Coin Metrics’ State of the Network: Issue 206

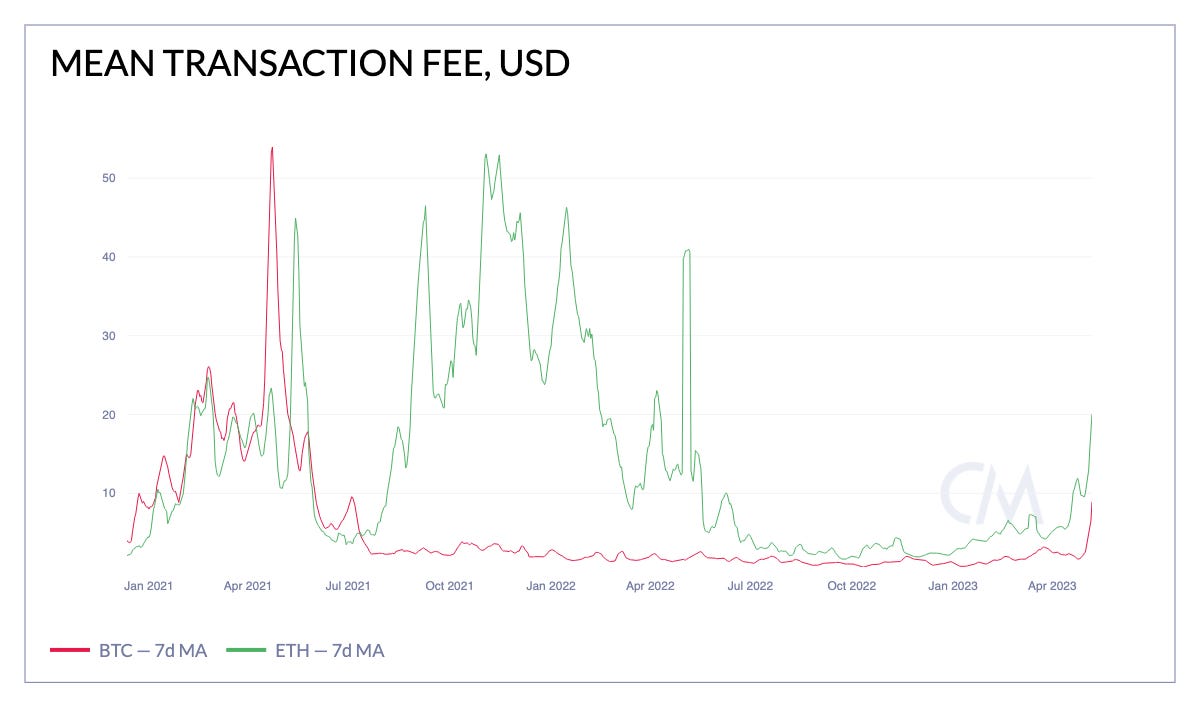

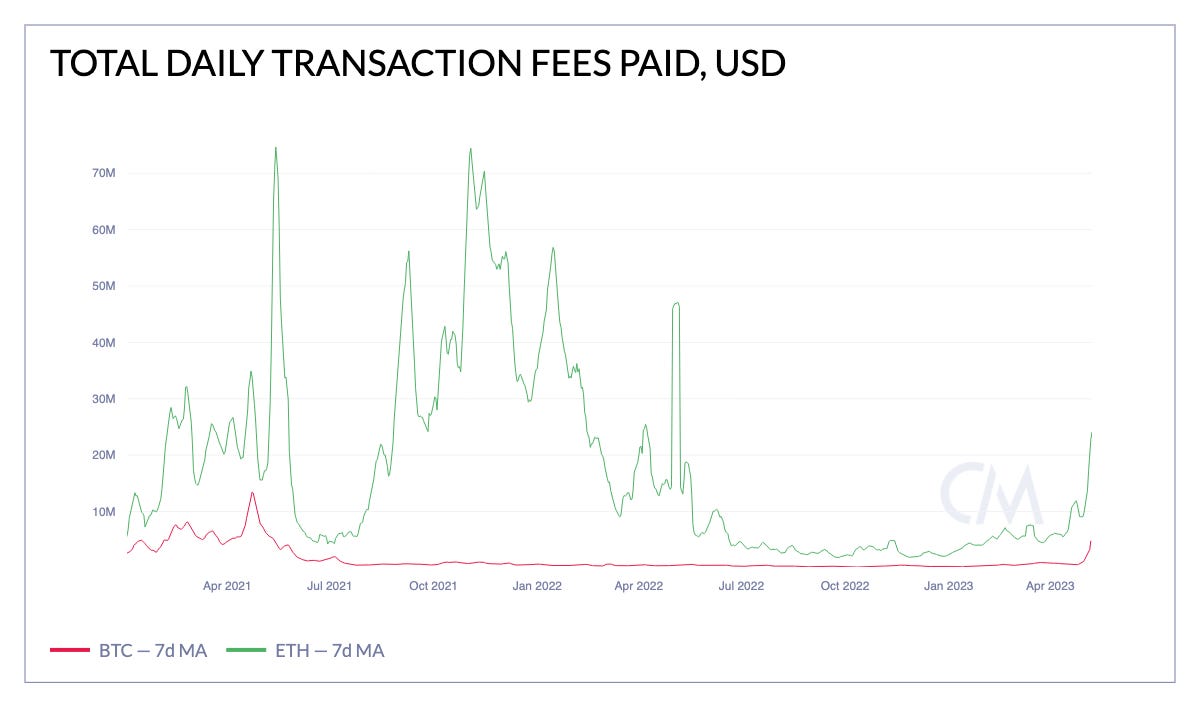

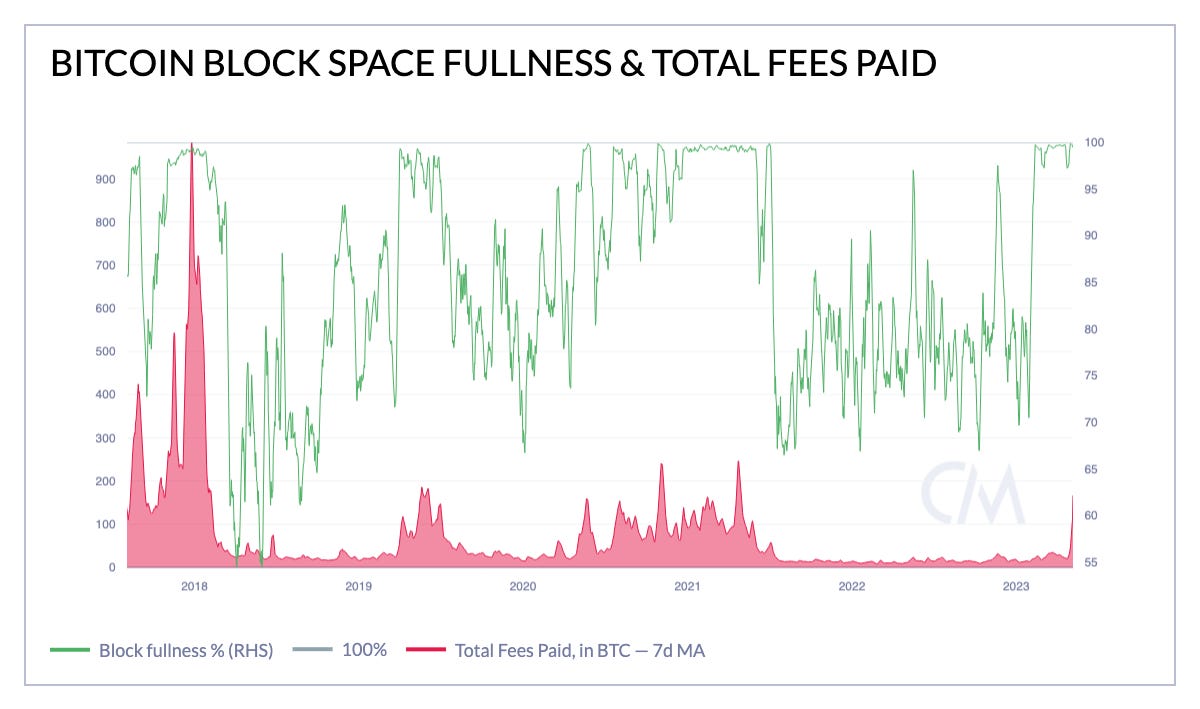

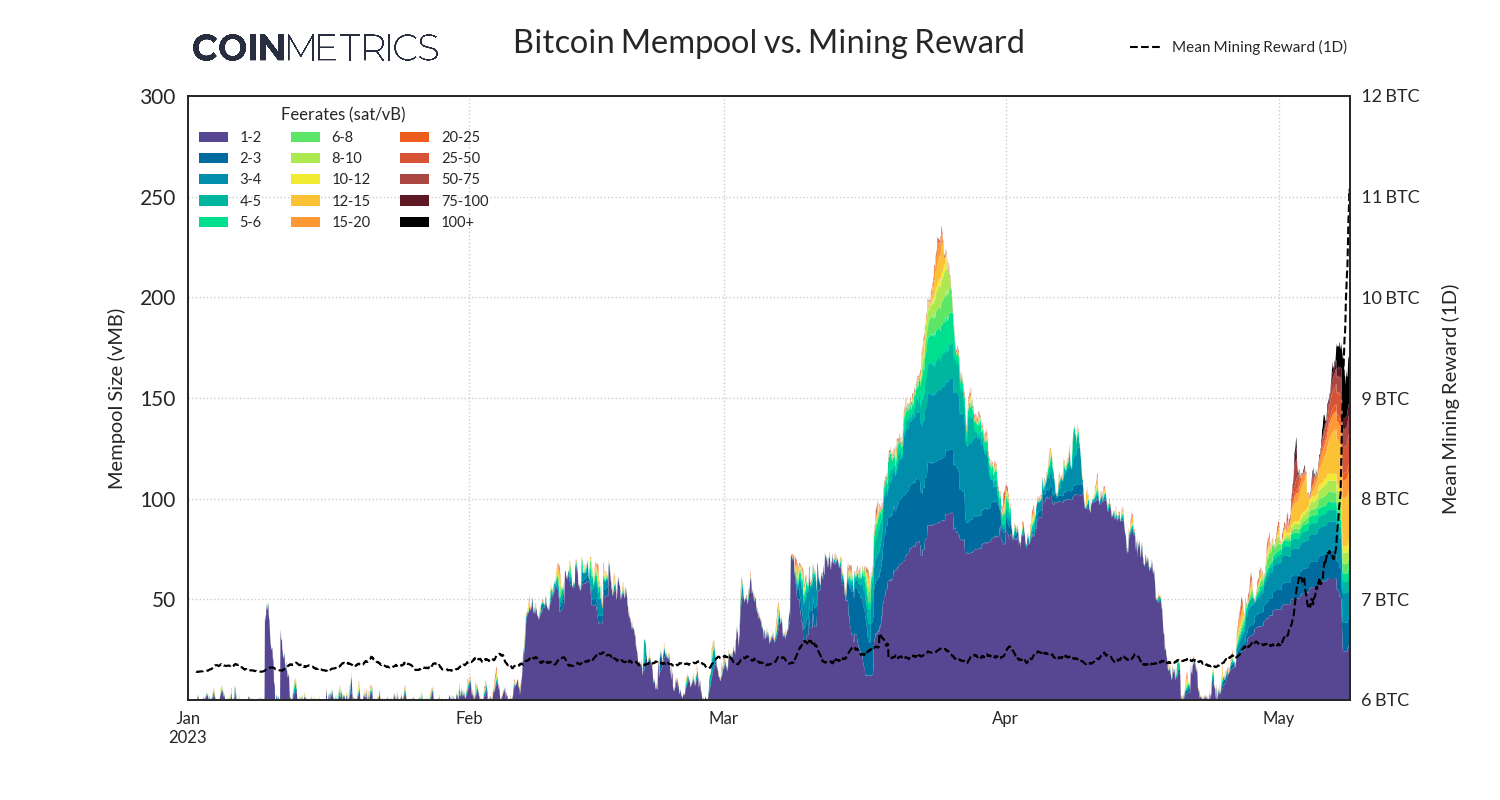

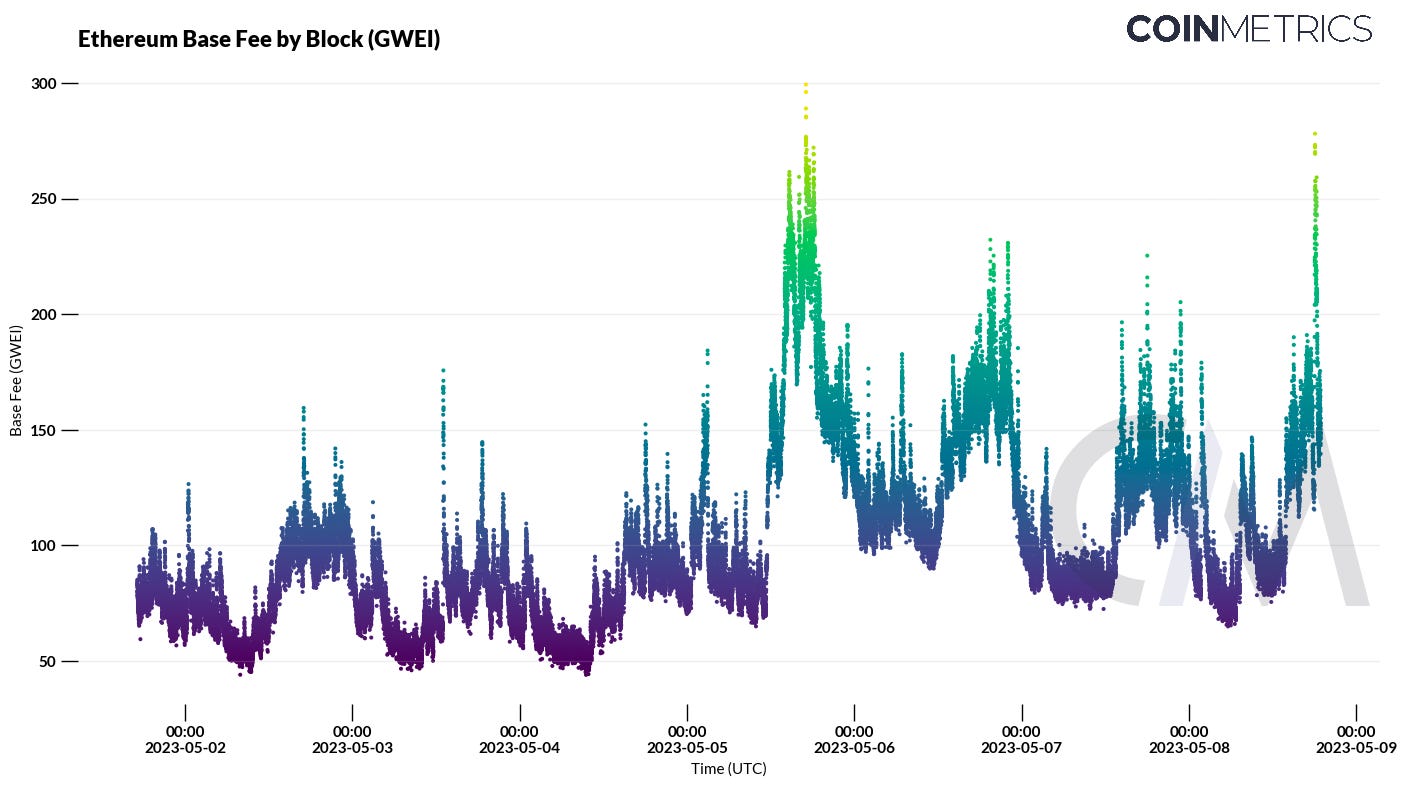

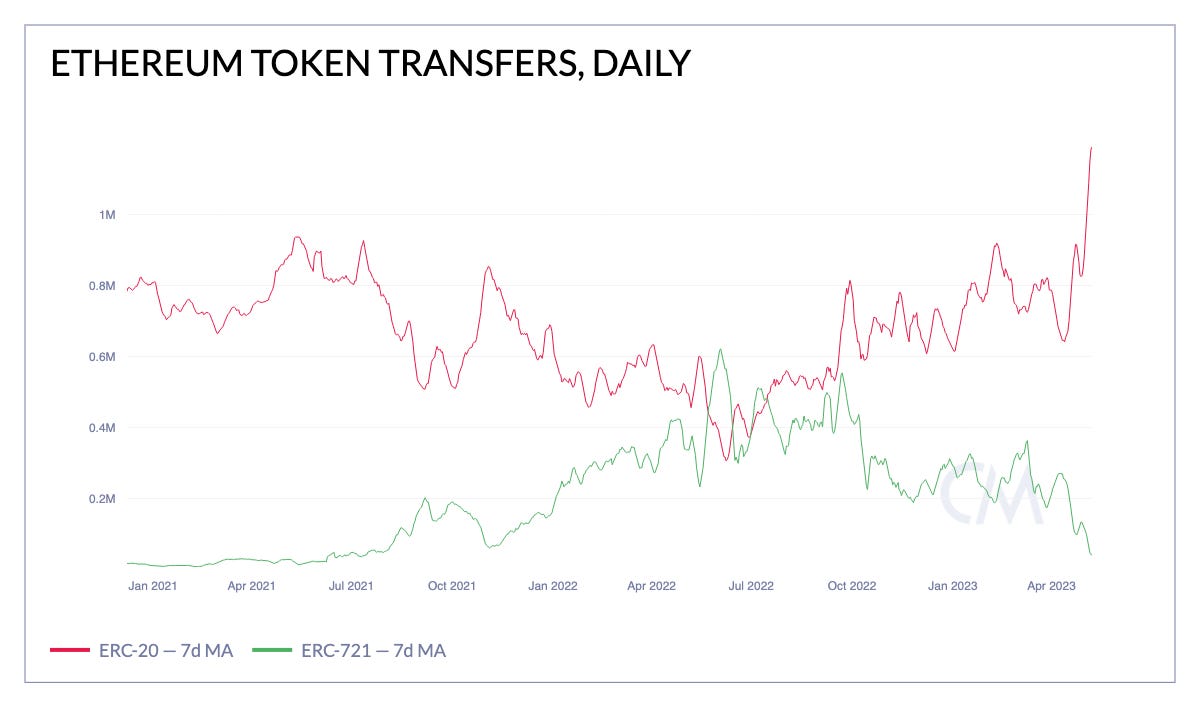

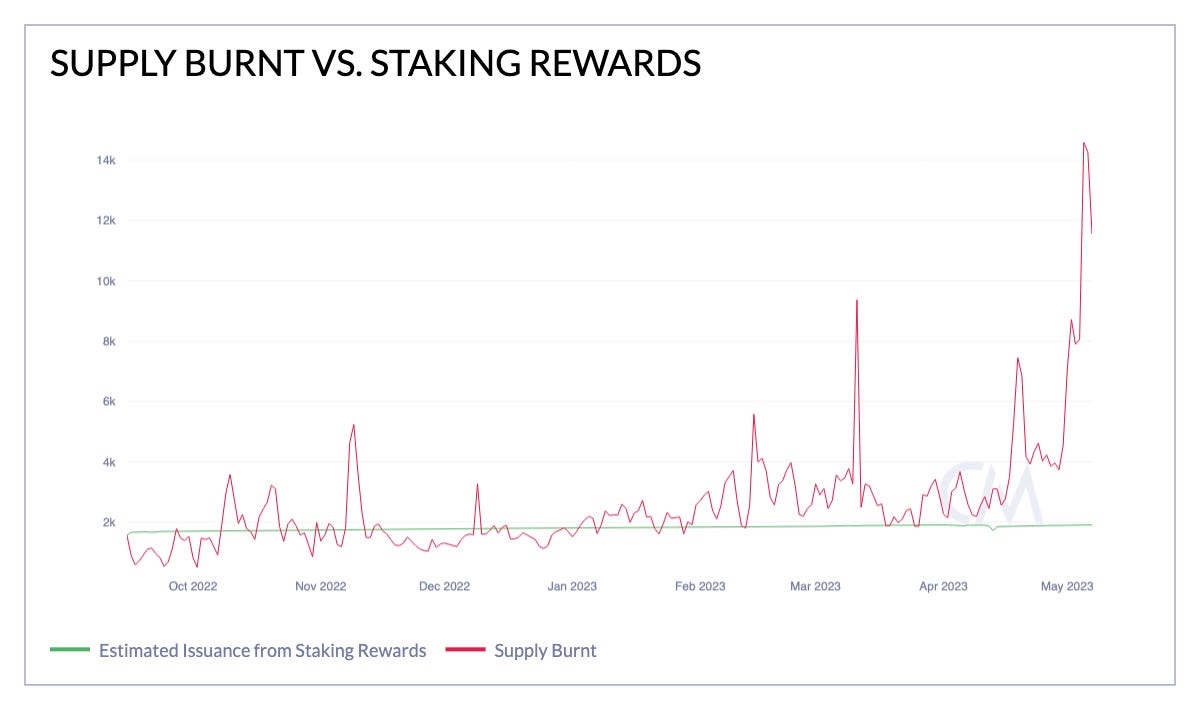

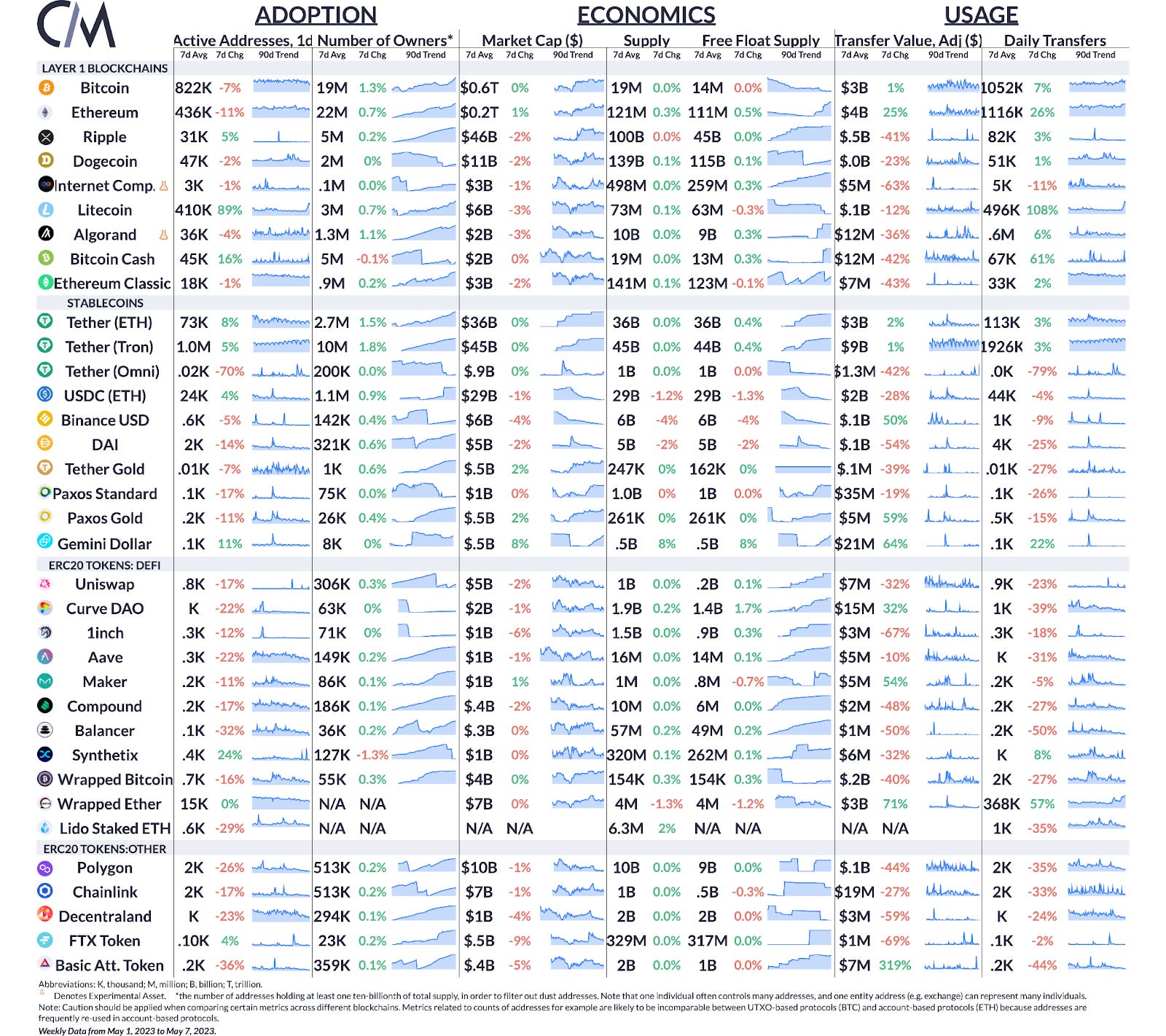

Get the best data-driven crypto insights and analysis every week: Bidding on Bytes: A Bitcoin & Ethereum Fee Market UpdateBy: Kyle Waters & Parker Merritt London wasn’t the only busy place this past weekend: traffic on the two largest blockchain networks, Bitcoin and Ethereum, both surged this past week with users paying an aggregate $193M to transact on the two chains—over two times the previous week’s total. In this week’s issue of State of the Network, we delve into the latest fee market frenzy that has engulfed both networks. Specifically, we examine the underlying causes of this surge in transaction fees on Bitcoin and Ethereum and explore the implications of this development for the future. Exploring Blockspace Supply & DemandFor the first time since late 2020, fees on Bitcoin and Ethereum both surged at the same time. The average transaction fee on Ethereum rose to $20 over the last week, while the average Bitcoin transaction jumped to $9. Although average fee rates in dollar terms still remained below the heat of the bull market in 2020–2021, this was a sharp increase from prior weeks. Source: Coin Metrics Network Data Before we get into more data, it’s important to grasp the basic dynamics of blockchain fee markets to better appreciate the recent rise in the price to transact on-chain. While there is some nuance in the details, conceptually the transaction fee markets on Bitcoin and Ethereum function by the familiar economic theory of supply and demand. Blockspace is a scarce resource because there is a limit to the number of transactions that can be included in a block based on protocol rules. On Bitcoin, this is determined by the data payload of a block, which is currently capped at an effective 4MB. While in the virtual execution environment of Ethereum, blocks are capped by the computational effort and memory resources used up by different types of transactions, measured by units of Gas (currently capped at a 30M gas limit per block). When demand outstrips blockspace supply, transaction fees help the market clear. Users incentive miners on Bitcoin and validators on Ethereum to prioritize their transactions by paying more in fees. This makes the fee market an essential area of study to understand the adoption of public blockchains. Turning back to the data, in total USD terms, transactors paid $33M on Ethereum on May 5th alone, while fees for Bitcoin transactions summed up to $12M on May 7th. This was the highest one-day total since May 12th, 2022 for Ethereum and April 23rd, 2021 for Bitcoin. Source: Coin Metrics Network Data BRC-20 Mints Boost Mining RewardsThe rise in fees on Bitcoin has been particularly notable, where the tepid fee market has been a concerning and puzzling development to Bitcoin researchers and observers. Facing an inevitable shrinking block reward, Bitcoiners often point to the maturation of the fee market as an essential development to ensure the security of the Bitcoin network in the future as the block subsidy predictably diminishes. Indeed, the next Bitcoin halving—the reduction of newly minted bitcoins awarded to miners from 6.25 to 3.125 per block—looms just one year away. But as any followers of Bitcoin know, experimentation has been a theme in 2023. The rise of inscriptions and ordinals on Bitcoin earlier this year allowed a burgeoning digital collectibles market to arise on Bitcoin. This new source of demand led to a busy mempool (the queue of transactions yet to be included) and more full Bitcoin blocks, but have not had a substantial impact on total fees—until this past week. Source: Coin Metrics Network Data An experimental standard for creating fungible tokens on Bitcoin called BRC-20 (short for Bitcoin Request for Comment, inspired by Ethereum’s well-known ERC-20) has created a chaotic wave of on-chain activity in the last few days. Following the standard’s quiet introduction in early March, BRC-20s have seen a rapid increase in adoption, clogging Bitcoin’s mempool and pushing the average fee to nearly $20 per transaction. Despite frictions and key differences to Ethereum’s ERC-20 standard, the token model has proven popular for memecoins issued on Bitcoin. Early adopters like ORDI and VMPX reached multi-million dollar market caps within days, trading OTC via Discord chats and Google Sheets until major exchanges like Crypto.com and Gate.io listed the tokens in May. BRC-20 minting activity has driven on-chain transfers to new highs, with 685K transactions occurring on May 1st, shattering the previous record of 498K transactions on December 14th, 2017. The recent surge in interest in Inscriptions has once again divided the Bitcoin community, much like the initial Ordinals wave in mid-February. While the "monetary maximalist" faction of the community have largely labeled the flood of BRC-20s a 'DDoS Attack' on blockspace, Bitcoin's earliest advocates often opt for a "network maximalist" perspective, believing that all cryptocurrency innovations would eventually be ported to the original blockchain. Though the BRC-20 standard is a bare-bones imitation of Ethereum’s ERC-20, the token does unlock experimental new use cases for Bitcoin’s core transaction types, such as decentralized exchanges powered by Partially-Signed Bitcoin Transactions (PSBTs). The path to widespread adoption of blockchain technology is a long and winding road, and it is often the unexpected twists and turns along the way that lead to the most significant breakthroughs. The uptick in mining rewards has also helped supplement the network’s security budget, driving the average per-block payout north of 11 BTC as BRC-20 minters bid 600+ satoshis per virtual byte (sat/vB) to help guarantee their transaction’s inclusion in the next block. Notably, Bitcoin’s scaling roadmap has always relied on Layer-2s like the Lightning Network to support the settlement of lower-value transactions. The on-chain congestion brought on by BRC-20s led to Binance temporarily pausing BTC transfers, compelling the exchange to publicly commit to enabling Lightning withdrawals. Although proponents of the Lightning Network prefer to see adoption driven by organic usage, the proliferation of BRC-20 tokens has compelled trading platforms to upgrade their Bitcoin-based payment infrastructure. Even if Bitcoin’s most conservative users don’t approve of the activity, there’s little that can be done to stop BRC-20s from a technical perspective. The token standard’s simplicity and persistent on-chain footprint make it difficult to discourage, forcing critics to decide whether the nuisance of Inscriptions truly warrants forking the blockchain. Ultimately, the market will decide whether BRC-20s can maintain a foothold in the tokenization landscape, or fade away like Bitcoin’s many long-forgotten sidechains & Layer-2s. Ethereum Congestion Highest Since The MergeMeanwhile, Ethereum experienced its own surge in network traffic over the last week. Transaction fees on the largest smart contract platform reached their highest levels since The Merge last September, with some blocks even hitting a base fee as high as 300 GWEI. Source: Coin Metrics Network Data Pro, Block-by-Block Metrics The root cause of this congestion has been the trading of small altcoins, including a series of memecoins—chiefly, $PEPE. This is not the first time a group of traders and transactors interested in a single project have pushed Ethereum to high levels of network congestion on the base layer. Putting aside questions surrounding the dubious utility of memecoins, there have been a few notable on-chain impacts worth mentioning. First, the latest memecoin mania appears to be having an effect of “crowding out” the Ethereum NFT market, with the number of ERC-721 tokens (the most popular NFT standard on Ethereum) falling while daily transfers of ERC-20 tokens are rising significantly (in red below). Source: Coin Metrics Network Data Pro With the mechanism of ETH burn implemented in Ethereum’s sweeping EIP-1559 fee market overhaul, higher network traffic directly impacts the monetary characteristics of ETH. Due to high fees, over 14K ETH was burnt on May 5th, the highest daily total since The Merge. This was significantly above the amount of new ETH issued to validators in staking rewards, resulting in a large net reduction in ETH supply. Source: Coin Metrics Network Data Pro Finally, like the discussion of Bitcoin’s Lightning Network above, the congestion at the base layer of Ethereum has renewed discussion around the future path to scalability, and the importance of Ethereum’s own layer-2 (L2) scaling solutions reaching maturity. Luckily, Ethereum’s next major upgrade, dubbed Cancún, is set to help lower L2 fees with the implementation of EIP-4844. ConclusionThe fee market is a crucial aspect of analyzing public blockchains, as it reveals the level of user demand for blockchain services. In the context of the recent surge in transaction fees caused by the "memecoin" phenomenon, some might view this development as unsavory or frivolous. After all, the history of blockchains is already filled with its fair share of animal-themed coins and other thousands of tokens spawned out of thin air. However, the proliferation of these animal-themed coins underscores the neutrality of public blockchains and highlights the transformative power of blockchain technology in finance. As T.S. Eliot once wrote, "Only those who will risk going too far can possibly find out how far one can go." Today’s fascination might be eccentrically-named coins, yet, the future may hold the potential for public blockchains to revolutionize funding for critical causes, such as biotech research for rare diseases, infrastructure, or other public goods. A striking illustration of this potential was even recorded just last year. The ability of public blockchains to facilitate millions of dollars of donations to the Ukrainian government at the onset of the Russian invasion, achieved faster than traditional financial infrastructure, serves as a prominent example. Public blockchains, much akin to the internet, can enable “virality loops.” And just like the internet, some of this will be deemed beneficial, while other virality loops may prove less constructive. Even momentarily putting aside philosophical points on censorship resistance and utility, the positive impact to network security by providing more fees to miners and validators cannot be dismissed. Nascent markets are bound to be chaotic in the short term, but in the long run, capital will surely stick to those projects underpinned by the most robust fundamentals. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro The stablecoin ecosystem continues to experience swift change. The market cap of Tether (USDT) has risen back to $80B, split across $36B on Ethereum and $44B on Tron. Meanwhile, the market cap of USDC sits at $28B on Ethereum, the lowest level since October 2021. The supply of BUSD fell under 6B; the stablecoin had a total outstanding supply of 23B just last November. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 205

Tuesday, May 2, 2023

A data-driven update on MakerDAO & Dai

Coin Metrics’ State of the Network: Issue 204

Tuesday, April 25, 2023

Breaking down blockchain addresses

Coin Metrics’ State of the Network: Issue 203

Wednesday, April 19, 2023

Review of Ethereum's 'Shapella' Upgrade

Coin Metrics’ State of the Network: Issue 202

Tuesday, April 11, 2023

A preview of Ethereum's upcoming Shanghai/Capella upgrade

Coin Metrics’ State of the Network: Issue 201

Tuesday, April 4, 2023

A data-driven overview of the events from Q1, 2023

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏