Britain faces a deep freeze in living standards

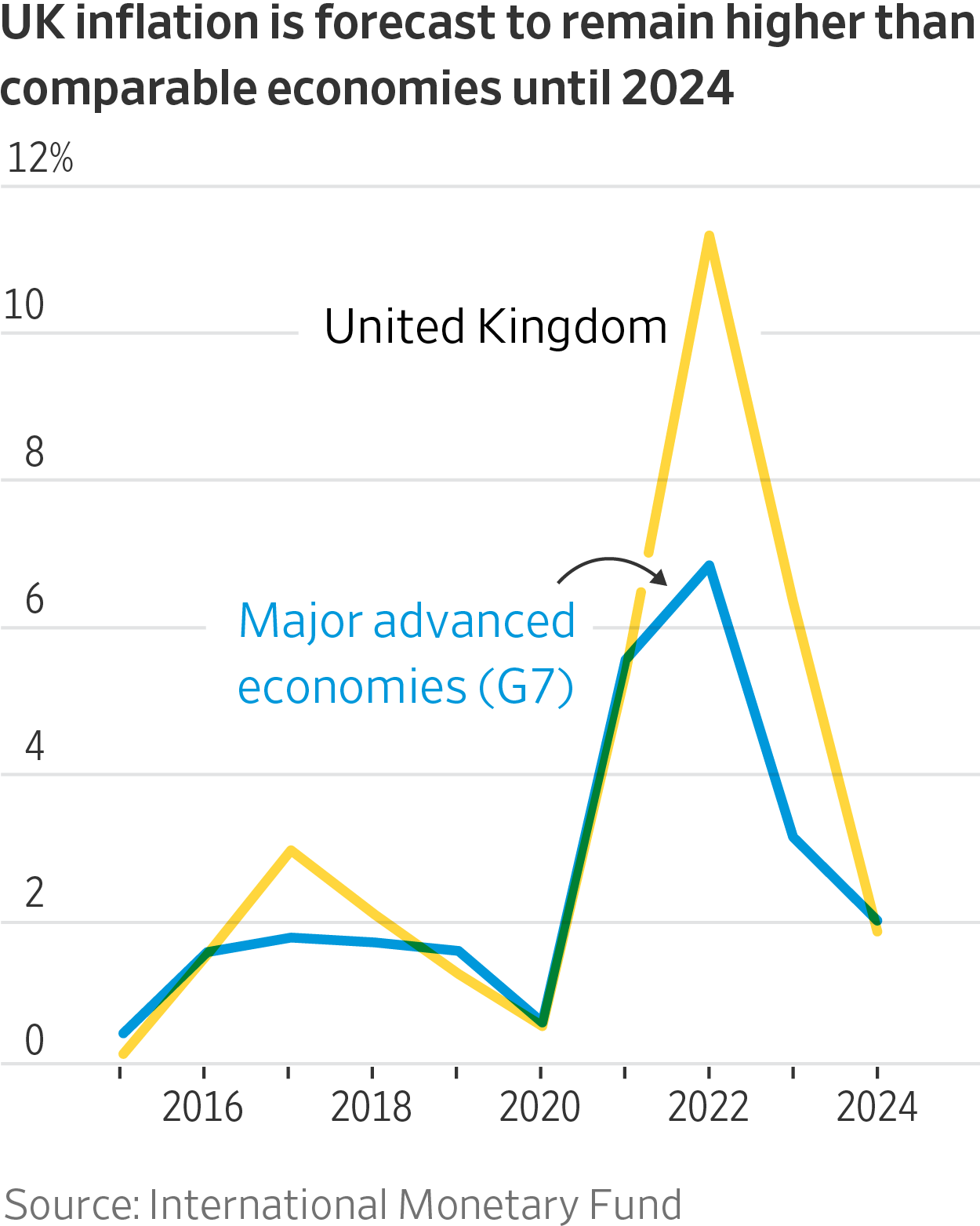

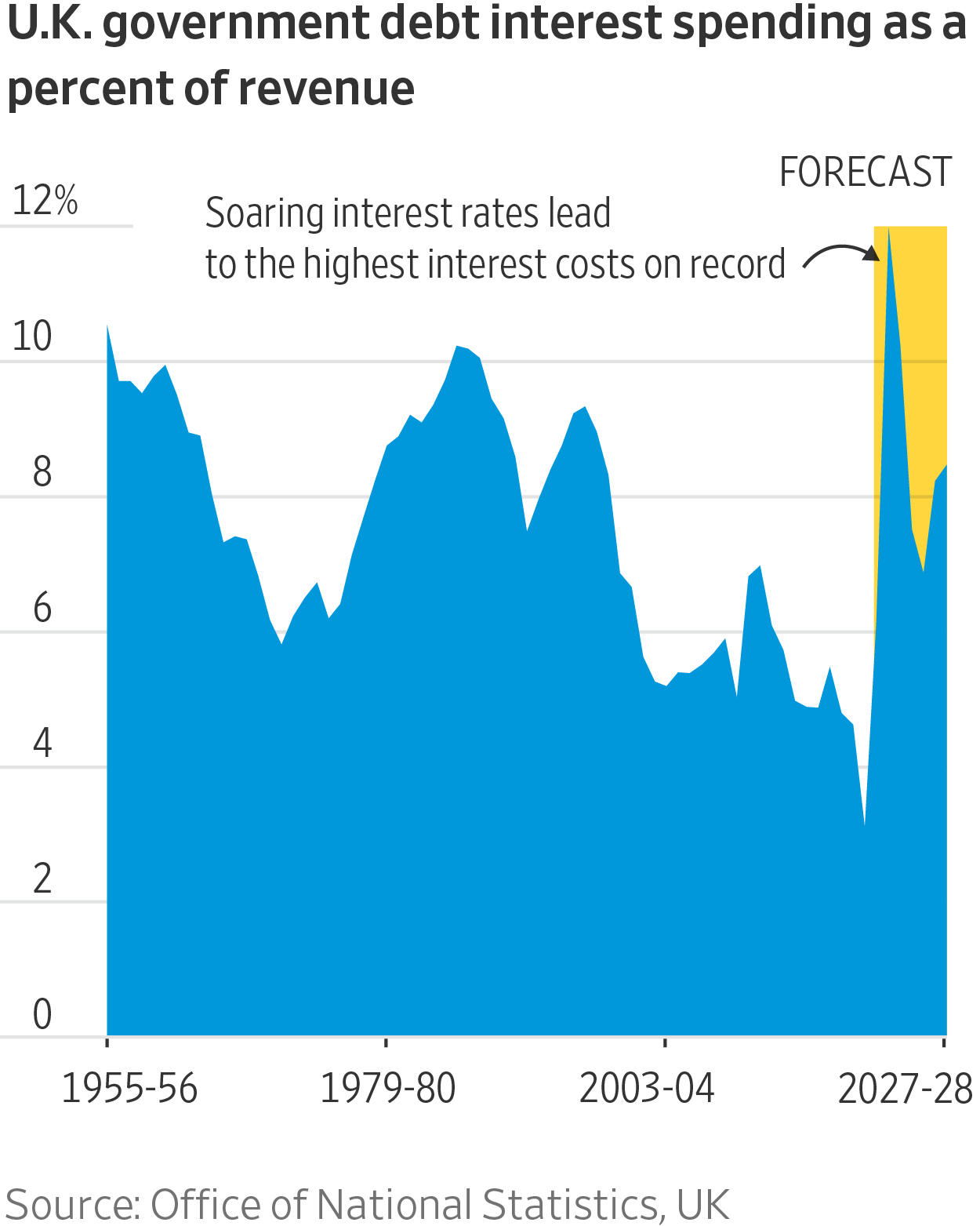

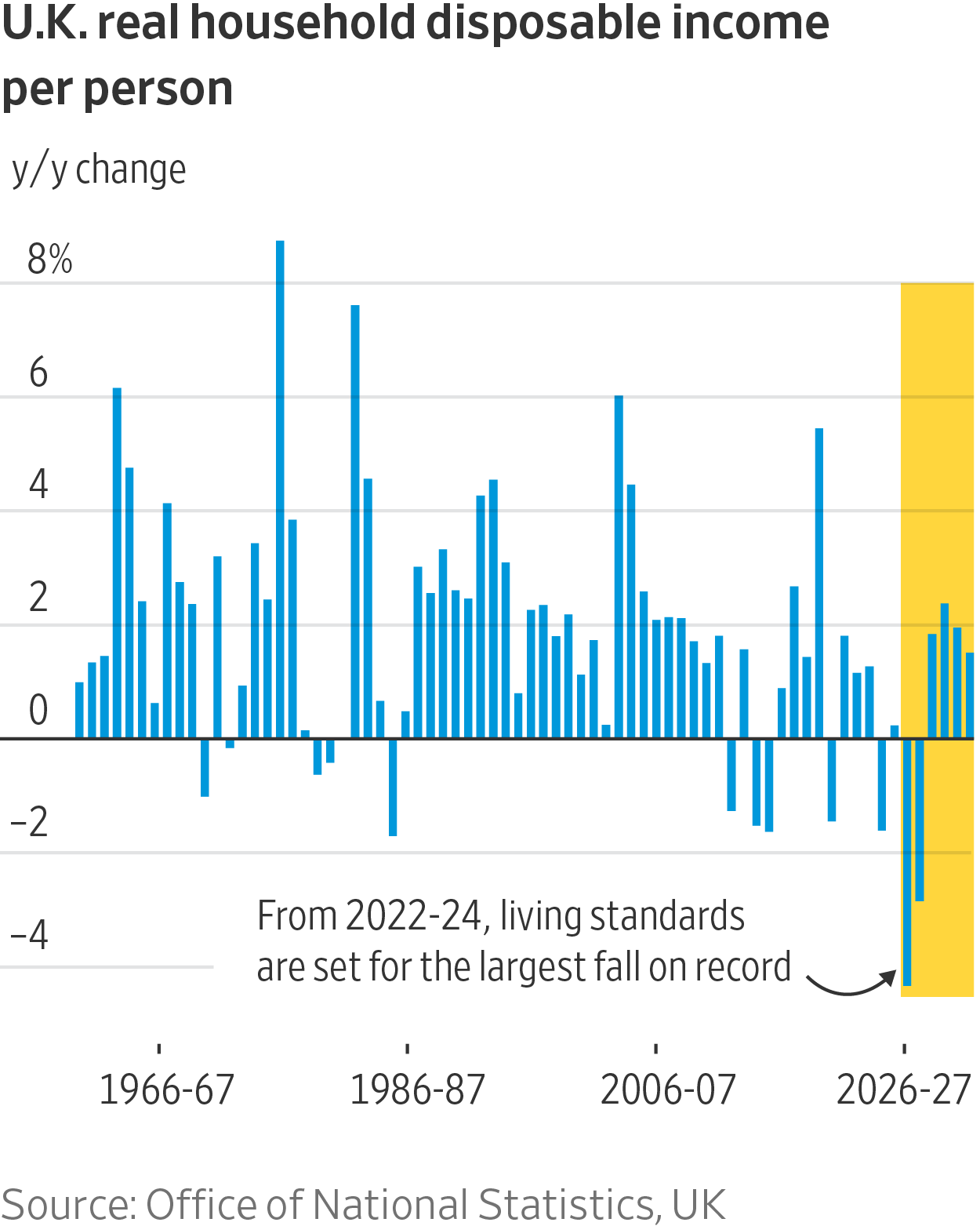

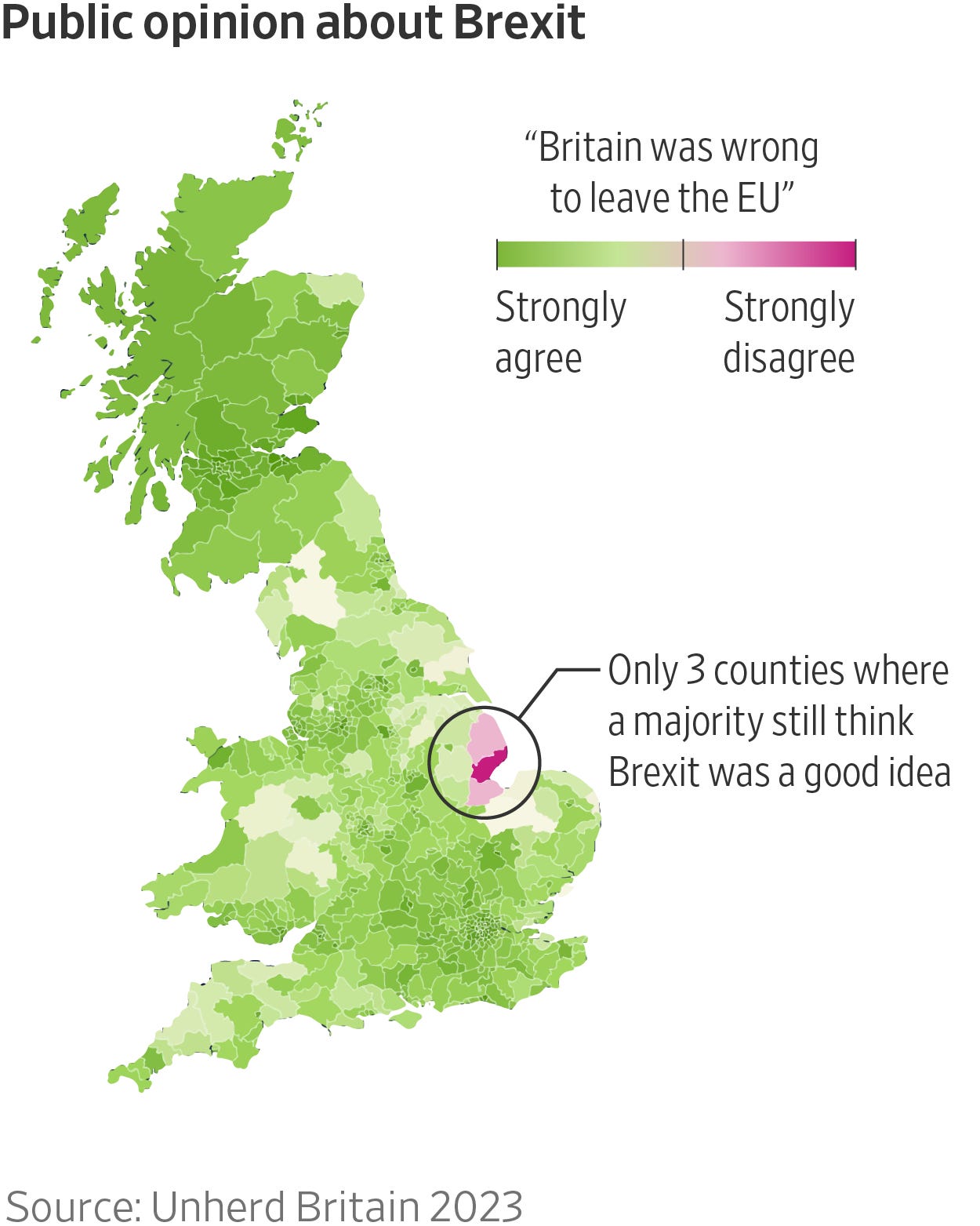

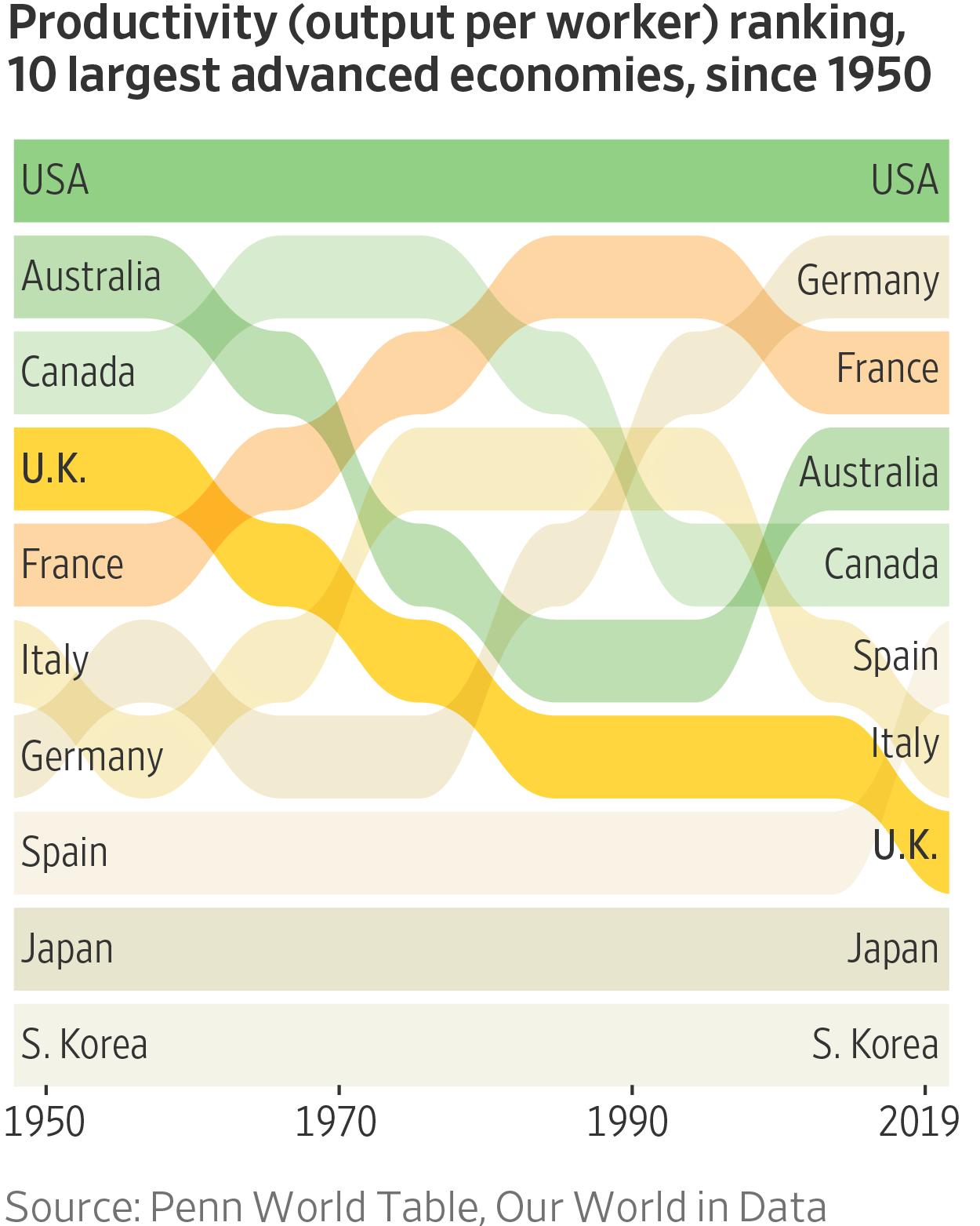

Britain faces a deep freeze in living standardsThe UK economy was in a fragile state. Then came a global pandemic.All major advanced economies are expected to slow in 2023. Higher interest rates, shrinking excess savings, and inflation will take a toll. But, according to IMF forecasts, only one economy—the United Kingdom’s—is expected to contract. If this forecast proves correct, the UK will be among the slowest major economies to rebound to its pre-pandemic size—only crossing that threshold in 2025, years after European peers like Germany. The UK is not unique in facing economic headwinds. Policymakers and central bankers across the world are trying to engineer a stabilization in prices without inciting a recession. But the UK’s situation is much more precarious. Take inflation, for example. Like most of Europe, a major source of energy for the UK is liquified natural gas, which is now more costly because of the war in Ukraine. But while gas is 27% of the energy mix in Germany, and 17% in France, it is 40% for the UK. The fall in the value of the British pound compounds the effect. As a result, British inflation is forecast to be higher than most other countries for the foreseeable future. The situation is similar when it comes to the impact of higher interest rates. Central banks, including the European Central Bank, the US’s Federal Reserve, and the Bank of Japan, are hiking policy rates in order to dampen the excess demand fueling rapid price gains. Households feel the impact of these higher rates most acutely through higher mortgage costs. But—unlike in the US where most homeowners are locked into 30-year mortgages, or most European countries where home loans are extended for more than ten years—in the UK, most mortgages are on a two- or five-year term. As these loans mature and need to be refinanced, households are facing a doubling in their mortgage payments. The good news is that the UK’s fiscal house is in order—the government is not as deeply indebted as many other comparable countries. The British government has borrowed about as much as the value its economy produces in one year. In the US, government debt is 30% higher than GDP. In Japan, government debt is two and a half times larger than GDP. The bad news is that almost a quarter of British government debt is tied to inflation. This protects the country’s pensioners from an erosion in the value of their bond holdings as prices rise. But it also means that, much like British households facing steeply higher mortgage costs, the government’s debt cost is rapidly ratcheting higher. Before the pandemic, for every pound the government raised through taxation and other revenue, only about 3p was set aside to pay interest on government borrowing. But the government is now borrowing more, partly to shield households from energy inflation. And interest rates, especially for debt tied to inflation, are higher. As a result, the government’s interest cost has quadrupled. In the current fiscal year, the British government will spend the highest proportion of its revenue to service its debt since at least 1955. Most economists agree that taking on more debt to shield vulnerable households makes sense. In the US, for example, the government ran large deficits throughout the pandemic in doing just this. But when former Prime Minister Liz Truss proposed unfunded stimulus last autumn, investors rebelled. Gilts (UK government bonds) and the British pound crashed. Investors’ appetite for British debt is more fickle than for American debt. In order to put the government on sound fiscal footing, the current administration has announced a freeze on the tax allowance and tax bands (the levels of income corresponding to various tax rates). But since inflation is soaring, this amounts to a large tax hike in inflation-adjusted terms. The country’s statistical record keeper, the Office for National Statistics (ONS), estimates that 3.2 million Britons will now be required to pay basic income tax for the first time, and an additional 2.6 million will migrate from the basic tax rate to the higher rate. The culmination of all of this—steep inflation, higher interest rates, low growth, and higher taxes—is a drop in British living standards that is set to be the worst on record, according to the ONS. After a tough few years ahead, some pressures are likely to ease. Inflation is forecast to subside and interest rates should fall. Growth could recover. But many of the UK’s challenges are secular, not cyclical. The lingering effects of Brexit is one of these challenges. Leaving the EU has exacerbated worker shortages and hampered trade. The associated uncertainty has deterred companies from making needed investments. Tellingly, support for Brexit has plummeted. All but three British counties now think leaving the EU was a mistake. But most economists think Brexit is only one of many causes of the country’s malaise. More frequently, they cite the UK’s stagnant productivity as a major culprit. In the 1950’s, the UK’s productivity was close to the average for large advanced economies. Today, British workers produce less per hour than all but the Japanese and South Koreans. The national mood in the UK is grim. Consumer confidence recently touched a record low. This is understandable. Fifteen years ago the UK was amongst the countries most damaged by the global financial crash. Since then Britons have weathered austerity, political turmoil, a rupture with their largest trading partner, and a pandemic. Now they face a prolonged economic slump, even as their neighbors recover. The British are famous for their stiff upper lips. Once again they will be put to the test. |

Older messages

Unpeeling an Inflation Conundrum

Friday, February 24, 2023

Why is measuring inflation so fraught?

Does it matter that central banks are losing squillions?

Friday, February 17, 2023

The QE flipside — red ink everywhere

Where are all the workers?

Monday, February 13, 2023

Quiet quitting? The Great Resignation? The best explanation for the shortage of workers is retiring baby boomers.

And now, a cartoon about monetary policy

Tuesday, February 7, 2023

In pricing-in an end to rate hikes, investors push that day back

The Uneasy US Housing Stalemate

Wednesday, February 1, 2023

Affordability is bad, but a bust is unlikely

You Might Also Like

6 Most Common Tax Myths, Debunked

Saturday, March 8, 2025

How to Finally Stick With a Fitness Habit. Avoid costly mistakes in the days and weeks leading up to April 15. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY Six of

Weekend: My Partner Can’t Stand My Good Friend 😳

Saturday, March 8, 2025

— Check out what we Skimm'd for you today March 8, 2025 Subscribe Read in browser Header Image But first: this is your sign to throw away your old bras Update location or View forecast EDITOR'S

Your Body NEEDS to Cardio Row! Here Are Some Options.

Saturday, March 8, 2025

If you have trouble reading this message, view it in a browser. Men's Health The Check Out Welcome to The Check Out, our newsletter that gives you a deeper look at some of our editors' favorite

What Do You Really Need?

Saturday, March 8, 2025

Is opposing consumerism lacking gratitude? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

“Otway” by Phoebe Cary

Saturday, March 8, 2025

Poet, whose lays our memory still / Back from the past is bringing, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Cameron Diaz Returned To Fashion Week In A Fabulous Little Red Dress

Saturday, March 8, 2025

WOW. The Zoe Report Daily The Zoe Report 3.7.2025 Cameron Diaz's Asymmetrical Red Dress Lit Up The Stella McCartney Fall 2025 Show (Celebrity) Cameron Diaz Returned To Fashion Week In A Fabulous

5-Bullet Friday — Breaking the Sperm Bank, D-Cycloserine, Tools for Grumpy Elbows, and Wisdom from Seth Godin

Saturday, March 8, 2025

“If you're feeling creative, do the errands tomorrow. If you're fit and healthy, take a day to go surfing. When inspiration strikes, write it down." ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Inside Alex Pereira's Training for Saturday's UFC 313 Showdown

Friday, March 7, 2025

View in Browser Men's Health SHOP MVP EXCLUSIVES SUBSCRIBE Inside Alex Pereira's Training for Saturday's UFC 313 Showdown Inside Alex Pereira's Training for Saturday's UFC 313

Update Your Android Devices Now 🚨

Friday, March 7, 2025

This TikTok Cleaning Method Might Have Broken My Fan. The security update includes fixes for two zero-day exploits. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY

EmRata's Itty-Bitty Bikini Just Brought Back This "Cheugy" 2010s Trend

Friday, March 7, 2025

Plus, everything you need to know about Venus retrograde, your daily horoscope, and more. Mar. 7, 2025 Bustle Daily New books from Emily Henry, Karen Russell, and Kate Folk are among Bustle's best