The Pomp Letter - Operation Job Destruction Is Underway

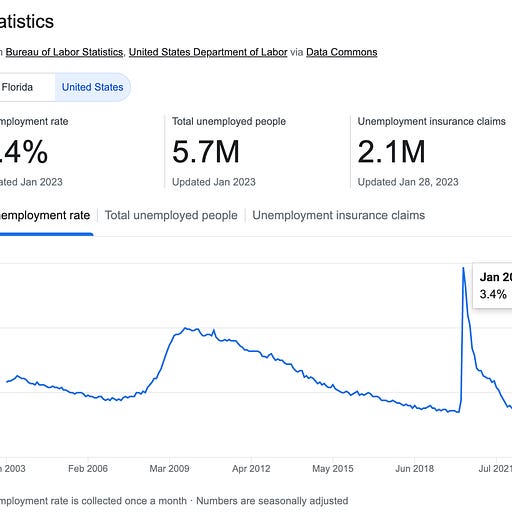

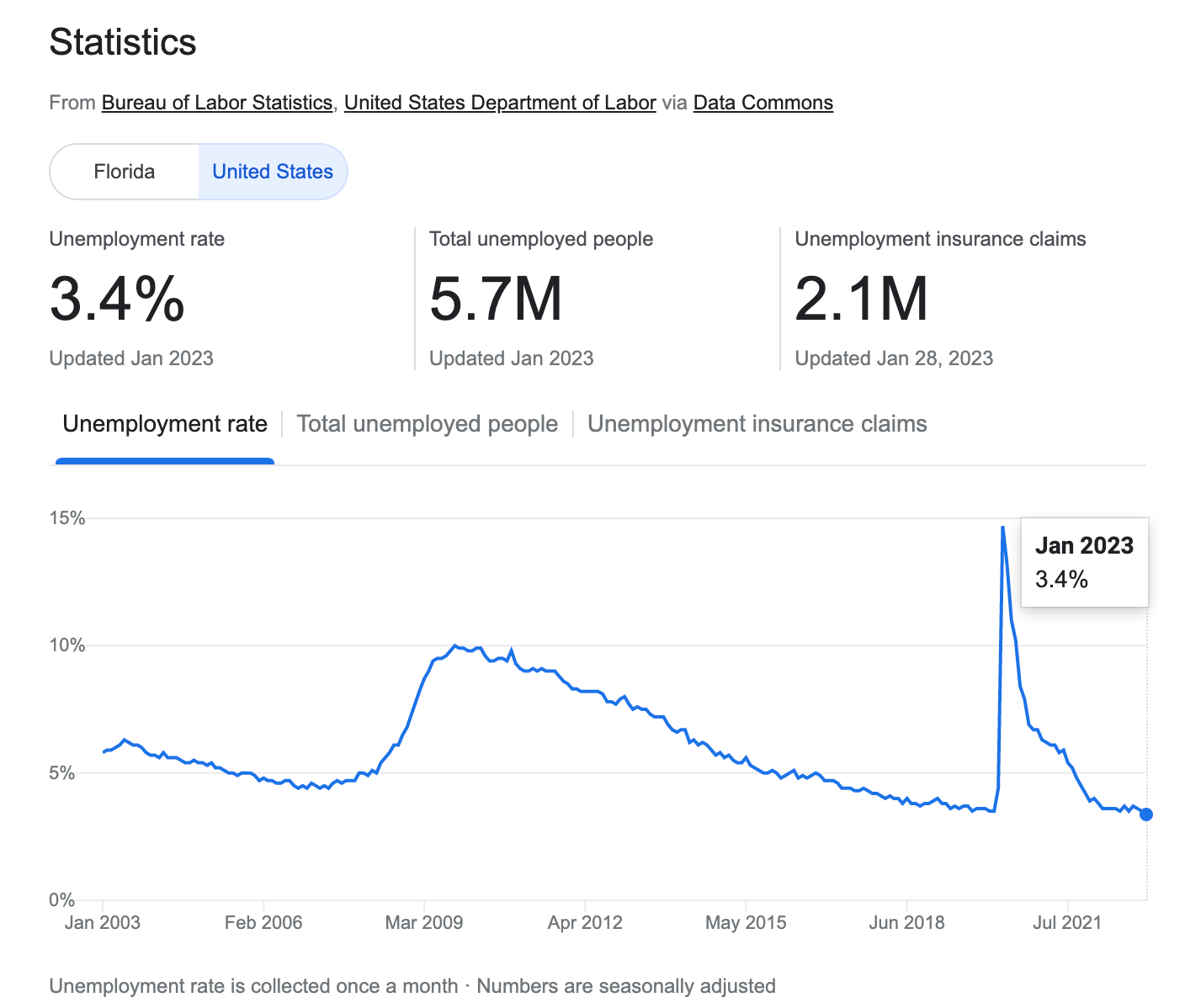

To investors, The Federal Reserve is tasked with fostering “the stability, integrity, and efficiency of the nation's monetary, financial, and payment systems so as to promote optimal macroeconomic performance.” That is a lot of complex jargon to explain a simple concept — the Fed manages the country’s monetary system. This management is expressed through Congress’ dual mandate to the Fed: (1) maintain stable prices and (2) pursue maximum employment. It is obvious that the Fed has failed miserably at the stable prices mandate over the last three years. We saw inflation peak at 40+ year highs and the average American consumer is paying significantly higher prices for staple goods. Additionally, this failure on price stability creates significant problems for businesses that now struggle with the ever-changing nature of their input costs. The inflation challenges have been well covered, but what about the employment mandate? If we go back to January 2020, the unemployment rate was sitting at a historic low of 3.6%. The pandemic, and ensuing government-mandated lock-downs, created an explosion of layoffs and unemployment claims. At one point, there were 6.6 million new unemployment claims per week. This led to the unemployment rate spiking to just under 15% by April 2020 — to put the severity of the spike in perspective, this increase in unemployment over a 60 day period outpaced the entire increase in unemployment over the first 18 months of the Great Depression. Not a great situation. Thankfully, the Federal Reserve’s monetary policy decisions, coupled with fiscal policy and an ensuing historic economic rally, led to an impressive recovery in employment data. We currently sit at a 50+ year low of 3.4% unemployment in the United States, which is even better than the 3.6% we had achieved right before the pandemic era began. This accomplishment will be viewed as a win by everyone except the central bank. Their theory is that a strong labor market, where unemployment is low, leads to higher inflation. If that sounds weird, here is Nik Popli’s explanation from a recent TIME article:

Remember, the Fed’s dual mandate is stable prices and maximum employment. They are failing at stable prices, but achieving maximum employment at a level not seen in decades. Unfortunately, the Fed is going to erode progress on the employment side in order to get the inflation under control. This is the tightrope act that is required from central banks who are tasked with overseeing a complex economic machine. Don’t forget one important detail though…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

Free Markets, Regulation, Charlie Munger, and Bitcoin

Wednesday, February 8, 2023

Listen now (6 min) | Charlie Munger wants to ban bitcoin, but is that a good idea?

Podcast app setup

Wednesday, February 8, 2023

Open this on your phone and click the button below: Add to podcast app

Bitcoin Fundamentals Keep Getting Stronger

Tuesday, February 7, 2023

Listen now (5 min) | A breakdown of bitcoin's fundamentals.

Meditations by Marcus Aurelius

Monday, February 6, 2023

Listen now (16 min) | Pomp's notes on Meditations by Marcus Aurelius

The Puppeteer of Markets

Friday, February 3, 2023

Listen now (5 min) | Central banks have a lot in common with Geppetto & Pinocchio.

You Might Also Like

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔

🔔Opening Bell Daily: Investor jitters grow

Monday, March 10, 2025

Traders keep selling stocks and US indexes are lagging the rest of the world.

A shellacking

Monday, March 10, 2025

Gaming share prices crater on US consumer fears ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But