The Fed Promised A Miracle And It Looks Like They May Pull It Off

Today’s letter is brought to you by Sidebar!Ready to take your career to the next level? Make your transition successful by leveraging a Personal Board of Directors. A trusted peer group, with battle-tested perspective, and proven playbooks, to have real, tactical discussions with to propel you forward. With Sidebar, senior leaders are matched with a small group of highly-vetted, private, and supportive peers to lean on for unbiased opinions, diverse perspectives, and raw feedback. Everyone has their own zone of genius. Together, we’re better prepared to navigate professional pitfalls and push each other to do more, do it better, and do it faster.

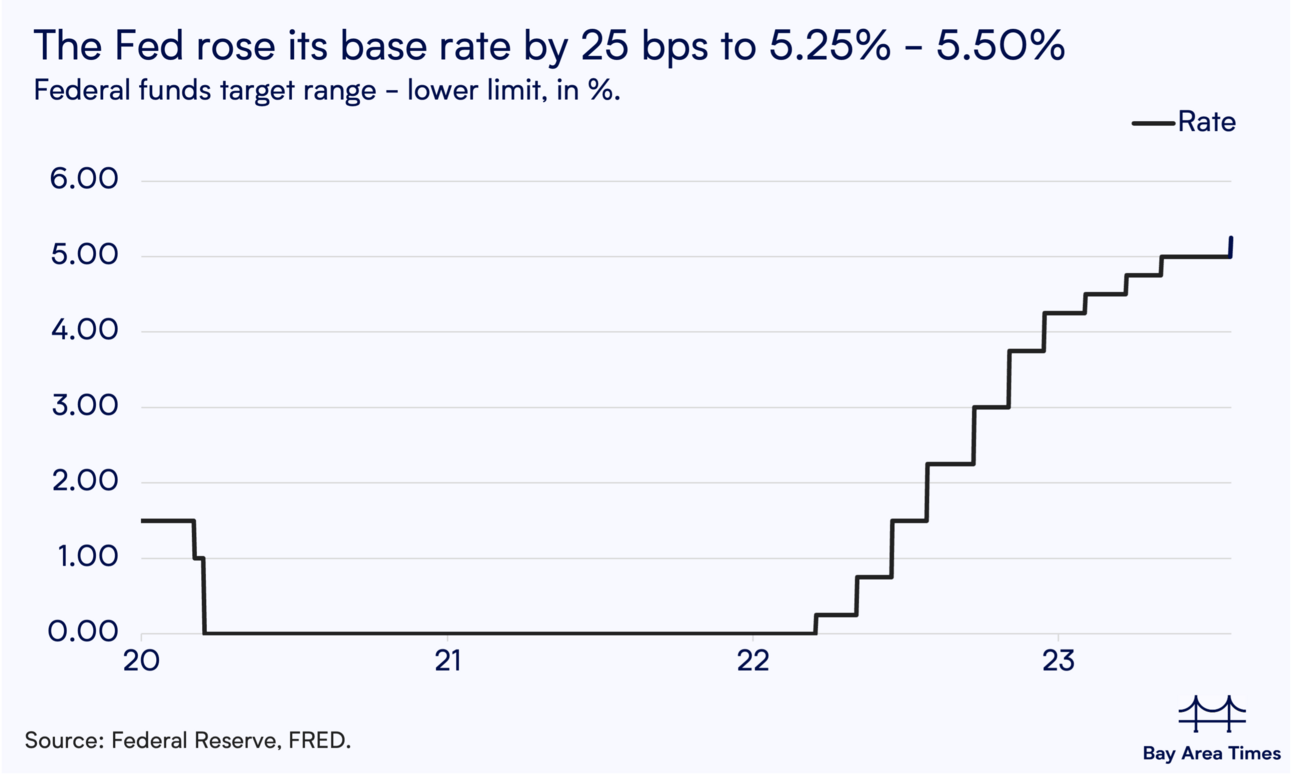

Why spend a decade finding your people – join Sidebar today. Join the growing waitlist of over 2,500 top senior leaders, and apply to become a founding member. To investors, The Federal Reserve was mocked relentlessly during the pandemic for their atrocious understanding of their impact on inflation. After cutting interest rates to 0% and helping print trillions of dollars, the central bank was confident that inflation would be transitory. They were wrong. Inflation peaked at over 9% in the United States and the CPI metric remained above 5% for about two years. There was nothing transitory about the inflation that ravaged the bottom 50% of citizens who have no investable assets. As if that was not bad enough, the Fed appeared to compound the problem by jacking up interest rates over 500 basis points in just over a year. This was an important development because the Fed had previously given guidance in 2020 and 2021 that interest rates would remain below 1% for years to come. Since individuals and businesses planned their lives off that guidance, the central bank violated their trust when they did the exact opposite. These two mishaps make it clear why very few people believed the Fed when they stated their intention to achieve a soft landing of the US economy back in 2022. The idea was the monetary policy leaders would be able to increase interest rates and drain liquidity from the economy without experiencing a significant increase in unemployment or a meaningful contraction in economic activity. Everyone from market participants to former central bankers highlighted the near impossibility of this task. But, in a stroke of genius or a batch of good fortune, it appears more likely every day that the Federal Reserve may pull off their soft landing target. Yesterday, the central bank raised the interest rate by 25 basis points to a target range of 5.25% - 5.5%, which is the highest interest rate range in 22 years. This steep of an acceleration in the interest rate has never happened before. The consensus view has been a recession would be imminent because you can not increase interest rates this quickly without breaking things. After receiving more data, the answer appears more complicated than we previously thought. First, we already experienced a recession last year. The GDP data for Q1 and Q2 2022 was negative, so this met the standard of a recession in most people’s eyes, especially given the recession definition has long been “two quarters of negative GDP growth.” You probably don’t remember that recession though. Why? The National Bureau of Economic Research boasts of having a monopoly on calling a recession. You can’t make this stuff up. The organization has said that two quarters of negative GDP growth does not automatically qualify as a recession, but instead they will let the American people know when a recession has actually occurred. It would be funny if it was not so absurd. The second piece of nuance related to a recession and the financial tightening pursued by the Federal Reserve is how resilient the US economy has been throughout this period. Jeff Cox of CNBC explains why the economic strength is a leading indicator that the odds of a recession are diminishing:

This leads us to question how the Federal Reserve could aggressively hike interest rates, yet nothing is breaking in the economy? Well, that is not necessarily true. The third piece of nuance is related to the areas of damage, which have been in unexpected corners of the economy. Historically, a central bank’s pursuit of quantitative tightening would lead to high unemployment and GDP contraction. While those have stayed strong and bucked the historical trend, we have seen numerous banks blow up in the last few months. Three of the four largest bank failures in history have occurred in the last seven months. We continue to see regional banks failing on a weekly basis. So this means that the Fed’s actions didn’t impact the average consumer in a way that was previously predicted, but instead it literally killed financial institutions — and the Fed continues to tighten financial conditions despite banks breaking. So where does this leave us now? The Federal Reserve is going to wait for more data on inflation and jobs before deciding whether to continue hiking interest rates or not. They should get two full months of data before they need to make another decision, which will give them a good idea of how strong the economy really is at the moment. The odds of a recession are diminishing by the day as well. The longer that interest rates stay above 5% without unemployment growing aggressively or GDP contracting in a material way, the less likely it is that we will see the pain of a widespread recession. If this happens, which is increasingly looks like it will, the Federal Reserve will have pulled off the impossible — a soft landing. It is still too early to celebrate. There are a variety of things that could go wrong, but if a soft landing is achieved then we should congratulate the Fed on a job well done. After their recent mistakes and inaccurate predictions, the central bank could use a win on such an important stage. Hope you all have a great day. I’ll talk to everyone tomorrow. -Pomp Remi Adeleke is a former Navy SEAL, and also the author of 2 books, "Transformed: A Navy SEAL’s Unlikely Journey from the Throne of Africa, to the Streets of the Bronx, to Defying All Odds" & "Chameleon: A Black Box Thriller. "Chameleon" is his brand new fiction story of his life, and many of the experiences he went through. This man has not only gone from being a Navy SEAL, but he has also broke into the media & entertainment industry. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Navy SEAL Rebuilds Life After Nigerian Government Steals His Family’s Wealth Get Better Crypto Data: Do you want faster, easier crypto data? Sign up for Velo Data, a new product that we have been working on to solve this problem: velowaitlist.com 🚨 You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. | |||||||||||||||||||||||||||||||||||||||||||||||

Older messages

How The Lottery Funded America And Grew To $1 Billion Jackpots

Thursday, July 20, 2023

Listen now (6 min) | To investors, Gambling is an American tradition. More specifically, the lottery has been a core component to funding the rise of America and many of our most respected institutions

This Movement Will Determine Your Great-Grandchildren's Economic Prosperity

Monday, July 17, 2023

e/acc is a movement that will usher in economic growth and prosperity by inspiring people to build solutions to hard problems using technology.

The Fed Is Playing Chicken With A Recession

Monday, July 10, 2023

Listen now (4 min) | Read the end of today's letter for information on Sidebar: To investors, There are a few graphics and visuals that I came across over the weekend that tell a scary story for

Bitcoin Q2 Network Report

Friday, July 7, 2023

To investors, The team at Reflexivity Research, led by Will Clemente, recently published a Q2 report on the state of the bitcoin network. This in-depth report covers everything from on-chain activity

The State of Bitcoin Mining

Thursday, June 29, 2023

Listen now (11 min) | To investors, I hosted a conference on bitcoin mining yesterday. Speakers included CEOs and leaders of the most successful mining companies in the industry. (view recording here)

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these