This Data Proves The Economy Is Lost & Confused

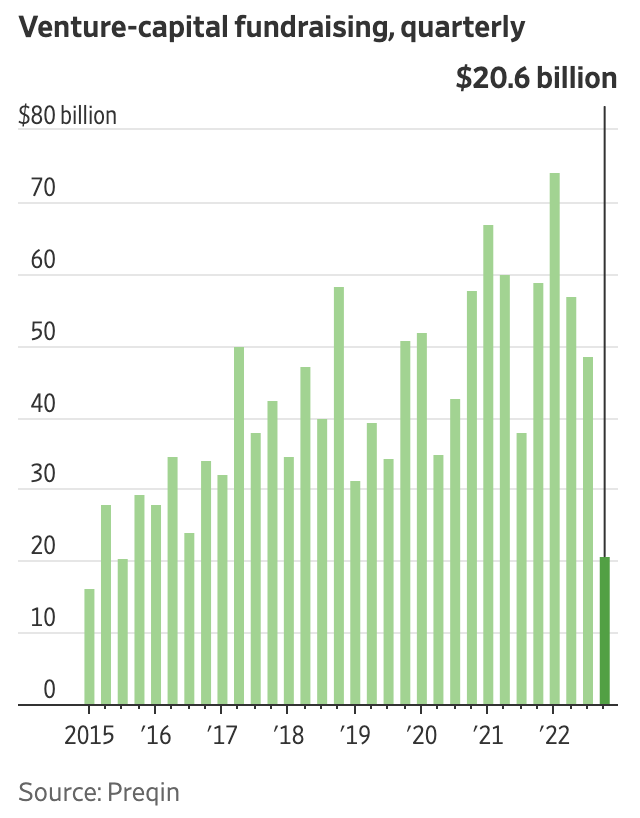

To investors, The economic pain that has rippled through the economy over the last 15 months is hard to quantify with a single metric. Thankfully, there are multiple data points from Q4 2022 being published in the last week or so, which gives us a better understanding of what is happening across markets. First, funding for venture capital funds has fallen off a cliff. Given the collapsing valuations, and the general apprehension in deploying dollars into a rising interest rate environment, a decrease in LP commitments would be expected. But the magnitude of the decrease is what is so shocking. Berber Jin wrote in the Wall Street Journal:

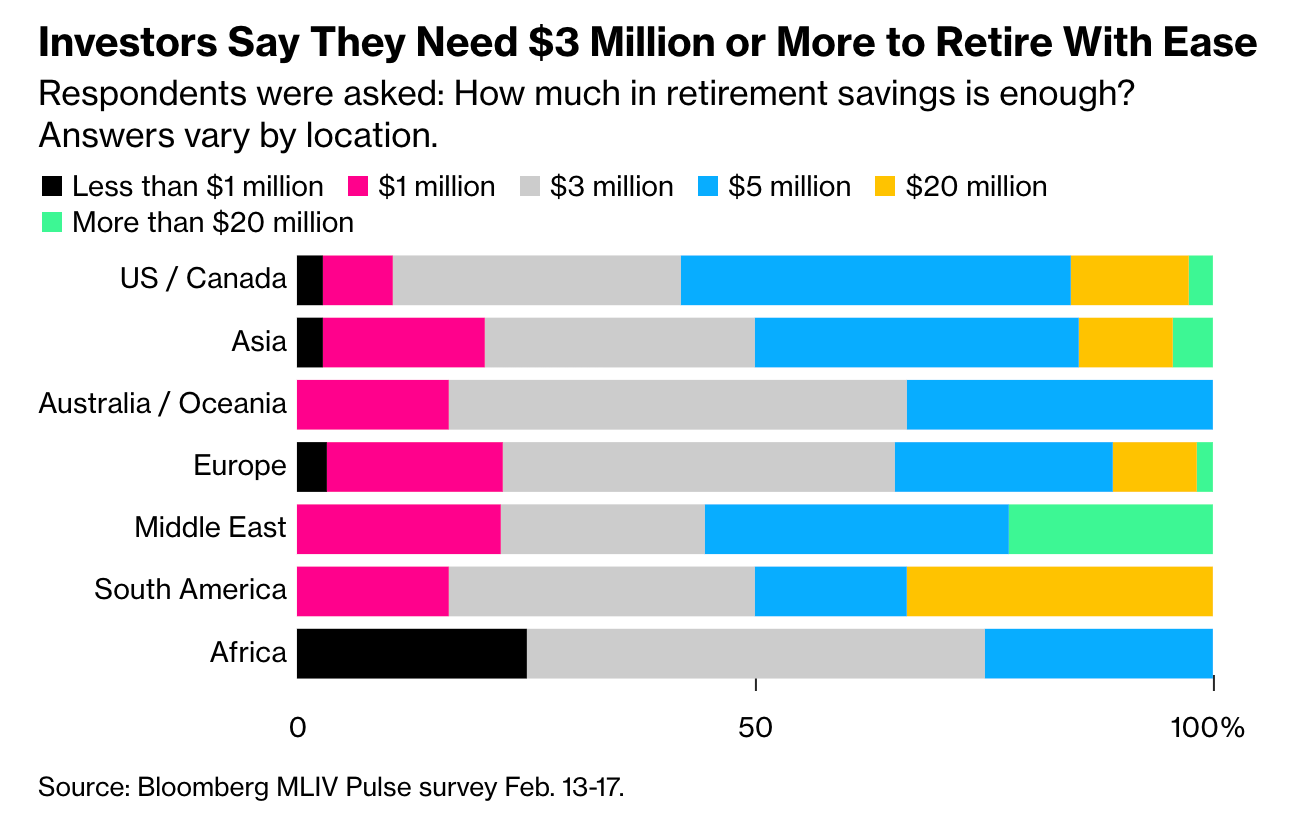

One cause of this nine-year low in venture fundraising is LP’s risk aversion at the current moment, but a larger cause is likely to be fewer venture funds trying to raise capital during tumultuous times. As valuations and markets are more uncertain, venture funds deploy less capital. As venture funds deploy less capital, they have enough dry powder to deploy when ready, so they don’t need to raise new funds. If venture capitalists aren’t raising new funds, LPs don’t have as many opportunities to invest in the venture asset class. Just as supply chain disruptions caused numerous second and third order effects, slower deployment of venture dollars from VCs will have numerous unintended consequences as well. Venture capitalists aren’t the only group of people who are being affected by the current environment though. The 2022 results for university endowment financial returns has been published and the picture is not pretty. Only eight endowments in the entire country made money on a nominal basis last year and zero — yes, you read that right….zero! — endowments made any profit on a real return basis. This is mind-boggling to think about. These are investment professionals who spend all their time trying to drive profits. The lack of performance is less a judgment of the endowment teams and more a perfect example of how difficult it is to invest during a chaotic, uncertain economic environment. During 2022, there was nearly nowhere to hide if you were managing any material amount of money. The negative impact is not exclusive to institutions however. Bloomberg recently conducted a survey asking people how much money they believed they would need to retire with ease. The majority of respondents claimed the target range would be $3 million - $5 million for retirement. This is a large leap in expectations from citizens who previously believed they would need less than $1 million to retire comfortably. A combination of living longer with an accelerated annual erosion of purchasing power has led to hundreds of percent increase in the amount of money that retirees feel they need. Wild. This doesn’t tell the full story though. There is even more data coming out now that is revealing something bigger and crazier…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

Lessons From Bruce Lee on Being Phenomenal, Dealing With Crisis, and Personal Improvement

Monday, February 20, 2023

Listen now (14 min) | To investors, I have been reading one book per week this year. This past week's book was Be Water, My Friend: The Teachings of Bruce Lee by Shannon Lee. Highly recommend

Podcast app setup

Monday, February 20, 2023

Open this on your phone and click the button below: Add to podcast app

The Average American Is Going Broke At An Alarming Rate

Friday, February 17, 2023

Listen now (5 min) | To investors, The economic volatility of the last three years has been well documented, but nowhere is it more obvious than in the plight of the average American worker. The

Social Security, Ponzi Schemes, and Decades-Old Ideas

Friday, February 17, 2023

Listen now (6 min) | To investors, The Social Security program was created by President Roosevelt in August 1935. The initial idea was 'a social insurance program designed to pay retired workers

Inflation Is Destroying Small Business In America

Tuesday, February 14, 2023

Listen now (7 min) | The situation is really, really bad.

You Might Also Like

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏