The Pomp Letter - The US Economy Is Drunk & Confused

Today’s letter is brought to you by Sidebar!Ready to take your career to the next level? Make your transition successful by leveraging a Personal Board of Directors. A trusted peer group, with battle-tested perspective, and proven playbooks, to have real, tactical discussions with to propel you forward. With Sidebar, senior leaders are matched with a small group of highly-vetted, private, and supportive peers to lean on for unbiased opinions, diverse perspectives, and raw feedback. Everyone has their own zone of genius. Together, we’re better prepared to navigate professional pitfalls and push each other to do more, do it better, and do it faster.

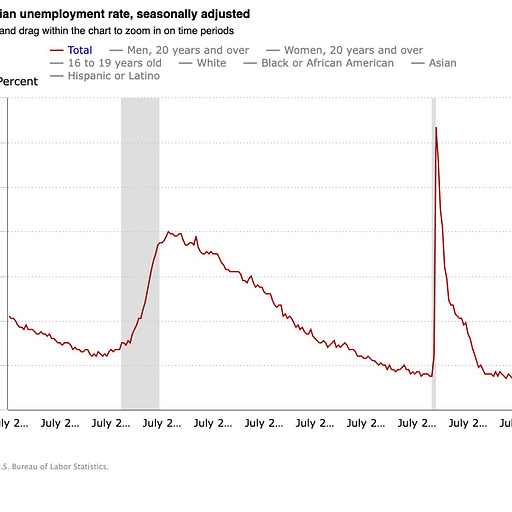

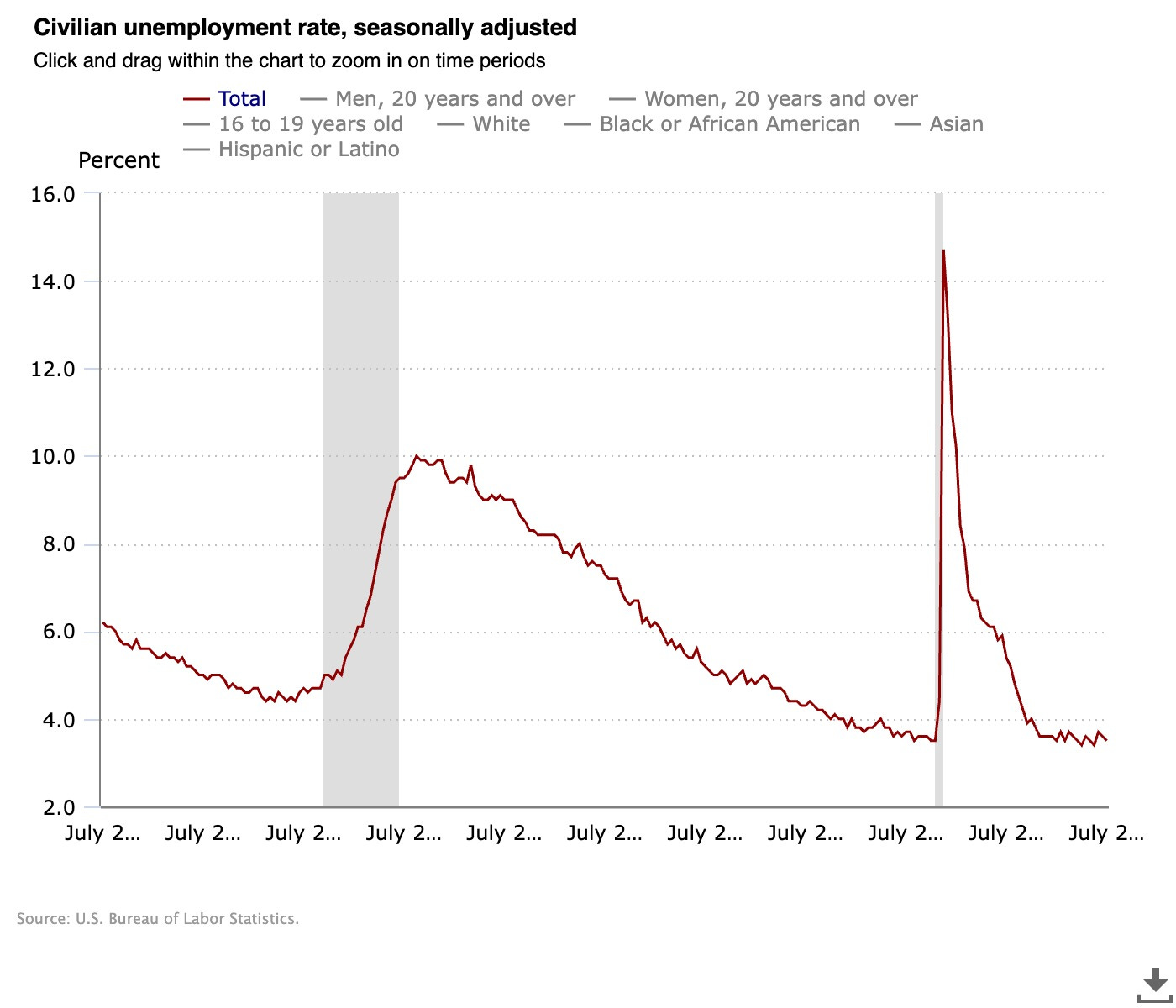

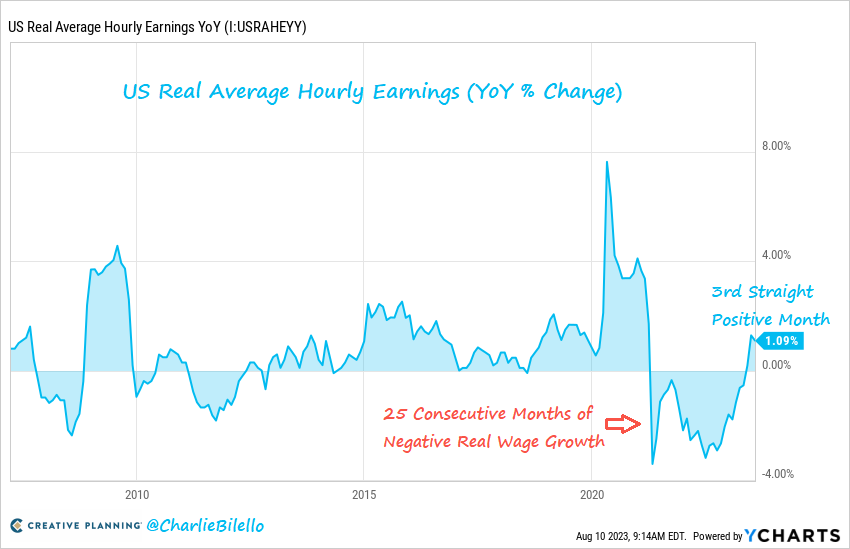

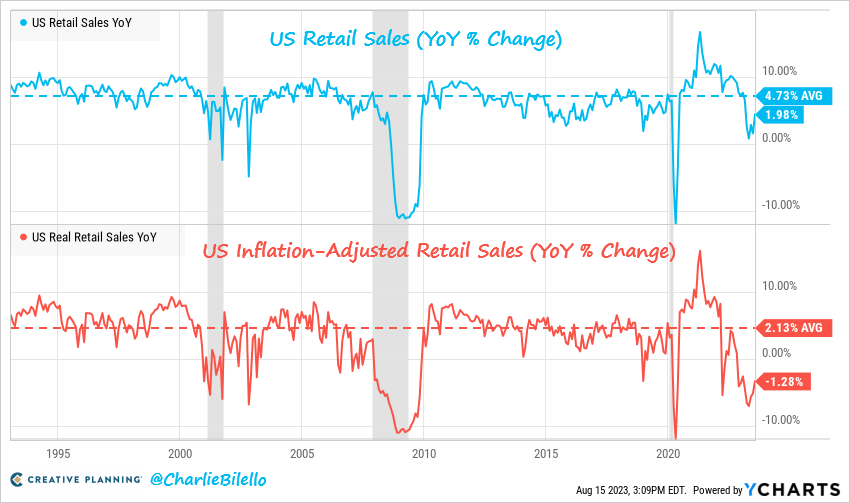

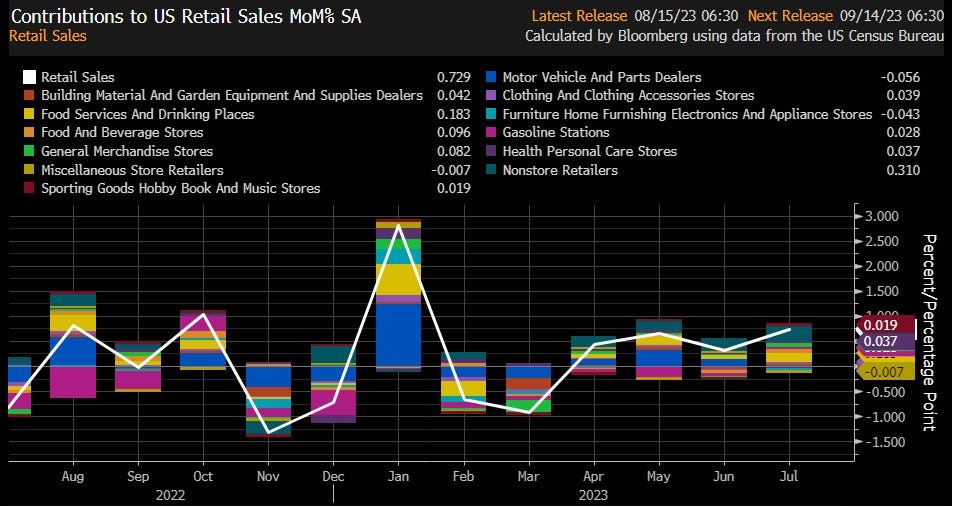

Why spend a decade finding your people – join Sidebar today. Join the growing waitlist of over 3,500 top senior leaders, and apply to become a founding member. To investors, People have been predicting a recession for months. But the economy doesn’t seem to care. The S&P 500 is up 15% year-to-date and nearly back to all-time highs. Unemployment also remains stubbornly low at 3.5%. As Charlie Bilello points out, “after a record 25 consecutive months of negative real wage growth, wages have now outpaced inflation on a year-over-year basis for 3 straight months. This is a great sign for the American worker that hopefully continues.” But the Federal Reserve is not out of the woods yet. In fact, the Fed is likely in an impossible situation. They have raised interest rates more than 500 basis points in about 18 months, which is the fastest pace on record. Headline inflation has fallen from over 9% to less than 4%, yet there are lingering concerns that inflation could reverse and accelerate again. These inflation fears are largely driven by the fact that numerous economic measurements continue to come in at higher levels than expectations. According to Bloomberg’s Lisa Abramowicz, “investors are throwing in the towel on hopes for near-term central bank rate cuts. Global bond yields are at the highest levels since 2009 as economic data keeps coming in hotter than expected.” She goes on to highlight that “a San Francisco Fed study estimates that US consumers have about $190 billion of excess savings left and that it'll likely be depleted during the current quarter.” Then we can look at something like retail sales — Bilello states “after adjusting for inflation, US retail sales fell 1.3% over the last year, the 9th consecutive YoY decline. That's the longest down streak since 2009. Nominal retail sales increased 2% YoY vs. a historical average of 4.7%.” But Kathy Jones says is more excited about the “large upside surprise in retail sales. Retail sales increased 0.7% vs. an expectation of 0.4% month-over-month. The control group, which feeds into GDP, increased 1.0% vs. an expectation of 0.5%.” So what exactly is going on in the US economy? Are we headed towards good times or bad times? Up or down? Pain or bliss? The short answer is that no one knows. The Federal Reserve has to use these conflicting data points to determine whether they have done enough rate hikes. If they have, then inflation will continue to come down, the Fed will eventually cut rates, and asset prices will continue their decade-long trend of up-only. But if the Fed misjudges this, and they mistakenly pivot now prematurely, then we could see an accelerating inflation trend that catches the central bank unprepared.

The public narrative in recent weeks has switched from “the Fed will have to continue hiking interest rates and a recession is on the horizon” to “the Fed is done hiking interest rates and the good times are coming back.” These meeting minutes reveal that the central bank has a different view of the economy. It is nearly impossible for a human to use backwards-looking economic data to make monetary policy decisions that impact the future. There are too many moving parts and an economy is too complex. The Federal Reserve will do the best they can, but the conflicting data is compounding the challenge in the current environment. Regardless of whether the Fed continues to hike interest rates or not, someone is going to complain that the governing body got it wrong. Inflation never shows up — people will say it was never going to come anyways. Inflation comes roaring back — the “hike interest rates forever” crowd will be screaming “I told you so!” Unfortunately the people caught in the crossfire of the monetary policy debate are everyday Americans who simply want to live their lives. They want to plan their future, including choosing a city to live in, a home to purchase, children to raise, and a job to obtain. These big life decisions are directly and indirectly impacted by the cost of money, whether people realize it or not. If we don’t know the cost of money a month from now, it becomes nearly impossible to plan your future life with any degree of accuracy. That has always been the case, but seems more obvious today than ever before. Hopefully we can escape this complex, uncertain, and chaotic time with minimal damage to the economy and the financial health of Americans. I am hoping for the best but preparing for the worst. I suggest you do the same. Hope everyone has a great day. I’ll talk to you tomorrow. - Anthony Pompliano Darius Dale is the founder & CEO of 42Macro. In this conversation we talk about global liquidity, what drives it - both in private & public sector, and how to understand its future impact on asset prices. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here My Appearance on CNBC with Brian Sullivan Last Night Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Greatest Business Deal of the Last Decade

Monday, August 14, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Ready to take your career to the next level? Make your transition successful by leveraging a Personal Board of Directors. A

These 8 Bitcoin Charts Are Worth Watching

Monday, August 14, 2023

Listen now (3 mins) | To investors, I found a number of interesting data points while I was digging into the bitcoin market over the weekend. First, there are now more than 1 million addresses on the

Podcast app setup

Thursday, August 3, 2023

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Tuesday, August 1, 2023

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Tuesday, August 1, 2023

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these