The Average American Is Going Broke At An Alarming Rate

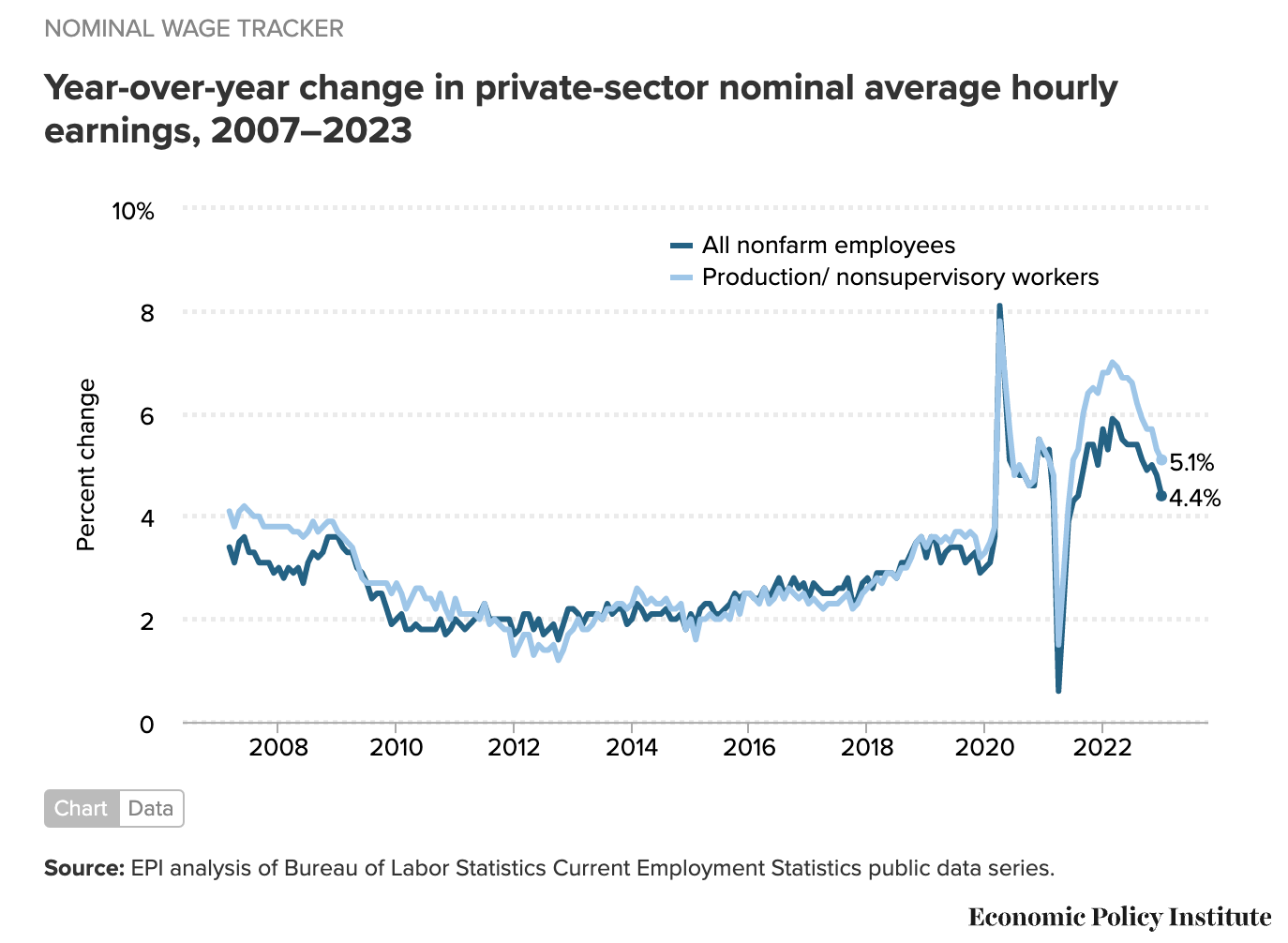

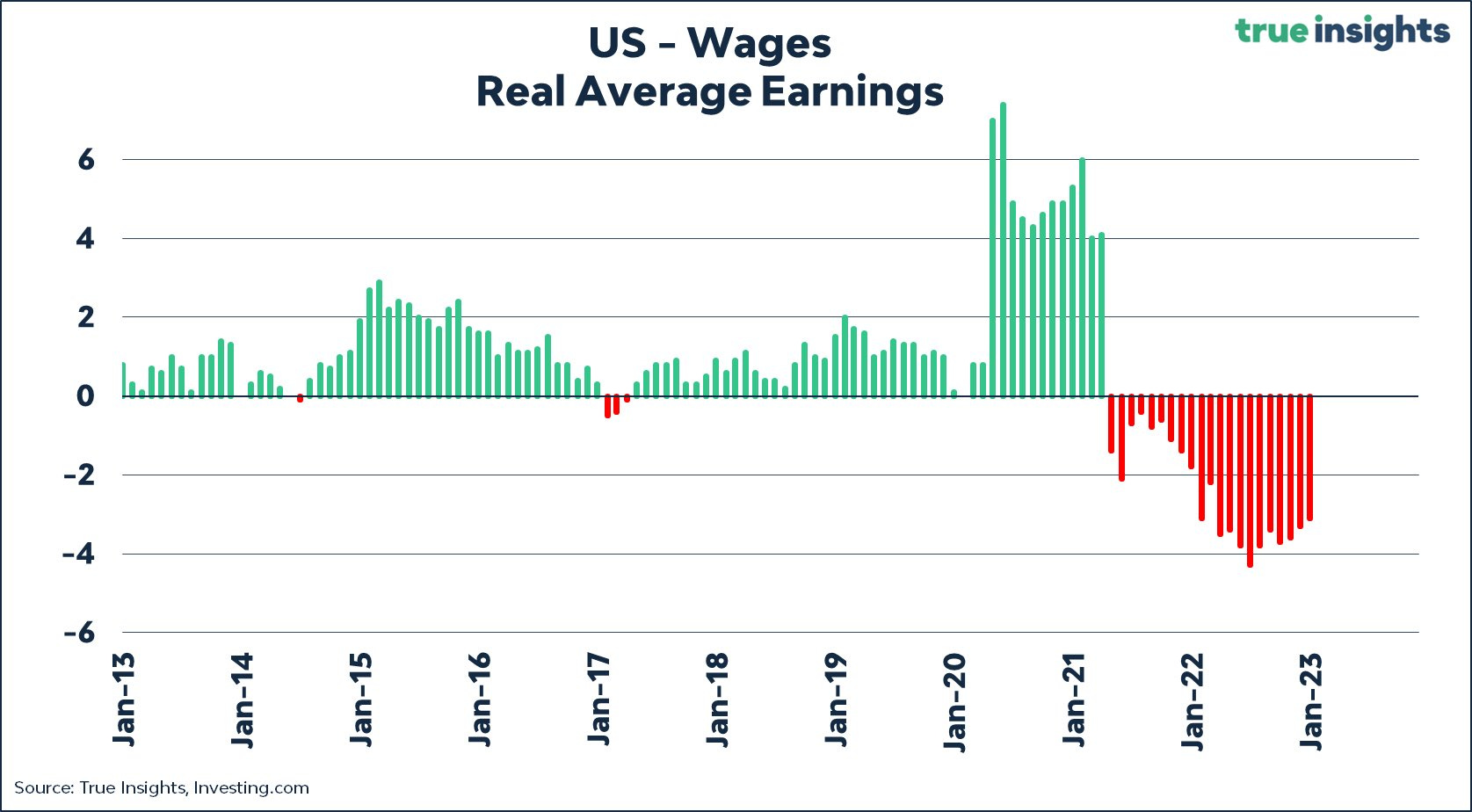

To investors, The economic volatility of the last three years has been well documented, but nowhere is it more obvious than in the plight of the average American worker. The alarming data point that originally sent me down a rabbit hole of research was that over 50% of Americans who make $100,000 or more report living paycheck-to-paycheck. Think about that for a second. It is estimated that 18% of individuals in the US make more than $100,000 per year and approximately 34% of all US households clear the same income threshold. That equates to tens of millions of Americans with a 6-figure income, yet an inability to achieve financial security. If we lower the income threshold to include anyone in the workforce, it is estimated that more than 60% of all US workers are living paycheck-to-paycheck. Remember, we aren’t talking about a developing nation, but rather the United States of America who has one of the most developed economies in the world. So what exactly is going on here? There are multiple factors, but a good starting place is the wages that private sector employees are being paid. The year-over-year change of these wages remains positive, but it sits at only 4.4% for all non-farm employees. I say “only” because the increase in nominal average hourly earnings is growing at a slower rate than inflation, which means that the real average hourly earnings over the last year has actually been negative. In layman terms, workers on average are being paid less money in purchasing power terms for their work. To illustrate how bad this phenomenon is, you can see in this graphic that the real average hourly wage has been negative since the start of 2021. That is two straight years of workers falling further and further behind, which puts immense pressure on their financial situation. If you think this is bad, just wait until you see how bad the rest of the data is…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

Social Security, Ponzi Schemes, and Decades-Old Ideas

Friday, February 17, 2023

Listen now (6 min) | To investors, The Social Security program was created by President Roosevelt in August 1935. The initial idea was 'a social insurance program designed to pay retired workers

Inflation Is Destroying Small Business In America

Tuesday, February 14, 2023

Listen now (7 min) | The situation is really, really bad.

The Creative Act: A Way of Being by Rick Rubin

Monday, February 13, 2023

Listen now (14 min) | To investors, I have been reading one book per week this year. This past week's book was The Creative Act: A Way of Being by Rick Rubin. Highly recommend reading it. If you

Inflation Generation: The Lasting Impact of Monetary Policy

Friday, February 10, 2023

Listen now (7 min) | To investors, The last three years have been economically volatile. We had the pandemic-induced liquidity crisis of March 2020, a face-melting rally of financial assets that

Operation Job Destruction Is Underway

Thursday, February 9, 2023

Listen now (5 min) | To investors, The Federal Reserve is tasked with fostering “the stability, integrity, and efficiency of the nation's monetary, financial, and payment systems so as to promote

You Might Also Like

10x more leads (powerful)

Monday, March 10, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🥒 Now you’re in a pickle

Monday, March 10, 2025

This upstart grew sales by 29% YoY in a stalling industry View in browser mim-email-logo-2025-2 As liquor sales stagnated last year for nearly the first time in two decades, one segment of the market

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏