Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #316

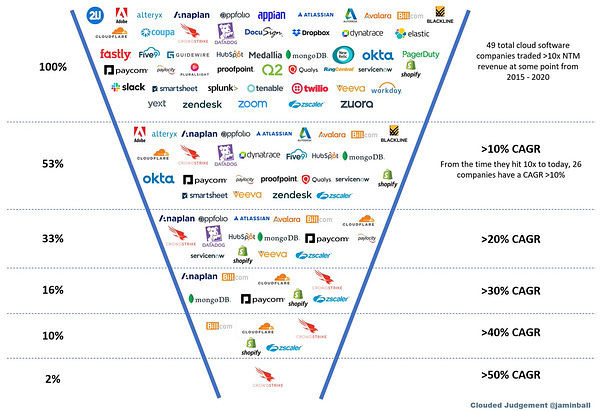

What's 🔥 in Enterprise IT/VC #316Carnage in security to come, a game of musical chairs but still massive outcomes for the winnersThere are way too many cybersecurity companies with way too much funding, and the road ahead is not going to be smooth for many. Palo Alto Networks just announced its latest acquisition of Cider Security at a price or $195M in cash and perhaps up to $300M with other incentives. In fact, PANW apparently “walked away from a $600 million deal for Apiiro in favor of a $200 million purchase of Cider Security, Calcalist reported.” To Apiiro’s credit it parlayed that into a $100M round of funding to go the distance. All of this got me thinking - what has PANW’s acquisition history been and along those lines how about Crowdstrike? What does this mean for cybersecurity startups, and the amount of capital they raise? When you have two of the largest pure play cybersecurity companies in PANW with a market cap of $50B and Crowdstrike at $32B mostly focused on adding new product to upsell to its installed base, this doesn’t bode well for the many hundreds of startups with way too much funding. Here’s PANW’s list of 18 companies, and other than Expanse which added $67M ARR, most of PANW’s acquisitions were pure play tech buys in the $150 -$300M range. Here’s Crowdstrike’s list of 5 acquisitions with Humio at $392M and the rest undisclosed which likely indicates acquihires. Let’s now look at the amount of capital raised from Cider and Humio. CiderSecurity raised $38M and if the full price of $300M is realized, the value is about 8x the cash raised. For Humio, it looks like it raised about $31.8M so this ratio is about 12.3x the cash raised. These are solid outcomes for sure, especially if the companies raised $30M or less, but as of now, there are 46 cybersecurity 🦄 and not all of them will go public. In addition, many of these companies raised from $1B+ funds so these acquisitions won’t move the needle much. (BTW, I don’t know what the valuations of the latest rounds were and this ratio is more of a rough estimate of capital efficiency vs. pure returns). Here’s another reason why 2023 will be tough for many startups - vendor consolidation. (CNBC)

And with that, PANW is going on the offensive. Here’s more from its earnings transcript from this past week. They are going for the kill and ramping up sales reps while others pull back. This an aggressive and expensive move, and it will be interesting to see how much more market share PANW is able to gain.

It’s going to be an interesting 2023 in cybersecurity. The space is absolutely huge and growing, and there are still lots of opportunities for founders, especially those creating new categories under the radar of the 🦍. For those founders, keep innovating on product, be capital efficient, and remember that each subsequent round of capital you raise also limits your exit options as your investors will also be looking for a solid return. To be fair, PANW and CRWD are not the only acquirers as Google Cloud and Microsoft have made some large acquisitions over time, but you get my point. I’m sure PANW’s acquisition will kick off a domino effect as the game of musical chairs begins and a few more companies in the CNAPP space get acquired. If you’re the last man standing, I hope you are the one who can go the distance and reap the rewards because those will be huge. Let the games begin 💪🏼! As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

|

Older messages

What's 🔥 in Enterprise IT/VC #315

Saturday, November 12, 2022

A silver lining from this past week?

What's 🔥 in Enterprise IT/VC #314

Saturday, November 5, 2022

Themes from VC Annual Meetings

What's 🔥 in Enterprise IT/VC #313

Saturday, October 29, 2022

Stormy 🌧️ ahead but keep the faith - the halo effect from public cloud spend is real

What's 🔥 in Enterprise IT/VC #312

Saturday, October 22, 2022

🙏🏼 celebrating 6 years of What's 🔥...Customers don't buy TAM, they buy products which they can't live without - how Data🐶 intense focus on 1 product in early days led to $1.6B revenue run

What's 🔥 in Enterprise IT/VC #311

Saturday, October 15, 2022

The importance of staying lean and mean in the early days

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏