Top of the lyne - High churn, low LTV

Gen AI companies are often looked at with skepticism for their inability to scale past consumer/prosumer use cases, which are ailed by high churn and low LTV. Murf AI isn’t one of those companies. Murf is the runaway leader of the text-to-speech space not just for prosumers, but also for businesses. What separates the wheat from the chaff in this space (and Murf from the rest) is a GTM orchestration that (a) proactively triggers self-serve conversions and (b) serves flaming hot enterprise opportunities to their sales team. On a platter. This is the story of how the generative AI company Murf uses behavioral AI to penetrate the enterprise market while putting their self-serve conversions on anabolic steroids.

Meet Murf AI 🤝Entertainment animation agencies creating entire TV series episodes using AI-generated voices… authors creating a series of fantasy fiction audiobooks with little to no production costs… YouTube influencers creating rap videos using AI-powered speech - these stories are all very real in 2023 and they’re all powered by Murf.ai. Synthetic speech company Murf lets users generate “human-like” voiceovers without needing to buy recording equipment or hire a voice artist. Founded in October 2020, Murf saw its ARR rise 26x over the next two years while synthesizing more than one million voiceover projects along the way, in various speaking styles and tones. With a library of more than 120 human-parity AI voices across 20 languages, Murf raised a $10 million Series A round in September 2022, on the back of their blazing growth. What they didn’t know at the time, was that their growth so far was about to pale in comparison to the volcanic surge that was coming their way.

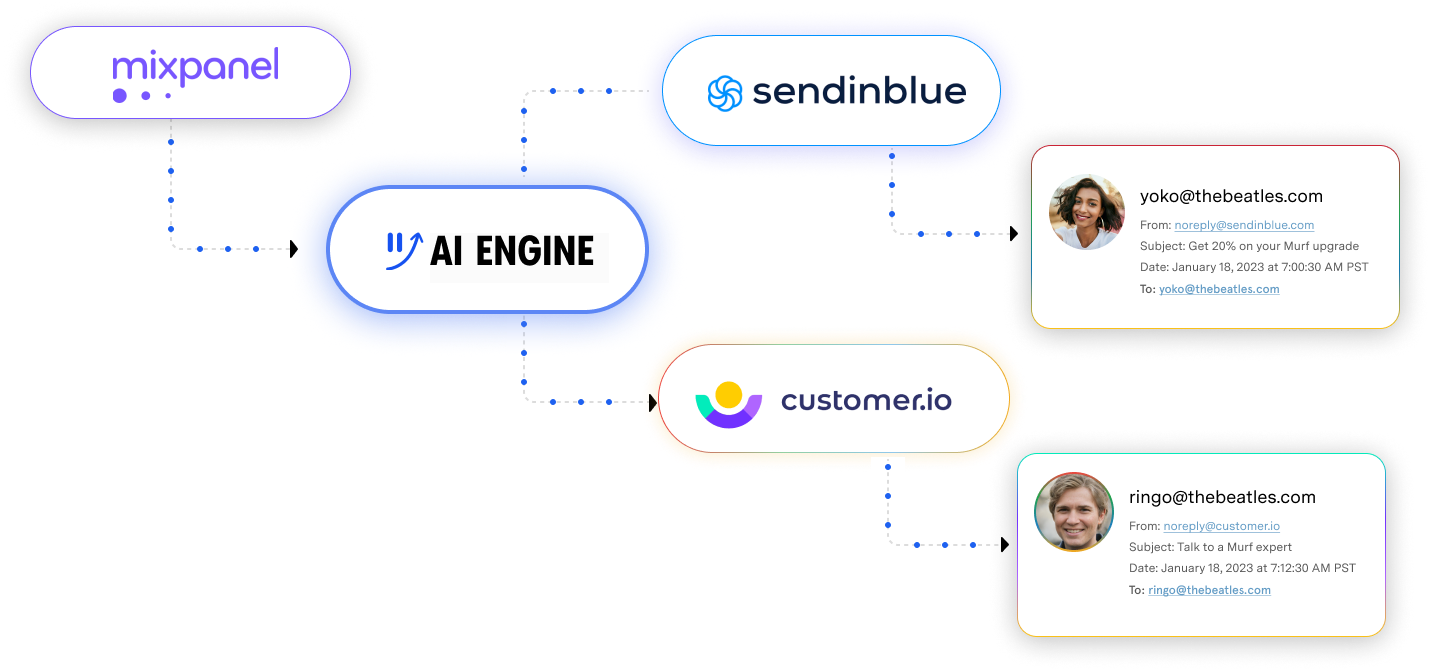

The trouble with growing 3x in 3 months...Murf tracks the behavioral data of users on Mixpanel. On the GTM end, they use Customer.io and Sendinblue to trigger emails to their customers prompting conversions - both self-serve and sales-driven. Prior to using behavioral AI, Murf built cohorts on Mixpanel to qualify users to trigger conversion prompts to. They tested a few hypotheses:

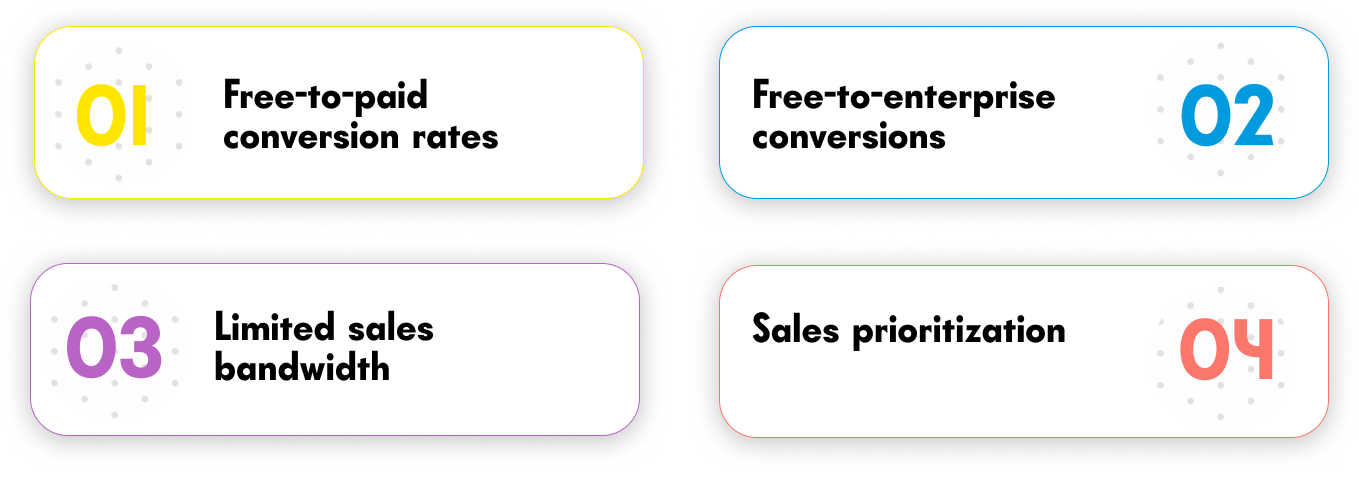

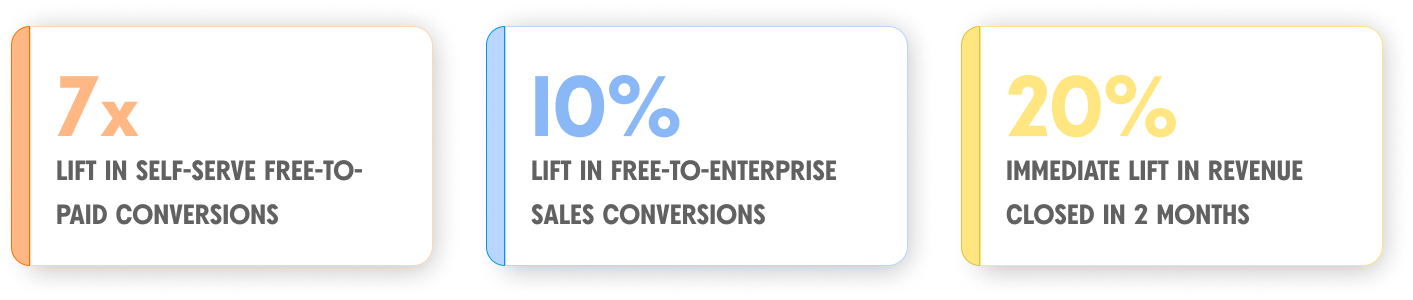

And so in September 2022, an AI company Murf turned to AI for help in a very unsurprising turn of events. Murf integrated behavioral AI into their GTM stack. Skyrocketing conversion rates by 7xMurf's problem was two-fold. On one hand, they needed to focus their relatively small sales team on the leads most likely to convert, rather than waste time, energy, and emails chasing leads who weren't qualified to convert yet. Playbook #1Goal defined to the AI: Free-to-enterprise sales-led conversions Playbook #2Goal defined to the AI: Free-to-pro self-serve conversions AI for AI: Up next for MurfWith these two playbooks orchestrating their GTM, Murf is able to be proactive about penetrating enterprises at a higher ticket price. Their top of the funnel growth rates continue to hold. And so, while acquisition is not a burning problem for Murf (it's an understood problem statement), a problem with a lot of unknowns is churn reduction and account expansion. Playbooks 3 & 4 loading ⏳, but more on that later. |

Older messages

These boots are made for strappin'

Saturday, May 20, 2023

"...and that's just what we'll do." - Userflow founders

Slack's greatest magic trick

Saturday, April 29, 2023

Breaking the magician's code: Why a >120% NRR is a science, not a magic trick

The Go-To-Market silver bullet

Wednesday, April 19, 2023

How a 1-2 of behavioral AI & In-app nudges powered Pictory's +14% increase in Net Revenue Retention

How to nail category creation (and then some)

Thursday, April 6, 2023

4 things we learnt about category creation from Maze CEO Jonathan Widawski

Is there an enterprise sales gene?

Thursday, March 30, 2023

If you don't find it here, you won't find it anywhere

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved