The Pomp Letter - The Financial Crisis Is Upon Us

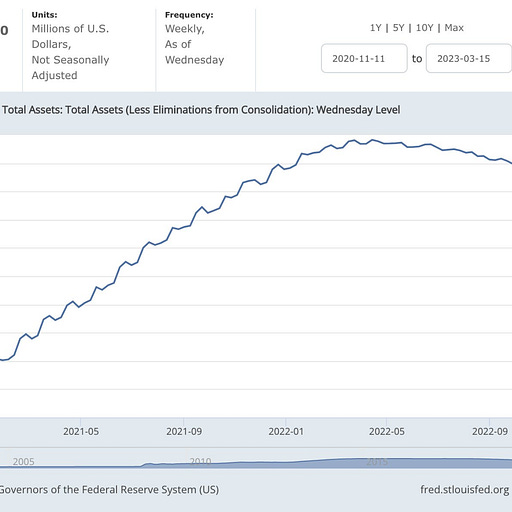

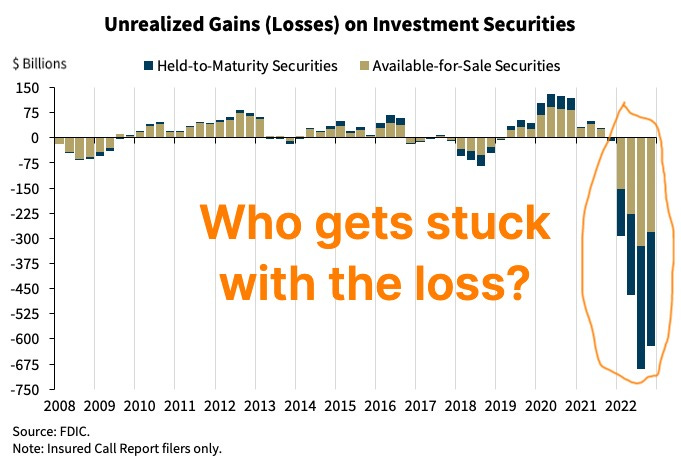

To investors, There is a massive financial crisis underway at the moment. Alarm sirens are going off almost every day. As a friend told me yesterday, “bodies keep floating to the surface.” This is really, really not good. The shut down of Silvergate Bank, along with the takeovers of Silicon Valley Bank and Signature Bank, have been well documented. Two days ago we got word that Credit Suisse was under immense stress and the Swiss National Bank agreed to step in with tens of billions of dollars in liquidity. Yesterday it was announced that First Republic Bank was going to receive $30 billion in deposits from 11 other banks. $30,000,0000,000 doesn’t get handed to you by your competitors if there aren’t some major issues at hand. But all these bank issues are just the appetizer in my opinion. The main course started last night when we received confirmation that the Federal Reserve increased their balance sheet last week by nearly $300 billion. This increase in the balance sheet comes after a year of quantitative tightening, which contracted the Fed’s assets. But now we have a pivot in the Fed’s balance sheet strategy. One of the biggest problems with this pivot is that the Fed has not yet won their battle against inflation. In fact, the Fed increased interest rates by 4.5% and dumped about $1 trillion off their balance sheet, but they never got inflation below 6%. MAJOR. PROBLEM. The Fed is increasing their balance sheet because they have to lend money to the banks. Without this new injection of liquidity, many of the banks appear to be insolvent due to their unrealized losses on long-duration, low-yield debt. Why do the banks have unrealized losses on that debt? Because the Fed jacked up interest rates at the fastest pace in history and the banks didn’t properly hedge their positions against this scenario. On one hand it is understandable why there was no hedging — the Fed told everyone that interest rates were going to be 0.5% or less right now. On the other hand, when has it ever been a good idea to believe everything a central bank tells you? It may be worse than that though — Balaji Srinivasan describes the gravity of the situation with the following:

One way to think about what has happened here is to compare Sam Bankman-Fried’s FTX debacle to the actions of US-regulated banks. FTX reportedly took in customer deposits and invested them in high-risk assets, which ended up leading to massive financial loss of the depositors’ funds. These loses, and the overall failed scheme, was exposed when depositors conducted a run-on-the-bank last year. US-regulated banks have done something that looks eerily similar. They took customer deposits and invested them in the wrong assets. Now the big difference is that the banks were not buying crypto assets, but rather buying US Treasuries and other debt instruments, which have been historically seen as low-risk. Regardless of the risk profile though, the banks now have immense unrealized losses on their balance sheets and when the bank runs started at some of the banks last week, these losses were exposed for everyone to clearly see. It is absolutely insane to think that FTX and these regulated banks had a comparable mechanism at play. Thankfully, the regulated banks were able to preserve 100% of depositors’ money after the government bailed them out, but the equity and bond holders of both FTX and Silicon Valley / Signature Banks ended up in the same situation. That is exactly how capitalism is supposed to work. This brings us to the current crisis. The Federal Reserve and other central banks around the world are in a lose-lose scenario. If they increase their balance sheet and stop hiking rates, they will be able to quell the banking crisis. The trade-off will be a loose monetary policy in a high-inflation environment, which will almost certainly lead to significantly higher inflation in the future. If the Fed chooses to ignore the current banking issues and continue hiking rates, which would be in-line with what the economic data is telling them to do, then we will test whether the US government, who is currently facing a debt limit crisis, can actually come up with enough money to backstop every bank’s deposits. That is not an experiment I want to see us run. This leads me to what I believe the base case for the US economy and dollar will be moving forward. I do not think the Federal Reserve, FDIC, OCC, and other organizations will allow a banking crisis to occur on their watch. That is a good thing. But in order to prevent the banking crisis, we will likely see a return of loose monetary policy and inflation will continue to resist the Fed’s demands. It is not only unclear how high inflation can go, but it is also impossible to predict how long the high inflation environment could last for. The United States is responsible for the global reserve currency. If our monetary policy decisions create high inflation, we should expect people to flee the dollar and look for alternatives. The traditional finance people will point to gold or foreign currencies as a potential solution. I disagree. As I have been saying for years now, bitcoin is going to be the big winner in my opinion. The decentralized, digital currency was built out of the ashes of the last financial crisis and I believe it will achieve global adoption through the current one. I know that many people will question whether we are actually in a financial crisis right now. All that I ask is for you to do your own research. Look at the data. Identify the strong and weak points of the economy. Take a look at bank balance sheets, government debt, and the current inflation levels that are accelerating, rather than decelerating month-over-month. This situation is very troublesome. Some of you will also argue that bitcoin is not the solution. That is fine. In fact, it is good to be skeptical. Bitcoin needs critics. But if you are going to take that position, make sure you have done your homework first. Read the bitcoin white paper. Ensure you understand the pros and cons of a programmatic monetary policy, especially in light of undisciplined fiat monetary policy. It is going to be essential that you pay attention in the coming weeks. You need to be informed. As Vladimir Lenin said, “There are decades where nothing happens; and there are weeks where decades happen.” Given that two of the three largest bank failures in US history happened last week, these may be a few weeks where decades happen. Hope you all have a great weekend. I’ll talk to everyone on Monday. -Pomp Reader note: I write this letter every morning as a way to organize my thoughts and solicit feedback from smart individuals like yourself. The letter is sent for free once a week and to paid subscribers four times a week. If you would like to receive this letter every day, you can subscribe here for $100 per year. Hope you join us. 🚨Want A New Job? 🚨My team and I have helped almost 2,000 people get a new job in the bitcoin and crypto industry. A big part of our success has been a training program we run, which teaches people the fundamentals of the industry and technology. If you are interested in transitioning into this new sector, I recommend you check out the training program for our April cohort. You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. |

Older messages

The American Banking Scandal of 2023?

Thursday, March 16, 2023

Listen now (8 min) | To investors, The past week has seen three banks shut down, including the second and third largest bank failures in United States history. This appears to be created by a bad

Did The Government Bailout Of Banks Just Seal The Victory For Inflation?

Monday, March 13, 2023

Listen now (7 min) | To investors, Silicon Valley Bank's failure on Friday afternoon left the business and finance industries scrambling in uncertainty. Would depositors get their money back? What

Silicon Valley Bank Is A Casualty Of The Fed's Market Intervention

Friday, March 10, 2023

Listen now (8 min) | To investors, Silvergate Bank announced they would liquidate earlier this week. Now Silicon Valley Bank has come under immense pressure as a bank run commenced yesterday. There is

What I Learned Talking To Interesting People This Weekend — LYCEUM Miami Recap

Monday, March 6, 2023

Listen now (7 min) | To investors, I hosted a conference this weekend at the Miami Beach Convention Center. The event featured guests from across industries and I sat on stage for nearly 9 hours to

6 Charts To Explain The Fed Standoff With Inflation

Thursday, March 2, 2023

Listen now (4 min) | To investors, The month of March marks the one year anniversary since the Federal Reserve started aggressively hiking interest rates. Inflation remains persistently high at 6.4%,

You Might Also Like

Marketing Weekly #222

Sunday, March 9, 2025

Why Faceless Social Media Accounts Don't Work — Lessons From Someone Who Tried • How We Cut Lead Costs by 75% with Facebook Ads (and How You Can Too) • The True Art of Being Customer-Centric • The

Why The Per-Seat Model Isn’t Dead (Yet)

Sunday, March 9, 2025

And the top SaaStr news of the week To view this email as a web page, click here The Per-Seat Model Isn't Dead. But Also, Surprisingly, It Was Never Dominant. The Per-Seat Model Isn't Dead. But

Startups gear up for EU defense surge

Sunday, March 9, 2025

Also: Female founder face anti-DEI wave, our Global Markets Snapshot wraps up February's action & more Read online | Don't want to receive these emails? Manage your subscription. Log in The

Sunday Thinking ― 3.9.25

Sunday, March 9, 2025

"Whenever honesty is missing, walls slowly start appearing."

🚨 Weekend Wrap-Up: Chatbots Are Stealing 96% Of Your Clicks

Sunday, March 9, 2025

The Weekend Update... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 How to create a unicorn

Sunday, March 9, 2025

Vanta opens up about building a security game-changer. 🔐

Brain Food: Guts Over Brains

Sunday, March 9, 2025

Your reputation isn't just what people say about you—it's the position from which you make every move. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Recruiting Brainfood - Issue 439

Sunday, March 9, 2025

50 Thoughts on DOGE, World Energy Employment Report, a self updating spreadsheet with Real Time TA jobs, the psychological injury of being laid off and why AI Agents need to be KPI'd... ͏ ͏ ͏ ͏ ͏ ͏

+49% increase in cart adds (funny A/B test)

Sunday, March 9, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

🦸🏻#13: Action! How AI Agents Execute Tasks with UI and API Tools

Saturday, March 8, 2025

we explore UI-driven versus API-driven interactions, demystify function calling in LLMs, and compare leading open-source frameworks powering autonomous AI actions