The Best Performing Asset During The Pandemic Era Will Surprise You

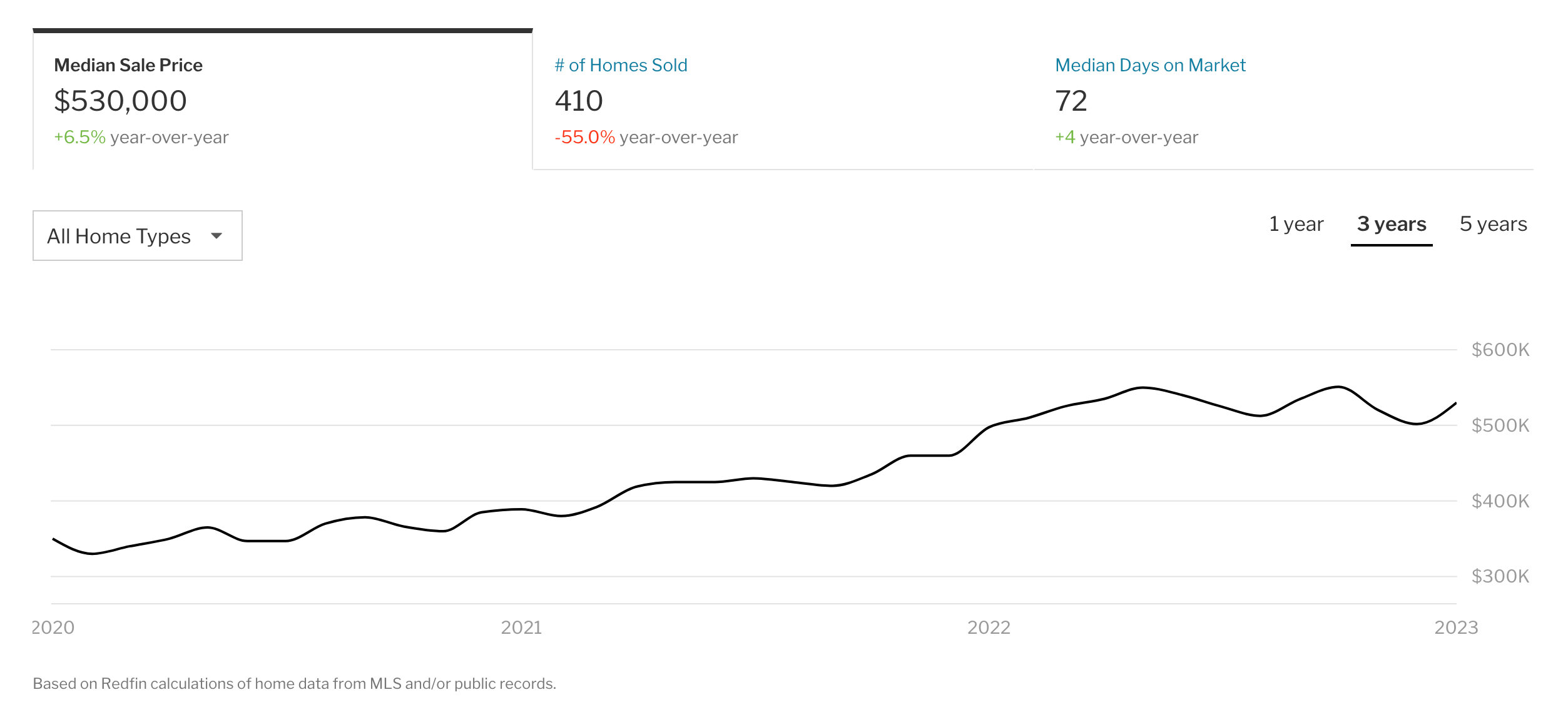

To investors, The last three years of financial markets have been chaotic. Uncertainty and a lack of predictability ruled the day. It highlighted the difficulty of investing and humbled investors across different asset classes. There is a tendency in the investment game to always look forward. People don’t like to look back, evaluate what went right or wrong, or dissect which decisions were erroneous. I spent a few hours this morning doing exactly this though — I wanted to see which assets performed best over the last three years. Were the public narratives correct? What were the hidden gems? Which strategies were completely off-base? Here is what I found… First, the methodology that I used was to start the analysis from January 1, 2020 till today. You can always pick a random timeline to fit within a narrative, but I felt this was the best start date to highlight the pre-pandemic prices of various assets. We can start with the major US stock indexes. The S&P 500 is up approximately 24% and the Nasdaq 100 is up 38.5% in the almost 38 month period. If we look internationally, the MSCI Emerging Markets Index is down nearly 13%. If we remove the emerging markets and look at the MSCI World Index, it has appreciated nearly 15% in the same time frame. The conclusion of the basic equity indexes is that we had long periods of appreciation and drawdowns over the three years, but developed nations out performed emerging markets and the US outperformed the world. Many of these indexes, including the S&P 500 and the Nasdaq 100, performed generally in-line with their historical annual return profile. In the bond markets, we see the S&P 500 Bond Index is down 6% since Jan 1, 2020. The Vanguard Total Bond Market Index is down about 18%. The S&P Global Developed Sovereign Bond Index is also down around 10%. It doesn’t take a rocket scientist to understand that the bond market has been obliterated in the last 12 months and the total return on these assets for the 3-year period is negative. The real estate market generally has not done much better. The Dow Jones U.S. Real Estate Index is down 8% since the start of 2020 and the Green Street Commercial Property Price Index is essentially flat during the same time period. We can also look at the MSCI World Real Estate Index, which consists of various equities in the real estate sector globally, and see that the three year performance is under 1% appreciation as well. These broad-based indexes don’t tell the full real estate story though. For example, Miami real estate is up over 50% since January 2020. On the other hand, San Francisco median sale price is down about 7%. Geography mattered over the last three years for real estate, especially when you account domestically for the dramatic moves from California and New York to Florida and Texas. The conclusion on real estate is that it didn’t actually perform nearly as well as you would have expected during a high-inflation environment. The big run up in prices has essentially been given back in many markets due to the aggressive monetary tightening from the Federal Reserve. But let’s push further into this analysis… 🚨 The rest of this letter is only available for paying subscribers to The Pomp Letter. Their support makes this work possible. If you’re not a subscriber, consider subscribing to read the rest of this letter and help us continue to create independent work on financial markets 🚨... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

This Data Proves The Economy Is Lost & Confused

Tuesday, February 21, 2023

Listen now (6 min) | To investors, The economic pain that has rippled through the economy over the last 15 months is hard to quantify with a single metric. Thankfully, there are multiple data points

Lessons From Bruce Lee on Being Phenomenal, Dealing With Crisis, and Personal Improvement

Monday, February 20, 2023

Listen now (14 min) | To investors, I have been reading one book per week this year. This past week's book was Be Water, My Friend: The Teachings of Bruce Lee by Shannon Lee. Highly recommend

Podcast app setup

Monday, February 20, 2023

Open this on your phone and click the button below: Add to podcast app

The Average American Is Going Broke At An Alarming Rate

Friday, February 17, 2023

Listen now (5 min) | To investors, The economic volatility of the last three years has been well documented, but nowhere is it more obvious than in the plight of the average American worker. The

Social Security, Ponzi Schemes, and Decades-Old Ideas

Friday, February 17, 2023

Listen now (6 min) | To investors, The Social Security program was created by President Roosevelt in August 1935. The initial idea was 'a social insurance program designed to pay retired workers

You Might Also Like

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏