Margins - FTX and How to Lose Money

Ranjan here and in today’s post I’m going to try to write about FTX. As readers have likely noticed, we haven’t been writing very much, but I’ve probably received more requests to help make sense of the FTX debacle than any other topic, even Elon. Here goes. If you follow Can or me, you probably have a sense of where we stand on crypto (not exactly bullish). My longtime gripe has been a lack of normie utility for crypto, while Can questioned the technology underlying Web3 (Note 1). Overall, I keep my skepticism at an arm’s length as there are a lot of people I consider very smart working in the space and I have to give some credit that maybe something will come out of it. But FTX. The more I read, the more my head spins and the more I keep asking myself: how did they manage to lose so much money? They’ve lost all sorts of money. Billions of real-life fiat money. Money they made up. Money others made up. The very origin story of SBF is one of Kimchi Premiums and Japan arbitrage. You all know how much I love the idea of arbitrage, but arbitrage is supposed to be free money. The whole story gets even more confusing because the corrupt relationship between Alameda and FTX should’ve given them an additional unfair edge at making even more riskless money. They shouldn’t lose money. One thing I am familiar with is market-making in illiquid instruments (if you’ve been a longtime Margins reader, you might remember me getting run over by the Dong). It’s important for people to understand the dynamics of creating liquidity in illiquid financial products to properly comprehend just how crazy it is for SBF to have lost all that money. Market-Making 101As an emerging market currency derivatives market-maker (that’s a mouthful) we’d regularly have to ‘make a price’ on currency products where almost no one was participating. To take my Dong debacle as an example:

That’s what happens when you own a typical futures contract, but things get more complicated as the market-maker.

The game, and honestly it’s a beautiful one, is different banks will compete on how ‘tight’ the spreads they make are, meaning the smallest distance between the bid and the offer. If you show a spread the customer likes, they’ll deal and then, as the market-maker, you’re sitting on some risk. In the case of my Dong disaster, we were trying to get more business out of a huge hedge fund, so I had to show a tight spread on an amount much bigger than the typical trading volume of the product. I ended up long a bunch of Dong. In a perfect world, the market-maker makes the price, gets dealt by the customer, and goes back into the market and offloads the risk. In a liquid market, I could sell someone else my Dong right away and make a little money from the spread. But this was not a liquid market and there weren’t other buyers and sellers. At that point you get stuck with the position and pray the Dong rises. It gets even more complicated because, even if your derivatives contract settles in a few months, you’re marked-to-market every day. There was a whole risk department that tried to get an accurate understanding of what your daily change in profit & loss might be. In illiquid products, the whole daily revaluation thing really was more art than science (Note 2), but your entire survival as a market-maker is properly understanding the risk that’s sitting on your books. ScrewedA few days after getting stuck with the position, the indicated price of the Dong started collapsing after not moving for a month. It gets even more complicated because of how that daily revaluation took place.

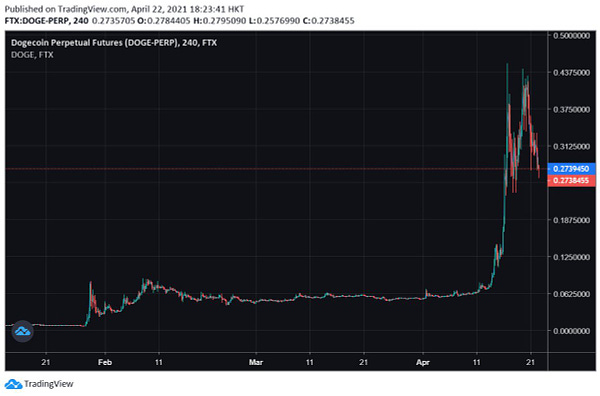

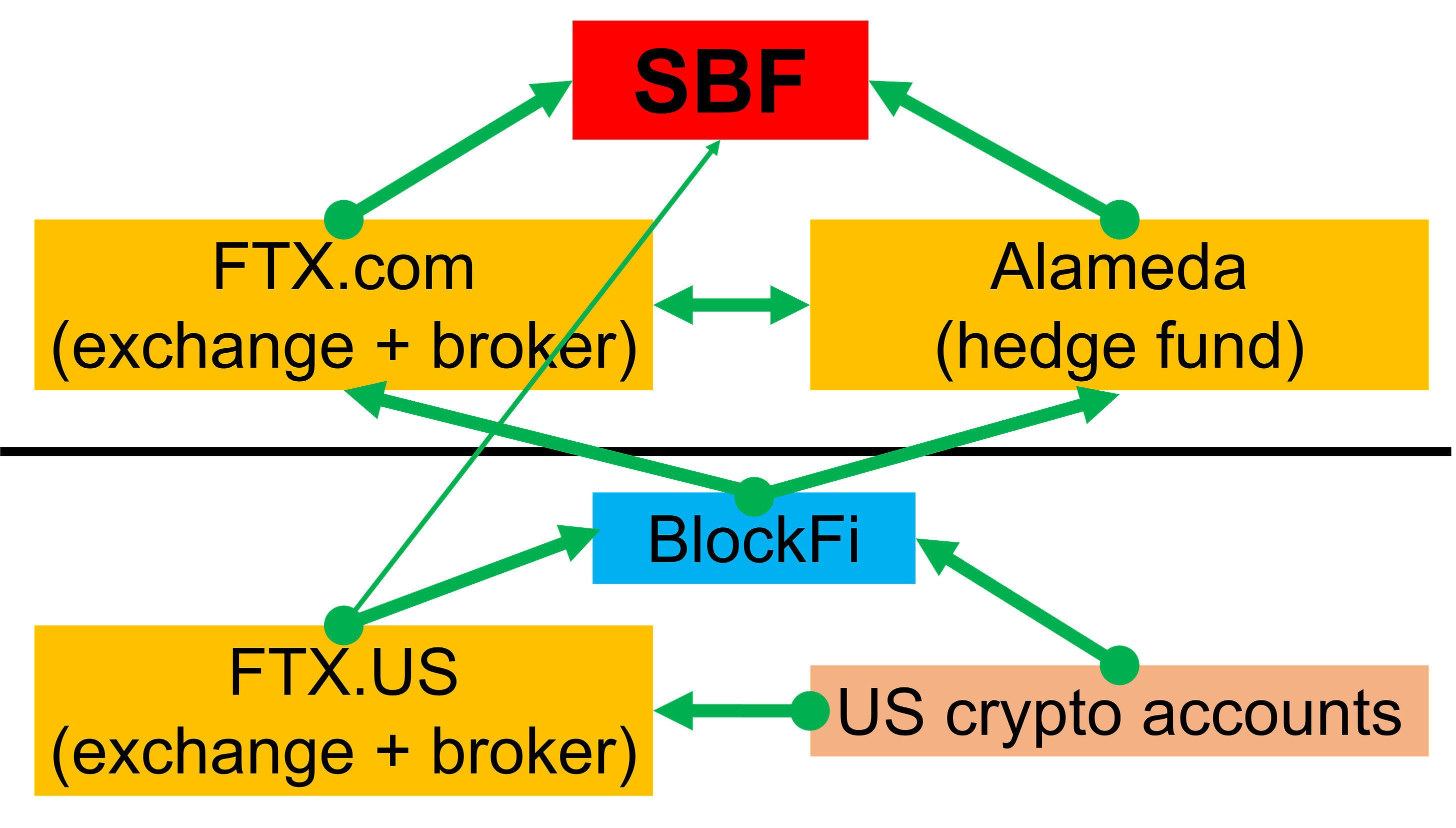

I know to the average human who lives in the normal-people world this might all sound absurd. It’s just so shady and corrupt, but I wasn’t angry a few years later when I found out that’s what likely happened. The emerging FX market was so wild west-y I’d even guess that’s not illegal. It was just a game where the more information and control over the market you had, the more you could screw others and make easy money. Back to FTXOkay, why did I just tell (and partially re-tell) you this long Dong deal in a piece about FTX? It’s because FTX was famous for making markets in anything and bragged about showing the tightest spreads in everything. FTX would quote tight markets in “Shitcoin Index Perpetual Futures.” My hope is that the financial normies reading this get a bit more understanding of the dynamics involved with making markets in an illiquid product that are controlled by a few players who have an informational edge. And that’s where I get more confused about how SBF lost so much money. The Alameda-FTX connection should’ve done the opposite. FTX could be the exchange promising Insane Financial Product™ and Alameda could make the market on FTX for Insane Financial Product™. Alameda could also be the hedge fund that went directionally long or short Insane Financial Product™. There were so many corrupt ways to make money. One of the simplest things for Alameda, the directional hedge fund, to do was front-run. They did, in fact, do things like buy up tokens before they were listed on FTX, knowing the price would skyrocket right after. That’s such easy money. But it’s not just token listings. FTX, the exchange, would have all the data on other market makers and what they were doing and what their orders were. When I had to quote the Vietnam trade, I had no idea whether I’d end up long or short Dong. I had no clear picture of what the other players were doing. I had no relationship with the central entity publishing the daily fix rate that everything was marked on. To have that kind of information should’ve been literal gold for Alameda and FTX. Alameda, the market-maker could run over every other market-maker on FTX. Alameda, the hedge fund, could take directional bets knowing every buy and sell order on the platform. FTX, the exchange, would explode in trading volume. And then you get into the retail gravy. You have Tom Brady and Gisele convincing the world to jump onto your platform and trade Insane Financial Product™. You’re Robinhood and Citadel at the same time. They could fleece retail.  Basic Blow-UpsGetting screwed by the Dong in 2007 makes me feel old for just how analog the whole process was. If all the promise of machine learning whizbangery was true, the FTX-Alameda corruption was set up to be a magical money machine. The markets they were playing were being invented in near real-time without any regulation, they controlled all the levers for how those markets should move, and they were theoretically doing it at scale with unimaginable speed and precision. That’s what keeps making it more confusing how they ended up losing so much money. But the first very clear thing that has come out has been, for all the quantitative-big-data-MIT-game-theory-talks-with-Tyler-Cowen, this was, at least partially, a tale as old as trading time. The two best pieces I’ve read on what likely happened were Sadly, FTX and What Happened at Alameda Research. They lay out in (comprehensive) detail how Alameda basically sold as a highly complex, quantitative thing that could execute infinite trades in real-time to profit from minute market inefficiencies, but were really just going long Doge. No, seriously, Alameda’s former CEO actually bragged about buying Doge after Elon tweeted about it as a trading strategy:  And even recently, this influenced how we bet on DOGE. We've held a long DOGE position for *months* and it's gone great -- all based on noticing how it goes up when Elon tweets:

- likely some bullish impetuses (Elon, TikTok, ETFs, etc.)

- more upside potential from liquidations …..in a thread about their trading superpowers where he openly says they switched to just going long stuff:  2 years ago, Alameda maintained pretty strict delta neutrality most of the time, generally trying quite hard to make sure our PNL was from spreads and arbs. Today, not so much -- we got ... uh, really long in winter 2020, for instance. What changed?

A thread about super powers. This explanation feels almost depressingly basic, but I’m sure it certainly played a part in their downfall. They were just levered long crypto-everything and got caught. But I do think there’s a bit more to the story. Master Plan SamBen Hunt at Epsilon Theory has a more ‘master plan’-ish theory of what SBF was up to. As the Alameda-FTX empire became increasingly levered, the goal shifted into amassing as many crypto assets as possible. The whole SBF loves Regulators bit was an effort to get regulatory approval to clear his own trades. The piece does a great job mapping out how all the various entities could work together to bypass regulations, help hide losses, and become a classic Madoff-like ponzi scheme where new money came in to hide earlier losses. This seems like the clear second part of the story. I’ll take this one step further, and it’s why I told you the whole Dong diatribe. Maybe the original plan was to let Alameda get run over left and right as a market-maker. They’d make markets in every imaginable Insane Financial Product™ and give the tightest spreads. Remember, the very reason our bank wanted me to make a market in the Dong was because the hedge fund asking was a big client that dealt in all sorts of asset classes in size. You might lose a bit of money up front, but you’d grow volume and make it up in the end. Maybe a chunk of the billions lost was to other crypto players who took advantage of this, but FTX, the exchange, could keep growing and keep raising money at outsized valuations. In the end, it’d be a source of real USD into SBF’s accounts. Letting Alameda take the hit to juice FTX volume is not an unreasonable idea, especially given the ZIRPsanity of the time. Any edge Alameda had (how real was any of it?) was probably eroding, and maybe SBF was smart enough to realize long Doge positions weren’t the answer. Building up FTX into the world’s second biggest exchange meant he could convince real institutions to give him real-life dollars at absurd valuations. This would have the flywheel effect of giving him billions in paper net worth, which would bring in magazine covers and more real cash through more real fundraising. And that is real cash you can basically steal. You can’t buy 19 properties worth $121 million with your parents in the Bahamas with Serum, but you can with cash from a teacher’s pension fund. You can’t use FTT to spend $100k a week on catering that you threw away. You can’t buy Robinhood or Twitter shares or become one of the biggest political donors in the country or invest $500 million back into the VCs who invested in you with shitcoins. I mean, SBF openly cashed out $300 million in their last fundraise (yes, the one where they raised $420.69 million…AYFKM 🤯!) And that’s kind of where I am at the moment. I’m actually trying to give SBF some criminal mastermind, master plan credit. I cannot believe the whole FTX fiasco was simply mismanaged risk that got hit by a crypto winter and a CZ tweet. It was not just a bank run. SBF’s original sin was the FTX and Alameda relationship, and when you bring this insanely corrupt exchange-brokerage-market-maker-fund structure all together, the only crime should’ve been making too much money (Note 3). This feels less like a ponzi scheme and more like outright theft where their cash VC funding turned into a personal bank account, and it’s not more complicated than that. Even if your directional hedge fund is making a lot of really bad trades and even if your exchange is really bad at evaluating your customer risk and even if your brokerage is really bad at allowing for margin and even if your market-maker is really bad at making prices, when you have control over all of them in markets that you control…how do you lose all that money? It still doesn’t add up, at all. Note 1: I’m not eternally anti-crypto and found a pre-margins 2018 piece of mine where I was feeling bullish crypto as a utility. It covered a ERC72 betting experience focused on the World Cup. Go USMNT! Note 2: As more comes out about how absurdly lacking any risk controls were in the SBF empire, it reminded me just how important the risk controls at trading desks were. Our head of risk, every day, ordered the same Chicken and Broccoli lunch special from the same Chinese restaurant because “he knew what he was getting and it was good value.” I think that’s exactly who you want managing your risk. Note 3: Can you think of any famous financiers who are successful examples of making crazy money thanks to an “insanely corrupt exchange-brokerage-market-maker-fund structure” 😀? |

Older messages

Shein and the Tech Cold War

Saturday, October 8, 2022

Algorithmic tweaks and clothing as trash

Why are maps so hard to make?

Wednesday, June 1, 2022

Announcing Felt's public launch and $15M Series A. Maps are fun now! Margins is back!

Late Stage Prisoners Dilemma

Friday, May 13, 2022

Tigers and hedge fund hotel parties

Elon's Giant Package

Monday, April 25, 2022

A mini-grand theory on what he's up to with Twitter

9.2% and the Master of Twitter

Tuesday, April 5, 2022

13Ds, Gs, and the SEC

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The