The AI Hype Cycle Learned From Bitcoin Hype Cycle

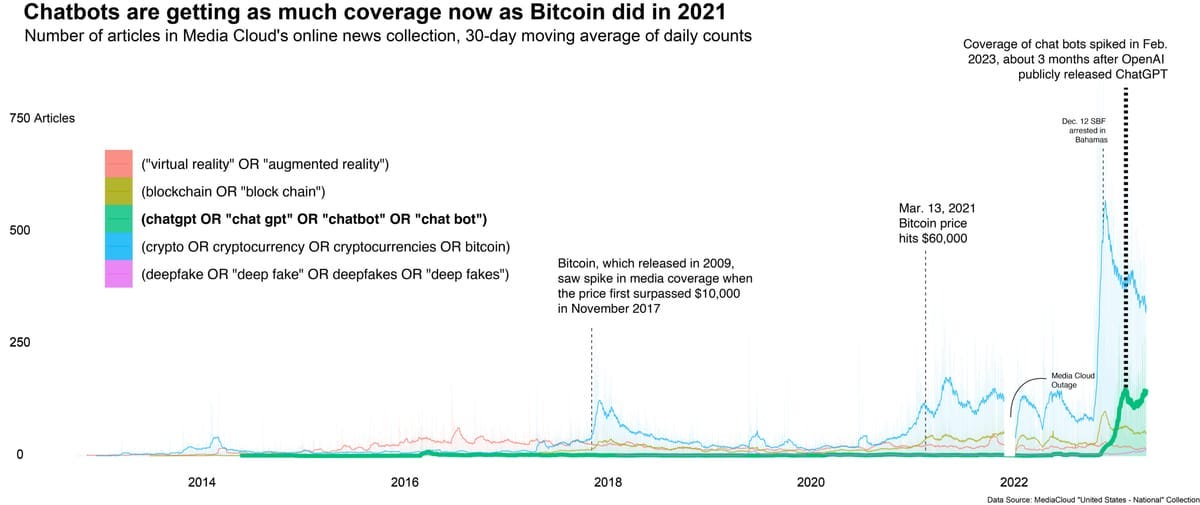

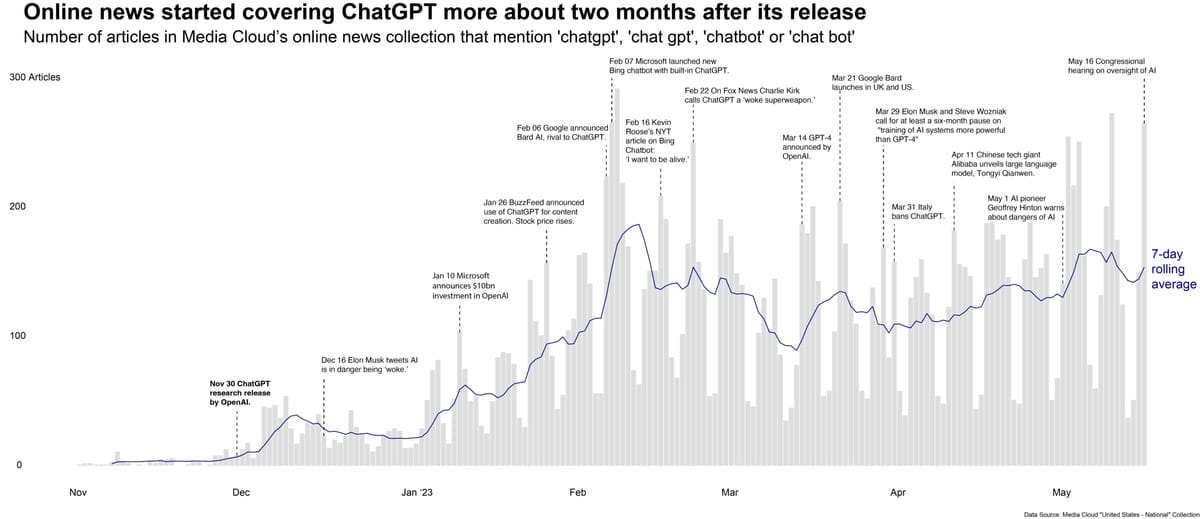

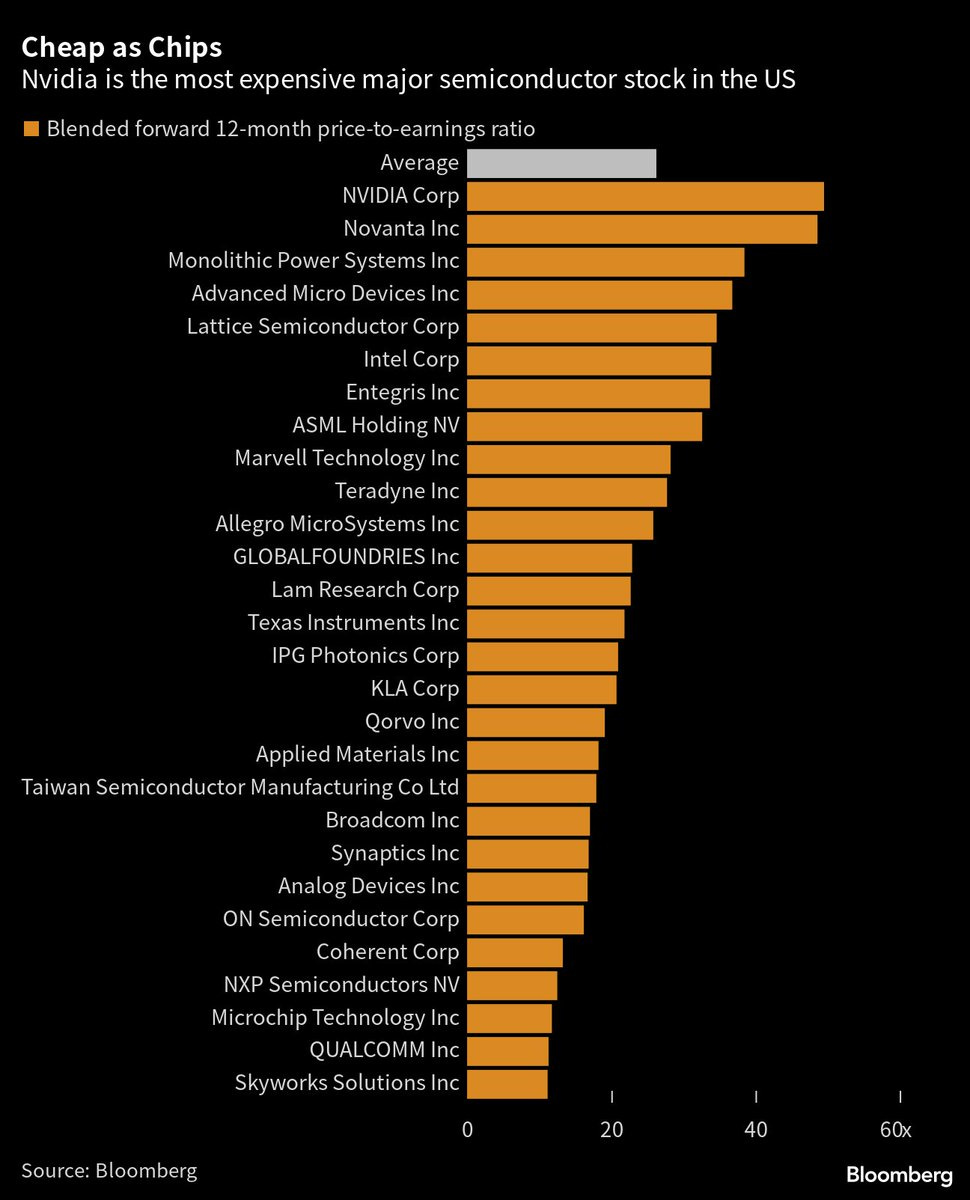

To investors, Artificial intelligence is now being talked about by the media as much as bitcoin was discussed during the all-time high run of 2021. This is noteworthy because the media’s coverage will only accelerate adoption, while also helping to solicit more investment dollars to the industry. As Bay Area Times explained, coverage of new product releases like ChatGPT have not slowed down months after the initial take-off. These hype cycles around new technologies, whether AI or bitcoin, always get a bad name from critics. But the hype cycles are essential in seeing the technology flourish. You need excitement to get people to leave their old jobs and come build products or companies in the new industry. You need excitement for investors to part with their hard-earned money and invest in the new industry. And you need excitement to break through the noise and capture the attention of potential new users. Think of the hype cycle as an industry-funded marketing campaign. The more people who get excited about a new technology, the more entrepreneurs, capital, and users will show up to help make dreams become reality. Now it should go without saying, but unsubstantiated hype can be a negative thing. There has to be substance underlying the excitement. Historically, these hype cycles have been related to some major breakthrough. Smart people are getting excited about something new — the timing may be off, but the breakthroughs usually end up creating something valuable. The internet bubble birthed the internet. The mobile bubble birthed the iPhone. The crypto bubble birthed bitcoin. And my guess is that the artificial intelligence bubble is going to birth a lot of compelling products as well. Remember, humans are bad at predicting the future. People get ahead of themselves in these hype cycles. As Bill Gates famously said, “most people overestimate what they can do in one year and underestimate what they can do in ten years.” If you look back through history, the hype ended up being real — it just happened on a much longer timeframe than initially thought. This brings me to the current hype cycle of AI. There is plenty of craziness that can already be identified. For example, Nvidia has the highest forward P/E of semiconductor stocks in the U.S. As this Twitter user pointed out, now would be a good time to remember the famous Scott McNealy (former CEO of Sun Microsystems) statement to Bloomberg just after the dot-com collapse:

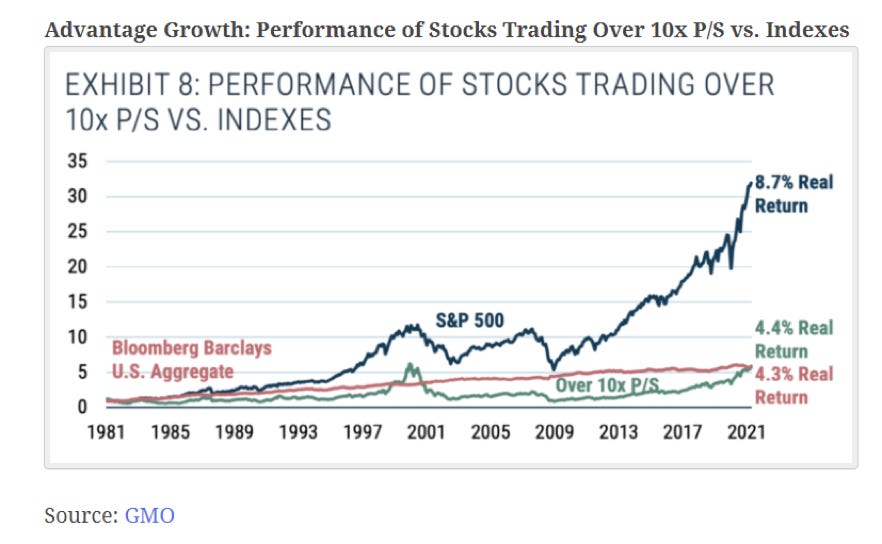

So what has happened in the past to stocks trading at more than 10x sales? It hasn’t gone very well. According to GMO, stocks trading in this range have suffered against the S&P 500 index. The hype cycle is a necessary part of building out new technologies and industries. The capital shows up, but you need to be very cautious of how you choose to participate. Things will become overvalued incredibly quickly — don’t be the person buying at the top of a market. I have no clue if the AI bubble is going to peak this week, next week, next month, or next year. Timing markets is a fools game. But I do think it is important to identify bubbles as they form. People will make a lot of money through the full hype cycle, and thankfully real products and services will be built, but you have to be careful that you don’t follow the herd into a losing proposition. Contrary to popular belief, we need more hype cycles. That would be a sign that innovation and new technologies are coming to market. It also means that billions of dollars will trade hands, which will print massive winners and losers. Frankly, this is a story as old as time. Learn from history and try to avoid some of the mistakes that others already made. Hope you all have a great day. I’ll talk to everyone tomorrow. -Pomp 🚨 I am hosting a private, invite-only conference for 500+ founders later this year 🚨 It is completely free to founders. I want to invite a few people outside my immediate circle. If you're a founder, apply here & our team will be in touch if accepted: You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. |

Older messages

Introducing the Bay Area Times

Monday, May 22, 2023

Listen now (2 min) | To investors, Today, we are publicly announcing the Bay Area Times — a new product that uses data and visuals to analyze what is happening across business, finance, and technology

Is Bitcoin The Largest Insurance Company In The World?

Friday, May 19, 2023

Listen now (5 min) | To investors, The concept of an insurance policy is straightforward. A contract is created between a policyholder and an insurer. The contract states that the insurer is legally

Podcast app setup

Wednesday, May 17, 2023

Open this on your phone and click the button below: Add to podcast app

The UK Attacks Bitcoin But Actually Ends Up Promoting It

Wednesday, May 17, 2023

Listen now (3 min) | Note: You all should have received my latest book summary (Excellent Advice for Living by Kevin Kelly) in your inbox this morning. It is under our new book brand — The Bookrat. If

Podcast app setup

Wednesday, May 17, 2023

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these