6 Charts To Explain The Fed Standoff With Inflation

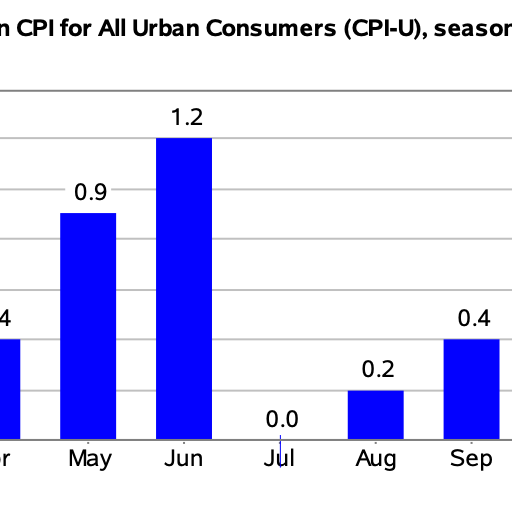

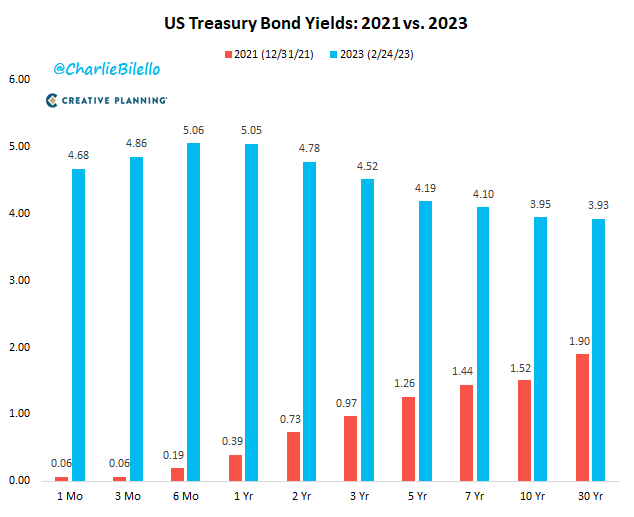

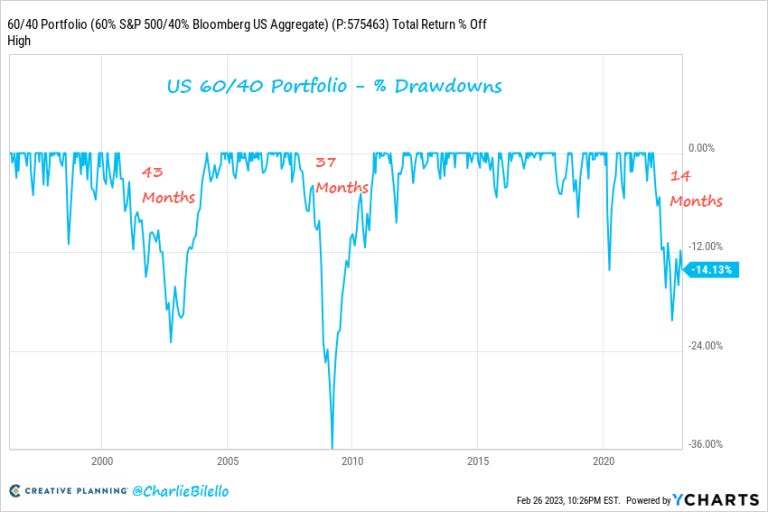

To investors, The month of March marks the one year anniversary since the Federal Reserve started aggressively hiking interest rates. Inflation remains persistently high at 6.4%, so it is hard to argue that the tighter financial conditions have had the intended impact. As I dug into the data this morning, I found a few things that were interesting. First, January’s 0.5% acceleration in the CPI was the most since October 2022 (also 0.5%) and you have to go back to June 2022 for a higher monthly acceleration. The general consensus is that higher rates should lead to lower inflation. This means the 2-year inflation expectations in the market should be declining as the Fed gets more aggressive, but as Lisa Abramowicz pointed out this morning, inflation expectations in the market have actually been increasing over the last 6 months.  U.S. 2-year inflation expectations have surged over the past six months, despite tighter Fed policy. Inflation expectations are not the only place where the market is being distorted by this central bank intervention though. Charlie Bilello points out that US Treasury yields have gone from historic lows to 16-year highs in just over a year. Charlie goes on to highlight the Fed’s tightening has had on the classic 60/40 portfolio. He writes “a US 60/40 portfolio is currently in a 14-month drawdown, 14% below its high. This is now the longest drawdown for a 60/40 portfolio since the financial crisis (37 months) and before that the dot-com bubble (43 months).” As we see the standard portfolio allocation crashing in value, and the depletion of individual’s savings, we know credit card debt has been rising. Couple that rising debt with increasing interest rates and you would expect delinquencies on this debt to be increasing as well…... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

The Great CEO Within by Matt Mochary

Monday, February 27, 2023

Listen now (11 min) | To investors, I have been reading one book per week this year. This past week's book was The Great CEO Within: The Tactical Guide to Company Building by Matt Mochary. Highly

The Best Performing Asset During The Pandemic Era Will Surprise You

Friday, February 24, 2023

Listen now (5 min) | To investors, The last three years of financial markets have been chaotic. Uncertainty and a lack of predictability ruled the day. It highlighted the difficulty of investing and

This Data Proves The Economy Is Lost & Confused

Tuesday, February 21, 2023

Listen now (6 min) | To investors, The economic pain that has rippled through the economy over the last 15 months is hard to quantify with a single metric. Thankfully, there are multiple data points

Lessons From Bruce Lee on Being Phenomenal, Dealing With Crisis, and Personal Improvement

Monday, February 20, 2023

Listen now (14 min) | To investors, I have been reading one book per week this year. This past week's book was Be Water, My Friend: The Teachings of Bruce Lee by Shannon Lee. Highly recommend

Podcast app setup

Monday, February 20, 2023

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

I launched the ULTIMATE seo chrome extension (free)

Sunday, March 9, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s Bitcoin Reserve, Tokyo Beast’s $1M Championship & King of Destiny’s 2M $GOD Showdown – Your Ultimate Crypto & Gaming Update!

Sunday, March 9, 2025

PlayToEarn Newsletter #263 - Your weekly web3 gaming news

The Profile: The man who wants to know everything & the med spas offering balding treatments

Sunday, March 9, 2025

This edition of The Profile features Tyler Cowen, Lalisa Manobal, Zhang Shengwei, and others. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏