Online Gambling Channels Accelerate the Circulation of Illicit Funds,Cryptocurrency Exchanges Must Prioritize Fund…

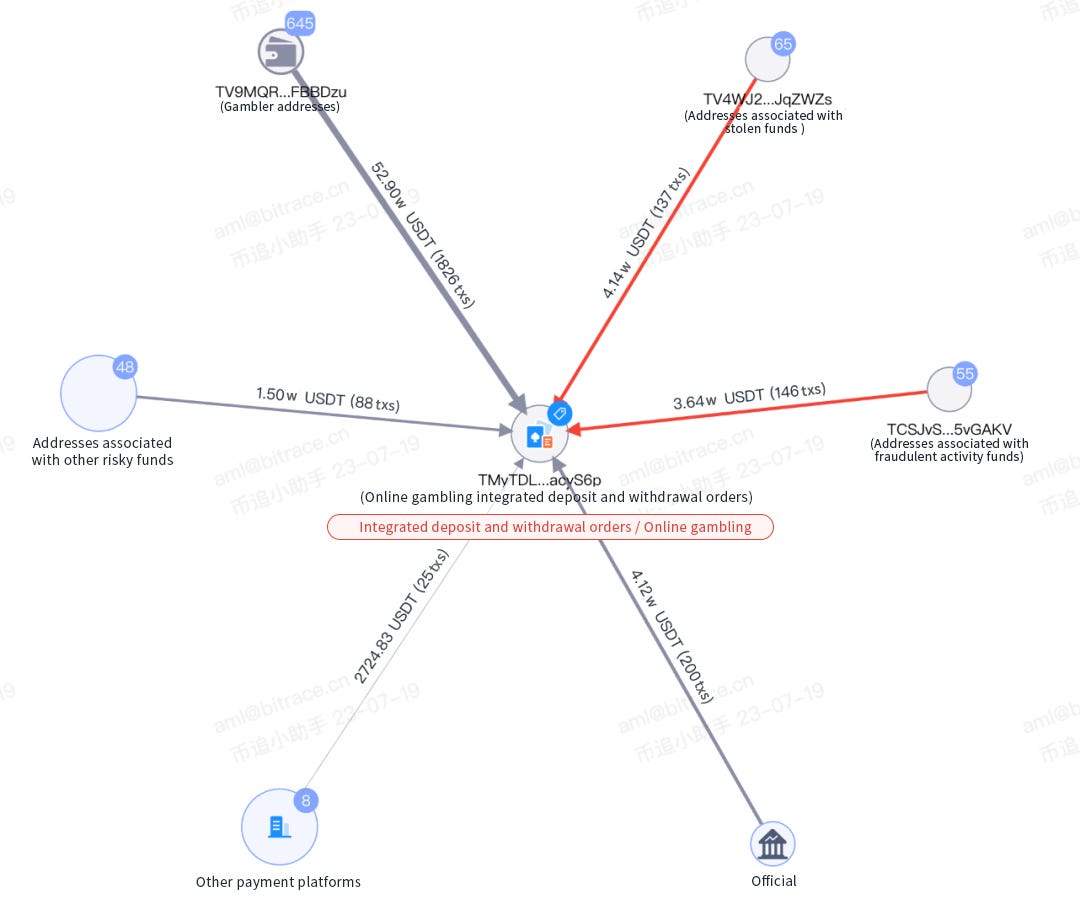

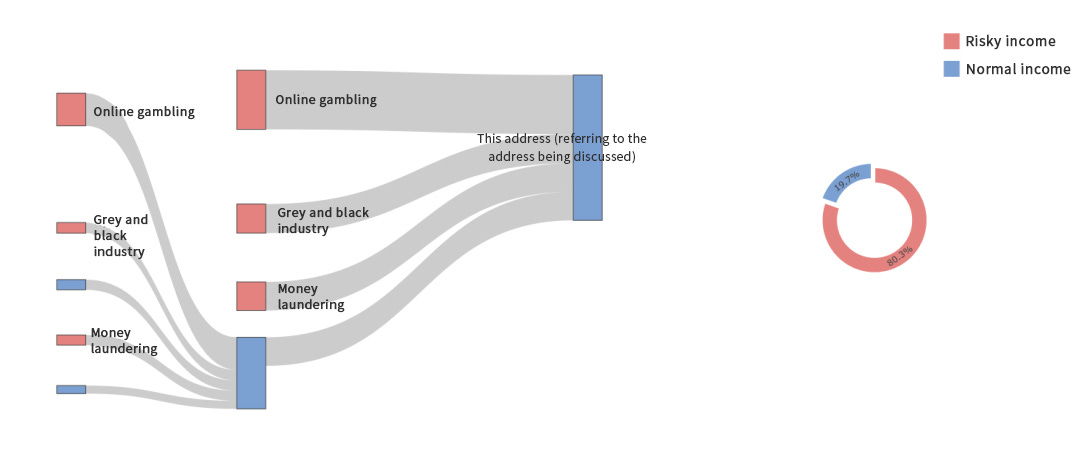

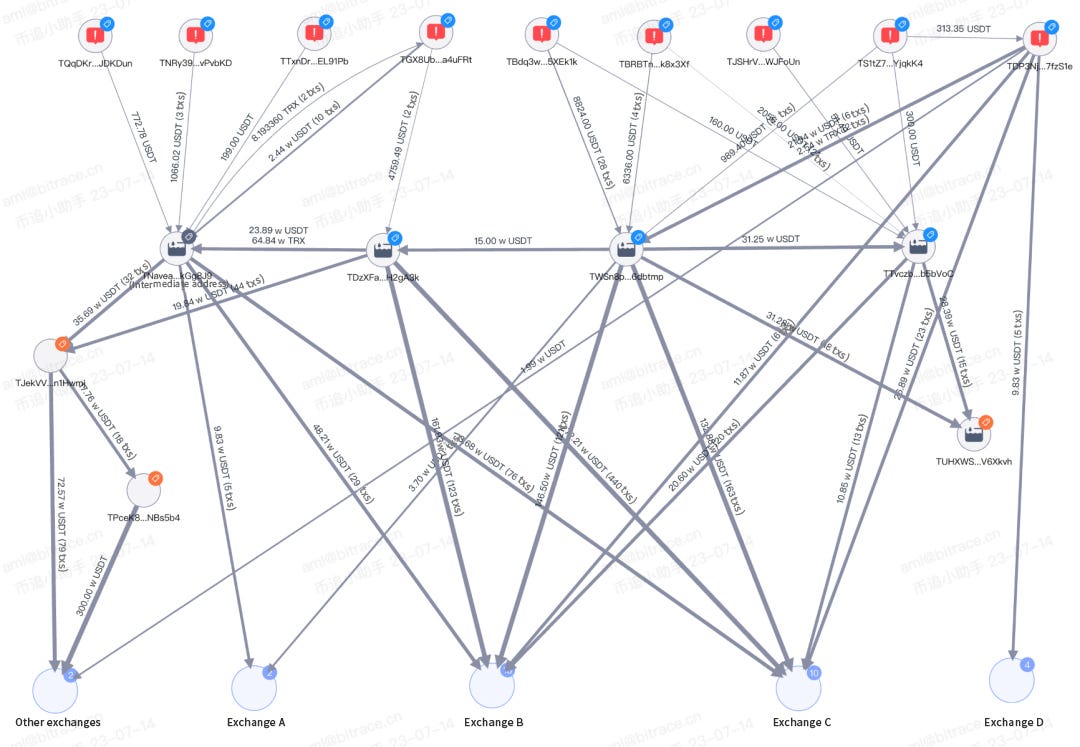

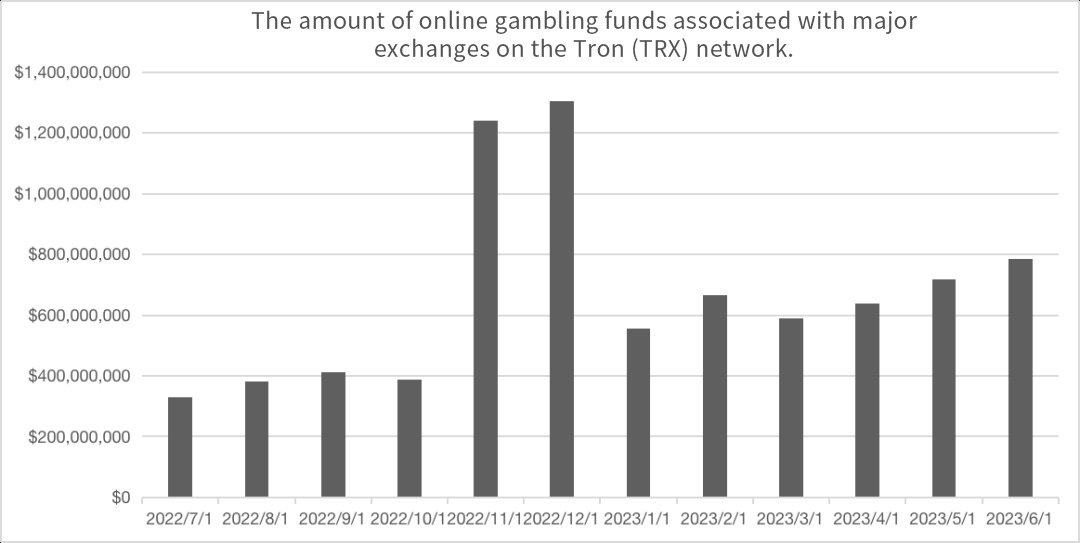

By Bitrace Source: https://mp.weixin.qq.com/s/pciYFbwDIMQXjUj4B4mDyw Stablecoins play a pivotal role in our industry, providing a more anonymous and flexible value transfer and storage solution compared to traditional fiat currencies with restricted circulation. This feature has attracted significant interest from the gambling industry, as evident from a series of reports by Bitrace, highlighting the extensive adoption of Tether (USDT) - the leading stablecoin - in online gambling activities. Given that online gambling is deemed illegal in certain countries or regions, local residents or platforms accepting USDT related to gambling may face legal risks. Moreover, Bitrace has observed the use of online gambling channels by certain criminal syndicates to launder stolen or fraudulent cryptocurrencies, thereby exposing cryptocurrency exchanges to additional legal risks when these illicit funds enter regular investors' addresses and trading platforms. To shed light on the risks associated with online gambling-related crypto funds, this article will expose real-world activities involving the flow of funds to and from online gambling platforms, as well as the increasing trend of contamination in major crypto exchange deposit addresses. Laundering of Illicit Funds Through Online Gambling Channels Typically, channels for crypto funds to enter and exit online gambling platforms are established through cryptocurrency payment services. These services provide payment channels to facilitate fund settlements for online gambling platforms. However, due to the lack of basic KYT/AML mechanisms, these platforms indiscriminately accept users' crypto funds, resulting in the inflow of illicit funds. As an example, Bitrace traced the fund sources of one cryptocurrency payment platform up to five layers of addresses. The data revealed that a portion of the funds received by this address, amounting to 666,000 USDT between September 30, 2022, and July 19, 2023, directly or indirectly originated from addresses associated with internet fraud and phishing websites. Out of this amount, approximately 41,400 USDT came from addresses related to stolen funds, 36,400 USDT from addresses linked to fraudulent activities, and 15,000 USDT from other high-risk fund-related addresses. This suggests a tendency for certain criminal organizations to launder grey and black cryptocurrencies through online gambling platforms. For the cryptocurrency addresses of gambling platforms, when the funds reach a sufficiently large amount and the deposit-withdrawal frequency is high, these addresses effectively become mixing points for such illicit funds, concealing their ultimate destinations. Further data indicates that this trend is widespread. Over the past year, the inflow of illegal funds to various online gambling platforms through cryptocurrency payment services far exceeds their legitimate income. As of July 19, 2023, among 20 sampled payment addresses used for fund settlement on typical online gambling platforms, they were involved in 112,290 transactions with 18,174 counterpart addresses. Apart from other online gambling-related crypto funds, they received 419,968,608 USDT of money laundering-related crypto funds and 428,112,117 USDT of funds related to illicit activities, accounting for 44.42% of their total income. This indicates that online gambling platforms have become part of the money laundering path for criminals. Contamination of Exchange Addresses by Online Gambling Funds Another case occurred in the fourth quarter of 2022 when a woman in Santa Clara County, California, fell victim to an emotional fraud scheme, resulting in a loss of approximately $980,000 worth of cryptocurrencies. Investigating officers from the Regional Enforcement Allied Computer Team traced some of the stolen funds to flow into an online gambling pool, with 80,000 USDT being withdrawn and circulated into a certain exchange by Chinese gamblers. The court ruled that the funds acquired by the account owner were illegal proceeds. After freezing the account owner's exchange account for three months, the remaining 30,728 USDT was returned to the victim. Further investigations into the online gambling platform's fund addresses revealed that during that quarter, some of the platform's addresses directly or indirectly transferred 10,815,500 USDT to more than six centralized exchange addresses. This batch of funds might have entered the exchange's OTC market due to the platform's profit realization or flowed into other investors' accounts via regular gamblers' withdrawals. Additional data also indicates an increasing trend of gamblers or online gambling platforms and their proxies cashing out gambling funds through centralized cryptocurrency exchanges. Over the past year, direct or indirectly associated online gambling funds transferred to the hot wallets of mainstream exchanges exceeded 7.6 billion USDT. Among these, smaller and medium-sized exchanges had a higher proportion of risky funds compared to major exchanges, possibly due to differences in risk management capabilities between platforms. Additionally, the surge in online gambling-related funds in November and December 2022 might be related to a significant increase in online gambling activities during the World Cup. Cryptocurrency Exchanges Should Prioritize Fund Risk Management The above content aims to illustrate the widespread preference of crypto criminal organizations for laundering grey and black cryptocurrencies through online gambling platforms. With the rise of online gambling activities, the inflow of gambling funds into centralized cryptocurrency exchanges through gamblers' withdrawals and the cashing out by online gambling platforms and their proxies is increasing. This clearly demonstrates that the inflow of grey and black crypto assets through online gambling platforms into exchanges is an undeniable fact, and exchange operators should be vigilant about such compliance risks. Proposed solutions include:

Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

How do DeFi protocols adopt real-world assets ("RWA") - An overview of MakerDAO's RWA layouts

Monday, July 24, 2023

TLDR In the RWA sector, the first explosion is from fixed-income products, driven by the treasury management demands of DAOs and Web3 companies. The top TVL rankings in the RWA sector are dominated by

Asia's weekly TOP10 crypto news (July 17 to July 23)

Sunday, July 23, 2023

Author:Crescent Editor:Colin Wu 1. Hubei Police Cracks the First National “Virtual Currency Case” in China link On July 18th, according to a publication by Ping An Hubei, the Shaoyang County

Weekly Project Updates: EthCC Held in Paris、zkSync Airdrops NFTs, Linea Mainnet Goes Live, etc

Saturday, July 22, 2023

1. Etherum's Weekly Summary a. Annual Ethereum Community Conference (EthCC) Held in Paris link The annual Ethereum community conference (EthCC) was held in Paris from July 17th to 20th, featuring

WuBlockchain Weekly: U.S. Senate Proposes Stringent Regulation for DeFi, Binance Cuts Benefits and Top10 News

Friday, July 21, 2023

1. US Senate Plans to Enact Strict Regulation on DeFi Through Legislation link On July 19th, according to Coindesk, the US Senate is preparing to pass a new bill that aims to regulate the

Hong Kong's Largest Online Bank Discusses How to Welcome New Cryptocurrency Policies

Thursday, July 20, 2023

Write By Techub News Translate By ChatGPT4 https://mp.weixin.qq.com/s/PsVchR5at6X9nkkZSwrfgg As a virtual bank in Hong Kong, ZA Bank is more receptive to new technologies and industries than its Hong

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%