Earnings+More - Weekend Edition #90

Weekend Edition #90Caesars’ digital bridge, F1 could be a Las Vegas fixture, Bally’s headcount, sector watch – crypto trading +MoreGood morning and welcome to the latest weekender. On today’s agenda:

Caesars’ digital bridgeThe “lofty goal” of $550m of digital EBITDA by 2025 might be optimistic. I can see clearly now: There is “healthy” and “understandable” skepticism around Caesars’ claims to be able to generate $550m of digital profits by 2025, suggested the analysts at Wells Fargo. But they added that they “do see a path” to $400m of EBITDA from the company’s OSB and iCasino business.

Hinge and bracket: To get there, Wells Fargo suggested success will “hinge” on modest sports-betting GGR market share gains, maintaining rational promo spend levels, executing its iCasino ramp while also curtailing marketing. The $550m target rests on Caesars being able to grab 11% medium-term sports-betting market share alongside a “structurally high hold” of 7.2% vs. 2022’s 4.5%. iCasino GGR would need to hit $500m or ~8% market share, promotions cut to $265m and marketing costs pegged at $220m.

Plausibility: Wells Fargo suggested $400m is more plausible, with “more realistic assumptions” for 2025 of 9% sports-betting market share, 7% iCasino share, promos of $230m and marketing at $230m. How do you get to Carnegie Hall? The analysts suggested “several imperatives” for Caesars including improvements on hold – “a must” – and OSB share in new states of ~10%, while the iCasino “market share capture” must also be successful.

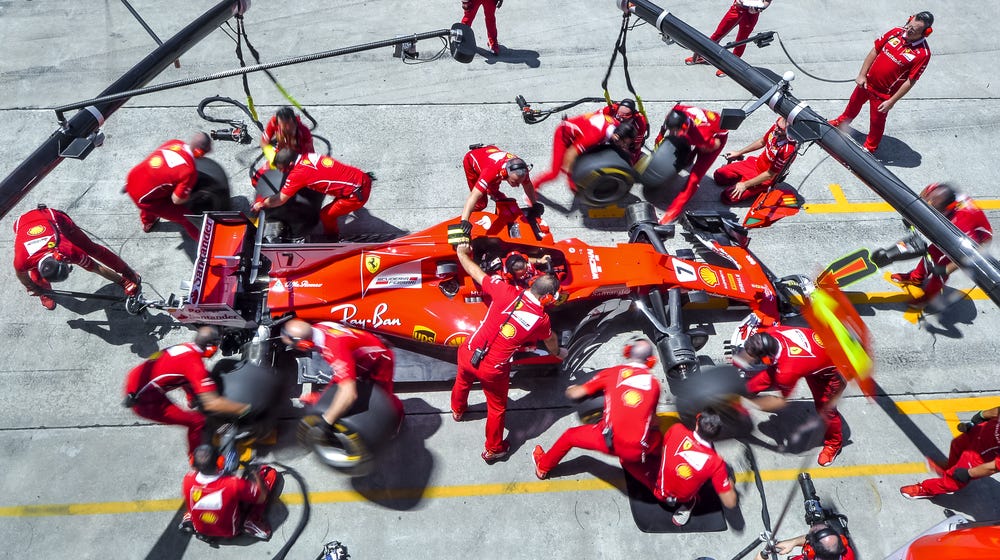

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com Drive to surviveChecking in on current development sites, the team at CBRE suggests there is every indication that F1 will be more than a three-year gig. Motor home: Visiting the site of the paddock area currently being built for the Formula 1 Grand Prix in mid-November, the team at CBRE have pointed out the $500m investment in Las Vegas on the part of F1 dwarfs that of other GPs.

More than a pitstop: As it stands, F1 is only slated to appear in Las Vegas for three years. However, CBRE noted that the Clark County Commission recently passed a resolution that made it possible to close Las Vegas Blvd the week before Thanksgiving every year until 2032. Pipeline: CBRE noted that 2023 is a big year for developments and new openings in Las Vegas with 60 projects in the pipeline, including Hard Rock’s rebranding of the Mirage, Red Rock Resorts’ new Durango casino, the opening of the Fontainebleau and the MSG Sphere.

DraftKings deep diveRemaining neutral, Deutsche Bank seeks an “intelligent debate” in future profitability. Point: For the bulls, DB suggested there is evidence of increasing promo intensity, incremental market share gains, better hold percentages and a decent capital position, with net cash providing a “differentiating aspect” among peers. Counterpoint: “Taking a more critical look,” however, DB suggested that promo easing is having a “direct impact” on handle, “taking the steam out” of future TAM projections. Meanwhile, DraftKings is “overly exposed” to lower margin OSB relative to iCasino.

Bally’s diminishing headcountTo do: The application of data-driven marketing into retail casinos and a greater focus on cost management are top of new CEO Robeson Reeves to-do list, according to Wells Fargo.

Analyst takesPlaytech: The team at Peel Hunt admitted their previous FY27 estimate on adj. EBITDA of €518m was a “little miserly” given Playtrech spoke this week about a new medium-term target of between €500m and €600m.

Gambling.com is “off to a hot start” in Q1 due to the launches of the Ohio and Massachusetts sports-betting markets, said the analysts at Truist. Noting that Q4 and Q1 were traditionally the company’s strongest quarters, they suggested the guidance for 2023 of revenues at between $93m and $97m was in line with analyst expectations.

Entain: Despite MGM Resorts’ commentary in early February that it isn’t interested in pursuing a buyout of its BetMGM JV partner, the team at Jefferies refused to let go of the possibility. “Many observers noted the supplementary ‘for now’ comment,” they suggested, potentially grasping for straws. BC’s delayed gratificationNon-instant karma: Better Collective would not divulge “sensitive data” on player values, but CEO Jesper Søgaard said the “delayed gratification” of the revenue share model the group favors varies according to geography.

Earnings in briefZeal: Looking ahead to 2023, the Germany-based lottery product provider said it has an application pending with the German regulator to provide online games. It added that it expected revenues for the year to be between €110m and €120m, with EBITDA expected to come in at €30m-€50m. ICYMISame-game changer: This month’s edition of Due Diligence delved into what is being said by the operators about same-game parlays and in particular about the in-house vs third-party debate.

In Compliance+More yesterday the news was led by the latest multi-million-pound fine handed out by the UK Gambling Commission to Kindred for RG and AML failings.

Sharpr this week reported on comments from New Jersey Division of Gaming Enforcement Deputy Attorney General Anthony Strangia, who said that about half of the state’s licensed sportsbooks accept esports wagers. On the Gambling Files podcast this week, affiliates marketing was in the spotlight as Fintan chatted to Kim Lund.

Sector watch – crypto tradingStake on me: Coinbase saw its shares drop over 14% on Thursday after the company told the market it had received a warning from the SEC about an impending action on various trading activities.

Well done: Staking means exchange users lock up their tokens in other crypto projects in return for a high yield. Awaken the Kraken: Coinbase maintains the tokens listed on its exchange are not securities. However, rival Kraken discontinued its own staking business under similar pressure from the US authorities, albeit without admitting or denying the SEC allegations.

Further reading: Matt Levine on what the SEC really wants. 😱 Coinbase’s five-day share price chart ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. NewslinesCentury Casinos has received licensing approval from the Nevada Gaming Commission in relation to its acquisition of the Nugget Casino in Sparks. EveryMatrix has been awarded a license to distribute its content, platform and services in Connecticut. On social They'd cause problems up top in League 2  Politics UK @PolitlcsUK Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Playtech’s hard rockin’ ’n’ rollin’

Thursday, March 23, 2023

Playtech talks up Hard Rock, Gambling.com is a doubler, BC talks up digital sports future, Michigan data +More

Same-game changer

Tuesday, March 21, 2023

The lowdown on SGPs, analyst takes +More

US sportsbooks’ banking choice MVB tumbles

Monday, March 20, 2023

Banking crisis drags MVB shares down, Spain's local heroes, PA data, startup focus – Grilla +More

Weekend Edition #89

Friday, March 17, 2023

Betr's expanded offering, Light & Wonder dual track, Sportradar analyst reaction, New Jersey February +More

Sportradar’s game, set and match

Thursday, March 16, 2023

Sportradar CEO talks revenues and ATP, Playtech's Hard Rock deal, Jason Robins' taxonomy, Super Group and Inspired earnings +More

You Might Also Like

⚠️ Final Call for Localrank.so Launch Discount

Friday, March 21, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

India Holds, Modi Folds

Friday, March 21, 2025

+ Electric two-wheeler maker Ola Electric is now under government scrutiny. Meanwhile, billionaire Elon Musk's X is suing India.

Where to Get $$$ in Canada? U.S. LLC or Corp? Answers to all of these questions

Thursday, March 20, 2025

Life in the North can be hard...especially for ecommerce entrepreneurs

$164,449 in 15 days SCREENSHOT & 24HR Warning (👀 Read now)

Thursday, March 20, 2025

View in browser ClickBank Hi there, There are just over 24 hours to go until the first of tomorrow's Strategy Labs starts and if you haven't secured your seat yet, select a time and get

Programmer Weekly - Issue 246

Thursday, March 20, 2025

March 20, 2025 | Read Online Programmer Weekly (Issue 246 March 20 2025) Welcome to issue 246 of Programmer Weekly. Let's get straight to the links this week. Learn how to make AI work for you AI

[Invite] How to bring the social data receipts 🧾

Thursday, March 20, 2025

Register for our webinar featuring Forrester. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The deliverability edition, delivered straight to your inbox. 😏

Thursday, March 20, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Python Weekly - Issue 691

Thursday, March 20, 2025

March 20, 2025 | Read Online Python Weekly (Issue 691 March 20 2025) Welcome to issue 691 of Python Weekly. Let's get straight to the links this week. Articles, Tutorials and Talks Why Python

The Economic Data Is Wrong And The Fed Should Have Cut Rates

Thursday, March 20, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

MONDAY: Last chance to save on Digiday Programmatic Marketing Summit passes

Thursday, March 20, 2025

Hear from industry leaders at Digitas, OMD and more