Earnings+More - Sizing Kentucky

Sizing KentuckyKentucky sports-betting estimates, Datalines – Ohio, Nevada conference visitors, GAN’s adverse investor reaction, startup focus – 2mee +MoreGood morning. On today’s agenda:

Blue field opportunityThe analysts are quick to flesh out the Kentucky opportunity. Out of the starting gate: With the ink barely dry on Gov. Andy Beshaar’s signature on Kentucky’s sports-betting legislation, JMP’s analysts suggest it will be 15th largest out of the current slate of 28 OSB states with a GGR at maturity of between $250m-$300m.

You don’t say: The existing fantasy sports market in Kentucky means that FanDuel and DraftKings will be in prime position to pick up early market share leadership, JMP suggests to absolutely no one’s surprise.

As per Ohio (see below for February data), JMP suggests it is likely the new launch will see “deeper initial investment, faster user adoption rates and high initial returns” compared to previous state launches.

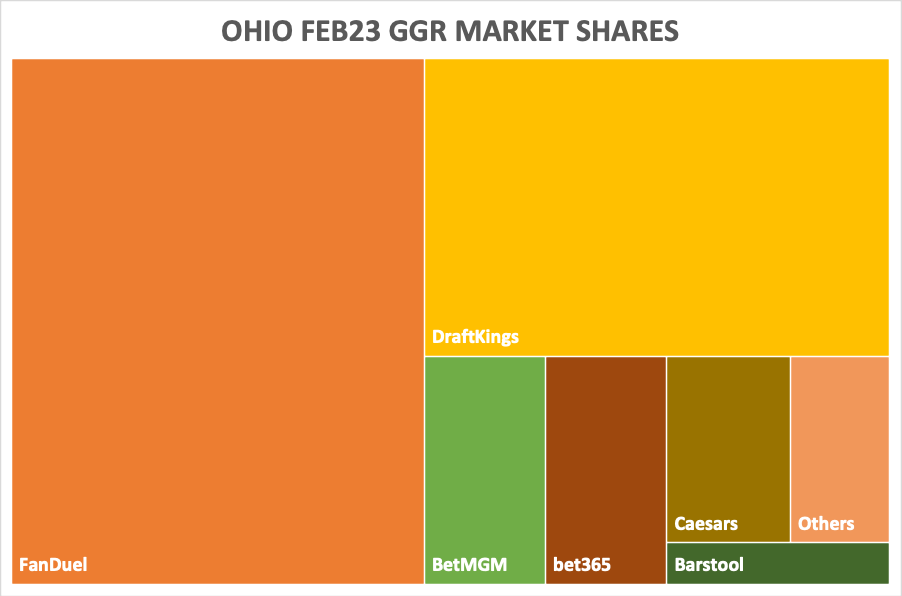

** SPONSOR’S MESSAGE ** Huddle is a next-generation technology provider for iGaming operators, dedicated to unlocking the full potential of this rapidly growing industry. Huddle’s cutting-edge automated odds feed solution offers fast, accurate pricing and trading services, helping operators increase turnover and drive margin; whilst reducing costs and managing risks. To find out more, please visit: https://huddle.tech/ Datalines – OhioBet365 emerges as a meaningful competitor in Ohio. Stoked: FanDuel and DraftKings continued their dominance of the Ohio market in February with a combined 77% of GGR but bet365 was a notable entry into the top four with 5.5% GGR share and 5% of handle.

Making hay: Meanwhile, the team suggests FanDuel – which they argue is “less encumbered” by profit expectations – was able to use aggressive promo spend in February to maintain its handle and GGR share.

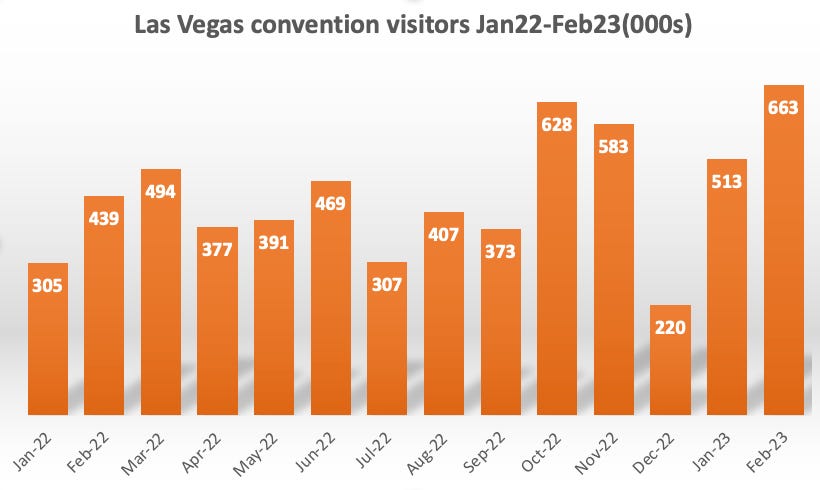

💯 Bet365 muscles its way into the top four in Ohio Datalines – Las Vegas VisitorsStrip revenues matched January's GGR total despite having three fewer days of activity, helped by the notable revival in conference traffic. The Las Vegas Strip continued its record-breaking run with Strip revenue at $712m, flat MoM but up 19% YoY while the quarter to date is up 22%. JMP’s analysts noted the continued strong fundamentals including the returning convention custom.

🍹 Las Vegas convention visitors rebound to just below pre-pandemic levels The shares weekInvestors reacted badly to GAN’s earnings. Cooling off period: The news AMC on Thursday that GAN has initiated a strategic review was enough to bring a 25% fall in GAN’s share price, reversing all of the gains from earlier in the week.

🤮 GAN’s shares slumped 25% on Friday ** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. The week aheadThe latest E+M Startup Month asks whether the evidence from the dearth of funding rounds in Q1 is evidence of the sources of funding drying up.

In Compliance+More today, the first Career Path has been issued, the new monthly edition trends in the compliance space and how they affect the working lives of those employed in the betting and gaming sector. Analyst takesBragg Gaming: Roth MKM says Bragg is one of the fastest-growing companies within their coverage noting that EBITDA growth for 2023 is predicted to be 33%. The team suggests Bragg is hoping to ramp up proprietary content and will be able to maintain distribution for all major operators in the three major iGaming states. Earnings in briefGaming Realms: FY22 revenue rose 22% to £18.7m helped by a 35% surge in licensing revenues. Adj. EBITDA rose 34% to £7.8m. Over the year, Gaming Realms signed up 53 partners to its Slingo Originals content.

FansUnite: Betting Hero drove most of the group’s FY22 revenues, but on the analyst call CEO Scott Burton said in Ontario regulations are nixing any affiliate activity. He added that the Canadian Gaming Association was working with the Alcohol and Gaming Commission of Ontario and was confident activation services will go live this year. Galaxy: The land-based and online tables games provider said revenue rose 5% to $6m while adj. EBITDA rose 30% to $3m. Startup focus – 2meeWho, what, where and when: Founded by James Riley in 2014, the York-based adtech provider drives engagement via sending messages through the medium of holograms for use by operators, affiliates and publishers Funding backgrounder: 2mee’s last funding round was closed in March 2022 with £500,000 raised from unnamed tech investors. The pitch: 2mee’s platform and efficient workflows allow operators to send influencers as advertising short-form video clips to their own sites and apps, as well as those of affiliates and content publishers.

What’s new: The big news coming out of 2mee is the full launch of HoloAd in Q2. “We have beta-launched the product with a handful of partners and the early results are off the charts,” Riley says. What will success look like? 2me is on target to triple revenues in the next 12 months, meaning breakeven will be reached just two years after commercialization.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com DatalinesMacau recorded a 247% YoY (+23% MoM) rise in GGR in March to $1.5bn, with the Deutsche Bank team noting that Q1 concluded with the jurisdiction enjoying a 95% YoY rise in GGR, even if it was down 54.5% vs. Q119.

NewslinesMinor leagues: Bally's is the new media rights holder of the Minor League Baseball organization and will act as its exclusive fantasy, OSB and gaming partner. Herr Grun: 888 has launched its MrGreen online casino brand in Germany in the past week, the first time the brand is available on 888’s proprietary technology platform. Codere hopes to raise €100m through new debt issuance as co-CEOs Alberto González del Solar and Alejandro Rodino have stepped down after completing a strategic review. Codere will also postpone €700m in bond maturities. On social Thanks for the memories, Graham 🤍🖤🤍🖤

#ffc #coyw #oneteaminfulham  Sky Sports Premier League @SkySportsPL An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekend Edition #91

Friday, March 31, 2023

GAN to seek what's best for shareholders, Playtech's LSports stake, RSI exits Connecticut, Entain TAB NZ deal +More

FanDuel’s iCasino headway

Tuesday, March 28, 2023

FanDuel's iCasino market shares examined, Sweden and Spain's per capita difference explained, Portugal FY data +More

Entain leads hunt for PointsBet Australia

Monday, March 27, 2023

Entain leads PointsBet Australia race, DraftKings' pay awards, Flutter sets dual listing date, startup focus – Golden Heart +More

Weekend Edition #90

Friday, March 24, 2023

Caesars' digital bridge, F1 could be a Las Vegas fixture, Bally's headcount, sector watch – crypto trading +More

Playtech’s hard rockin’ ’n’ rollin’

Thursday, March 23, 2023

Playtech talks up Hard Rock, Gambling.com is a doubler, BC talks up digital sports future, Michigan data +More

You Might Also Like

Where to Get $$$ in Canada? U.S. LLC or Corp? Answers to all of these questions

Thursday, March 20, 2025

Life in the North can be hard...especially for ecommerce entrepreneurs

$164,449 in 15 days SCREENSHOT & 24HR Warning (👀 Read now)

Thursday, March 20, 2025

View in browser ClickBank Hi there, There are just over 24 hours to go until the first of tomorrow's Strategy Labs starts and if you haven't secured your seat yet, select a time and get

Programmer Weekly - Issue 246

Thursday, March 20, 2025

March 20, 2025 | Read Online Programmer Weekly (Issue 246 March 20 2025) Welcome to issue 246 of Programmer Weekly. Let's get straight to the links this week. Learn how to make AI work for you AI

[Invite] How to bring the social data receipts 🧾

Thursday, March 20, 2025

Register for our webinar featuring Forrester. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The deliverability edition, delivered straight to your inbox. 😏

Thursday, March 20, 2025

The latest email resources from the Litmus blog and a few of our favorite things from around the web last week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Python Weekly - Issue 691

Thursday, March 20, 2025

March 20, 2025 | Read Online Python Weekly (Issue 691 March 20 2025) Welcome to issue 691 of Python Weekly. Let's get straight to the links this week. Articles, Tutorials and Talks Why Python

The Economic Data Is Wrong And The Fed Should Have Cut Rates

Thursday, March 20, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

MONDAY: Last chance to save on Digiday Programmatic Marketing Summit passes

Thursday, March 20, 2025

Hear from industry leaders at Digitas, OMD and more

Influencers will make more money in 2025

Thursday, March 20, 2025

March 20, 2025 | Read Online Google's March 2025 core update is rolling out. Sponsored by Online traffic from Generative AI surging, but reporting less conversions What: A report by Adobe surveying

We Never Do This!

Thursday, March 20, 2025

But This One's Big!