Earnings+More - LVS: Macau ready to tee off

LVS: Macau ready to tee offLas Vegas Sands benefits from Macau rebound, Rank sees land-based return +MoreGood morning. On today’s agenda:

Whatever I said, whatever I did, I didn't mean it. LVS on a roll“We’re raging bulls on Macau,” says the CEO as revenues soar. Keep the faith: Rob Goldstein said LVS would be investing more in “this extraordinary market” after forecast-busting Q1 figures, which showed revenues at $1.28bn, up 132% YoY, and Macau property EBITDA bouncing back to profit at $398m from a $11m loss this time last year.

A big driver: Goldstein noted the Macau recovery was still “in its infancy”. “I wouldn't call it normal operating mode,” he added. Reaching for a sports analogy, he hit upon golf. “We're still at the driving range,” he said. “We haven't gotten to the first tee yet.”

I’m doing fine now: While the recovery in Macau “has not hurt” in Singapore, Goldstein did caution “there’s only so much money out there”. Singapore property EBITDA rose 225% to $394m – or 90% of pre-pandemic levels – helped by “astounding” slot numbers, according to Goldstein. A touch of bling: He added that in Macau LVS would hope its Londoner and Four Seasons properties would “dominate” both the mass market and the high-end. “We cede no segment to our competitors,” he said. “We want to be first in every category.”

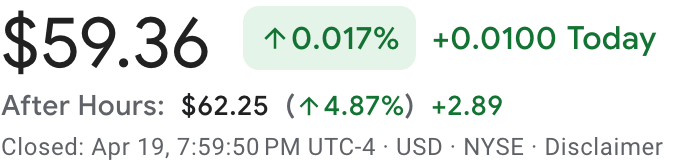

New York, New York: Goldstein said the group expected to hear about its bid for a Long Island resort in Q124, although Hofstra University continues to push back against the project. Analyst takes: Deutsche Bank said the Macau numbers were “meaningfully stronger” than expected, while Jefferies suggested the figures were “notably bullish” given the recovery is in its early stages. 🍆 LVS rises in after-hours trading ** SPONSOR’S MESSAGE** The Huddle Journal

These remarkable statistics demonstrate Huddle's expertise, cutting-edge technology, and unwavering commitment to customer satisfaction. Learn more and check the Huddle Blog here: https://huddle.tech/college-basketball-statistics-and-huddle-performance-2023/ Earnings+More readers pollYour chance to have your say. Everyone likes a poll, right? E+M has teamed up with YouGov to conduct our first ever readers poll. To take part, simply click on this link. The poll consists of 15 multiple choice questions and only takes a couple of minutes. We’ve tried it out and, like a quick check up with the dentist, it’s painless and over very, very quickly, we promise.

We thank you for your time. Rank updatesImprovements in US casino trade drives optimism on full-year profits. Back to the tables: Improved visitation across the Grosvenor casino estate helped drive a 15% YoY uplift in NGR in FY23 Q3 to £78m, online leapt 16% to £53m as group NGR rose 13% to £174m.

In Compliance+MoreGoing mainstream: US sports betting has a betting ads problem as a Coalition for Responsible Sports Betting Advertising is formed by the sports leagues and broadcasters. Earnings in briefStar Entertainment warning: The Australian casino operator warned it had seen a “significant and rapid” downturn in operating conditions at its Gold Coast and Sydney properties, driven by the impact of regulatory operating restrictions and a poor consumer environment.

Monarch Casino: The Black Hawk property in Colorado was the primary drive for Monarch as revenue grew 8% to $117m, while adj. EBITDA was up 6% to $37m. The company said it continued to grow market share with a “revitalized” casino floor. Lottomatica guide priceA whole lot of money: Lottomatica has set its IPO guide price at €9-€11, which implies a valuation at float of €2.27bn-€2.67bn. The final price will be determined following the upcoming book-building process, which will take place next week.

** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. DatalinesDraftKings’ Mass gambit: The debut data from Massachusetts has confirmed the strong rumors that DraftKings wouldn’t miss out… BetMiGM: iCasino dominance continues for BetMGM in Michigan. Penn is mightier: Pennsylvania tops half-a-billion across all gaming in March. Further reading: Check out the forthcoming edition of the Data Month on Tuesday for more reaction. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

888 back in the Middle East VIP game

Wednesday, April 19, 2023

888's new Middle East onboarding, Earnings+More readers poll, Lottomatica listing, NY casinos, Japanese resorts casino news +More

MGM’s ‘Japan dream’ comes true

Wednesday, April 19, 2023

MGM's Japanese opportunity, Better Collective makes adtech buy, LVS in the week ahead, startup focus – Kutt +More

Playtech B2B feels the Caliente heat

Wednesday, April 19, 2023

Entain's first quarter, Playtech's B2B issues, Better Collective's M&A commentary +More

Bottle job: Belgium’s betFIRST up for grabs

Tuesday, April 11, 2023

The betFIRST biding battle, quarterly transactions review, Playtech's Hard Rock Deal +More

Weekend Edition #92

Thursday, April 6, 2023

Entain's 365scores deal, Ontario data, FanDuel and Caesars analyst takes, regional US data +More

You Might Also Like

The #1 customer LTV in the world (4 keys)

Thursday, March 20, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Lessons From Dot Com Boom

Thursday, March 20, 2025

+ Homes in Delhi are becoming obscenely expensive. Meanwhile, IndiGo is looking to soar greater heights.

Topic 32: What is Qwen-Agent framework? Inside the Qwen family

Wednesday, March 19, 2025

we discuss the timeline of Qwen models, focusing on their agentic capabilities and how they compete with other models, and also explore what is Qwen-Agent framework and how you can use it

🦅 This will help you from being stopped by imposter syndrome

Wednesday, March 19, 2025

xAI's first acquisition | Instagram tests AI-generated comments | Facebook Stories now eligible for creator monetization

From $0 to $12 Million Per Year With Fat Joe

Wednesday, March 19, 2025

This week, we're excited to have Joe Davies from FatJoe.com on the Niche Pursuits Podcast. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Skype is dead, but SORA changes everything😲(read ASAP)

Wednesday, March 19, 2025

View in browser ClickBank Hi there, You may have heard that after 22 years, Microsoft is killing off Skype and replacing it with Teams 😬 but let's be honest... this isn't exactly exciting news.

You’re the heart of social—we see you

Wednesday, March 19, 2025

And you deserve better tools, better support, and better balance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Here’s the One Investment That Can Change Your Life in 2025

Wednesday, March 19, 2025

The Biggest Opportunity of 2025

Founder Weekly - Issue 677

Wednesday, March 19, 2025

March 19, 2025 | Read Online Founder Weekly (Issue 677 March 19 2025) Welcome to issue 677 & of Founder Weekly. Let's get straight to the links this week. Google purchased Nest ($3.2B), Amazon

A look at the categories for this year's Greater Good Awards

Wednesday, March 19, 2025

As companies tackle pressing issues like wellness, sustainability and local community betterment, their efforts often go unnoticed despite their powerful impact. The Greater Good Awards offer a