Earnings+More - Playtech B2B feels the Caliente heat

Playtech B2B feels the Caliente heatEntain’s first quarter, Playtech’s B2B issues, Better Collective’s M&A commentary +MoreGood morning. First on today’s agenda, we give a quick rundown of Entain’s Q1 numbers, which gives the market a first sighting of BetMGM’s Q1 performance, before dipping into this month’s edition of Due Diligence.

And, there is a reminder about the Earnings+More readers poll. Love is a gamble and I'm so glad that I'm winning. Entain’s BetMGM boostBetMGM enjoys a 76% boost to Q1 revenues as Entain revels in a strong start to the year. Across the water: BetMGM’s revenues rose to $470m in Q1, in line with guidance for this year of revenues at $1.8bn-$2bn and 76% up YoY. No adj. EBITDA losses were given but Entain said the JV remained on track to deliver adj. EBITDA profitability in the second half.

Across the universe: NGR across the group rose 15%, or 17% when the share of BetMGM is taken into account. Online rose 16% and retail was up 14%. Gaming NGR was the standout, up 25% YoY.

Funnel vision: Recall, at the start of April Entain bought live scores app provider 365scores in a deal worth up to $160m. Nygaard-Andersen said the move was in line with its strategy of “opening up the funnel” for customer engagement.

🔇 Entain share price shows a muted response to the Q1 numbers ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Earnings+More readers pollYour chance to have your say. Everyone likes a poll, right? E+M has teamed up with YouGov to conduct our first ever readers poll. To take part, simply click on this link. The poll consists of 15 multiple choice questions and only takes a couple of minutes. We’ve tried it out and, like a quick check up with the dentist, it’s painless and over very, very quickly, we promise.

We thank you for your time. Playtech’s B2B profit analysisThe recent strategic partnership with Hard Rock grabbed the headlines but a look at the B2B numbers shows the company’s reliance on Caliente. I need you: As was discussed in last week’s Deal Talk, Playtech will be hoping the deal with Hard Rock to provide iCasino platform services while also taking a single-digit stake in the business will emulate the commercial success of the deal with Caliente, although avoiding a similar legal mess.

The driver: While the Caliente contribution to B2B revenues isn’t broken out, it can be seen from the geographic breakdown that Mexico – the overwhelming majority of which is likely accounted for by the revenue share with Caliente, with Codere accounting for a small slug – was worth €124m in 2022.

Juggling balls: The legal situation with Caliente surrounding the validity of an option for the Caliplay business remains hard to call, with one possible outcome being that Playtech gets paid out of the deal and sells its 49% share of Caliplay back to Caliente.

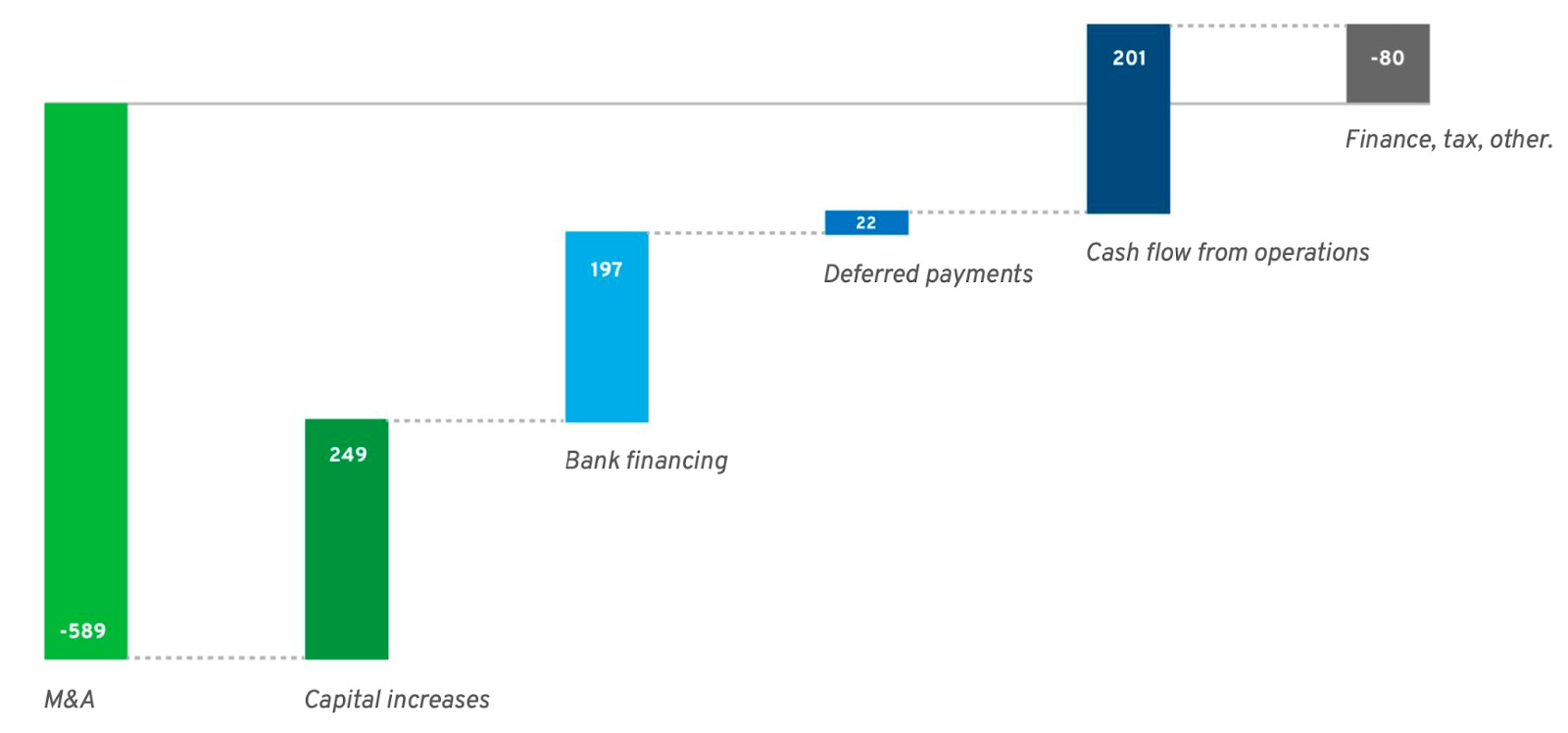

Better Collective M&AM&A was much discussed during Better Collective’s recent investor event. Buy, buy baby: M&A past, present and future was a key subject during the super-affiliate’s marathon Capital Markets Day event held in late March. A company that has grown as much via acquisition as organically, since 2017 Better Collective has completed 28 deals worth a combined €589m.

💰 Pay the piper: Better Collective’s funding of its acquisition spree Roll your own: CFO Flemming Pedersen made the point during the meeting that up until the US opportunity opened up for affiliates, Better Collective had been successfully pursuing a roll-up strategy of European-focused affiliates. Big numbers: Post-PASPA, however, as can be seen, it has branched out both geographically and in terms of product areas.

The multiplier: Pedersen gave an example of why Better Collective’s record on acquisitions stands up so well. Pointing to the €9.6m deal for Soccernews.nl in the Netherlands in September 2021 he said that after moving the business to the Better Collective tech stack, increasing the frequency of content and taking over all the commercial dealings it had multiplied revenue by 5x in 18 months.

That was then, this is now: CEO Jesper Søgaard laid out what Better Collective is looking for now in an acquisition, which he then broke down into three elements:

“When we can tick those boxes, and if it relates to any shape or form of sports, then we’re interested,” Søgaard said. “That’s the kind of brands where we believe we, as owners, will be able to monetize them better and grow that audience, enabling further investments into the business.” The big sky: Better Collective’s M&A plans need to be viewed from the perspective of its overall efforts to reposition itself as a digital sports media play. Hence, the move for Skycon, which adds display advertising expertise to the mix.

Keeping score: One area where it sees a gap in its own offering is in the area of live scores. This has been the scene of some activity just recently, with Entain buying 365scores for up to $160m.

** SPONSOR’S MESSAGE** The Huddle Journal

These remarkable statistics demonstrate Huddle's expertise, cutting-edge technology, and unwavering commitment to customer satisfaction. Learn more and check the Huddle Blog here: https://huddle.tech/college-basketball-statistics-and-huddle-performance-2023/ Analyst takesDraftKings: New state launches “keep getting better”, with Ohio and now DraftKings’ home state of Massachusetts showing what the analysts at CBERE suggested are better-than-expected customer acquisition and revenue trends in Q123.

Massachusetts: Staying with DraftKings, the team at EKG noted in its monthly Sports Betting Monitor that DraftKings “appears to have come out strong” when Google search trends are analyzed.

CalendarApr 19: Las Vegas Sands Apr 25: Boyd Gaming Apr 26: Kindred, Kambi, Churchill Downs earnings Apr 27: Churchill Downs call, Evolution, Betsson, GLP An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Bottle job: Belgium’s betFIRST up for grabs

Tuesday, April 11, 2023

The betFIRST biding battle, quarterly transactions review, Playtech's Hard Rock Deal +More

Weekend Edition #92

Thursday, April 6, 2023

Entain's 365scores deal, Ontario data, FanDuel and Caesars analyst takes, regional US data +More

Is the funding tap running dry?

Tuesday, April 4, 2023

The number of founding rounds for Q1 suggests something of a drought, gambling's exposure on banks +More

Sizing Kentucky

Monday, April 3, 2023

Kentucky sports-betting estimates, Datalines – Ohio, Nevada conference visitors, GAN's adverse investor reaction, startup focus – 2mee +More

Weekend Edition #91

Friday, March 31, 2023

GAN to seek what's best for shareholders, Playtech's LSports stake, RSI exits Connecticut, Entain TAB NZ deal +More

You Might Also Like

We Never Do This!

Thursday, March 20, 2025

But This One's Big!

🎙️ New Episode of The Dime The Hard Thing About Hard Things: A Melody of Grit & Fortitude ft. Christina Betancourt Johnson

Thursday, March 20, 2025

Want to be featured on The Dime Podcast? Scroll to the end of this email to find out how. Listen here 🎙️ The Hard Thing About Hard Things: A Melody of Grit & Fortitude ft. Christina Betancourt

Well-connected VCs reduce startup risk

Thursday, March 20, 2025

Energy storage 'Holy Grail' draws investors; foodtech dealmaking grows strategic; Europe's female founders grab €10B+ Read online | Don't want to receive these emails? Manage your

Is social media a waste of time?

Thursday, March 20, 2025

Is your social media presence driving traffic and revenue for your business? Showing up in your audience's feed isn't enough (if you manage to show up at all). With organic reach declining, you

34% of All Startup Acquisitions Are By Other Start-Ups

Thursday, March 20, 2025

A New Record To view this email as a web page, click here saastr daily newsletter 34% of All Startup Acquisitions Are By Other Start-Ups. A New Record. By Jason Lemkin Wednesday, March 19, 2025 | Blog

🦄 Decacorn Spy vs Spy

Thursday, March 20, 2025

A spy story of the grandest scale in the world of payroll management. 🕵🏻♂️

The Right Call Takes More Than Luck

Thursday, March 20, 2025

Making the right call takes more than luck—it takes judgment, courage, and a willingness to make adjustments along the way.

Got Your Back(links)

Thursday, March 20, 2025

3 sure-fire ways to build.

As retail media booms, lines blur between performance and brand marketing budgets

Thursday, March 20, 2025

Marketers and agencies are grappling with divisions over who exactly controls retail media spend, causing a trickle-down effect on how retail media deals are brokered. March 20, 2025 PRESENTED BY As

🔔Opening Bell Daily: 'Transitory' is back

Thursday, March 20, 2025

The Fed forecasted slower growth and higher inflation yet stocks surged.