Interesting research: the "World Cup effect" in the stock and crypto markets

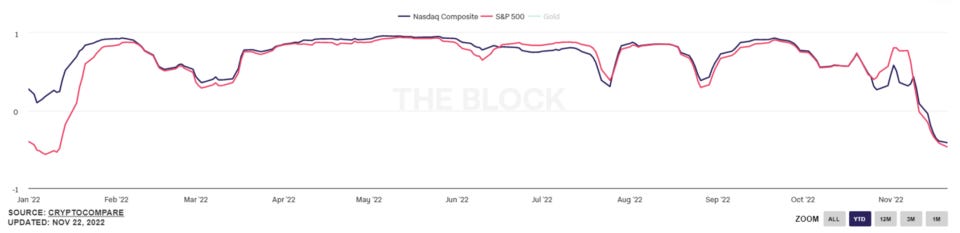

Author: @0xMavWisdom There has been a magical World Cup spell in traditional financial markets, where the markets perform poorly during most World Cups, and this effect still holds true in the cryptocurrency market. From a year-to-year perspective, the poor performance of the cryptocurrency market during the World Cup year may be related to the fact that the deleveraging cycle after the inherent bubble of the market coincides with the hosting cycle of the World Cup (every four years); In terms of months, the cryptocurrency market during the 2014, 2018 and 2022 World Cups all performed poorly. The poor performance of the cryptocurrency market during this World Cup was especially reflected in the recent slump of tokens of football fans represented by LAZIO and PORTO. During the World Cup, the performance of the cryptocurrency market is like a poisonous spell imposed on it, with the fan Token of the corresponding team plummeting before the start of the tournament, and even goals becoming the best time to “dump”, and even worse when they are scored or lost. As the cryptocurrency market matures and traditional financial capital enters, the cryptocurrency market continues to strengthen its linkage with the global equity market. According to THE Block data, the cryptocurrency market has remained highly correlated with the U.S. stock index for a longer period of time year-to-date, so we have to focus first on the impact of the World Cup on global equity markets, especially U.S. stocks. A study by academics led by Alex Edmans, entitled “Sports Sentiment and Stock Returns,” investigated how global risk markets tend to underperform during the World Cup, not only in terms of lower-than-average market volume, but also in terms of poor returns. In the case of U.S. stocks, for example, the study found that the average stock market return during the World Cup was -2.58%, while the average return for all days during the same period length was +1.21%. Although the survey data is older, from 2007, the statistics on average stock market returns during the World Cup since 2002 to the present (chart below) still confirm that the negative effect of the World Cup held on U.S. stocks is not an empty one. The scholars also found that after a country’s soccer team lost the World Cup, low investor sentiment in the losing country transmitted to the stock market, so that the stock market returns in that country were significantly lower than average the next day, while in the winning country, the researchers did not find a corresponding positive impact of the team’s win on that stock market, perhaps related to the price in of investors’ optimistic expectations. In conclusion, the point scholars are trying to make is that investors’ emotions play a powerful role in investment decisions. During the World Cup, investors’ sentiment fluctuations in each country are the hands behind the ups and downs of the local capital market, and as a cryptocurrency market where multi-national investors can participate and is highly transnational, the market volatility caused by investors’ sentiment in each country has a compounding effect in the market, exacerbating the volatility of the cryptocurrency market. In a study titled “Predictable Irrationality That Can Be Exploited,” two scholars suspect that the World Cup effect is due to the seasonal effect that occurs in June and July, which affects returns, and add variables to control for this, but statistically, the seasonal effect does not explain the World Cup effect. The original authors, Guy Kaplanski and Haim Levy, argue that because this effect is predictable, by recognizing and understanding this phenomenon, investors may find some means to exploit this effect. In this case, the most natural strategy for investors is to sell the market short before the World Cup begins, explaining the sharp pullback in soccer fan Tokens ahead of either Euro 2021 or this year’s World Cup, as well as the poor performance of the cryptocurrency market in the month of the World Cup year. Investors taking advantage of the World Cup effect will only exacerbate World Cup-induced declines, and may also cause declines to start earlier, even before the tournament begins. Thus, World Cup utility is like options irrational mispricing that does not go away over time. In addition to research by academics on investor sentiment, the shift in investor attention is also a factor in the market downturn during the months of the World Cup, which attracted more than 3 billion viewers in Russia in 2018, during which investors’ attention will shift to the betting market and their behavior will be more socially oriented, resulting in less frequent trading in the relatively formal financial markets and more “quiet” speculative hot money than usual. All in all, for the financial markets represented by cryptocurrencies and stocks, the World Cup only showed them a “yellow card” warning with less impact, but the World Cup fever could not drive the cryptocurrency market, and even the plunge should be attributed more to the “red card” events like the FTX crash and aftershocks. Reference articles: 《Sports Sentiment and Stock Returns》 Alex Edmans, Diego Garc´ıa, and Øyvind Norli 《Exploitable Predictable Irrationality: The FIFA World Cup Effect on the U.S. Stock Market》Guy Kaplanski and Haim Levy Follow us |

Older messages

World Cup Concept Leaders: Introducing Chiliz's Fan Token Economy

Tuesday, November 22, 2022

Author: @0xMavWisdom (We have no partnership or sponsorship with the projects mentioned in this article and do not provide financial advice) As the World Cup approaches, Chiliz token CHZ, a blockchain

Global Crypto Mining News (Nov 14 to Nov 20)

Monday, November 21, 2022

1. Canaan Inc. reported financial statements for the third quarter of 2022 and its third quarter revenue was $978.2 million, compared to total revenue of RMB 3.99 billion for the first three quarters,

The story of an early FTX user: How to make a lot of money from FTX and lose money because of 'faith'

Monday, November 21, 2022

First, let's count the losses in this FTX event. ● The assets still in the FTX: $225000; ● FTT's loss: $100000 ● Total $325000 This is the largest loss in the investment career, the lesson is

4 Blockchain Soccer Games Endorsed by FIFA

Monday, November 21, 2022

Author: @CC99Carol Editor: Colin Wu Abstract: The recent explosion of centralized exchanges has caused the crypto market, which has just recovered a bit of vitality, to suffer another heavy setback. On

Asia's weekly TOP 10 crypto news (Nov 14 to Nov 20)

Sunday, November 20, 2022

Author:Lily Editor:Colin Wu 1. HongKong & FTX's weekly summary 1.1 HEX Trust reduces minimum residual exposure to FTX and Alameda to zero Link Hong Kong-based institutional custodian HEX Trust

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%