Flipside Crypto - The outlier chain

This newsletter edition is from our new Substack, Bears Are for Building. Be sure to subscribe for free if you haven’t already! You’re likely familiar with the term outlier. A bit of data that stands out from the rest, an outlier is something - or someone - that behaves unexpectedly. And it’s that act of being different that is the reason we notice an outlier in the first place. An outlier isn’t necessarily a bad thing, or a good one, and context (or sometimes hindsight) is what decides. 7 donuts when you ordered half a dozen? Good outlier (or good marketing). Struck by lightning multiple times? Bad outlier. This week, we studied an outlier among blockchains. On-chain primitives, but make it freeCanto is a blockchain born in one of the most tumultuous times of crypto’s history — their Twitter account launched in May 2022, around when $UST depegged. While nothing in this industry can be called “traditional” by definition, most chains approach economic sustainability in similar ways — the native token incentivizes validators and funds a chain foundation that works to maintain and improve the chain. That foundation in turn often funds builders with grants or investments to come build DEXes, new token economies, and various projects to fill the ecosystem. Canto, on the other hand, decided that the core infrastructure of a blockchain should be free, rather than funded. They call it Free Public Infrastructure (FPI), saying that when foundational dapps are launched for-profit, we often see them become rent-seeking, hindering the user experience. They identified three core primitives that “have emerged to anchor any healthy DeFi ecosystem”, all of which are made free on Canto:

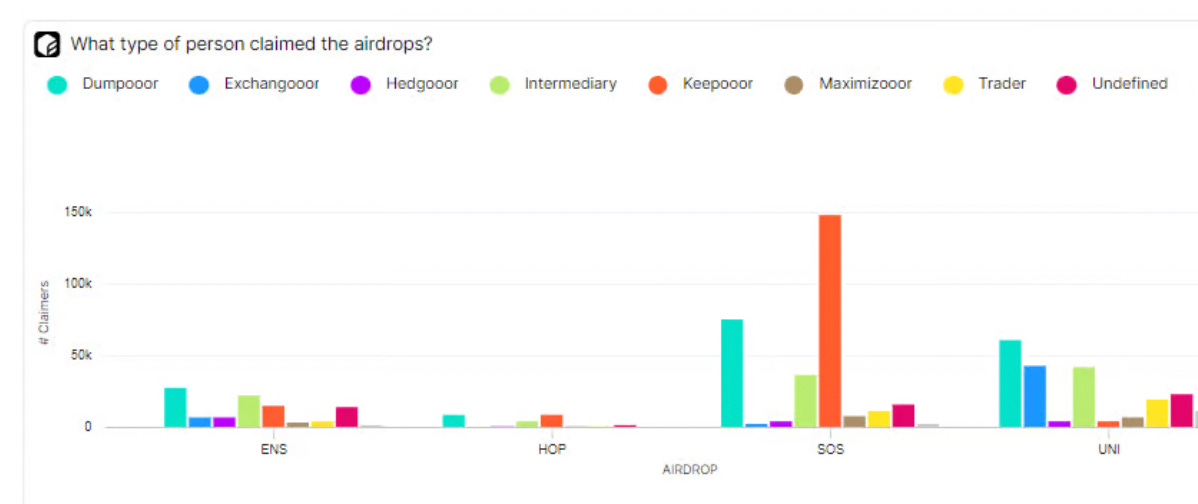

On Canto, the core DEX can’t be changed, launch a token, or add fees over time. The lending market is governed by Canto stakers (who are systemically disincentivized to be rent-seeking by design), and for the unit of account ($NOTE), an algorithm determines an interest fee rate designed to stabilize the unit’s price, with any leftovers funding additional public goods. Anyone can still build goods covered by FPI, but users will always have the native free/subsidized alternative. And whatever builders decide to build, they’re rewarded directly by the chain’s transaction fees. Contract-Secured Revenue is an approach to funding development that takes a portion of the transaction fees generated by smart contracts deployed on chain, and pays it to the builders who deployed them. So, the more your dapp gets used, the more money you make. This also means you can charge less. While it’s entirely possible builders just won’t charge less, FPI and CSR exist to protect against price-gouging — when usage guarantees revenue, anyone can deploy a quality protocol and earn support. Okay, sounds cool and all, but will it work? Who knows? We should always be cautious with new experiments. But it’s probably good someone’s trying. — This week, we launched a new show in which Flipsiders interviewed two Canto validators. Every week we'll bring you analysis, data, and insights into the most talked about or underrated parts of the industry. Watch the 30-minute episode here. — Airdrop AnalysisDid you know we have a research-focused newsletter? The Flip is a collection of deep-dives and topical analyses into hot crypto topics. Below is an analysis that asks, Do airdrops even work? As part of our post-airdrop analytics, we've developed 8 action categories to understand how people react to airdrops, what they do with the tokens, and how the distribution of these responses differ across airdrops. The actions are:

In the above chart, we can see the concentration of each for popular airdrops. Since most airdrops are primarily a user acquisition strategy, we’ll want to see higher concentrations of Keepooors and Market Makers, with less Dumpooors, Maximizooors, etc. Check out the full the report for more. — And finally, want more executive insights and crypto research? Subscribe to Bears Are for Building for free! |

Older messages

Why I'm bullish on the '23 bear

Friday, January 20, 2023

A letter to the Flipside team, by CEO Dave Balter.

Crypto regulation gone wrong

Friday, January 20, 2023

Is this "crypto regulation" in the room with us? By Mike Featherstone.

How blockchain changes us

Friday, January 6, 2023

(Or, "the future is now, old man"). By Daphne Kwon.

Everyone's watching

Friday, December 30, 2022

Building in public, crypto's not-so-secret weapon. By Daphne Kwon

Why I left TradFi for Crypto

Friday, December 23, 2022

(We)b3 Can Do Better

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏