Earnings+More - Is the funding tap running dry?

Is the funding tap running dry?The number of founding rounds for Q1 suggests something of a drought, gambling's exposure on banks +MoreGood morning. In edition #9 of the Startup Month:

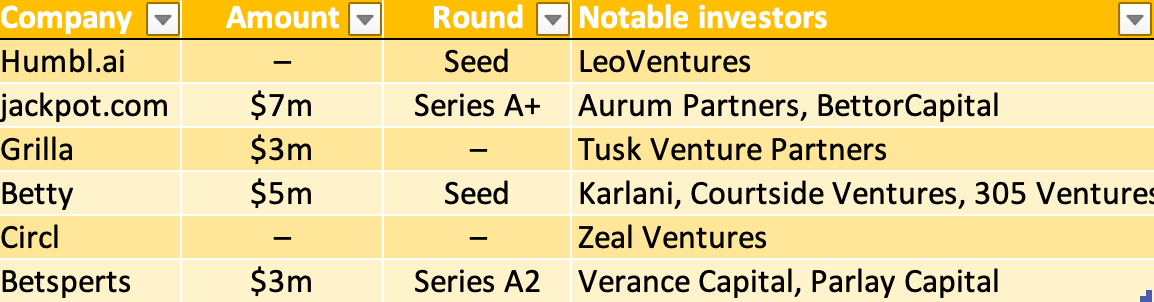

The funding droughtBetting and gaming-related funding rounds as tracked by E+M hit a low point. The dirty half-dozen: According to the Earnings+More startup funding tracker, the number of deals announced in the first quarter came in at a mere six, raising a combined total of less than $20m.

🏜️ Funding rounds dry up in Q1 Excluding the undisclosed deal amounts, the $18m figure represents a ~60% drop on the $46m that E+M tracked in Q1 last year.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com River runs dryA predicted outcome: A slowdown in funding has been anticipated since long before the turn of the year as the economic backdrop worsened and interest rates rose. But it isn’t so simple as to suggest that simply the well has run dry, suggest the market commentators, with a variety of factors playing into the apparent slowdown in activity. Under the radar: One issue is rounds that go unannounced. This may include bridge rounds, whereby current investors stump up more cash, or new money rounds at higher valuations.

Put that in your pipe: Then there is the issue of timing. As Chris Grove from Acies Investments points out, normally in the first quarter work we would see activity driven by work done at the end of the preceding year. “But there simply wasn't that pipeline coming out of 2022 this year,” he says.

Heads turned: Kelly Kehn from Happyhour.io says the sector might also be suffering right now from investors turning their attention to the innovation happening elsewhere, particularly in AI. This could lead to a reduction in the number of funding rounds for iGaming start-ups, as investors seek out companies with more unique and innovative ideas,” she says.

Heading for the high ground: Peter Heneghan, senior associate at Bettor Capital, says there is a “valuation sensitivity” that also comes into play with a “flight to quality” evident right now.

Hope springsKeep smiling: Heneghan remains positive, though, that there is “significant funding available” for startups, and more broadly, for the gaming space as a whole.

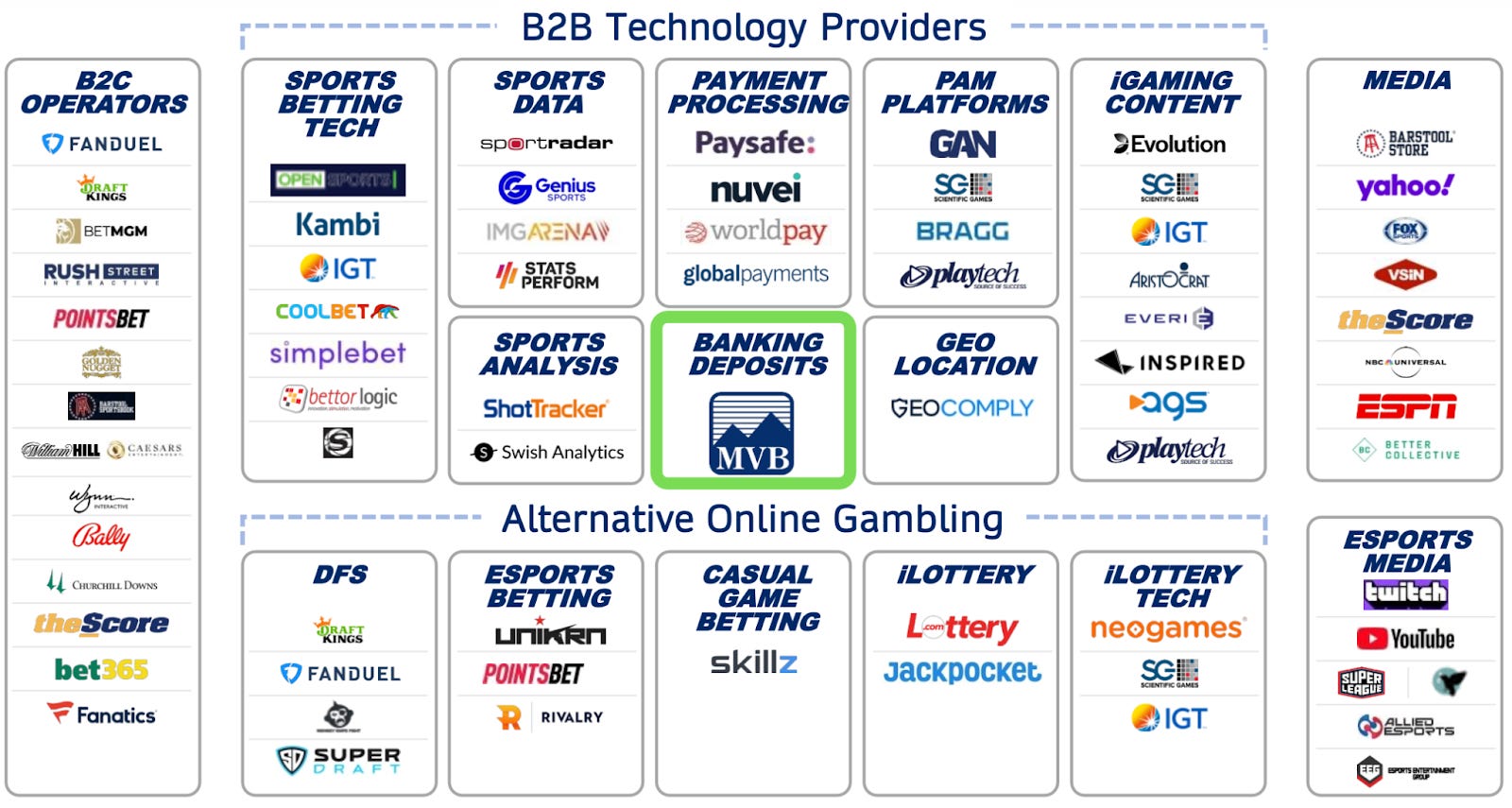

** SPONSOR’S MESSAGE ** Huddle is a next-generation technology provider for iGaming operators, dedicated to unlocking the full potential of this rapidly growing industry. Huddle’s cutting-edge automated odds feed solution offers fast, accurate pricing and trading services, helping operators increase turnover and drive margin; whilst reducing costs and managing risks. To find out more, please visit: https://huddle.tech/ Gambling’s Most Valuable BankThe collapse at Silicon Valley Bank left sector startups largely untouched – but highlighted a collective reliance on a West Virginia bank. Most wanted: In part, the collapse at Silicon Valley Bank was a problem happening elsewhere, only tangentially touching on the betting and gaming space. Few sector companies banked with SVB and any issues were resolved by the US government stepping in to guarantee all deposits.

Persona non grata: The dependency isn’t through choice. As Dean Sisun, founder and CEO at Prophet Exchange, says gambling companies “don;t have many options” when it comes to where they bank. “It’s MVB or no one,” he adds.

Stand by me: Recalling his time as a DFS start, Joey Levy, founder and CEO at betr, says that when “everyone was running away from the sector” due to the regulatory uncertainty MVB was the “one bank which stepped up at the time”

👀 Hard to avoid: MVB’s clients in betting and gaming Treasury questionsFollow the money: Both Levy and Sisun confirm that a question that has shot up the priority list for startup management teams across all sectors is the treasury question. That is, where have they stashed their cash?

Eggs/basket: This will be the legacy of the SVB near-death experience, suggests Cherniak from Avenue H. “Startups will surely diversify their banking portfolios moving forward so as to be less dependent on any one institution,” he says.

💡 Be the bank: Of course, this desire for diversification runs slap bang into the aforementioned problems the sector faces when it comes to banking.

Further reading: How safe are America’s banks? ** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Growth company gazette

Recent startup focuses

Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Sizing Kentucky

Monday, April 3, 2023

Kentucky sports-betting estimates, Datalines – Ohio, Nevada conference visitors, GAN's adverse investor reaction, startup focus – 2mee +More

Weekend Edition #91

Friday, March 31, 2023

GAN to seek what's best for shareholders, Playtech's LSports stake, RSI exits Connecticut, Entain TAB NZ deal +More

FanDuel’s iCasino headway

Tuesday, March 28, 2023

FanDuel's iCasino market shares examined, Sweden and Spain's per capita difference explained, Portugal FY data +More

Entain leads hunt for PointsBet Australia

Monday, March 27, 2023

Entain leads PointsBet Australia race, DraftKings' pay awards, Flutter sets dual listing date, startup focus – Golden Heart +More

Weekend Edition #90

Friday, March 24, 2023

Caesars' digital bridge, F1 could be a Las Vegas fixture, Bally's headcount, sector watch – crypto trading +More

You Might Also Like

We Never Do This!

Thursday, March 20, 2025

But This One's Big!

🎙️ New Episode of The Dime The Hard Thing About Hard Things: A Melody of Grit & Fortitude ft. Christina Betancourt Johnson

Thursday, March 20, 2025

Want to be featured on The Dime Podcast? Scroll to the end of this email to find out how. Listen here 🎙️ The Hard Thing About Hard Things: A Melody of Grit & Fortitude ft. Christina Betancourt

Well-connected VCs reduce startup risk

Thursday, March 20, 2025

Energy storage 'Holy Grail' draws investors; foodtech dealmaking grows strategic; Europe's female founders grab €10B+ Read online | Don't want to receive these emails? Manage your

Is social media a waste of time?

Thursday, March 20, 2025

Is your social media presence driving traffic and revenue for your business? Showing up in your audience's feed isn't enough (if you manage to show up at all). With organic reach declining, you

34% of All Startup Acquisitions Are By Other Start-Ups

Thursday, March 20, 2025

A New Record To view this email as a web page, click here saastr daily newsletter 34% of All Startup Acquisitions Are By Other Start-Ups. A New Record. By Jason Lemkin Wednesday, March 19, 2025 | Blog

🦄 Decacorn Spy vs Spy

Thursday, March 20, 2025

A spy story of the grandest scale in the world of payroll management. 🕵🏻♂️

The Right Call Takes More Than Luck

Thursday, March 20, 2025

Making the right call takes more than luck—it takes judgment, courage, and a willingness to make adjustments along the way.

Got Your Back(links)

Thursday, March 20, 2025

3 sure-fire ways to build.

As retail media booms, lines blur between performance and brand marketing budgets

Thursday, March 20, 2025

Marketers and agencies are grappling with divisions over who exactly controls retail media spend, causing a trickle-down effect on how retail media deals are brokered. March 20, 2025 PRESENTED BY As

🔔Opening Bell Daily: 'Transitory' is back

Thursday, March 20, 2025

The Fed forecasted slower growth and higher inflation yet stocks surged.