The Product Person - The Rise and Fall of FTX - Part Two

The Rise and Fall of FTX - Part TwoBuilding a crypto exchange, the early days of FTX, the magic beans token (FTT), and Binance vs FTX.Hello folks! Dan joining Richard from our previous post. We hope you enjoy reading Part Two of the FTX saga as much as we enjoyed putting it together for you! Part One if you missed it last time. Disclaimer: Throughout the course of research on FTX, we’ve encountered various conflicting claims on major events. Even SBF himself uses different figures in direct interviews. As a result, we primarily use documents from the FTX lawsuit discovery with sources in the footnotes. -------- Previously, we left off on Alameda’s fundraising efforts. Their pitch deck touted some incredible claims to investors, so understandably, most declined to participate. This was a massive roadblock for the Alameda team. In an interview, Sam said: “…in order to really scale to where it needed to go, Alameda would have needed—and it did eventually succeed in this, but to actually get a substantially bigger capital base than it had, if you look at the amount that we're paying on capital combined with just a bunch of other difficulties there.” [1] Alameda specialized in quantitative trading. In other words, they deployed algorithms that comb through markets to look for profitable openings. Jane Street, Sam’s former employer, is one of the top quantitative prop-trading firms (meaning it trades solely with its own capital, close to $300 billion at its peak). Quantitative trading is like picking up pennies in front of a bulldozer. Most profit opportunities are a tiny percentage of the position. For example, in a net asset value per share trade (NAV), Jane Street’s maximum upside is only 0.05% of its position. [2] So if Alameda went all in on this trade, they were risking $55 million to earn $27,500. As a result, most quantitative trading firms use leverage to reap greater profits on their trades. Alameda claimed to trade $150-300 million each day, roughly 3-6x AUM. With 6x leverage, the same trade from our prior example would net Alameda $165,000. Not bad for a day’s work. Finding risk-neutral opportunities requires heavy human and computer resources. This meant high fixed costs for Alameda. However, once the appropriate trades were discovered, the variable cost for each trade was extremely low. To make serious returns, Alameda needed more capital to deploy into each trade. Capital that investors were unwilling to give part with. Out of reach for now. Building a Crypto ExchangeWhen Alameda pulled off their Japanese arbitrage play, they used Coinbase to execute the trades. But Coinbase was designed for the average person to trade crypto, not souped-up trading firms. Alameda was forced to wait for higher withdrawal and transfer limits on Coinbase to ramp up their trades. Apart from friction with the Coinbase platform, the Alameda team knew that creating a crypto exchange could be very lucrative. In SBF’s own words during his interview with Acquired, “One cool thing about crypto is it's very transparent from some perspective. It's very easy to see how much are the exchanges making… This is circa late 2018. They were transacting how much per day? Globally, $5–$10 billion. What were their fees? They're making four basis points on average on that. That's a few million dollars a day that they're making, so billion dollars a year of revenue. It's a lot of revenue.” [1] In late 2018, Sam visited Hong Kong and spoke with a group of traders who encouraged him to develop a new derivative crypto exchange. Gary flew out to Hong Kong the next day and SBF, “… just canceled [his] return flight, rented out a WeWork, and basically never left.” [1.5] Internally, Sam and the Alameda team evaluated the chances of establishing a successful crypto exchange at 20%. But SBF felt confident. “We pretty deeply understood what product one would be to make. If you want to do this, what you need to do, the answer is like, oh, no, actually, that's pretty straightforward. We could do that.” At the time, the crypto exchange landscape was divided into two separate markets – spot and derivatives. Spot exchanges like Coinbase match buyers and sellers for each specific cryptocurrency. If you place an order to buy 100 BTC on Coinbase, Coinbase looks through its open sell orders to piece together your order – you might end up buying from 10 sellers selling 10 bitcoin each or a single seller who was selling a 100 bitcoin block. For the service of facilitating these trades, Coinbase charges a fee of 0.5% of the transaction. Derivative exchanges like Bitmex, OKEx, and Huobi function similarly to spot exchanges with one key difference – they focus on options (bets) rather than spot orders. If you wanted to bet that Bitcoin price was about to go up, you could purchase a call option to buy Bitcoin tomorrow at a strike price of $15,000. If Bitcoin prices rise, you get to ‘exercise’ the call and buy Bitcoin for $15,000 a piece. Then, you can turn around to sell it back on the market for today’s higher price for profit, or continue holding. If Bitcoin price drops, you lose the premium you paid to purchase the call. FTX chose to go after the derivatives market.

In their own words, FTX’s wanted to build an exchange “by traders, for traders”. Ironically, Enron Online used a similar motto thirty years earlier - “a system for traders designed by traders”. [3] On their best days, existing derivative crypto exchanges were loose and unprofessional. On their worst days, they were criminally negligent. Several executives at BitMEX were indicted by federal prosecutors in Manhattan on money laundering charges in 2020. [4] Many exchanges also struggled to handle liquidations in a controlled manner. For example, you use $10 to buy $100 worth of Bitcoin with 10x leverage. If the price of Bitcoin drops 10%, your $10 is wiped out. But the remaining $90 of Bitcoin is still held by the exchange, which tries to liquidate the position. If the price of Bitcoin drops by another 10%, the exchange absorbs a loss of $9. So, exchanges introduced the concept of ‘socialized losses’ or ‘clawbacks’ – redistributing losses amongst their other customers. OKEx, one of the largest futures exchanges, implemented this exact scheme in August 2018 when its algorithms liquidated a $416.9 million BTC position. OKEx socialized roughly 1,200 Bitcoin or roughly $8.8 million in losses.[5] In their own press release, “We will take a portion of the profit in equal percentage from all profited traders only to cover the difference between the liquidated price and settled price.” [6] SBF commented, “Basically, the futures [derivatives] market is half the total market. There are only two real players in it, and they're shit shows… But they're still printing money despite being shit shows. That's right, which is an interesting combination… So we just felt like, fuck it, we can do better than this.” [7] After incubating FTX within Alameda until late 2018, the two entities officially separated in May 2019. The Early Days of FTXFTX soft launched on June 1st 2019. By June 11th, they captured $50 million of daily volume on the exchange. By July 5th, $300 million daily. FTX was pulling in anywhere from $60,000 to $210,000 of revenue every single day just 35 days after launch. Two factors accounted for this explosive growth. First and foremost was Alameda’s trading activity on FTX. For every option order placed by their customers, FTX needed to find someone else to take the opposite side of the trade. Otherwise, that order stays unfilled – no counterparty, no trade. From the very beginning, Alameda was able to provide volume to the exchange by buying or selling derivative orders made by FTX’s users. This was a match made in heaven. FTX receives lots of trading volume along with the fees earned on facilitating the trades, while Alameda suddenly has access to a treasure trove of orders to pick through. For Alameda, it was like shooting fish in a barrel. The second factor to FTX’s success was their engineering prowess. This became especially apparent when they figured out a way to offer unprecedented leverage for their customers. Liquidation was a major consideration for SBF and Gary as they built FTX. By the time it was built, FTX’s liquidation engine was one of the most sophisticated in the crypto space. It was designed to automatically close positions that drop below the maintenance margin, 4.5% of position size. It does this by closing the position on the open market. However, it can be hard to liquidate larger positions quickly. To backstop this, once positions hit the Auto Close Margin Fraction (2% of position), FTX begins closing them at a discount to LPs (liquidity providers) that have opted in to the system. Then, it becomes the liquidity provider’s responsibility to determine the best course of action, whether that means holding the position for the long run or to immediately hedge. If all of the above fails, FTX auto-delevers an account’s position against non-LP accounts with opposite positions open, and attempt to cover any losses out of their insurance fund. As the last line of defense when the insurance fund runs dry, clawbacks kick in. [8] The sensitivity of their liquidation engine allowed FTX to offer up to 101x leverage. In other words, you could buy $1010 worth of Bitcoin with just $10 in capital. If Bitcoin went up even just 1%, you’d double your money. For comparison, traditional brokerages are only comfortable with leverage in the 1.5x range. Beyond even the liquidation engine, FTX was adding a new, revenue-generating product every 11 days and shipping new infrastructure features every 7 days. By July 2019, SBF was once again in talks with venture investors for a potential seed round in FTX. Chris McCann and Edith Yeung of Race Capital were involved, with the venture firm later publishing their internal deal memo on the investment. [9] By August 6, 2019, FTX had raised $8 million from investors: Proof-of-Capital, Kenetic, FBG Capital, Race Capital, Consensus Labs, and Galois Capital. The Magic Beans TokenOn July 29th 2019, FTX launched the FTX token, also known as FTT. [10] Of the 350 million total FTT tokens, FTX sold 140 million FTT at launch:

Since FTT was created by FTX, they took in roughly $70 to $95 million off the token launch sale. — Record scratch — “How did FTX instantly make almost $100 million with this thing called FTT?” Most news reports compare FTT to magic beans that sprouted from nothing. The reality is more nuanced. The FTT token rewarded its holders with discounts on FTX exchange fees based on how much FTT they held. For example, owning $100 worth of FTT granted a 3% discount on FTX fees while holding $5,000,000 FTT meant a 60% discount on FTX fees. Without getting into arcane details of the derivative markets, FTX takes a small percentage from both the buyer and seller on each trade - anywhere from 0.005% to 0.07% depending on the transaction size. These fees rack up quickly for FTX’s main users, professional traders who traded multiples of their AUM daily. Alameda was trading between $600 million to $1.5 billion with only $100m AUM in July 2019. With just a 0.04% fee, Alameda spent roughly $7-$18 million every month on trading fees alone. In percentage terms, this is 7-18% of their AUM. Ouch. Launching FTT was an instant cure. Simply holding 25 FTT tokens cut FTX trading fees by half or more. With fewer and smaller fees, FTX sees more and more people trade on their platform, which results in a more liquid market. With a more liquid market, FTX offers tighter bid-ask spreads, which means that buyers and sellers get better prices for their purchase/sale of cryptocurrency. The token’s incentives had created a powerful flywheel. FTX had successfully replicated a tried-and-true playbook previously run by other exchanges including BNB (Binance), OKB (OKEx), DEX (Uniswap), and KCS (KuCoin). [11] Taking the model one step further, FTX publicly promised to repurchase and burn tokens equal to:

In other words, FTT would become more scarce over time, phasing out the discounts on the FTX exchange. This anticipation of future demand would fuel FTT’s price growth as speculators piled on. To ensure the token launch was successful, FTX also incentivized people to buy FTT for reasons beyond exchange benefits. First, FTX promised their customers early access to purchase FTT and receive a 20% discount. This alone brought over 500 new registrations every day to FTX. The mad rush of users trying to buy FTT overwhelmed the FTX compliance department, “… trickling out of the office around 1am each day, refusing to leave until we hit our target.” Second, for the first 3 days after the token listed, buyers got 5% bonus FTT. In other words, buying $100 worth of FTT at $1 per token yielded 105 FTT tokens instead of the usual 100. Third, buyers who promised not to sell their FTT for an agreed upon period (staking) received various incentives such as increased referral rates, maker fee rebates (FTX paying you to make trades!), waived fees, and more. Officially, FTT listed at 10 PM Antigua time on July 29th on FTX, Bitmap, and CoinEx. Prices quickly rose to 70% to $1.73 per token and by August 6th, the price of FTT hit $1.81. “Ten o’clock came and there was chaos; the frantic clacking of mechanical keyboards drowned out as we shouted back and forth. After about ten seconds I asked for a status update: where was FTT trading? It was up from 1 to 1.10 on CoinEx, and $1.20 on FTX. And BitMax? ‘One forty!’, Zhi shouted back. To confirm–that’s up 40%?’ Zhi paused for a second to double check. ‘Yeah! Customers net bought a few hundred thousand so far on BitMex.’” Binance vs FTX, Round 1Riding high on their successful seed round and FTT launch, an emboldened Alameda and FTX became increasingly aggressive in their dealings with other crypto players. In September 2019, Alameda registered a large short order on Binance futures in an attempt to liquidate trading positions by triggering automatic stop-losses. Binance adjusted in a matter of minutes, restoring their future prices to proper levels without liquidations. The attack registered as nothing more than a temporary blip. [12] Later, an anonymous entity called Bitcoin Manipulation Abatement LLC, accused FTX of manipulating crypto markets, causing $150 million in losses to “numerous cryptocurrency traders.” FTX settled the lawsuit out of court. [13] Despite Alameda’s aggression, SBF and CZ (CEO of Binance) reconciled. In December 2019, Binance invested $70 million into FTX. Both CEOs publicly praised one another throughout the round. “The FTX team has built an innovative crypto trading platform with stunning growth. With their backgrounds as professional traders, we see quite a bit ourselves in the FTX team and believe in their potential in becoming a major player in the crypto derivatives markets,” said Changpeng Zhao (CZ), Binance CEO. “We are pleased to have an excellent partner joining the Binance ecosystem and aim to grow the crypto market together.” “Binance is a market leader which has strong synergy with derivatives platforms, and we appreciate their global industry leadership, consistent execution and innovation,” said Sam Bankman-Fried, Founder and CEO of FTX. “The investment will help accelerate the growth of FTX with support and strategic advisory from Binance while FTX maintains its independent operations.” [14] Officially, this became FTX’s Series A round, just months after their $8 million seed round. The $70 million check corresponded to a ~$350 million valuation, netting Binance 20% ownership of FTX post-investment. Binance and FTX had publicly established a truce and joined forces. In private, each eyed up the broader crypto market for themselves… Enjoyed reading? We run Quill, an agency for startups that delivers growth through premium content. Check us out: [1] SBF on an Acquired podcast episode. We will later learn that Alameda got a substantially bigger capital base by some funky accounting magic with FTX. [1.5] An interview by Yahoo News with SBF. I didn’t even know that Yahoo News still existed until this article. [2] SBF’s previous work history at Jane Street lent him quite a bit of street cred. Jane Street is one of the best funds of our generation. [3] Credits to Will Ahmed, founder of Whoop, for spotting this similarity. [4] Criminally negligent is often used as an exaggeration. In this case, it’s surprisingly apt. [5] I still find this quite wild. Imagine if you placed a short on the housing market in the ‘08 crisis and your broker tell you, because my other clients lost too much money, I'm taking some of your money. That’s what OKEx just did. [6] OKEx’s support article reads as if a middle school student got caught cheating and now has to begrudgingly write an apology. [7] Back to the Acquired podcast. Honestly, if nothing else, SBF loves to talk. It’s unreal how many interviews he’s given. [8] FTX built a great liquidation engine. Before November 2022, SBF sold himself as the world expert in crypto exchanges. However, after FTX blew up, SBF covered himself saying, “oops, I was being dumb and made a mistake.” [9] The FTX deal memo from Race Capital is well written. At the time, it accurately described FTX’s progress, vision, and challenges. [10] FTX has been slowly taking down public facing pages. For now, their pages on FTT still stand. [11] CoinMarketCap from earlier in our article has an extensive list of exchange tokens [12] Exchange founders and Twitter are like milk and cookies. CZ is also an avid user of Twitter, often using it to announce Binance updates. [13] There’s not a lot of information about this lawsuit unfortunately. [14] Converting first-mover advantage into a moat through capital is a classic Binance move. Enjoyed this? Please share it with a friend or two. |

Older messages

The Rise and Fall of FTX - Part 1

Thursday, December 1, 2022

A history of FTX, from inception to disgrace.

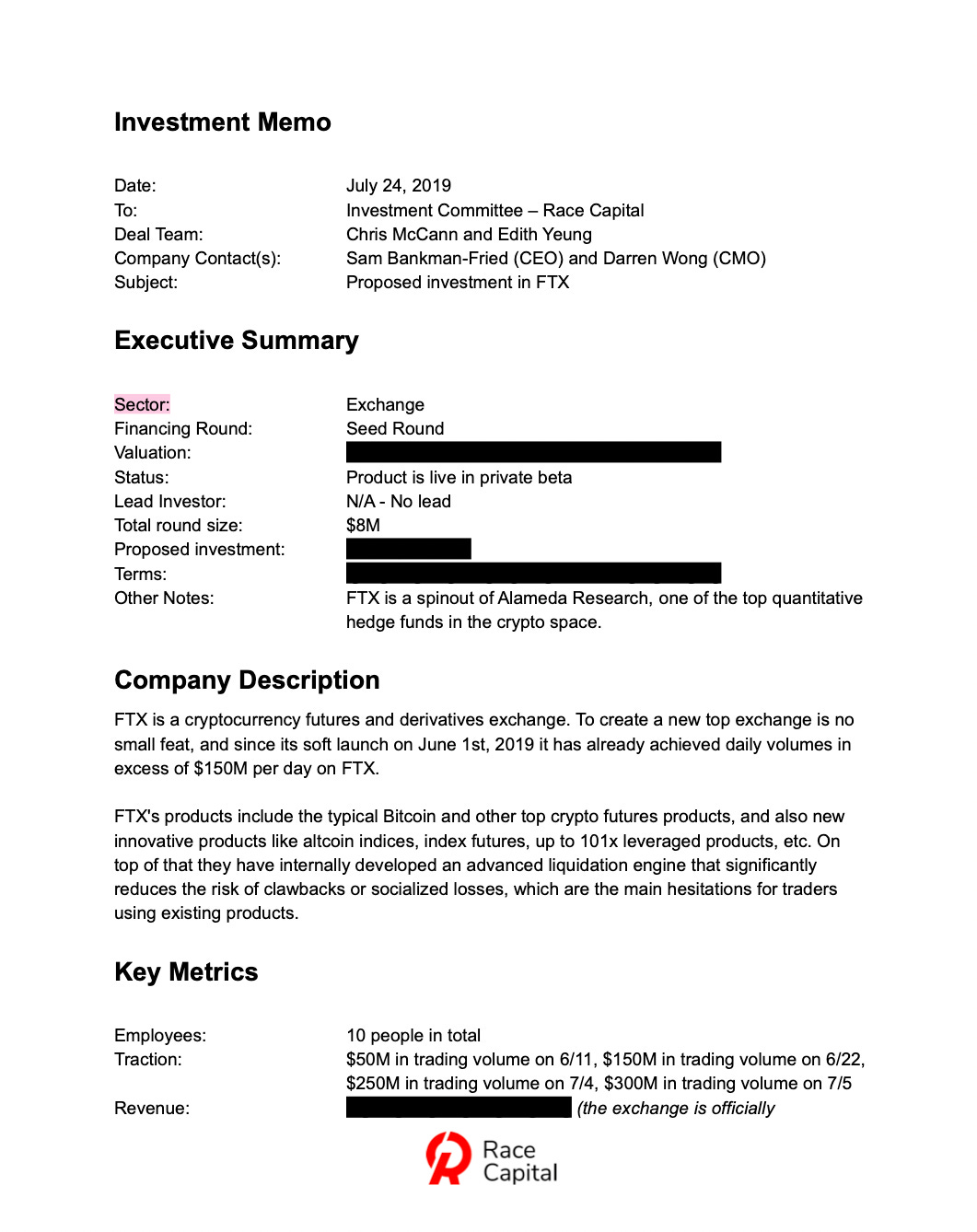

The Lean Startup

Thursday, August 25, 2022

Inside are 5 key insights from the New York Times Best-Selling Book, The Lean Startup.

7 Habits of Highly Effective Product Managers

Thursday, August 4, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's an article for you

Ann Miura-Ko on Floodgates's Thunder Lizard Theory and Achieving Product Market Fit

Thursday, July 28, 2022

Hey, Nick here! In this newsletter, I curate insights and timeless principles on how to build great products. You'll improve your product skills with every issue. Here's a video for you today…

Prioritization Shouldn't Be Hard

Thursday, July 21, 2022

Inside we discuss how product leaders should think about prioritizing strategic initiatives

You Might Also Like

Simplification Takes Courage & Perplexity introduces Comet

Monday, March 3, 2025

Elicit raises $22M Series A, Perplexity is working on an AI-powered browser, developing taste, and more in this week's issue of Creativerly. Creativerly Simplification Takes Courage &

Mapped | Which Countries Are Perceived as the Most Corrupt? 🌎

Monday, March 3, 2025

In this map, we visualize the Corruption Perceptions Index Score for countries around the world. View Online | Subscribe | Download Our App Presented by: Stay current on the latest money news that

The new tablet to beat

Monday, March 3, 2025

5 top MWC products; iPhone 16e hands-on📱; Solar-powered laptop -- ZDNET ZDNET Tech Today - US March 3, 2025 TCL Nxtpaper 11 tablet at CES The tablet that replaced my Kindle and iPad is finally getting

Import AI 402: Why NVIDIA beats AMD: vending machines vs superintelligence; harder BIG-Bench

Monday, March 3, 2025

What will machines name their first discoveries? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

GCP Newsletter #440

Monday, March 3, 2025

Welcome to issue #440 March 3rd, 2025 News LLM Official Blog Vertex AI Evaluate gen AI models with Vertex AI evaluation service and LLM comparator - Vertex AI evaluation service and LLM Comparator are

Apple Should Swap Out Siri with ChatGPT

Monday, March 3, 2025

Not forever, but for now. Until a new, better Siri is actually ready to roll — which may be *years* away... Apple Should Swap Out Siri with ChatGPT Not forever, but for now. Until a new, better Siri is

⚡ THN Weekly Recap: Alerts on Zero-Day Exploits, AI Breaches, and Crypto Heists

Monday, March 3, 2025

Get exclusive insights on cyber attacks—including expert analysis on zero-day exploits, AI breaches, and crypto hacks—in our free newsletter. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚙️ AI price war

Monday, March 3, 2025

Plus: The reality of LLM 'research'

Post from Syncfusion Blogs on 03/03/2025

Monday, March 3, 2025

New blogs from Syncfusion ® AI-Driven Natural Language Filtering in WPF DataGrid for Smarter Data Processing By Susmitha Sundar This blog explains how to add AI-driven natural language filtering in the

Vo1d Botnet's Peak Surpasses 1.59M Infected Android TVs, Spanning 226 Countries

Monday, March 3, 2025

THN Daily Updates Newsletter cover Starting with DevSecOps Cheatsheet A Quick Reference to the Essentials of DevSecOps Download Now Sponsored LATEST NEWS Mar 3, 2025 The New Ransomware Groups Shaking