Decentralized Real Estate Project Parcl: Combining NFT, DeFi and Home Sales

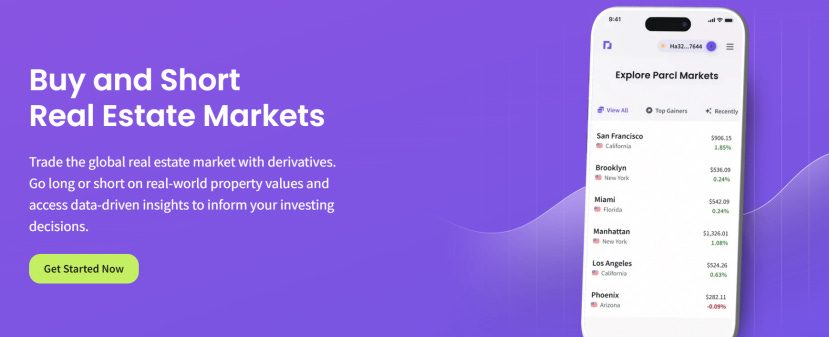

Author: Carol (Twitter: @CC99Carol) Editor: Wu Blockchain Abstract: As a special product with both physical and financial attributes, real estate has been quite sought after by investment groups. However, because of its stable nature, it is also often limited in scope due to its immovable attributes and physical limitations. In this context, a decentralized real estate investment platform called Parcl was created to break the geographical limitations of traditional real estate investment by combining NFT, DeFi and real estate asset elements to expand people’s investment scope, thus providing users with a convenient, efficient and low-threshold opportunity to enter the digital real estate ecosystem. Foreword As we all know, real estate is one of the most important asset types in people’s lives as a compound asset with both residential and financial attributes, and it is also favored by the investment market due to its connection with land and some policy factors. However, due to the immovable attributes of real estate and physical limitations, the scope of investment in real estate is actually quite limited, as local people can only invest in local properties, and the market itself is quite opaque, with limited information available to people. These factors also make it difficult for people to make the best investment decisions. In order to solve the above problems, some Web3 Builders have started to try to combine real estate with blockchain technology to reconstruct the property ownership model of real estate in the form of blockchain, so as to break the geographical restrictions and expand the market scope. At the same time, the decentralized nature of blockchain can realize the barrier-free investment in real estate worldwide, thus creating a new real estate investment model. Parcl, the project I am going to introduce today, is one of the applications with the above features. Parcl has just announced a $4.1 million seed round led by Archetype, with investments from Dragonfly Capital, ParaFi, Coinbase Ventures, Solana Ventures, and others. Brief Introduction Parcl Protocol is a decentralized real estate investment platform. Parcl provides users with detailed information and price trends of real estate around the world by consolidating data from global real estate sources and selecting a large amount of investment-worthy information. The market prices provided by Parcl are real-time and representative, and users can analyze the market dynamics by themselves and earn the relevant income through traditional financial methods such as buying and shorting. It is well known that the real estate market has great potential, but in the past, there was a clear polarization of the real estate investment community. Wealthy people with large assets often have access to first-hand information and a wide range of investments. But others rarely have the opportunity to get deeply involved, let alone get a piece of the action. Parcl is committed to using blockchain technology and the concept of decentralization to try to break this phenomenon of increasing class solidification, and provide a relatively easy and feasible way for ordinary people to get a share of the real estate market investment. Parcl has introduced a more efficient and simpler synthetic asset AMM, which refers to an exchange-traded smart contract protocol that performs price discovery through the use of mathematical functions, while a synthetic asset protocol is typically a smart contract protocol for collateralized synthetic risk that uses a predictive machine for the base price and an on-chain mechanism to execute or facilitate settlement at the base price, drawing on traditional AMM and synthetic asset protocols. settlement. Parcl also allows users to trade freely without intermediaries by creating tokens on the blockchain. Advantages and disadvantages of Parcl Protocol Advantages 1.Parcl combines real estate with blockchain technology, combining investment with virtual assets and integrating global real estate focused data packages, making it easier for users to observe market dynamics. For real estate investors, real estate transactions are expensive, tedious and artificially risky, full of uncertainties. Parcl combines asset elements such as NFT, DeFi and real estate to provide users with a convenient, efficient and low barrier entry into the digital real estate ecosystem. 2.Parcl creates an NFT by transforming the ownership of a property from an individual to a legal entity, which allows the user to transfer ownership of the entity through the NFT without having to register the title, saving significant financial, human and time resources. At the same time, the Parcl model also provides a new use case for NFT itself, which provides an idea to solve the problem of unclear pricing mechanism and illiquidity of NFT. 3.The Parcl protocol is built on the Solana chain, and its theoretical transaction speed can reach 50,000 transactions per second, which is very efficient, and its gas fee is also very low, which is more user-friendly. In addition, Parcl’s synthetic asset, AMM, provides an accessible way to invest in real estate, providing more sufficient liquidity for the entire real estate market. 4.Parcl provides users with real-time property data, which allows them to make better investment decisions and seize potential money-making opportunities. 5.The ultimate goal of Parcl is to provide information on property transactions around the world and to be able to conduct granular and extensive transactions. Compared to REITs, Parcl has control over the investment location and the monopoly of information is broken to a certain extent, which will greatly increase the profit opportunity. Disadvantages 1.Parcl is built on the Solana chain, and the ecological condition of Solana is not very good due to the recent incident of FTX, which may have some limitations for the development of the project itself. 2. Threshold problem. The majority of real estate investors are traditional Web2 world investors, and they are still relatively vague about the meaning of Web3 basic concepts, such as decentralized wallet, DeFi and so on. For them, investing in real estate in Web3 still has a certain investment threshold. 3.Parcl’s project model requires the conversion of individual real estate property ownership into corporate assets and then into NFT, and there are no relevant legal regulations and past cases, so whether there will be some legal compliance and property security issues need to be considered. 4.Investment behavior security issues. Traditional real estate often occurs in the closer physical distance, its investment model is more offline inspection, the actual development of the property can be more systematic understanding. In contrast, on-chain real estate is like an e-commerce model, and its scope is expanded to the world, so there may be a situation where people invest in houses thousands of miles away, but have no understanding of the actual situation, which may enhance the risk for the investment behavior itself. 5. The security of the encrypted asset. As a traditional real estate, real estate has strong stability and risk resistance, except for some extreme conditions, there is generally no problem of damage or theft. If the property rights of real estate are transferred to on-chain mode, the security issue will become one of the biggest challenges. 6. As a popular investment industry of Web2, the development of real estate has been relatively mature, and if it is suddenly transferred to the chain and linked with virtual assets, many people may be reluctant to try it. At the same time, the power of on-chain transactions against the real economy is still too weak. Summary To sum up, we can define Parcl as a decentralized investment platform that combines existing real estate with blockchain technology, which to a certain extent eliminates the tedious process of property transaction and provides a more efficient and convenient property investment market. The model adopted by Parcl is innovative, and it provides some ideas for the future development of NFT and the combination of real assets and blockchain. However, the traditional real estate economic model is still difficult to shake, and although on-chain transactions have their advantages, they cannot compete with it now. At the same time, the inertia of ordinary users will also make the on-chain model difficult to win their trust. Moreover, the overall design and model of Parcl is not mature enough, and there are some legal and asset security risks. Therefore, in my opinion, the current Parcl can be called a product with some innovative elements, but the specific application and effect will have to be verified by the market to make further judgment. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Highstreet Intro: a VR metaverse project from Taiwan, hitching a ride on Binance and Jay Chou

Wednesday, February 8, 2023

Author: @0xMavWisdom The VR track project has regained attention with the recent CZ shoutout, and just in time Highstreet is riding the wave with a marketing partnership with Jay Chou. CoinGecko data

Canto Eco Checklist, Trending L1 with DeFi Components

Tuesday, February 7, 2023

Author: @0xMavWisdom Following the recent launch of the Contract Security Revenue (CSR) cost allocation model, Canto has seen strong growth in the number of transactions, TVLs, and cross-chain data on

Global Crypto Mining News (Jan 30 to Feb 5)

Monday, February 6, 2023

1. Kazakhstan Parliament adopts law regulating crypto mining and exchange. The Law of the Republic of Kazakhstan on Digital Assets and its related accompanying documents were considered by the Senate

Asia's weekly TOP10 crypto news (Jan 30 to Feb 5)

Sunday, February 5, 2023

Author:Lily Editor:Colin Wu 1. Kazakhstan's weekly summary 1.1 Kazakhstan Parliament adopts law regulating crypto mining and exchange link Lawmakers in Nur-Sultan have approved the final version of

Innovation or attack? Sorting out the "NFT Big Block" on the Bitcoin Network

Sunday, February 5, 2023

Written By:Liu Changyong On February 1, 2023, Bitcoin Network mined the largest block in the history of nearly 4M, containing a nearly 4M largest transaction in the history, and the transaction fee is

You Might Also Like

Solana falls to lowest price since November 2024 losing 43% since January

Thursday, February 27, 2025

Volatility reigns as Solana's price retreat tests its resilience against past support levels. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Thursday, February 27, 2025

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📉 Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation alloc…

Thursday, February 27, 2025

Transactions on the Bitcoin network dropped to a 1-year low. The Ethereum Foundation allocated 45000 ETH to DeFi protocols. Standard Chartered established a JV to issue a HKD-backed stablecoin. ͏ ͏ ͏ ͏

XRP investors buoyed by Donald Trump’s Ripple posts and SEC’s ETF acknowledgment

Thursday, February 27, 2025

As Trump's posts stir optimism, SEC's acknowledgment of XRP ETFs heightens anticipation. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

USDT/USDC Prepaid Card’s Popularity Is Soaring – FinTax Reminds You to Be Aware of Related Risks

Thursday, February 27, 2025

In recent years, with the rapid development of the cryptocurrency market and digital payment technologies, several exchanges and wallet service providers have launched their own USDT/USDC prepaid card

SEC replaces Crypto Assets Unit with Cyber and Emerging Technologies Unit

Thursday, February 27, 2025

Laura D'Allaird leads the SEC's new unit to combat AI-driven fraud and bolster cybersecurity compliance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions will launch its LION token on 27 Feb; Yuga Labs sold its IP rights of the Meebits N…

Thursday, February 27, 2025

Loaded Lions will launch its LION token on 27 Feb on the Cronos EVM chain. Yuga Labs sold its IP rights of the Meebits NFT collection. Doodles plans to launch a new token, DOOD, on Solana. ͏ ͏ ͏ ͏ ͏ ͏

WuBlockchain Weekly: Hong Kong Recognizes BTC and ETH for Investment Immigration, SEC Discusses Staking, Argentina…

Thursday, February 27, 2025

According to the statistics of SoSovalue, as of Thursday, twenty state-level administrative regions across the United States have initiated relevant legislative procedures. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin surges to $99K as Coinbase defeats Gensler’s SEC lawsuit pending Commission approval

Thursday, February 27, 2025

Coinbase's settlement with SEC sets precedent in crypto regulation, sparking debate and potential legislative clarification. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏