WuBlockchain - Predictions for 2023 Part 3

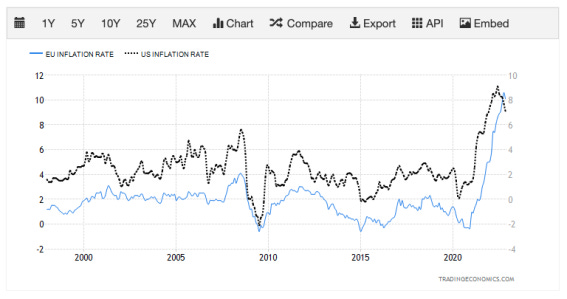

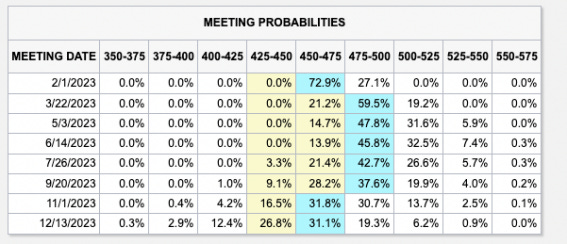

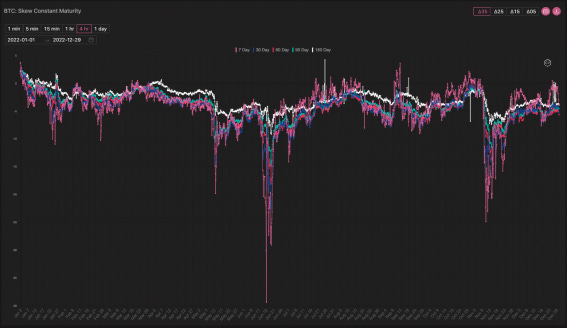

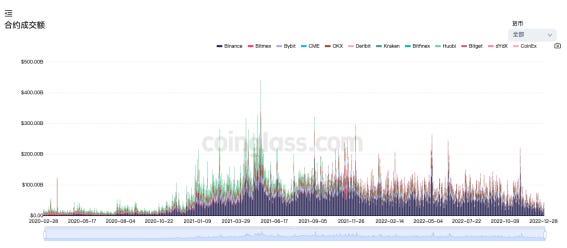

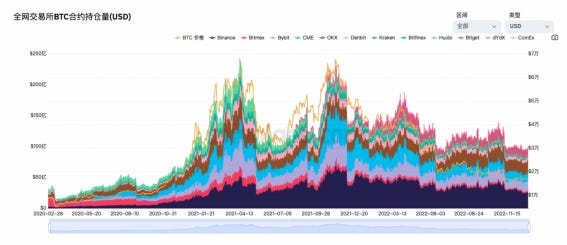

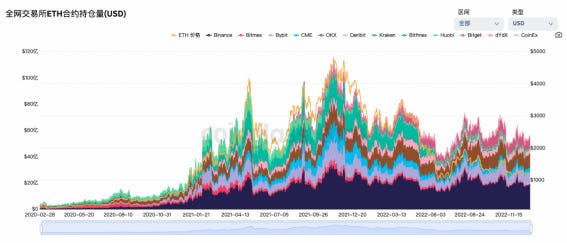

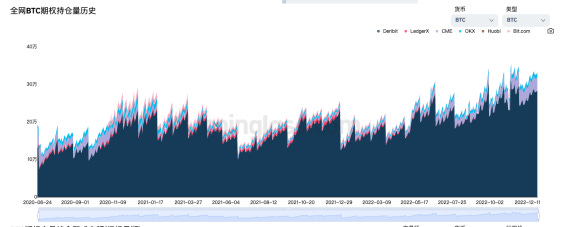

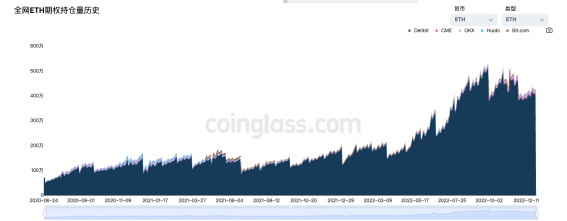

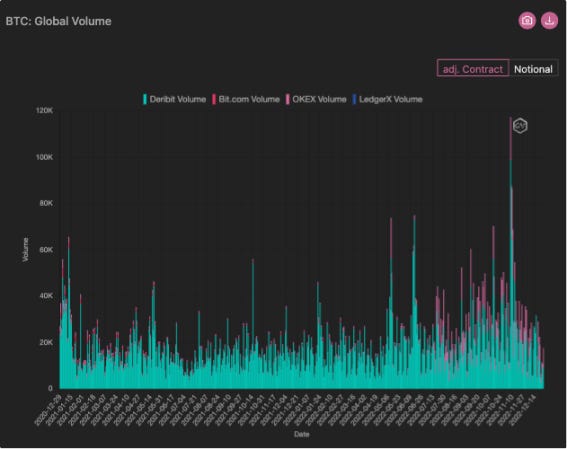

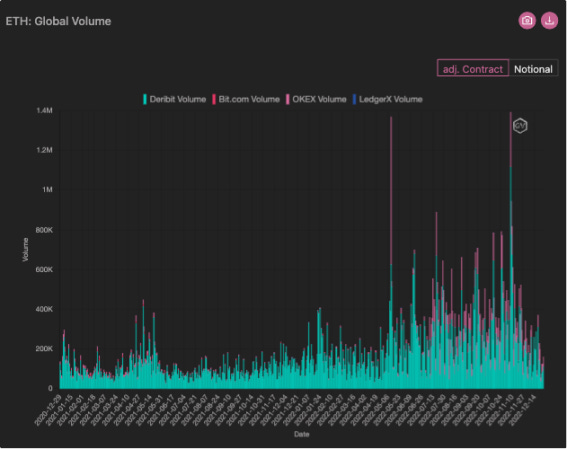

Author: Blofin Academy Next year’s macro trend forecast: In the first half of next year, the crypto market will still face strong liquidity pressure. The November-December economic data showed that while signs of recession in the US and Europe are becoming apparent, more data supported that the US economy “remains strong”, providing enough evidence for the Federal Reserve to maintain hawkish policy through 2023; Stubbornly high inflation in the region leaves the ECB little choice but to keep raising rates aggressively. Although the Fed began tapering off interest rate hikes in December 2022, inflation is far from returning to normal levels. As a result, the Fed’s “peak interest rate” will remain in place for at least six months. Traders in the interest rate market now expect rates to peak in March 2023 and last until at least November. As a result, liquidity pressure in the crypto market will remain high, and a rebound in prices and a market recovery are still a long way off. In the options market, mid-forward sentiment remains relatively bearish, not significantly improved from the start of 2022. Given the concentration of professional investors in the crypto options market, the crypto market is likely to continue to suffer in 2023. Crypto Sector Prediction: From the perspective of trading volume, both spot and future markets will shrink significantly in 2022 compared to 2021. Monthly exchange turnover in the spot market has fallen to late 2020 levels, while volume in the future market has behaved similarly to the spot market. However, traders in the future market remain relatively active from an open position perspective. Mainstream crypto future holdings, while below the bear market peak, are on par with the early and trough of the bear market — suggesting that the future market is likely to remain relatively liquid and trading opportunities through 2023. Given the stellar performance of decentralized derivatives exchanges such as GMX and dYdX in 2022, the derivatizes-related sector will also be a key node for attracting traffic in 2023. It is worth noting that the crypto options market has not been significantly affected by the bear market. The options market significantly outperformed 2021 in terms of both open interest and volume. As there are many unstable factors in the market in the bear market environment and relatively few stable and safe interest-bearing instruments and products, crypto options are favored by many investors in 2022 due to their high interest-bearing attributes and effective management ability of multiple risks. In addition, due to the concentration of professional investors and institutions in the option market, the analysis of changes in the option market can help effectively judge the possible operation and expected direction of the crypto market to a large extent. It is expected that the options-based sector (centralized/decentralized options trading business, structured products, options market data analysis, etc.) will further develop in 2023 as more professional institutions, market makers, and individual investors join the market. Author: ZhiXiong Pan, the Founder of ChainFeeds The next year is expected to see the release of indie or AAA games that VCS have been spending money on, and there could be a lot of bubble. Whether gaming is the best direction for Web3 startups will likely continue to be a question mark. There shouldn’t be any obvious breakthroughs on the technical side, but the protocol layer will continue to improve and be easy to use, and downstream developers will be more likely to develop productively efficient applications and products. Continue to focus on modular Web3 applications, which will continue to integrate more native components to provide real value products. Continue to be negative about the role of token economics in Web3, many Web3 entrepreneurs may still be obsessed with the initial flow brought by token economy, but whether it can really maintain long-term value, looking forward to next year more entrepreneurs can try again. Follow us |

Older messages

Weekly project updates: 1inch launches Fusion upgrade, new version of ERC4337, DeGods to bridge to Ethereum, etc

Saturday, December 31, 2022

1. 1inch launches Fusion upgrade to improve swap security and profitability link DeFi aggregator 1inch Network announced a major upgrade — Fusion — around its 1inch Swap Engine. The Fusion upgrade aims

WuBlockchain Research team's predictions for 2023 Part 2

Saturday, December 31, 2022

This article is the author's personal opinion and does not represent financial advice or WuBlockchain's opinion. Written By: GaryMa Market TLDR After a series of crash in crypto, there may be

WuBlockchain Weekly:BitKeep theft on a large scale、MicroStrategy sells BTC for the first time、wide spread API key …

Friday, December 30, 2022

Top10 News 1. BitKeep is suspected to have been stolen in a large area link BitKeep, a non-custodial wallet owned by Bitget, is suspected to have been stolen in a large area. The official said that it

WuBlockchain editorial team's predictions for 2023 Part 1

Thursday, December 29, 2022

Author: Joey Wu This article is only a personal opinion, does not constitute investment advice, does not represent WuBlockchain's opinion. 1. Bottom of the big cycle: 2023 is likely to be A year of

Review the Top10 important events of 2022: FTX CRASH, ETH Merge, FED Rate Hikes, LUNA, BAYC, Tornado and more

Tuesday, December 27, 2022

Written By: Colin Wu 1. FTX crashed and contagion There is nothing more important for the industry in 2022 than the collapse of the FTX, where SBF suddenly degenerated from being a builder of a huge

You Might Also Like

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: SEC Terminates Lawsuits Against Multiple Crypto Companies, Bitcoin Drops Below $80,000, OKX S…

Friday, February 28, 2025

On Friday, OKX market data revealed that BTC fell below $80000, reaching a low of $78258, with the current price at $80514, reflecting a 24-hour decline of 7.22%. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

FBI confirms North Korea-backed Lazarus hackers stole $1.5 billion from Bybit

Thursday, February 27, 2025

FBI tracks Ethereum laundering spree by North Korean hackers amid rising threat of cyber warfare in the crypto world. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with MicroStrategy Founder Michael Saylor: The Company Holding the Most Bitcoin in the World

Thursday, February 27, 2025

In this interview, Colin from WuBlockchain had an in-depth discussion with MicroStrategy founder Michael Saylor about the company's ongoing Bitcoin acquisition strategy, the growing adoption of

Abu Dhabi Invests $436.9M In Bitcoin ETF

Thursday, February 27, 2025

February 17th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Abu Dhabi Invests $436.9M In Bitcoin ETF Changpeng Zhao Sparks Meme Coin Rumours Coinbase Finally Lists POPCAT & PENGU

📈 BTC’s realised price (average acquisition price) reached an all-time high of $43,000; State of Wisconsin Invest…

Thursday, February 27, 2025

BTC's realised price reached an all-time high of $43000; Abu Dhabi's Mubadala Investment disclosed its BTC ETF holdings; South Korea to allow universities and charities to sell crypto donations

HashKey Exchange's Interpretation of the Hong Kong SFC Virtual Asset Roadmap

Thursday, February 27, 2025

We are pleased to see the Hong Kong government release the forward-looking and pragmatic “ASPI-Re” roadmap for advancing the virtual asset industry. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Argentina’s stock market plummets amid President Javier Milei’s LIBRA memecoin scandal

Thursday, February 27, 2025

Argentina's economic landscape shaken as Milei's LIBRA endorsement turns into multi-billion dollar fiasco. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Heated AMA Debate: 0G Team Responds to Allegations of CFX Soft Rug, Overvaluation, and Token Commitment Concerns

Thursday, February 27, 2025

This AMA primarily focused on the relationship between Conflux and 0G Labs, discussing 0G Labs' high valuation, fundraising structure, technical direction, and community concerns over transparency.

Pectra: Ethereum’s Next Major Upgrade

Thursday, February 27, 2025

Breaking down key changes included in Ethereum's Pectra hard-fork ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏