Alameda's Messy Balance Sheet Raises Concerns About FTX Does It Pose Systemic Risk?

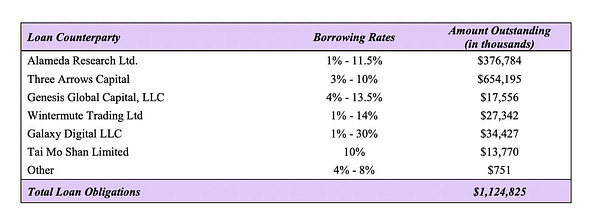

Preface: CoinDesk's report on Alameda found that its largest single asset, a large amount of collateral are FTX's platform coin FTT (most likely borrowing from FTX), a large number of opaque affiliate transactions between Alameda and FTX, previous financial products with interest rates beyond the norm, as well as large investments and acquisitions in the market, once again raising concerns. After the CoinDesk article was sent out, SBF Alameda FTX and others have not responded in detail, also from another angle to aggravate the outside world's doubts. 3AC and Tether are the institutions that outsiders like to compare FTX to. Once FTX crash, it could become a larger 3AC, posing a systemic risk to the industry. There is also a view that Bitfinex has a similar relationship with Tether as FTX and Alameda, and that Tether's transparency is starting to put it on the right track. In fact, the latter is more similar to an exchange that also has a "gold-sucking beast". The only way to dispel the doubts is to respond positively, and SBF should issue regular, open and transparent audit reports on its two institutions. CoinDesk According to a private financial document reviewed by CoinDesk, As of June 30, Sam Bankman-Fried's (SBF) asset management firm Alameda Research assets amounted to $14.6 billion. Its single biggest asset: $3.66 billion of “unlocked FTT.” The third-largest entry on the assets side of the accounting ledger? A $2.16 billion pile of “FTT collateral.” There are more FTX tokens among its $8 billion of liabilities: $292 million of “locked FTT.” (The liabilities are dominated by $7.4 billion of loans.) “It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token,” said Cory Klippsten, CEO of investment platform Swan Bitcoin, who is known for his critical views of altcoins, which refer to cryptocurrencies other than bitcoin (BTC). Alameda CEO Caroline Ellison declined to comment. FTX didn't respond to a request for comment. Other significant assets on the balance sheet include $3.37 billion of “crypto held” and large amounts of the Solana blockchain’s native token: $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.” Bankman-Fried was an early investor in Solana. Other tokens mentioned by name are SRM (the token from the Serum decentralized exchange Bankman-Fried co-founded), MAPS, OXY and FIDA. There is also $134 million of cash and equivalents and a $2 billion “investment in equity securities.” Also, token values may be low. In a footnote, Alameda says “locked tokens conservatively treated at 50% of fair value marked to FTX/USD order book.” Researcher of Huobi Incubator 0xLoki Alameda's balance sheet composition is very dangerous and if the market falls by more than 50% Alameda will face an insolvency situation. (1) Alameda has serious problems with high leverage and a very dangerous balance sheet composition. (2) FTX and Alameda's sources and uses of funds are very suspicious. (3) The excessive concentration of SOL/FTT poses a collateral risk to Defi/Cefi, which backs them as collateral.  7.即使按照100亿的资产沉淀进行估算,5%意味着5亿每年的资金成本,这显然不是来源于交易市场利润。当然无法排出高超的交易水平和投资策略能够带来丰厚的利润,但不要忘记,上一个这么辩解的人叫做Zhusu。 Binance Co-Founder Yi He Binance co-founder Yi He said of the incident, "Binance does not give unsecured loans, does not participate in transactions, does not blindly buy companies, does not blindly spend money on sponsorship, 20% of FTX's equity has been sold, heads up, heads down." 21stParadigm Co-Founder Dylan Leclair We don’t have insight into what the liabilities are denominated in. If it’s primarily USD, Alameda is in DEEP trouble. The asset side of their BS is entirely illiquid. If it’s loans denominated in ‘crypto’, it’s better, but still not great. FTX/Alameda puffed their feathers out in a big way at the bottom of the summer deleveraging… Were they really just swimming naked this entire time?  We do know that Alameda was a debtor to Voyager at the time of the 3AC bankruptcy, to the tune of $370 million.

Just how much USD denominated liabilities do they have against that illiquid pile of assets…

https://t.co/0MtFaOpVSl  Dylan LeClair 🟠 @DylanLeClair_ Famous Twitter KOL Cobie The funniest part of this to me is not the insanity of Alameda owning almost all of the float of FTT, but it’s that significant assets on their balance sheet include “MAPS, OXY and FIDA”(WuBlockchain Note: All three are small cap Token, MAPS $6.25 million, OXY $1.69 million, FIDA $130 million)  the funniest part of this to me is not the insanity of Alameda owning almost all of the float of FTT, but it’s that significant assets on their balance sheet include “MAPS, OXY and FIDA” 😐 Cinneamhain Ventures Partner Adam Cochran Alameda had $8B in loans against their assets,$5.82B of which was FTT, and there is all the locked SRM and SOL.This is a lot of leverage backed by illiquid tokens.Cause who is loaning someone $8B against that kind of collateral? Makes sense why they aggressively wanted to buy out the bankrupt lending platforms though, had any of that FTT been liquidated it would have hit these loans bad.  Makes sense why they aggressively wanted to buy out the bankrupt lending platforms though, had any of that FTT been liquidated it would have hit these loans bad Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Why is Core Scientific, the largest bitcoin miner in North America, on the brink of bankruptcy?

Friday, November 4, 2022

Editor: Kate Li, TSE Core Scientific, one of the largest publicly traded crypto mining companies in the US with a purported 457 MW of operations, filed a statement with the US Securities and Exchange

The direction of Web3 reform after Elon Musk's acquisition of Twitter

Thursday, November 3, 2022

On Oct. 28, the world's richest man, Elon Musk, completed the acquisition of social media giant Twitter for $44 billion after several twists and turns. After the acquisition, Musk fired

VC Monthly Report:Financing Amount in Oct. was the Lowest in Past Two Years

Thursday, November 3, 2022

Author: WuBlockchain Joey According to Messari, there were 71 publicized investments in crypto VCs in October, down 26% MoM (97 projects in September 2022) and down 46% YoY (131 projects in October

DID: How to return to use value from price speculation

Wednesday, November 2, 2022

Author: defioasis Editor: Colin Wu DID, full name Decentralized Identity, ie decentralized identity, is widely believed that DID has three characteristics: security, controllability and convenience.

The interpretation of the new crypto policy in Hong Kong, is it bullish?

Tuesday, November 1, 2022

Xiao Feng, Wanxiang Blockchain CEO Before March 1 next year, it is legal to set up a so-called virtual asset exchange in Hong Kong, if only trading BTC, ETH, etc., no one can stop it. In fact,

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%