Earnings+More - FanDuel’s iCasino headway

FanDuel’s iCasino headwayFanDuel’s iCasino market shares examined, Sweden and Spain’s per capita difference explained, Portugal FY data +MoreGood morning and welcome to edition #2 of the Data Month.

FanDuel’s iCasino advanceThe operator is making good on its promise to bolster its iCasino market share. Building blocks: In two of the big three iCasino states, FanDuel’s market share has been creeping up in 2023 as the company attempts to ensure its sports-betting dominance translates to a greater degree in the more immediately profitable iCasino segment.

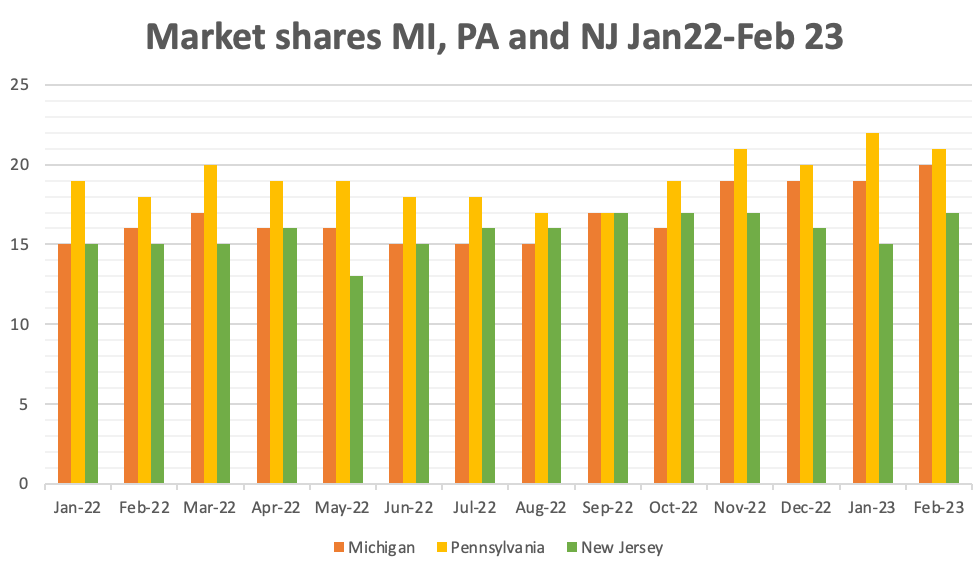

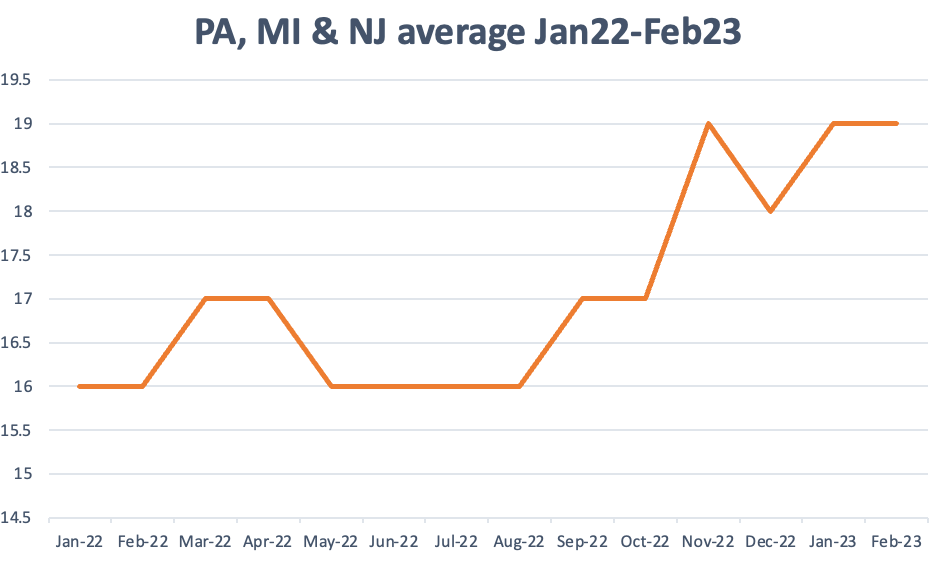

🍒 FanDuel’s iCasino market share month-by-month Jan22-Feb23 Pooling the market shares together, it can be seen that FanDuel’s average monthly market share across those three states stood at 16% in January 2022 and 19% by February 2023. ♠️ FanDuel’s average iCasino market share across MI, PA & NJ

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com Goal settingThis is Howe we do it: During the FanDuel investor event last November, CEO Amy Howe was keen to stress the company was not where it wanted to be with iCasino but that it was “on a very solid path to change that”.

The results, she said, were already evident, with iCasino direct activations up 55% YoY in Q322. That included the opening of Connecticut, but it still meant that like-for-like direct activations were up 33%.

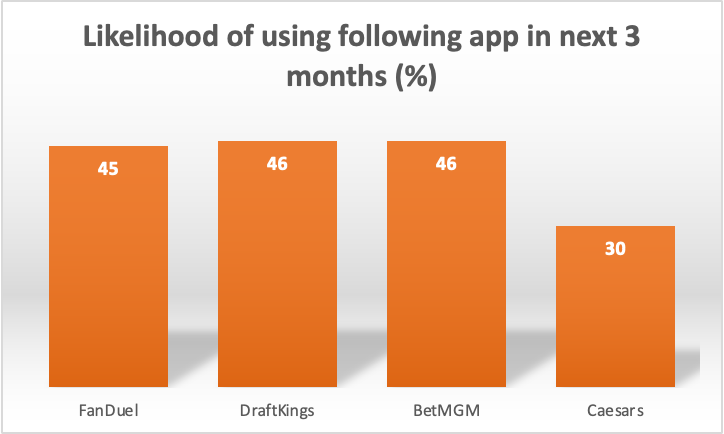

🍒 YouGov brand tracker survey (from FanDuel presentation) After the FOXFragmented: Howe agreed with one analyst questionnaire about the potential for iCasino to deliver greater market fragmentation vs. more settled sports betting. But she noted that within the Flutter operation there were other brands with which to attempt to grab further market share, with PokerStars being the most obvious.

The bottom line: The core message from FanDuel and parent Flutter is that the US/North American business will deliver EBITDA profitability this year. To be clear, that doesn’t appear to depend on delivering further iCasino market share gains; but every basis point will certainly help increase the quantum of profits. What we’re writingCompliance+More: The UKGC hits William Hill with a record £19.2m fine, plus UK White Paper rumors, North Carolina’s big OSB push +More. Sweden and Spain comparisonThe two countries achieved similar online GGRs in 2022, but there is a wide disparity between the per capita spend. Same but different: With similar licensing systems, similar levels of competitors, few product restrictions and attractive GGR-based tax rates, Spain and Sweden have similar inputs, but the outcome from each in terms of average spend per head of population is initially perplexing.

There is a clear difference between the two countries in terms of economic prosperity, but the team at Regulus don’t believe that explains more than 5ppts of the disparity. Then there is connectivity; Spain has a lower quality cell network, but this also doesn’t account for much more than 20ppts difference. Give me two good reasons: Two more reasons have been identified. One is the use of cash – Spain clings to its notes and coins, with POS cash transactions at 70%, while Sweden is much further down the road to cashless at 10%. The other is the existence of horseracing as a popular betting product. “Sweden has a secret weapon when it comes to betting: high quality – from a betting perspective – domestic horseracing,” Regulus pointed out.

How the land lies: Turning to gaming, Regulus noted that the same per capita gap cannot be explained away with horseracing, but a look at the whole market figures provides an answer. Again, Regulus identified a sizable disparity with Swedish per capita iCasino spend at €62 versus Spain’s much more modest €13, or an 80% gap.

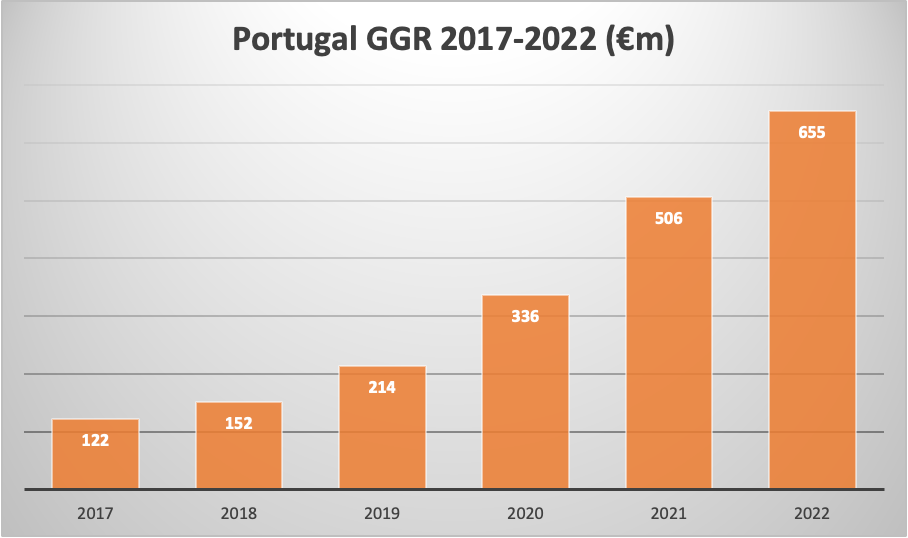

Portugal FY dataOnline revenue continues to grow, albeit it at a slower rate. Port of call: The Portuguese online market saw the pace of growth slow in 2022 to 29% compared with the 50%-plus increases in the previous two years, as total GGR came in at €655m. Since inception in 2017, the market has grown more than fourfold from €122m. 🚀 Portugal’s online market 2017-2022

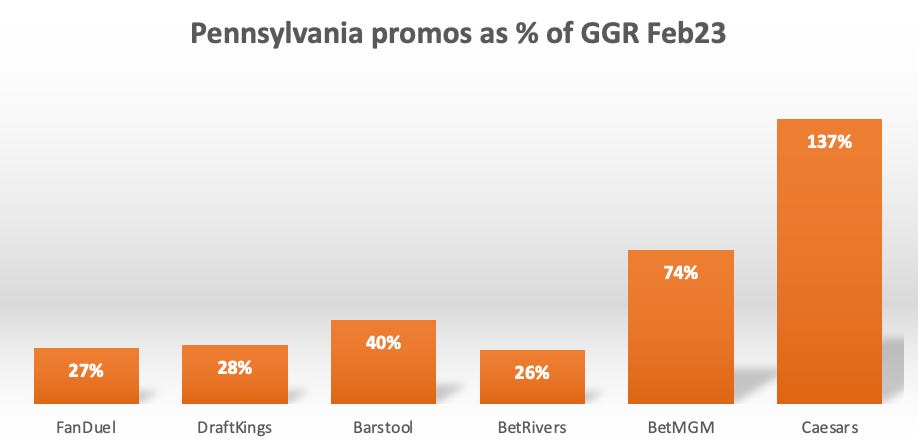

Names in the frame: This GGR was shared between 26 operators and, while we do not know the market shares, familiar names include Bwin, 888 and Betway, alongside domestic hero brands Casino Solverde, Casino Portugal, Placard.pt and the Luckia brand from neighboring Spain. ** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Data pointsPennsylvania: Promo spend data shows the cost of keeping up with the market leader. Horses for coursesWho rocks the Festival? OpenBet, the backend provider for many of the UK’s leading sports-betting offerings, said it saw a 22% rise in activity compared to last year’s Cheltenham Festival, with more than 65m bets processed.

Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Entain leads hunt for PointsBet Australia

Monday, March 27, 2023

Entain leads PointsBet Australia race, DraftKings' pay awards, Flutter sets dual listing date, startup focus – Golden Heart +More

Weekend Edition #90

Friday, March 24, 2023

Caesars' digital bridge, F1 could be a Las Vegas fixture, Bally's headcount, sector watch – crypto trading +More

Playtech’s hard rockin’ ’n’ rollin’

Thursday, March 23, 2023

Playtech talks up Hard Rock, Gambling.com is a doubler, BC talks up digital sports future, Michigan data +More

Same-game changer

Tuesday, March 21, 2023

The lowdown on SGPs, analyst takes +More

US sportsbooks’ banking choice MVB tumbles

Monday, March 20, 2023

Banking crisis drags MVB shares down, Spain's local heroes, PA data, startup focus – Grilla +More

You Might Also Like

⚠️ Final Call for Localrank.so Launch Discount

Friday, March 21, 2025

You are so very welcome ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

India Holds, Modi Folds

Friday, March 21, 2025

+ Electric two-wheeler maker Ola Electric is now under government scrutiny. Meanwhile, billionaire Elon Musk's X is suing India.

Where to Get $$$ in Canada? U.S. LLC or Corp? Answers to all of these questions

Thursday, March 20, 2025

Life in the North can be hard...especially for ecommerce entrepreneurs

$164,449 in 15 days SCREENSHOT & 24HR Warning (👀 Read now)

Thursday, March 20, 2025

View in browser ClickBank Hi there, There are just over 24 hours to go until the first of tomorrow's Strategy Labs starts and if you haven't secured your seat yet, select a time and get

Programmer Weekly - Issue 246

Thursday, March 20, 2025

March 20, 2025 | Read Online Programmer Weekly (Issue 246 March 20 2025) Welcome to issue 246 of Programmer Weekly. Let's get straight to the links this week. Learn how to make AI work for you AI

[Invite] How to bring the social data receipts 🧾

Thursday, March 20, 2025

Register for our webinar featuring Forrester. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The deliverability edition, delivered straight to your inbox. 😏

Thursday, March 20, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Python Weekly - Issue 691

Thursday, March 20, 2025

March 20, 2025 | Read Online Python Weekly (Issue 691 March 20 2025) Welcome to issue 691 of Python Weekly. Let's get straight to the links this week. Articles, Tutorials and Talks Why Python

The Economic Data Is Wrong And The Fed Should Have Cut Rates

Thursday, March 20, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

MONDAY: Last chance to save on Digiday Programmatic Marketing Summit passes

Thursday, March 20, 2025

Hear from industry leaders at Digitas, OMD and more