Happy Friday. Another economic report, another mixed signal about whether there’s going to be a recession or not.

Yesterday, the US’s Q4 economic growth figures came in, and they were…sorta good? Or, at least, better than expected? GDP growth slowed to 2.9%, down from 3.2% in Q3 2022, but still faster than was forecast, per Bloomberg. FWIW, many economists and bankers do expect there to be a recession this year, but there is a lot less consensus about the timing and severity.

In today’s edition:

5G finally has a use case—and it could disrupt internet service as we know it 5G finally has a use case—and it could disrupt internet service as we know it

The climate-tech funding tides are changing The climate-tech funding tides are changing

—Jordan McDonald, Grace Donnelly, Dan McCarthy

|

|

Francis Scialabba

Increasingly, telcos like Verizon and T-Mobile are moving into territory that has traditionally been occupied by internet providers.

Their tool of choice? 5G fixed wireless access (FWA), which uses radio frequencies to deliver a broadband connection. In the pre-5G era, relatively low speeds meant that FWA often wasn’t a viable alternative to broadband in many cases, but the introduction of C-band 5G spectrum at the start of 2022 opened the door for faster connections—and kicked off a new era in the broadband industry.

Leichtman Research Group (LRG) found that the number of new US FWA subscribers added by T-Mobile and Verizon more than tripled from Q3 2021 to Q3 2022, rising from about 190,000 to 920,000 subscribers.

- As of November 2022, the top broadband providers accounted for 110 million broadband subscribers in the US, per LRG, while FWA made up only a small chunk of that total—around 3.2 million subscribers.

And although growth returned in the following quarter, Q2 2022 was the first time that US cable giants Comcast, Charter, and Altice posted a quarterly loss in broadband subscribers, according to LRG, a decline some analysts attributed to competition from 5G FWA.

Put it in context: While FWA represents a potential challenge to legacy broadband providers, Mike Dano, editorial director of 5G and mobile strategies at Light Reading, told us that “pretty much everyone agrees that [fixed wireless] is not a permanent threat.” Read the full piece on FWA here.—JM

|

|

TOGETHER WITH LIQUIDPISTON

|

|

Meet the X-Engine™. Patented by LiquidPiston, this tiny-but-mighty engine can deliver up to 10x the power-to-weight ratio of legacy engines and up to 30% more fuel efficiency.

The EV market’s expected to grow 380% by 2030, but there will be a shortage of precious metals like lithium to build those batteries. That’s where X-Engine comes in, enabling hybrid electric cars to use 80% smaller batteries.

In fact, this technology is such a breakthrough that LiquidPiston has already secured 79 patents (granted + pending) and $30m in contracts to improve the mobility of power in ways like shrinking generators and making drones fly 2x farther.

Right now, you can become an early LiquidPiston shareholder as they upend the $400b mobile-power industry.

Invest in LiquidPiston today.

|

|

SOPA Images/Getty Images

After years of acceleration, investors may be tapping the brakes on mobility startups.

Funding for climate tech was relatively flat from 2021 to 2022, compared with investment slowdowns in other sectors, but a more granular look at the data suggests that resources have begun to shift away from previously dominant segments like transportation toward emerging technologies, according to Climate Tech VC (CTVC).

- Transportation, which has historically been the single largest climate-tech startup segment, was one of the categories driving this trend.

- Companies in transportation, energy, and food and land use made up 80% of the $100 billion invested in climate tech since 2020, according to CTVC.

Zoom out: It makes sense that transportation has historically captured so much climate-tech capital since it is responsible for the largest segment of greenhouse-gas emissions in the US. But CTVC noted there has been a mismatch in the amount of financial backing for other major emitters, like heavy industry and the built environment, over the last few years.

In 2022, investments in industrial decarbonization startups increased by 18%, built environment funding more than doubled, and dollars deployed for carbon-focused companies nearly quadrupled, according to CTVC. Read the full by-the-numbers breakdown here.—GD

|

|

Garmin

Usually, we write about the business of tech. Here, we highlight the *tech* of tech.

Car buying continues to digitize. According to Acura’s parent company, Honda, sales of its forthcoming EVs will be “100% online.” The move is apparently not an outright rebuke of dealers—Honda dealers will “remain part of the process”—but it is a notable embrace of the e-commerce model from a legacy automaker. FWIW, 49% of respondents to a 2022 CarMax survey of US car owners said they’d be comfortable with a “DTC model or similar.”

Garmin gets healthy. This week, Garmin—one of the biggest smartwatch makers—announced an FDA-cleared EKG app for its Venu 2 Plus smartwatch. Smartwatch bigwigs Apple, Samsung, and Fitbit already have EKG features, so it’s more a case of Garmin matching competitors than striking out on its own.

One last thing…FYI, in case you were looking to swap your iPhone for a newer one: Apple has reportedly decreased its trade-in values for iPhone 13 models by as much as $80.—DM

|

|

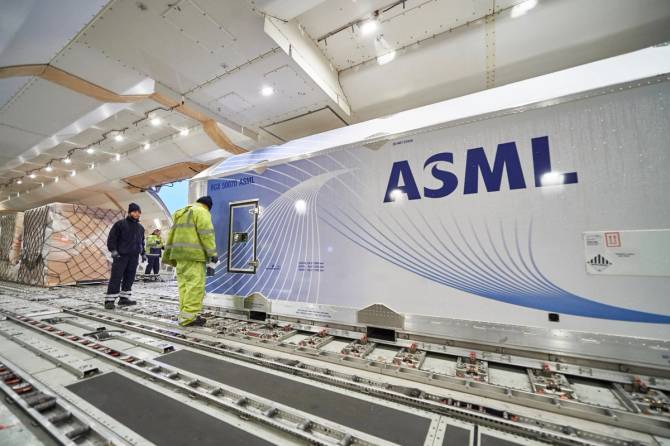

ASML

Stat: Despite the broader tech and semiconductor downturn, ASML forecast 25% YoY growth in net sales for 2023—an acceleration from last year’s 13% jump. Check our recent interview with the semiconductor lynchpin’s CFO.

Quote: “MSG Entertainment cannot fight their legal battles in their own arenas.”—New York Attorney General Letitia James in a statement regarding MSG's alleged use of facial recognition to deny entry to certain ticket holders

Read: The first interview with He Jiankui, the scientist behind the controversial “CRISPR babies,” since he disappeared in 2018.

Farewell, fraudsters: 91% of companies surveyed reported an increase in fraud last year. Alloy’s State of Fraud Benchmark Report examines how fintech companies are dodging disasters and mitigating risk. Get the report here.* *This is sponsored advertising content.

|

|

-

Microsoft’s revenue grew last quarter, but at just 2% year over year—its slowest rate in more than six years. It forecast a 3% YoY bump in revenue for this quarter.

-

Shutterstock rolled out generative AI tools to its customers, which it created in partnership with OpenAI. Meanwhile, Getty Images is suing Stability AI over Stable Diffusion, its image-generation AI.

-

NuScale received the first-ever US approval for the design of a small, modular nuclear reactor. The company had been working with the DOE to gain approval for more than a decade.

-

Senator Joe Manchin plans to introduce a bill that would delay implementation of the IRA’s EV tax credits “amid disagreements with the Treasury Department over how to implement the program.”

|

|

Three of the following news stories are true, and one...we made up. Can you spot the odd one out?

-

A Google spinoff is using AI to try and create brand-new smells.

-

The creator of a “robot lawyer” paused plans to use the chatbot in a courtroom after he was allegedly threatened with jail time.

-

NASA and DARPA announced plans to test a, uh, nuclear thermal rocket engine for the first time in half a century.

-

A hacker was arrested for programming an apartment complex’s smart dryer to use only the highest temperature, shrinking everyone’s clothes.

|

|

Catch up on the top Emerging Tech Brew stories from the past few editions:

|

|

|

We have not heard any such tales of evil, laundry-shrinking hackers getting their comeuppance.

|

|

|

Written by

Jordan McDonald, Grace Donnelly, and Dan McCarthy

Was this email forwarded to you? Sign up

here.

Guide →

What is AI?

Guide →

What is AI?

Guide →

What is 5G?

Guide →

What is 5G?

Take The Brew to work

Get smarter in just 5 minutes

Business education without the BS

Interested in podcasts?

|

ADVERTISE

//

CAREERS

//

SHOP 10% OFF

//

FAQ

Update your email preferences or unsubscribe

here.

View our privacy policy

here.

Copyright ©

2023

Morning Brew. All rights reserved.

22 W 19th St, 4th Floor, New York, NY 10011

|

|