones that do, by a wide margin. Those companies have unique needs. Providing financial services to those companies will be both very lucrative and very impactful. The less time they spend banking, the more time they spend building new things. Capital isn’t the only financial services company that has that belief. AngelList certainly seems to feel the same way, as does Mercury, as do others. The question then is how to put itself in a position to serve more of those companies, better, than anyone else. Which brings us back to Capital’s three-part strategy:

To learn more about Capital’s strategy, team, opportunity, and risks, and what The New York Times missed…Thanks to Jordi, Sarah, Dylan, and Brandon for working with me on the piece and Dan for editing! That’s all for today. See you back here Friday for your Weekly Dose of Optimism. Have a great week. Thanks for reading, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Weekly Dose of Optimism #18

Friday, October 28, 2022

The Crypto Story, IEA Calling Top, Data Lasers, Schumpeter's Workout Plan, ML-Powered Drug Discovery, Bleeding Edge AI

Formic: Automating Abundance

Monday, October 24, 2022

Why Robots are good, actually, and how Formic is accelerating their adoption

Weekly Dose of Optimism #17

Friday, October 21, 2022

Cancer Vaccines, Super Sponges, Starlink Aviation, Pillars of Creation, Q>1, Lex

Gassing the Miracle Machine

Monday, October 17, 2022

Elliot Hershberg & Dr. Jocelynn Pearl on the changing landscape of science

Weekly Dose of Optimism #16

Friday, October 14, 2022

The Great and Powerful Podcast AI, Rat Humanoids, Thinking about Thinking, Not So Quiet on the Chips Front, Genius Grants

You Might Also Like

Discover a preview of the content keeping Digiday+ members ahead

Thursday, February 27, 2025

Digiday+ members have more ways than ever to stay ahead of the news and trends transforming media and marketing. Explore premium content from our editors below, including weekly briefings, research and

See you in Boston?

Thursday, February 27, 2025

...back in person for the first time since 2019! Exploding Topics Logo Presented by: Semrush Logo You follow Exploding Topics because you want to get an edge on your competition. Now take that

Why I'm doubling down on my community in 2025... (free bonus)

Thursday, February 27, 2025

Hi there 2025 is chugging along (it's almost March!) – and there's a ton going on right now. But there's something that hasn't changed. Your agency still needs a constant stream of new

Programmer Weekly - Issue 243

Thursday, February 27, 2025

February 27, 2025 | Read Online Programmer Weekly (Issue 243 February 27 2025) Welcome to issue 243 of Programmer Weekly. Let's get straight to the links this week. Streamline IT management with

🎙️ New Episode of The Dime China Tariffs & The Next Era of Vapes: Impact on Supply Chains & Brands ft. Nick Kovacevich

Thursday, February 27, 2025

Want to be featured on The Dime Podcast? Scroll to the end of this email to find out how. Listen here 🎙️ China Tariffs & The Next Era of Vapes: Impact on Supply Chains & Brands ft. Nick

80% less time on social reporting sound good?

Thursday, February 27, 2025

Get Forrester's Total Economic Impact™ of Sprout. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Social proof in email marketing, National Toast Day, and the art of CTAs

Thursday, February 27, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Python Weekly - Issue 688

Thursday, February 27, 2025

February 27, 2025 | Read Online Python Weekly (Issue 688 February 27 2025) Welcome to issue 688 of Python Weekly. We have a packed issue this week. Enjoy it! The #1 AI Meeting Assistant Summarize 1-

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo