Astral Codex Ten - Mantic Monday 1/30/2023

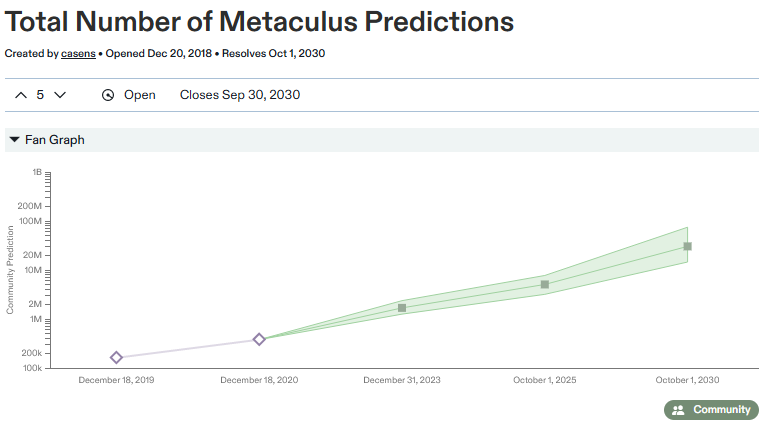

Happy One Millionth Prediction, MetaculusMetaculus celebrated its one millionth user forecast with a hackathon, a series of talks, and a party: This was a helpful reminder that Metaculus is a real organization, not just a site I go to sometimes to check the probabilities of things. The company is run remotely; catching nine of them in a room together was a happy coincidence. Although I think it still relies heavily on grants, Metaculus’ theoretical business model is to create forecasts on important topics for organizations that want them (“partners”) - so far including universities, tech companies, and charities. A typical example is this recent forecasting tournament on the spread of COVID in Virginia, run in partnership with the Virginia Department of Health and the University of Virginia Biocomplexity Institute (this year’s version here). The main bottleneck is interest from policy-makers, which they’re trying to solve both through product improvement and public education. In December, Metaculus’ Director of Nuclear Risk, Peter Scoblic, published an article in Foreign Affairs magazine about forecasting’s “struggle for legitimacy” in the foreign policy world. It’s paywalled, but quoting liberally:

It concludes:

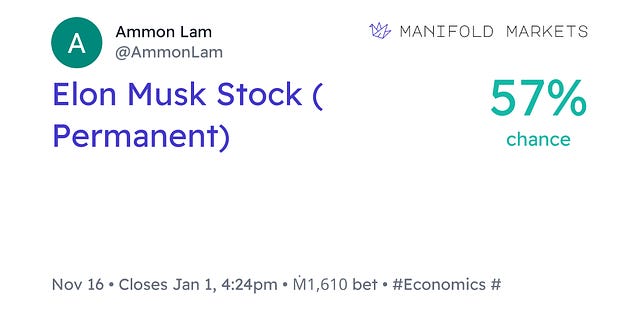

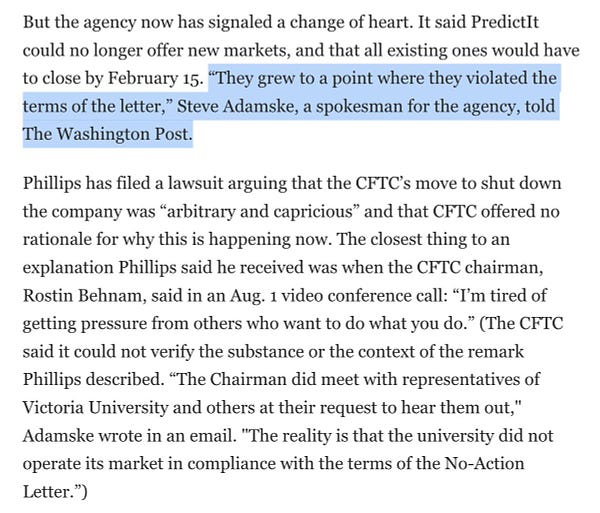

These are the kinds of questions Metaculus-the-organization is thinking about, and the kinds of problems it’s trying to solve. They’ve also got some exciting ideas for making their product more policy-relevant. For example, they’re working on causal modeling, where forecasters not only predict the chance of (eg) a Russian nuclear strike, but also all of the inputs into their decision. For example, there’s a 10% chance of a strike, which comes from a 15% chance if the war in Ukraine continues vs. a 5% chance if it doesn’t. And they think there’s a 50% chance the war will continue, which comes from a 60% chance if the US stops arms shipments and a 33% chance if it doesn’t - and so on. Policymakers can play around with the causal graph, investigate which factors make a strike more vs. less likely, and check how their preferred policy would affect things they care about. For more on the intersection of forecasting and policy, see this EA Forum post. To learn more about Metaculus, follow them on Twitter or Facebook. And here’s to many millions more predictions! Taking StockPrediction market users really want stocks. “Stock” in this sense means an instrument that measures the status of a person, group, or idea. When their status goes up, the stock goes up. When their status goes down, the stock goes down. It feels like a natural way to bet on things like “I’m bearish on Elon Musk and think everyone else is overestimating him.” It’s hard to turn this vague idea into a real financial instrument. You could try tying it to their Twitter follower count, or Google search trends, or net worth, but none of these exactly track “status”. If Musk commits murder in broad daylight, his search volume will go up, his Twitter follower count will stay about the same, his net worth might not be affected, but his status will have gone way down. The current solution is to make no effort whatsoever to moor stocks to the real world and just hope they work out. This could work! It’s kind of like a Ponzi scheme or crypto token. Some big influencer endorses MoonCoin, and MoonCoin goes up, because MoonCoin has gained status, which means more people will want to buy it, because it’s even more likely that more people will want to buy it later. Crypto tokens keep a fig leaf of “and maybe in the cyberpunk future when all transactions everywhere have switched to crypto this will really pay off”, but over time that fig leaf became increasingly threadbare, and a fun low-stakes instrument like Manifold stocks might do fine without it. But the 0% to 100% prediction scale is a bad match for stocks. If Elon started at 50% in 2000, then when Tesla made it big he surely should have doubled. And that brings him up to 100% and leaves nowhere for him to go. Also, people who bet on Elon Musk in 2000 might be miffed that their prescient choice only doubled their money. Probably the solution is some kind of cardinal number. But which one, and at what scale? Again, the lesson from crypto is that maybe it doesn’t matter. Just start at 10 or something or something and see where it ends up. Manifold leadership isn’t totally resigned yet to having stocks be meaningless Ponzi schemes. If you have a better idea for how to run stocks, leave it in the comments here and they’ll probably see it. CFTC vs. PredictIt Update Important update: The Fifth Circuit Court of Appeals has granted an injunction allowing PredictIt to continue operating while the Court considers granting longer term relief. So far it’s not clear if this means indefinite normal operation, or if they’ll spend the extra time trying to wind existing markets down. The overall chance of them winning their lawsuit remains unchanged at around 25%. PredictIt has gotten some sympathetic news coverage, including from the Washington Post. In the process, the Post tried to get some clarity on what terms of the no-action letter PredictIt violated, apparently without success:  The Washington Post asks the @CFTC why they're shutting PredictIt down. They give no real answer, just as in the original withdrawal letter. Closest thing we have to an answer is that they don't want other prediction markets. But why? No sense here at all. washingtonpost.com/lifestyle/2023…  @StephenPiment I'm flat appalled the CFTC said "you violated terms", but won't tell anyone, @PredictIt included, which ones, and then has big enough balls to try to get the judge to dismiss PI's "shotgun" defense. Um, with no info what other case COULD they make?

I guess they’ll have to give some kind of explanation during the hearing, right? Related: Richard Hanania has an article on How To Legalize Prediction Markets. The actual advice isn’t very surprising, and mostly boils down to “write letters to the government officials in charge of this”, but like other people I learned something new from the details:

Read the full article if you want to learn more, or hear about how you should contact your representative to change this. From The Department Of “Probably Not A Superforecaster”One goal of forecasting technology is to incentivize good predictions and create accountability for bad ones. Meanwhile, here’s former Russian President Dmitri Medvedev:  On the New Year’s Eve, everybody’s into making predictions

Many come up with futuristic hypotheses, as if competing to single out the wildest, and even the most absurd ones.

Here’s our humble contribution.

What can happen in 2023:  1. Oil price will rise to $150 a barrel, and gas price will top $5.000 per 1.000 cubic meters

2. The UK will rejoin the EU

3. The EU will collapse after the UK’s return; Euro will drop out of use as the former EU currency  4. Poland and Hungary will occupy western regions of the formerly existing Ukraine

5. The Fourth Reich will be created, encompassing the territory of Germany and its satellites, i.e., Poland, the Baltic states, Czechia, Slovakia, the Kiev Republic, and other outcasts  6. War will break out between France and the Fourth Reich. Europe will be divided, Poland repartitioned in the process

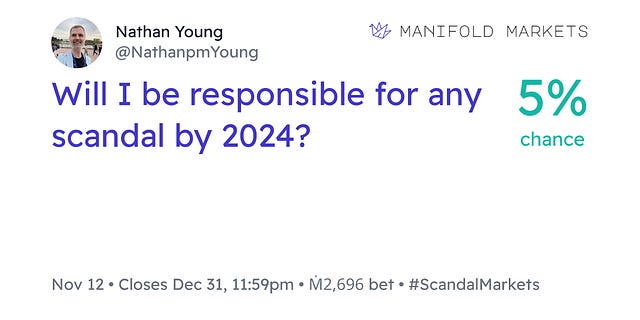

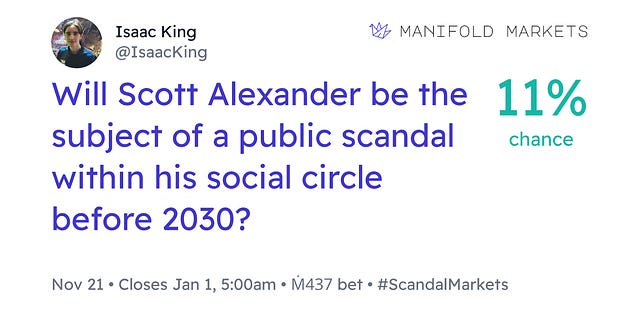

7. Northern Ireland will separate from the UK and join the Republic of Ireland  8. Civil war will break out in the US, California. and Texas becoming independent states as a result. Texas and Mexico will form an allied state. Elon Musk’ll win the presidential election in a number of states which, after the new Civil War’s end, will have been given to the GOP  9. All the largest stock markets and financial activity will leave the US and Europe and move to Asia  10. The Bretton Woods system of monetary management will collapse, leading to the IMF and World Bank crash. Euro and Dollar will stop circulating as the global reserve currencies. Digital fiat currencies will be actively used instead I don’t think he’s being completely serious, but if it’s a joke then I don’t get it. None Dare Call It . . . CONSPIRACY!We’ve previously talked about prediction markets as solutions to misinformation and conspiracy theories. What happens if you skip all the intermediate deconfusion steps and just try to predict if misinformation is true? I guess you get this. It’s pretty limited, since it can only predict the chance the conspiracy will be discovered; a conspiracy theorist might agree that there’s only a 3% chance we will get proof of this in the next few years. When I first looked into this a few weeks ago, a few conspiracy-related prediction markets gave pretty high predictions, because people weren’t sure if the market creators would resolve them honestly, which naturally pushes the price towards 50. I can see this going badly if someone who doesn’t know this failure mode posts one of them on social media as “proof” that prediction markets support their conspiracy theory. But right now the worst example I can find is still only 11%. Also a good sign: the lizardman prediction market is within 1 pp of the Lizardman Constant. My 2022 CalibrationMost of my 2022 predictions got folded into the 2022 contest, but not all of them, so I still need to score the remainder. Of my 50% predictions, 5 were right and 5 wrong, for a score of 50% The numbers look bad, but the graph looks good. Weird. These are probably too few questions to have an opinion. I’ll average them with past years sometime. Scandal Markets RevisitedIn November, just after the FTX collapse, we talked about scandal markets - markets that might predict whether some person or group was secretly doing something terrible. With such a market in place, people could either avoid associating with them (if it was high) or prove that they were blameless and couldn’t possibly known (if it was low). Since then, several things have happened that have made me less optimistic about these:

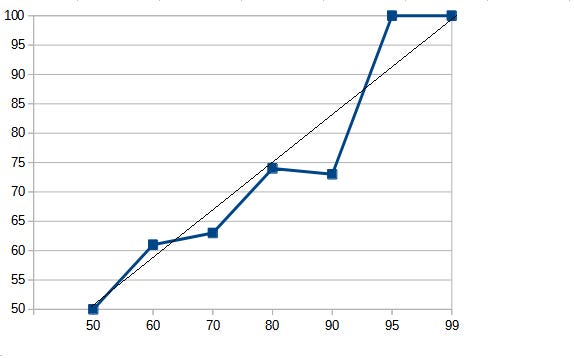

The specific updates I made on this are:

Are there ways around this? One way is extremely limited markets, like “will X be found to have committed fraud?” …but this obviously restricts what kinds of problems it can pick up. I could go on a murder spree and this would still resolve negative. This market tries to steamroll through the problem. It says:

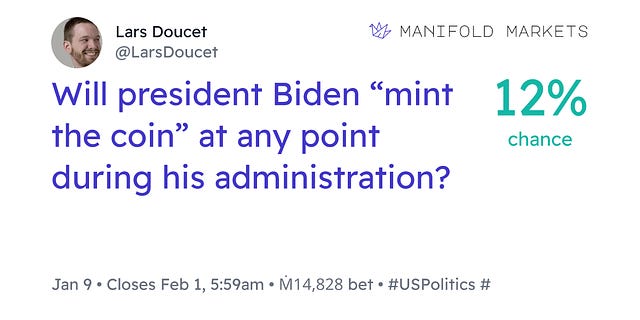

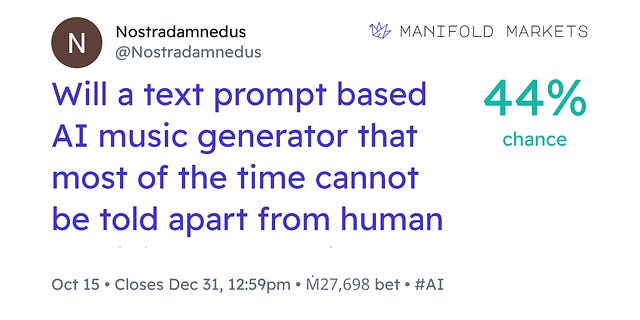

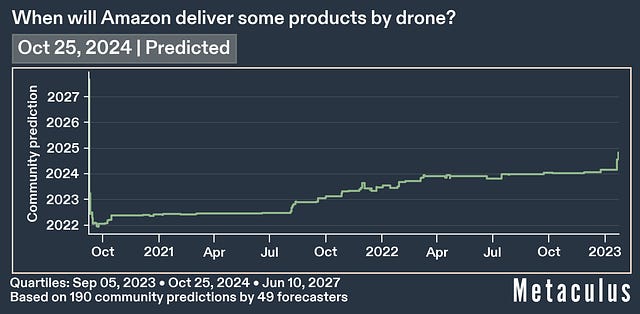

I agree that this is better than the vague framing, since it restricts the problem to scandals that we-the-abstract-set-of-people-making-and-using-the-market care about, but it doesn’t solve the KiwiFarms problem. You could solve it by banning comments, but half the benefit of these markets is incentivizing whistleblowers to come out. For now, I think direct scandal markets are a bad idea, and more careful scandal markets like the one above should be started only with caution. I think there’s more of an argument for doing this with public figures and people you’re depending on (the way charities that took FTX funding depended on FTX); public figures are probably more used to having random allegations like them thrown around. Still, the border between public and nonpublic figure is fuzzy and I would err on the side of caution. This Month In The MarketsUseful input to our previous discussion on whether all crypto things are scams or scams are actually quite rare - although I think this is somewhere in the middle, a 10%-per-two-years failure rate for the most trustworthy crypto-institution is still pretty bad Another useful contribution to discussions of whether crazy financial things a lot of people talk about will or won’t happen. I think no. If he does really well, everyone will shrug and not care, because of course he would; if he does badly, people will make a big thing of it. Of course, the alpha move would be to join, bet all of his starting money on “yes” in this market before anyone else knows about it, collect his winnings, then never bet again. Current level is 4%. I think this is moving forward at a rate of one year per year. Selection bias! Shorts1: The American Civics Exchange sells contracts on political futures. Does that make it a prediction market? Not exactly:

And they don’t give consistent, public prices for any of their contracts. In other words, they have every aspect of a prediction market except the predictions! I have to admit, I thought “some people might genuinely need to hedge political events” was kind of a fig leaf for prediction markets’ other good qualities, but this seems to take it very seriously. Related: their Twitter account. 2: How much money is in forecasting, where? Crypto vaporware is worth 100x as much as non-crypto beloved widely-used sites, but I think that’s probably either an artifact of the market cap measure, or obsolete. 3: “Squiggle is a is a special-purpose programming language for generating probability distributions, estimates of variables over time, and similar tasks, with reasonable transparency.” You're currently a free subscriber to Astral Codex Ten. For the full experience, upgrade your subscription. |

Older messages

Open Thread 261

Monday, January 30, 2023

...

Janus' Simulators

Thursday, January 26, 2023

This post isn't about AI, but bear with me

You Don't Want A Purely Biological, Apolitical Taxonomy Of Mental Disorders

Wednesday, January 25, 2023

...

Who Predicted 2022?

Tuesday, January 24, 2023

Winners and takeaways from last year's prediction contest

Open Thread 260

Sunday, January 22, 2023

...

You Might Also Like

☕ Whiplash

Monday, March 10, 2025

Amid tariff uncertainty, advertisers are expecting a slowdown. March 10, 2025 View Online | Sign Up Marketing Brew Presented By StackAdapt It's Monday. The business of sports is booming! Join top

☕ Splitting hairs

Monday, March 10, 2025

Beauty brand loyalty online. March 10, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach Let's start the week with some news for fans of plant milk. A new oat milk, Milkadamia Flat

Bank Beliefs

Monday, March 10, 2025

Writing of lasting value Bank Beliefs By Caroline Crampton • 10 Mar 2025 View in browser View in browser Two Americas, A Bank Branch, $50000 Cash Patrick McKenzie | Bits About Money | 5th March 2025

Dismantling the Department of Education.

Monday, March 10, 2025

Plus, can someone pardoned of a crime plead the Fifth? Dismantling the Department of Education. Plus, can someone pardoned of a crime plead the Fifth? By Isaac Saul • 10 Mar 2025 View in browser View

Vote now for the winners of the Inbox Awards!

Monday, March 10, 2025

We've picked 18 finalists. Now you choose the winners. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡️ ‘The Electric State’ Is Better Than You Think

Monday, March 10, 2025

Plus: The outspoken rebel of couch co-op games is at it again. Inverse Daily Ready Player One meets the MCU in this Russo Brothers Netflix saga. Netflix Review Netflix's Risky New Sci-Fi Movie Is

Courts order Trump to pay USAID − will he listen?

Monday, March 10, 2025

+ a nation of homebodies

Redfin to be acquired by Rocket Companies in $1.75B deal

Monday, March 10, 2025

Breaking News from GeekWire GeekWire.com | View in browser Rocket Companies agreed to acquire Seattle-based Redfin in a $1.75 billion deal that will bring together the nation's largest mortgage

Musk Has Triggered A Corporate Deregulation Bomb

Monday, March 10, 2025

A Delaware bill would award Elon Musk $56 billion, shield corporate executives from liability, and strip away voting power from shareholders. Forward this email to others so they can sign up “

☕ Can’t stop, won’t stop

Monday, March 10, 2025

Why DeepSeek hasn't slowed Nvidia's roll. March 10, 2025 View Online | Sign Up Tech Brew Presented By Notion It's Monday. So much is happening all the time, so you'd be forgiven for