Earnings+More - 888 back in the Middle East VIP game

888 back in the Middle East VIP game888’s new Middle East onboarding, Earnings+More readers poll, Lottomatica listing, NY casinos, Japanese resorts casino news +MoreGood morning. On the Weekender agenda:

888’s Middle East return888 says the hit to revenues from Middle East VIP issues has been cut by half. The cost of compliance 1: 888 said it had recovered 40-50% of the business lost at the start of the year after it moved to suspend its Middle East VIP business in late January due to significant compliance failures.

Triage: Mendelsohn said the company had taken “swift action” with regard to the Middle East VIP business. “The failure was isolated to a very specific cohort of players,” he added.

As trailed, revenue for 2022 was down 3% to £1.85bn but adj. EBITDA rose 15% to £311m. Net debt remained high at £1.7bn or 5.6x pro forma adj. EBITDA and despite several debt issuances through the year.

The cost of compliance 2: Online revenues for FY22 fell by 15% as the company attempted to right the UK ship in the face of a far tougher regulatory backdrop. Ex-UK, online fell 4%. The company said it undertook 500k vulnerability checks in the UK and 2.7m globally, a 19% increase.

Lookout: The online pain continued into Q1 with UK online down 9% YoY and international off by 11%. QoQ UK online fell 3% and international by 9%. Overall Q1 revenues were down 5% to £446m. A partial offset came from retail, which was up 8% YoY in Q1.

🍆 The markets liked what they saw from 888’s print, sending the shares up nearly 15% in early trading. Earnings+More readers pollYour chance to have your say. Everyone likes a poll, right? E+M has teamed up with YouGov to conduct our first ever readers poll. To take part, simply click on this link. The poll consists of 15 multiple choice questions and only takes a couple of minutes. We’ve tried it out and, like a quick check up with the dentist, it’s painless and over very, very quickly, we promise.

We thank you for your time. ** SPONSOR’S MESSAGE ** Challengers welcome GeoComply and Citigroup invite start-ups and emerging operators and suppliers to free NYC Summit with superstars of gaming Avengers assemble: innovators, disruptors and grizzled veterans set to share hacks, tips and tricks with developing companies targeting regulated gaming markets in the US.

Come with us: the US gaming market can be a tough nut to crack. To get some free advice from some who have cracked it, apply for this exclusive event here. PointsBet rumor millPointing in different directions: PointsBet is now looking at selling its US operations having failed to find a buyer for its Australian business at a suitable price, according to the Australian Financial Review. The paper says Moelis & Co has been appointed to find a buyer.

Lottomatica’s Milan moveThe Italian-focused betting and gaming group is set to float in Milan. Floating points: The IPO on the Euronext Milan exchange is expected to generate €425m in proceeds, which will go towards retiring a shareholder loan and paying a portion of existing debt. Post-float, net debt will be reduced to €1.3bn or ~2.4x FY23 estimated adj EBITDA.

ICYMICompliance+More led on Thursday on the likelihood that the UK White Paper is ‘on the grid’ for release by the government next week, with Monday being a possibility. Will the UK industry finally get a sighting of its future regulatory framework?

In Sharpr this week, more details were revealed about the plans for the Optic Gaming betting venture. In the latest edition of Deal Talk on Tuesday, Earnings+More looked at who might buy betFIRST in Belgium. On the Gambling Files this week, Jon and Fintan talk to Richard Marcus about the upcoming Global Table Games and Game Protection Conference in Las Vegas. New York lotsThe ‘new’ New York casino market could be worth $5bn a year. I♥️NY: New York could be on the way to being the second largest commercial gaming state in the US, according to analysts at Bank of America. The team suggested revenues will be worth >$5bn at maturity, with total EBITDA across the winning bids of nearly $2bn.

Pick a winner: While fighting shy of picking the winners, the BoA team echoed the consensus that MGM and Genting will snag a license each, leaving 10 bidders aiming for the remaining slot.

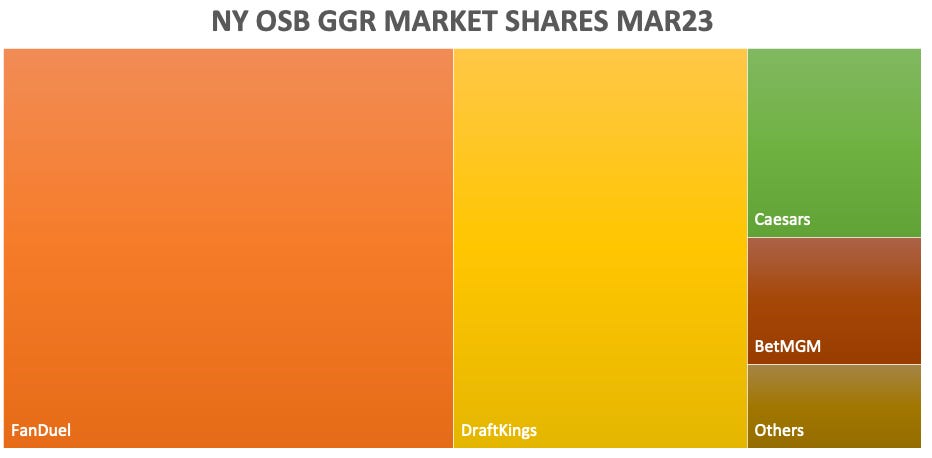

Datalines – New YorkCake: The top four continued their utter dominance in OSB with 96% between them. FanDuel led with 49%, DraftKings was second with 32%, Caesars was on 9% and BetMGM achieved 6% share.

🎂 New York winners – and the rest Bingo kingsEveri has snapped up electronic bingo provider Video King for $59m. Kings of the wild frontier: The fintech to gaming provider has effectively bought itself an installed base of 55k portable electronic bingo tablets that achieved revenues of >$25m in 2022 and which analysts suggested came with EBITDA margins of ~35%. That implies a multiple of ~6.7x.

M&A notebookTika tape: Playtika is reported to have attracted private equity takeover interest following the company’s strategic review last year. The casual games company was the subject of a rumored bid last summer from current shareholder Joffre Capital, which came to nothing. Growth company fundingProphet: Defying the recent funding drought, the New Jersey-based betting exchange has raised $10m of new funding from investors including MIXI Inc, Ninjabet.com and Chicago Trading Company.

Beyond Play: The platform and streaming provider has raised €5.5m of new funding led by previous backer Bettor Capital. David VanEgmond from Bettor Capital will also join the board.

Earnings in briefIntralot: Having brought Standard General in as an investor and reconfigured its debt, the Greek-listed lottery and gaming provider said it was now on a firmer financial footing after seeing 2022 revenues fall 5% to €392m. Cost cutting saw EBITDA rise 11% to €123m. Asia watch – Japan casinosThe long road to resort casinos in Japan is nearing a conclusion as the government approves the application for the city of Osaka. Prime Minister Fumio Kishida’s government has finally signed off on the proposal submitted by authorities in Osaka, opening the way to a scheduled launch in 2029, ending one of the longest sagas in global gaming.

Trust the process: Two other locations are up for consideration, including an IR in Nagasaki. However, as reported by Inside Asian Gaming, the bid there, led by the prefecture’s preferred partner Casinos Austria, has been somewhat mired in controversy with two unsuccessful local groups questioning the process.

Asia notebookMacau: The Government Tourism Office revealed there were 4.9m visitors in Q1 vs. 5.7m for the whole of 2022, with Macau casinos recording a 95% rise in GGR to $4bn during the period.

** SPONSOR’S MESSAGE ** March Madness statistics March Madness is over, and it's time to reveal the slam-dunk numbers that Huddle brought to the court this season! We're thrilled to share some exciting news with you:

Huddle continues to lead the industry when it comes to college football and basketball. Stay tuned for more updates and insights from Huddle. Find out more on our website: https://huddle.tech/ On socialThat’s leadership: Charles Gillespie from Gambling.com welcomes the news of the Premier League ban on gambling company shirt sponsorship. What we’re readingLand of luxury: Sportico’s JohnWallStreet column says Endeavor is on track to become the LVMH of sports following its UFC acquisition. No logo: English Premier League clubs have agreed to withdraw all gambling sponsorship from the front of matchday jerseys from the start of the 2026-27 season. NewslinesChurchill Downs has priced up a $600m new debt offering, which it intends to use to pay off an existing term loan. Lottery.com has received notice it does not comply with Nasdaq listing rules after failing to publish its 10-K. The company has requested a panel hearing. Sportradar has signed a two-year renewal agreement to supply sports data to the college sports-focused broadcaster Big Ten Network. Elys Game Technology will launch its North American online sportsbook platform by Q3. New York-based hedge fund Conifer Management has acquired a 10% stake in Catena Media. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

MGM’s ‘Japan dream’ comes true

Wednesday, April 19, 2023

MGM's Japanese opportunity, Better Collective makes adtech buy, LVS in the week ahead, startup focus – Kutt +More

Playtech B2B feels the Caliente heat

Wednesday, April 19, 2023

Entain's first quarter, Playtech's B2B issues, Better Collective's M&A commentary +More

Bottle job: Belgium’s betFIRST up for grabs

Tuesday, April 11, 2023

The betFIRST biding battle, quarterly transactions review, Playtech's Hard Rock Deal +More

Weekend Edition #92

Thursday, April 6, 2023

Entain's 365scores deal, Ontario data, FanDuel and Caesars analyst takes, regional US data +More

Is the funding tap running dry?

Tuesday, April 4, 2023

The number of founding rounds for Q1 suggests something of a drought, gambling's exposure on banks +More

You Might Also Like

The #1 customer LTV in the world (4 keys)

Thursday, March 20, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Lessons From Dot Com Boom

Thursday, March 20, 2025

+ Homes in Delhi are becoming obscenely expensive. Meanwhile, IndiGo is looking to soar greater heights.

Topic 32: What is Qwen-Agent framework? Inside the Qwen family

Wednesday, March 19, 2025

we discuss the timeline of Qwen models, focusing on their agentic capabilities and how they compete with other models, and also explore what is Qwen-Agent framework and how you can use it

🦅 This will help you from being stopped by imposter syndrome

Wednesday, March 19, 2025

xAI's first acquisition | Instagram tests AI-generated comments | Facebook Stories now eligible for creator monetization

From $0 to $12 Million Per Year With Fat Joe

Wednesday, March 19, 2025

This week, we're excited to have Joe Davies from FatJoe.com on the Niche Pursuits Podcast. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Skype is dead, but SORA changes everything😲(read ASAP)

Wednesday, March 19, 2025

View in browser ClickBank Hi there, You may have heard that after 22 years, Microsoft is killing off Skype and replacing it with Teams 😬 but let's be honest... this isn't exactly exciting news.

You’re the heart of social—we see you

Wednesday, March 19, 2025

And you deserve better tools, better support, and better balance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Here’s the One Investment That Can Change Your Life in 2025

Wednesday, March 19, 2025

The Biggest Opportunity of 2025

Founder Weekly - Issue 677

Wednesday, March 19, 2025

March 19, 2025 | Read Online Founder Weekly (Issue 677 March 19 2025) Welcome to issue 677 & of Founder Weekly. Let's get straight to the links this week. Google purchased Nest ($3.2B), Amazon

A look at the categories for this year's Greater Good Awards

Wednesday, March 19, 2025

As companies tackle pressing issues like wellness, sustainability and local community betterment, their efforts often go unnoticed despite their powerful impact. The Greater Good Awards offer a