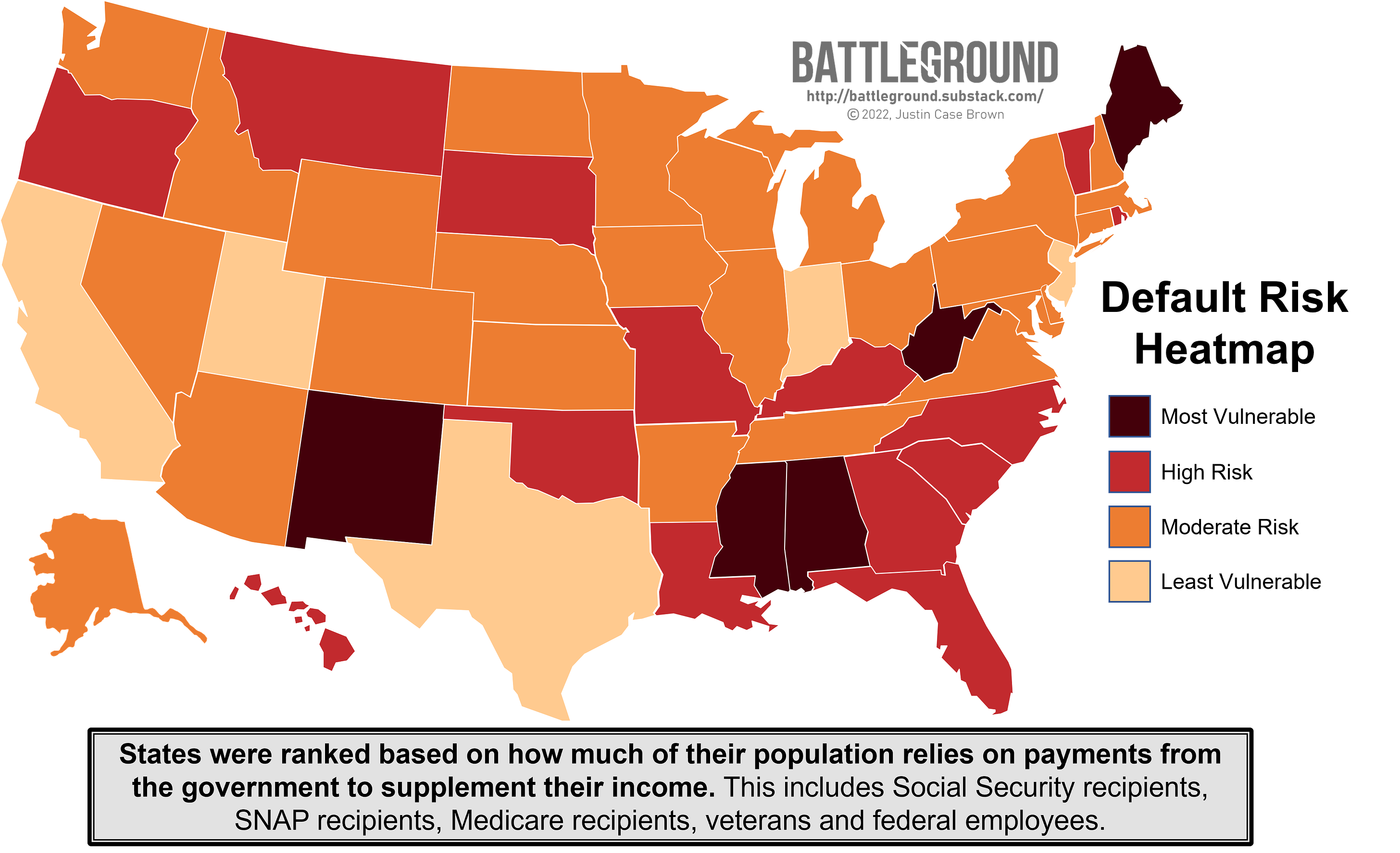

How Will Your State Be Impacted by a National Default?

Battleground is a reader-supported publication. Consider supporting the newsletter through Buy Me A Coffee. How Will Your State Be Impacted by a National Default?Not all states will feel the effects of the debt ceiling crisis equally. Learn which ones are the most vulnerable in the event of a national default.Topline Takeaways

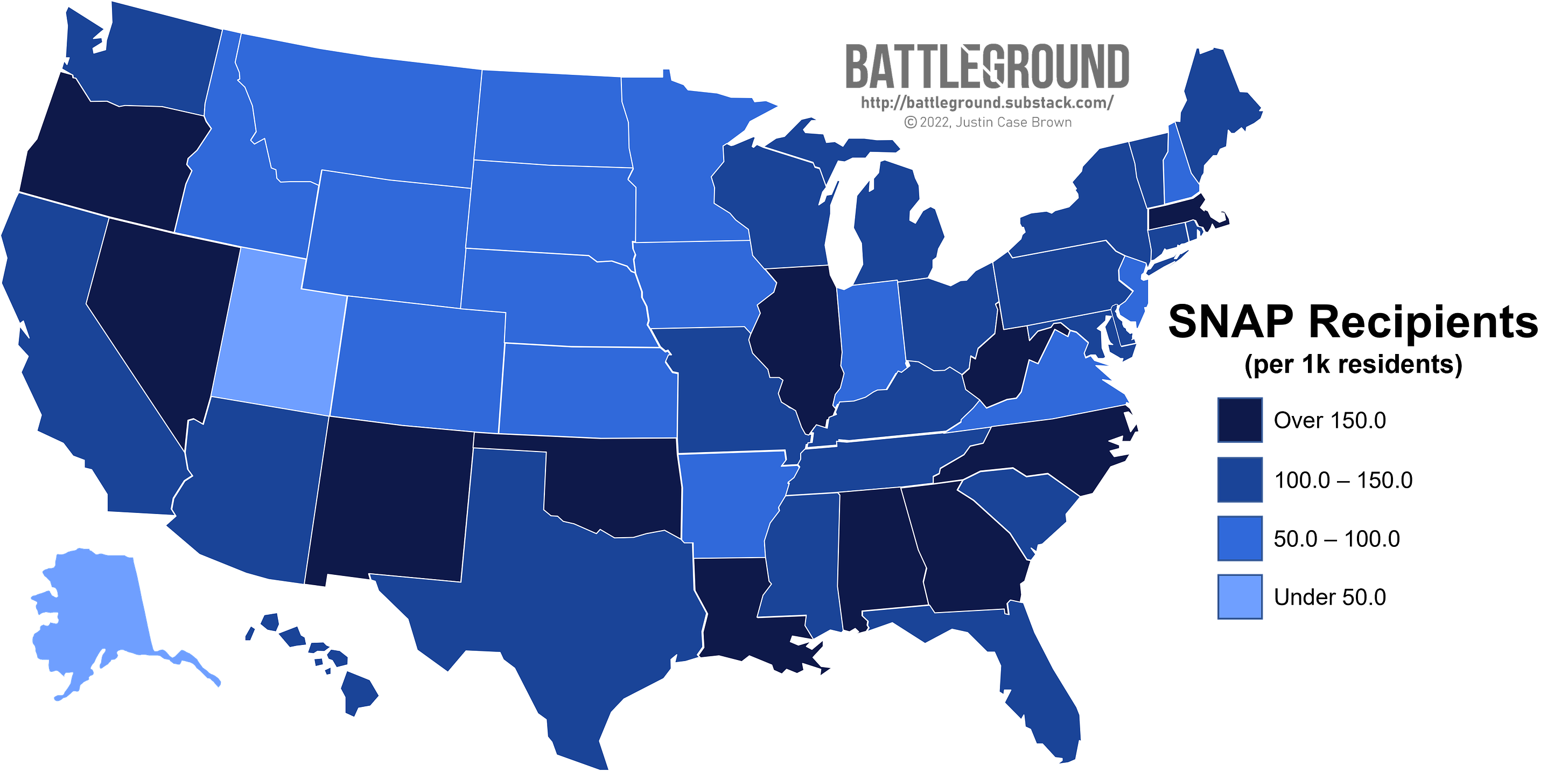

SNAP RecipientsRoughly $1B in SNAP food assistance benefits is due to be paid out on June 5 but these payments are expected to be delayed if Congress fails to raise the debt ceiling. This is likely to affect more than 41 million Americans, 1 in 8 of the total population all of whom are already struggling to make ends meet. However, these Americans are not equally distributed across the country. In fact, many of these SNAP recipients are clustered in deep-red, Republican-led states. Three of the top five states with the highest proportions of SNAP recipients, Louisiana, West Virginia and Oklahoma, are also among the most reliable Republican strongholds in the nation. Unfortunately for Republicans, cruelty is often the point of their approaches to policy. Congressional Republicans have been vocal about their disdain for current SNAP regulations. So much so, they cite SNAP as a reason for refusing to raise the debt ceiling in the first place. Republicans in Congress are laser focused on implementing more stringent work requirements and have openly stated a belief that people who receive this money are “couch potatoes.” What’s dismaying is that there’s mountains of research that establish that work requirements for welfare programs don’t meaningfully boost employment levels. Instead they’re incredibly effective at locking eligible recipients out of the system and reducing welfare rolls altogether. They don’t meaningfully fight poverty, in fact they may enhance its spiral. And all of this is because these work requirements don’t test if recipients are actually working, they test recipients’ ability to navigate government bureaucracy. (I have direct experience with this type of bureaucratic barrier: I was denied thousands in unemployment payments in late 2021 simply because I couldn’t get a case worker to approve my work search activities. That resulted in me taking on thousands in credit card debt which I’m still struggling to payoff to this day.) And quite honestly, this common-sense argument is the strongest logic against strengthening work requirements for SNAP:

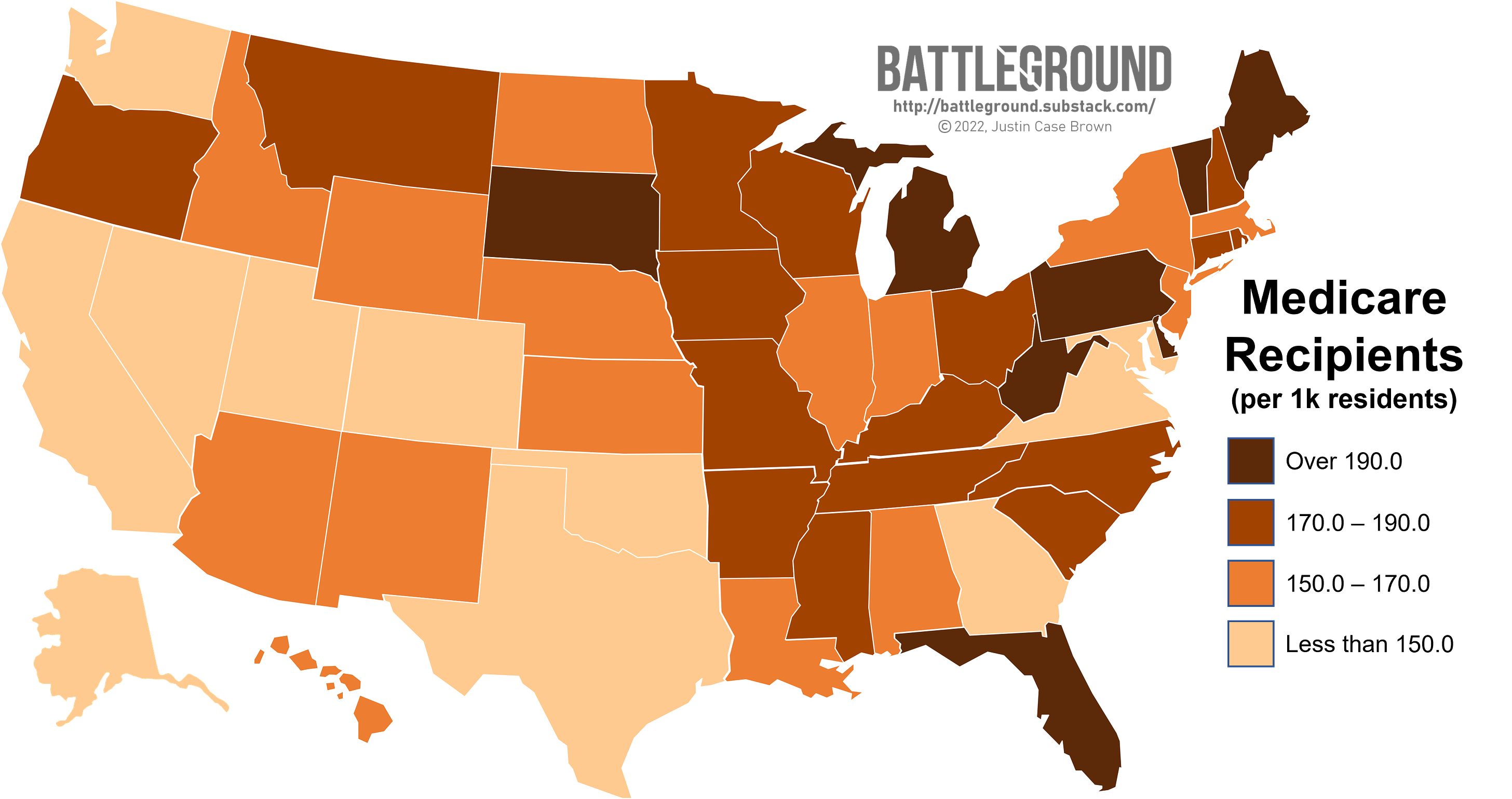

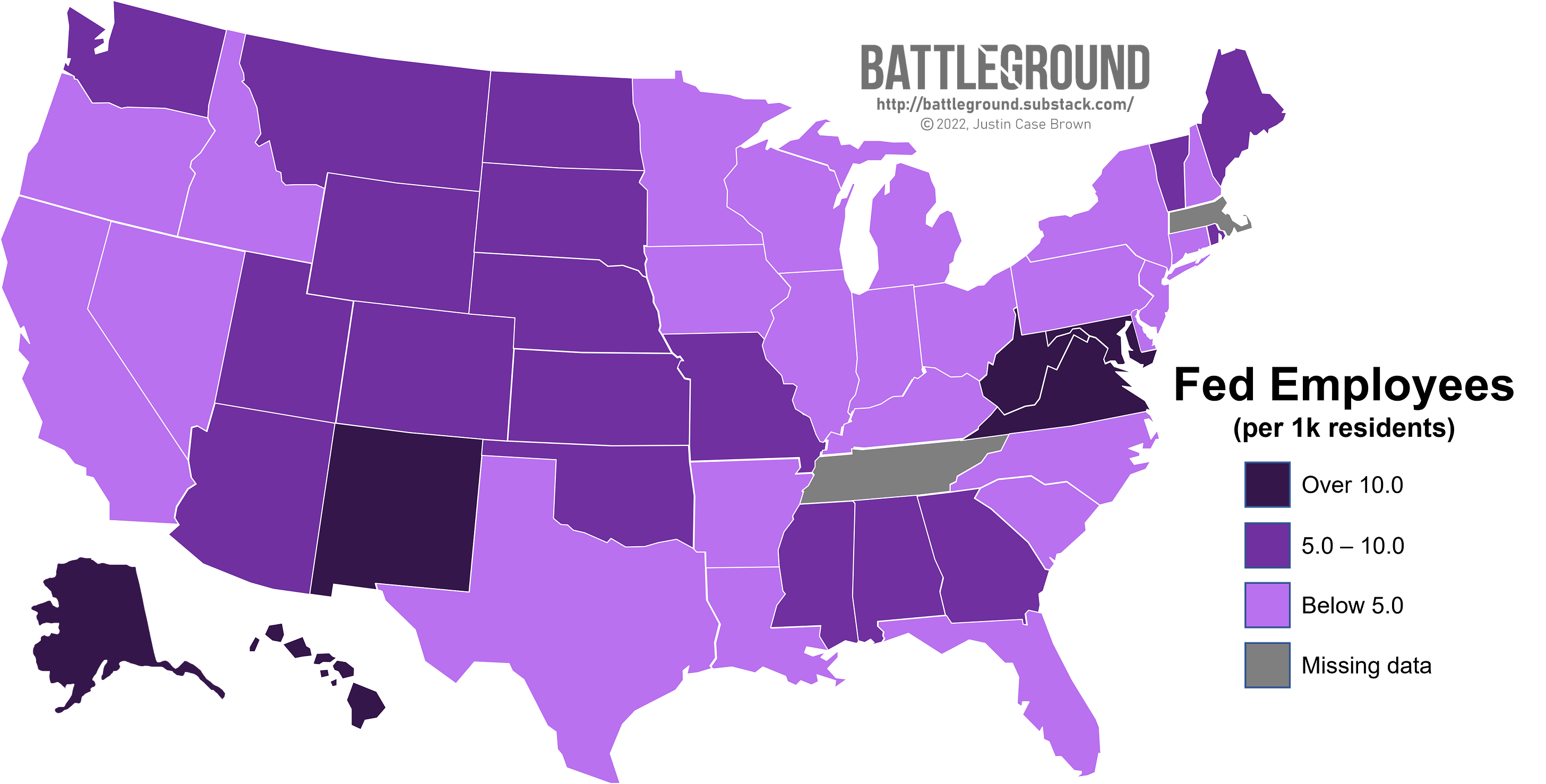

Medicare + MedicaidMedicaid reimbursements are due to be paid out on June 6 (and several other times in the month of June thereafter) so these payments are among the first to be in jeopardy if Congress fails to raise the debt ceiling. (While Medicaid and Medicare are different programs, Medicare recipients are also at risk in the event of a national default.) These payments are of a different type of welfare than SNAP in that these reimbursements are not generally paid out to patients but to healthcare providers. Many providers across the nation take both Medicaid and Medicare patients because they know that they will be reimbursed for the care provided by the federal government at a later date. What this means is that if the debt ceiling crisis lasts for an extended period of time, health care providers may temporarily deny healthcare to their Medicaid and Medicare patients because they can’t rely on the government to cover the costs in a timely manner. Since many southern states have fought Medicaid expansion, they’re slightly more insulated from this potential fallout. Instead these effects will be felt most across the northern half of the country in states like North Dakota, Michigan and Pennsylvania. Federal EmployeesNext in line to be potentially stiffed by the federal government are its own employees. The first pay date in June for federal employees is scheduled for June 9. If Congress fails to raise the debt ceiling, the government will fail to pay over $5B in salaries. This means everyone from civilian bureaucrats to military officials could potentially not receive their paychecks on time. (Some are even speculating that an extended default might lead to government furloughs and/or layoffs.) On this front, Democratic strongholds like Maryland, New Mexico and Hawaii are put in a bind as they have relatively high proportions of federal employees. Interestingly enough, these default antics have spurred a lawsuit from the National Association of Government Employees. The lawsuit seeks to liberate President Biden from his current restrictions on borrowing money to pay the government’s debt while also prohibiting any related layoffs or furloughs of federal employees. Plaintiffs argue that the current debt ceiling system is unconstitutional due to the way it runs counter to the 14th Amendment which prohibits the government from reneging on its debts. This lawsuit is being pushed through rather quickly and is emerging as a long-shot effort to avoid default. Arguments are scheduled to be heard this coming week.

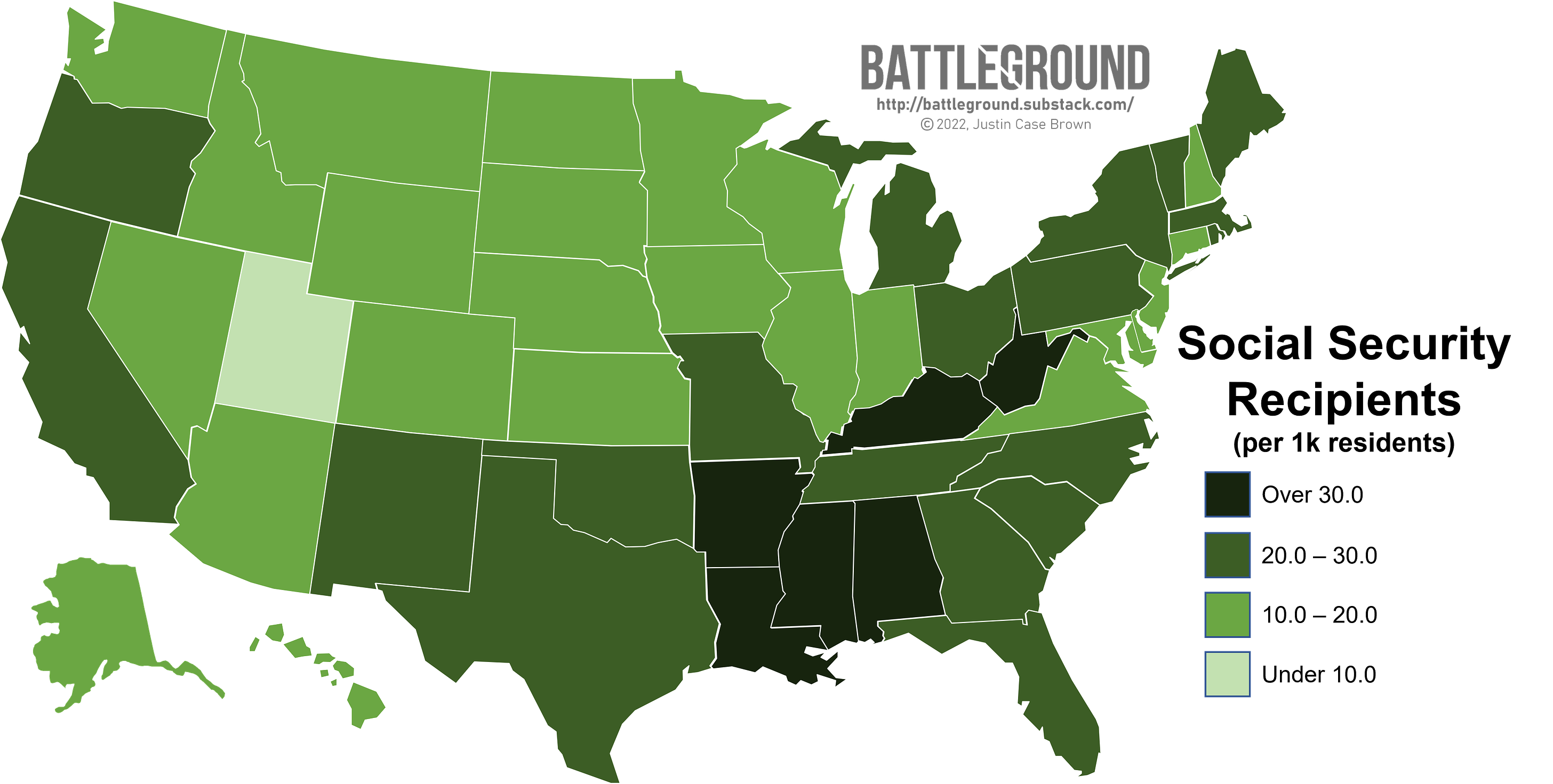

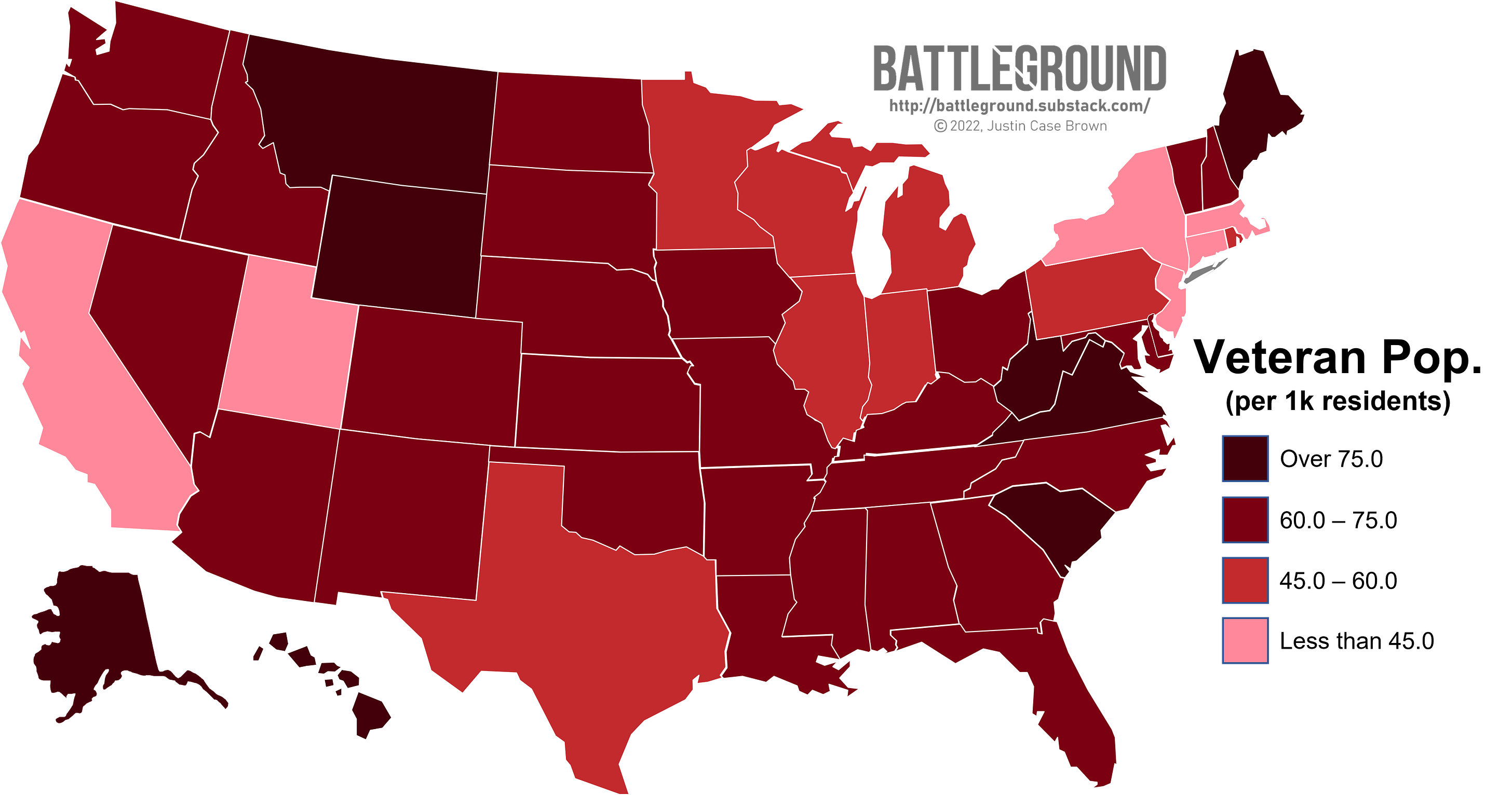

Social Security RecipientsThe federal government is scheduled to make four payouts to Social Security beneficiaries during the month of June, the first of which is set to be paid out on June 2. Luckily for (some) seniors, since Treasury Secretary Janet Yellen projects that the federal government will be able to meet all of its debts through June 5, those who are scheduled for this first payment are expected to receive their checks without issue. However, Social Security sends out checks to recipients throughout the month on different schedules (your pay day is determined by a multitude of factors like your birth date or if you’re currently living outside of the country) The following pay date is scheduled for June 14. If the debt ceiling is not raised by this date, many expect Social Security payouts to be delayed. While all recipients would receive back payments whenever Republicans stop holding the country hostage, many retirees rely on these checks to cover basic necessities like utility bills, groceries and rent. Delaying these checks even for a single week could cause unnecessary hardship for elderly people who are already struggling to make ends meet. According to the Social Security Administration, roughly a quarter of the elderly rely on Social Security checks to pay 90% of their family income. (That stat comes from a now 7-year-old study; the group is likely larger today due to the current cost of living crisis.) A default could also expose a handful of backwards regulations that force poorer recipients to be so reliant on government payments in the first place. For example, Supplementary Security Income (SSI) is a needs-based program that enforces a “resource limit.” This basically means that if a Social Security recipient has monetary assets that are below this resource limit, they can receive extra funding on top of their normal Social Security payments. However, since this SSI bonus is revoked if the recipient saves up enough money in their bank account this flatly encourages poor elderly folks to rely almost entirely on government support and discourages them from saving for emergencies. “There’s no fallback if these checks are late. These are people who are literally not allowed to have emergency savings.” -Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities. VeteransTreasury Secretary Janet Yellen just made millions of veterans let out a sigh of relief. For the past month, many have speculated that veterans benefits might be the first on the chopping block in the event of a national default as the government is on the hook to pay out $12B to veterans on June 1. Yellen has claimed that the government has enough cash on hand to cover these benefits, meaning that veterans may be spared from experiencing the worst of this crisis (at least temporarily.) Republicans are likely breathing a sigh of relief as well. Not only are elderly veterans one of their core constituencies, Republican strongholds like Wyoming, South Carolina and West Virginia have an over-prevalence of veterans compared to other states. If veterans benefits are halted, these states would likely experience the brunt of the economic hardship. While they’ll be spared come June 1, a prolonged default would eventually bring the pain to veterans’ doorsteps as well. In closing, I was motivated to write this post because few media outlets have taken on the task of explaining exactly who would be affected by a national default and how. Catastrophic hand-waving from economists doesn’t do much to explain why a default would be so detrimental to our country’s financial health. It also lessens the pressure on Republicans as most Americans fundamentally don’t understand what’s at risk. The best way to fight this childish behavior is through education. Please share this post widely with others to help your community understand why this manufactured crisis is so dangerous. The only way we can prevent this from happening again is if Americans across the country vocally oppose this behavior and the first step in mounting this opposition is helping everyone understand what’s at stake: their benefits, their paychecks and our nation’s collective well-being. |

Older messages

SCOTUS Set to Weigh In On Racial Gerrymandering in Alabama

Monday, May 22, 2023

And this is just one of many cases to come...

Sen. Tuberville on the U.S. Military's White Supremacy Problem: 🤷

Monday, May 15, 2023

Despite decades of research and increasing warnings from within the military, the senator believes it's all just hot air from Democrats.

Conservatives Want to End No-Fault Divorce, They Might Start In Louisiana

Monday, May 8, 2023

...and a pair of ex-Democrats just gave them the power to do so.

Don't Call Michigan a Blue State (yet)

Monday, May 1, 2023

Straight from the governor's mouth.

A Brief Spring Recess (+ a milestone!)

Wednesday, April 19, 2023

Battleground will be back in May!

You Might Also Like

☕ Great chains

Wednesday, January 15, 2025

Prologis looks to improve supply chain operations. January 15, 2025 View Online | Sign Up Retail Brew Presented By Bloomreach It's Wednesday, and we've been walking for miles inside the Javits

Pete Hegseth's confirmation hearing.

Wednesday, January 15, 2025

Hegseth's hearing had some fireworks, but he looks headed toward confirmation. Pete Hegseth's confirmation hearing. Hegseth's hearing had some fireworks, but he looks headed toward

Honourable Roulette

Wednesday, January 15, 2025

The Honourable Parts // The Story Of Russian Roulette Honourable Roulette By Kaamya Sharma • 15 Jan 2025 View in browser View in browser The Honourable Parts Spencer Wright | Scope Of Work | 6th

📬 No. 62 | What I learned about newsletters in 2024

Wednesday, January 15, 2025

“I love that I get the chance to ask questions and keep learning. Here are a few big takeaways.” ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡️ ‘Skeleton Crew’ Answers Its Biggest Mystery

Wednesday, January 15, 2025

Plus: There's no good way to adapt any more Neil Gaiman stories. Inverse Daily The twist in this Star Wars show was, that there was no twist. Lucasfilm TV Shows 'Skeleton Crew' Finally

I Tried All The New Eye-Shadow Sticks

Wednesday, January 15, 2025

And a couple classics. The Strategist Beauty Brief January 15, 2025 Every product is independently selected by editors. If you buy something through our links, New York may earn an affiliate commission

How To Stop Worrying And Learn To Love Lynn's National IQ Estimates

Wednesday, January 15, 2025

... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

☕ Olympic recycling

Wednesday, January 15, 2025

Reusing wi-fi equipment from the Paris games. January 15, 2025 View Online | Sign Up Tech Brew It's Wednesday. After the medals are awarded and the athletes go home, what happens to all the stuff

Ozempic has entered the chat

Wednesday, January 15, 2025

Plus: Hegseth's hearing, a huge religious rite, and confidence. January 15, 2025 View in browser Jolie Myers is the managing editor of the Vox Media Podcast Network. Her work often focuses on

How a major bank cheated its customers out of $2 billion, according to a new federal lawsuit

Wednesday, January 15, 2025

An explosive new lawsuit filed by the Consumer Financial Protection Bureau (CFPB) alleges that Capital One bank cheated its customers out of $2 billion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏