Inflation Is Destroying Small Business In America

To investors, The Federal Reserve has been committed to destroying inflation for more than 12 months. They have increased interest rates aggressively and worked diligently to drain hundreds of billions of dollars of liquidity from the financial system. Unfortunately, inflation doesn’t care. This morning’s CPI data reported inflation at 6.4%, which means we have been at 5% or higher for 22 straight months. This persistently high inflation environment continues to be relatively unresponsive to the Fed’s tighter financial conditions. There are a few things to be aware of related to this morning’s data. First, the year-over-year measurement of 6.4% is down from 6.5% in January, which will be celebrated as a positive sign by the untrained eye. In reality, inflation rose 0.5% from January to February though, so the perceived drop in the annual number is merely a base effect masking the actual change. Don’t be fooled by headlines — inflation has actually accelerated over the last few weeks. Second, the rise in inflation is being driven by energy, transportation, food, and shelter. Why is this important? These are the core ingredients to every day life for the average American family. For example, the cost of eating food at home has risen by more than 11% over the last 12 months, which puts immense financial pressure on millions of Americans.  Price changes over last year (CPI report)...

Fuel Oil: +27.7%

Gas Utilities: +26.7%

Transportation: +14.6%

Electricity: +11.9%

Food at home: +11.3%

Food away from home: +8.2%

Shelter: +7.9%

Overall CPI: +6.4%

New Cars: +5.8%

Medical Care: +3.0%

Gasoline: +1.5%

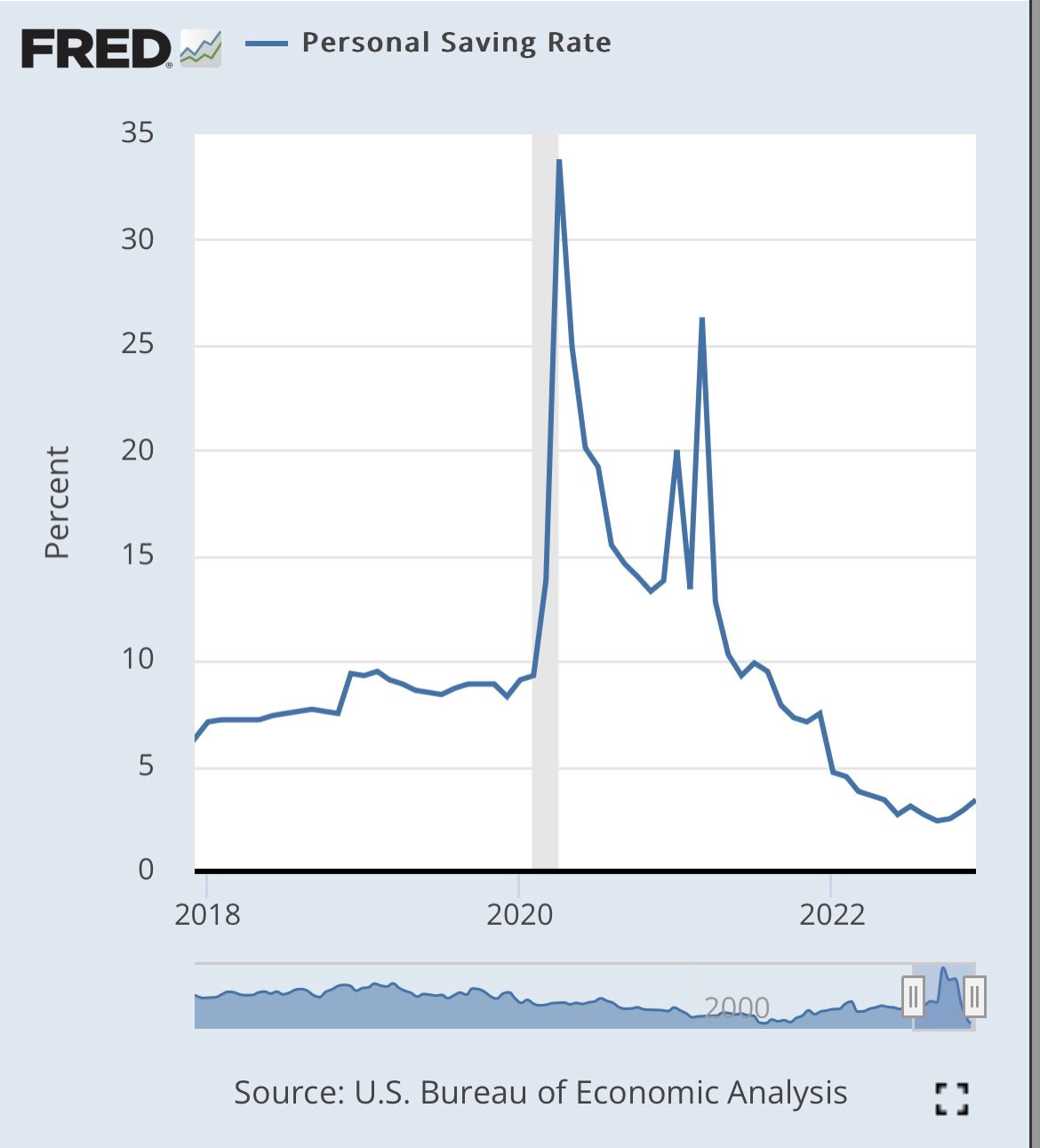

Used Cars: -11.6% Add in the increasing costs of electricity or transportation and it becomes easy to see why the savings rate has fallen to historic lows. In fact, to put this in perspective, 2022 was the second lowest personal savings rate on record since the data was first collected. The fall in the personal savings rate followed the all-time high that was achieved in 2020 post-stimulus packages. In layman terms, the government printed money, flooded the system with liquidity, dollars ended up in consumers’ bank accounts, and then consumers went out to spend like drunken sailors which drove prices, and subsequently inflation, to multi-decade highs. This is not rocket science. Artificially high liquidity in a system drives artificially high increases in prices. Ok, this is all fairly obvious though — here is where things start to get interesting…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

The Creative Act: A Way of Being by Rick Rubin

Monday, February 13, 2023

Listen now (14 min) | To investors, I have been reading one book per week this year. This past week's book was The Creative Act: A Way of Being by Rick Rubin. Highly recommend reading it. If you

Inflation Generation: The Lasting Impact of Monetary Policy

Friday, February 10, 2023

Listen now (7 min) | To investors, The last three years have been economically volatile. We had the pandemic-induced liquidity crisis of March 2020, a face-melting rally of financial assets that

Operation Job Destruction Is Underway

Thursday, February 9, 2023

Listen now (5 min) | To investors, The Federal Reserve is tasked with fostering “the stability, integrity, and efficiency of the nation's monetary, financial, and payment systems so as to promote

Free Markets, Regulation, Charlie Munger, and Bitcoin

Wednesday, February 8, 2023

Listen now (6 min) | Charlie Munger wants to ban bitcoin, but is that a good idea?

Podcast app setup

Wednesday, February 8, 2023

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏