Earnings+More - Caesars high on Vegas supply

Caesars high on Vegas supplyCaesars confirms buoyant results, the super affiliates report, BetMGM remains on top in Michigan +MoreGood morning. In today’s edition:

We're going to a place where everybody kick it. Caesars’ crowd pleaserCaesars trumpets strength in Vegas, regional resiliency and future online profit hopes. Captain fantastic: “It’s hard to express how strong Vegas is right now,” CEO Tom Reeg said after its Strip casinos saw an 11% leap in Q4 revenues to $1.15bn while FY22 revenues rose over 25% to $4.29bn. “The business feels fantastic,” he added.

Modesty permits: Reeg said the online business would register another “modest loss” in Q1 due to the costs associated with the launch in Ohio but, looking further out, the company expects the business will be an EBITDA contributor for 2024 as a whole across both sports betting and iCasino.

Hill to die on: Asked about the recent Super Bowl outage of the William Hill app in Nevada, Reeg noted the app was working (not working) on “old technology” and that it would be on the new Liberty platform by the next football season.

Stand and deliver: Eric Hession, president of Caesars online, noted the improvements to come in the iCasino operation with a new dedicated app and proper customer segmentation. Reeg said that, with online generally, Caesars was “leaning on” its Rewards database more and more.

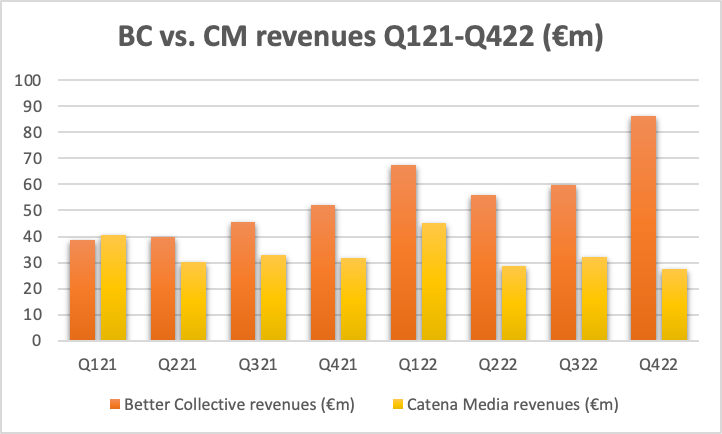

** SPONSOR’S MESSAGE ** The Fastest Sports Betting Data In The World: OddsJam offers real-time odds from over 150 sportsbooks in the United States, Canada, Europe, Australia, and more. See why tier 1 operators, affiliates, and DFS companies turn to the power of OddsJam sports betting data & screen to work smarter, not harder. Book a demo or drop us an email at enterprise@oddsjam.com. Affiliates Big WednesdaySuper affiliates Better Collective and Catena Media report strong earnings. Just super: Better Collective said its long-term aim of being regarded as a digital sports media group was “starting to materialize” after it saw Q4 revenues soar 63% to €86.1m, while rival Catena Media – where BC is a now a 5% shareholder – said its Q4 revenues were up 15% to €27.4m.

🥊 Better Collective accelerates away from Catena Media Oh-Ohio: January revenue at BC continued the growth trend, up >40% to €37m, though Søgaard warned that the quarter had been boosted by the launch in Ohio and was “not something that should just be extrapolated into the rest of the year”. Indeed, at Catena, January revenues fell 4% YoY on “tough comparatives”, including the New York launch last year.

No comment: Asked about the investment in Catena Media, the head of IR said the company “didn’t have any comments”. At the end of last year, Catena Media divested itself of the Ask Gamblers business amid rumors that the entire business was now up for sale. Raketech chips inRaketech expects revenues, excluding potential further acquisitions, to hit between €60m and €65m after it announced revenue growth of 33% in Q4 to €15.7m. The company said it had “identified significant growth initiatives”. US revenues increased 130% to €2.3m following the acquisition of ATS in 2021. Datalines – MichiganCombination play: BetMGM continued to lead in combined OSB-iCasino share of GGR at 31.1%, with the group recording 34.3% of the state’s iCasino GGR. iCasino GGR was up 26.7% to $154.6m, while OSB was down 7% to $33.6m and NGR was down 6.9% to $17.8m.

Earnings in briefKambi: A €12.6m termination fee from Penn Entertainment helped boost revenues over the period to €57.8m, up 66%. Operating profits rose 167% to €18.7m. The group noted that even without the termination fee a strong operational performance led to a 30% revenue increase.

Tabcorp said it had achieved 25% online market share for the first time since 2019, with its share of the total sports-betting market standing at just under 35%, after it announced H123 revenues of AU$1.2bn with EBITDA up 24% to AU$197m. Genting Singapore said the reopening of travel routes and return of tourists and international visitors in the second half of the year had been the main driver behind the rise as the company’s H2 adj. EBITDA rose 194% to $505.4m. Revenues rose 62% in FY22 to $1.72bn, while adj. EBITDA rose 73% to $774m. Analyst takesDraftKings: Despite evidence of an accelerated path to profitability, Roth MKM said its long-term pessimism remains as it doesn’t believe DraftKings can drive enough operating leverage for EBITDA margins “to even reach 20%”.

Everi: Jefferies said fintech and gaming supplier Everi’s recent announcement that it will provide its real-money gaming content to Caesars has the potential to become a “meaningful earnings driver over time”. ** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. NewslinesEsports Entertainment Group performed a reverse stock split of one for 100 shares in order to regain compliance with the Nasdaq’s $1 minimum bid price requirement. The group also announced the sale of its Bethard sportsbook for €9.5m. EEG will bank €1.65m of the proceeds, while €6.5m will be used to pay off the debt raised to finance the acquisition in 2021. William Hill will be the official betting partner of the Grand National and will sponsor three races during the Festival. Betsson’s Betsafe brand has been granted a license in Ontario. On social Not going to lie, I got so excited by the email from the Barbican saying I was going to "The Pit theatre to see Kakilang's HOME X" that I may now actually buy tickets. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

A taxing issue – the New York debate

Tuesday, February 21, 2023

DraftKings' and FanDuel's New York tax arguments examined, recent analyst takes +More

DraftKings soars 85% in 2023

Monday, February 20, 2023

DraftKings' post-earnings uplift, Pennsylvania data, startup focus – Betscope +More

DraftKings’ surgical strikes

Friday, February 17, 2023

The latest commentary from the DraftKings Q4 earnings call +More

Weekend Edition #85

Friday, February 17, 2023

DraftKings's profitability push, New Jersey's January data, LeoVegas exits 'smaller markets', the AGA state of the industry +More

GiG goes for a split

Friday, February 17, 2023

GiG strategic review, Flutter's US listing idea, Caesars admits to Nevada app outage, Betty raises $5m +More

You Might Also Like

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Trend Predictions for Coaches, Consultants & Experts in 2025

Wednesday, January 15, 2025

From platform shifts to portfolio careers: my thoughts on what's coming in the year ahead. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Breaking What Isn’t Broken: Lessons from USWNT Coach Emma Hayes

Wednesday, January 15, 2025

The moment we settle for what's comfortable, we stop evolving, learning, competing and getting better.

Refershing Campaigns

Wednesday, January 15, 2025

Oops.

Walmart deepens its metaverse presence with new e-commerce experience selling physical goods on Zepeto

Wednesday, January 15, 2025

Walmart's decision to focus on virtual clothing items for its latest foray into the metaverse shows how the company has learned from its previous experiments in the space. January 15, 2025

🔔Opening Bell Daily: Big bank earnings begin

Wednesday, January 15, 2025

Financial stocks have rallied since Trump won the election and soft-landing hopes have climbed.

Cash rich

Wednesday, January 15, 2025

Startups raised over $200m in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Hidden early stage growth hack of Airbnb

Wednesday, January 15, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Hidden early stage growth hack of Airbnb A script was scanning all new rental properties on

Big eCommerce Goals for 2025? We got you🎯

Wednesday, January 15, 2025

Essential Guides for eCommerce Success Hello Reader, Whether you're setting fresh goals or planning to build on last year's wins, we're here to help you achieve your eCommerce goals in 2025

Brand-new site gets 13 million monthly visits from Google!?

Tuesday, January 14, 2025

Content sites aren't dead yet