|

|

|

Good morning. The NFL is back tonight and your fantasy team, “Stroudy with a Chance of Deep Balls,” is looking dangerous. Nothing can go wrong this season.

Also, we wanted to shout out the hundreds of you who emailed answers to yesterday’s math question on how many points the Oregon Ducks could have scored if the mascot did 546 pushups during Saturday’s game. While they actually scored 81 points in the game, there were many different solutions—every score between 46 and 89, in fact (thanks, Nick).

- The most popular answer was 84 points all via touchdowns and extra points: 7+14+21…until 84.

-

The most creative answer was 59 points, in which the Ducks started out with 15 safeties (two points each), kicked five field goals, and closed out the game with two touchdowns plus extra points. Sounds like you had a productive day at work, Menachem.

As one reader wrote, “Math is fun!” We agree. Have a great Thursday.

—Molly Liebergall, Matty Merritt, Cassandra Cassidy, Abby Rubenstein, Neal Freyman

|

|

|

|

|

Nasdaq

|

14,020.95

|

|

|

|

S&P

|

4,496.83

|

|

|

|

Dow

|

34,641.97

|

|

|

|

10-Year

|

4.252%

|

|

|

|

Bitcoin

|

$25,687.77

|

|

|

|

AMC

|

$8.62

|

|

|

|

*Stock data as of market close, cryptocurrency data as of 3:00am ET.

Here's what these numbers mean.

|

-

Markets: Stocks continued their September slump yesterday, with tech companies getting hit especially hard as investors fretted about another possible Fed rate hike because of data showing prices for manufacturing and services trending upward. It was a mixed bag for the meme stock faithful, with AMC hitting an all-time low after releasing a plan to sell new shares and GameStop rising after-hours thanks to better-than-expected sales last quarter.

|

|

|

|

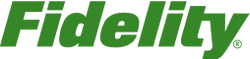

Mother alert: Working women have made historic gains, and those with young children are leading the charge.

According to the latest numbers from the Bureau of Labor Statistics…

- Workforce participation rates were 57.7% among women and 68.2% among men as of August. This 10.5 percentage-point difference is the narrowest that’s ever been recorded.

- For full-time work, the gender pay gap decreased in Q2 to 16 cents—or women earning 84 cents for every dollar men make—the smallest disparity on record (but still not a huge leap from 20 cents in 2002).

These catch-ups have been driven by women between 25 and 54 years old, whose labor participation rates are higher than ever and are outpacing men’s post-pandemic work rebounds. Remarkably, women’s largest increases in workforce participation came from mothers of children under five, who are working more now than they did in 2019, according to the Brookings Institution.

Taking the village

Many companies are trying to reinstate in-person work policies, jeopardizing the remote work flexibility that allowed many mothers to do their jobs while at home with their kids. Compounded by the approaching end of pandemic-era childcare aid, working women’s labor peaks are at risk of plateauing—or worse.

More than 70,000 struggling daycare programs may shutter when federal aid stops flowing at the end of the month, leaving the parents of 3.2 million children scrambling, according to estimates from the Century Foundation, a nonpartisan think tank. Since childcare often falls to mothers more than fathers, experts fear that the widespread closure of daycare centers will lead to a pullback of women in the workforce.

Over the childcare cliff: A mass exodus of working mothers could worsen labor shortages, cost US states $10.6 billion each year in tax and business revenue, and cause families to earn about $9 billion less each year, the Century Foundation estimates.—ML

|

|

Your favorite investing podcast is back (!!!) for a fourth season. Yep, we’re talkin’ about Fresh Invest, our award-winning podcast sponsored by Fidelity Investments and powered by Morning Brew.

This season is all about providing tips and strategies to help you invest wisely—wherever you are in life. Every week, Morning Brew’s co-founder and executive chairman, Alex Lieberman, sits down with Fidelity professionals to discuss long-term wealth-building strategies in today’s investing landscape.

First topic on the docket: current market trends, inflation, and tactical ways you can grow your investments in these economic conditions.

Check out the first episode now, wherever you get your podcasts.

|

|

Sylvain CORDIER/Gamma-Rapho via Getty Images

Biden admin moves to block drilling on millions of wild Alaskan acres. The Interior Department proposed regulations yesterday that would ban new oil and gas drilling in more than 40% of the National Petroleum Reserve in Alaska. They would also cancel leases issued by the Trump administration that allow drilling in the Arctic National Wildlife Refuge. What the proposal doesn’t do is impact the recent approval of the $8 billion Willow oil project in the same Alaskan wilderness, which Biden angered environmental groups by approving. If finalized, the new restrictions the new restrictions will likely face a lawsuit from fossil fuel companies aiming to block them. Biden admin moves to block drilling on millions of wild Alaskan acres. The Interior Department proposed regulations yesterday that would ban new oil and gas drilling in more than 40% of the National Petroleum Reserve in Alaska. They would also cancel leases issued by the Trump administration that allow drilling in the Arctic National Wildlife Refuge. What the proposal doesn’t do is impact the recent approval of the $8 billion Willow oil project in the same Alaskan wilderness, which Biden angered environmental groups by approving. If finalized, the new restrictions the new restrictions will likely face a lawsuit from fossil fuel companies aiming to block them.

Hunter Biden to be indicted again this month. Prosecutors expect to seek a new indictment against the president’s son on a gun charge by the end of September after a judge scuttled his plea deal in July. This likely means former President Donald Trump, who is facing multiple indictments, won’t be the only candidate dealing with awkwardly timed legal disputes as the presidential election approaches (though President Biden himself is not involved in the case against Hunter Biden). A judge ruled yesterday that two of Trump’s alleged co-conspirators in the Georgia election interference case should go to trial in October. Hunter Biden to be indicted again this month. Prosecutors expect to seek a new indictment against the president’s son on a gun charge by the end of September after a judge scuttled his plea deal in July. This likely means former President Donald Trump, who is facing multiple indictments, won’t be the only candidate dealing with awkwardly timed legal disputes as the presidential election approaches (though President Biden himself is not involved in the case against Hunter Biden). A judge ruled yesterday that two of Trump’s alleged co-conspirators in the Georgia election interference case should go to trial in October.

There’s another big storm brewing. For now, Lee is just a tropical storm, but it’s expected to gain strength over the Atlantic Ocean and become a major hurricane, possibly a Category 4 with 150 mph winds. It’s too soon to say where exactly the storm will blow once it grows. It could hit the East Coast, Canada, or islands in the Caribbean—or it could remain out at sea. Lee is the 12th named storm this year in the Atlantic, where hurricane season usually peaks in mid-September. The National Oceanic and Atmospheric Administration predicts there may be as many as 21 before the season ends. There’s another big storm brewing. For now, Lee is just a tropical storm, but it’s expected to gain strength over the Atlantic Ocean and become a major hurricane, possibly a Category 4 with 150 mph winds. It’s too soon to say where exactly the storm will blow once it grows. It could hit the East Coast, Canada, or islands in the Caribbean—or it could remain out at sea. Lee is the 12th named storm this year in the Atlantic, where hurricane season usually peaks in mid-September. The National Oceanic and Atmospheric Administration predicts there may be as many as 21 before the season ends.

|

|

Francis Scialabba

Your sedan is probably eavesdropping. Cars were found to have the worst privacy policies of any product category analyzed by the nonprofit Mozilla Foundation—even worse than your Google Nest or Apple Watch, a report released by the foundation yesterday said.

Unless your ’67 Chevy is still truckin’, you’re probably at risk. Mozilla found that the 25 vehicle brands analyzed, including Audi, Toyota, Mercedes-Benz, and Ford, failed to hit basic privacy standards.

That means your car and the services you use in it, like GPS or satellite radio, can collect data such as your contact info, race, or immigration status, and any other personal inferences the systems can make about you based on where you go.

- Nissan admitted that their vehicles collect data on drivers’ sex lives, but didn’t explain what data or how they get it.

-

Tesla was the worst-ranked car brand in terms of privacy. (Remember the totaled one that was shipped to Ukraine but remained connected to CNBC Executive Editor Jay Yarow’s Spotify account?)

The fine print: Most major automakers’ privacy policies have no opt-out choice and don’t offer encryption for your data. No US brands have a way to totally delete your info, and 19 car companies even specify that they can sell your data to brokers, marketers, or dealerships. See what yours does here.—MM

|

|

|

Who are you partnered with? It’s no secret that Vanguard, Fidelity, and Schwab could be considered 3 of the most popular brokerage firms. But they stack up slightly differently when it comes to fees and their specific suite of services. Learn more about who should work with Vanguard, Fidelity, and Schwab.

|

|

David M. Benett/Getty Images

For the first time in nearly twenty years, the Rolling Stones will release a new original album next month. And if the single unveiled yesterday is any indication, rock-and-roll’s OG frontman, Mick Jagger—now an octogenarian—hasn’t missed a beat.

Ronnie Wood, Keith Richards, and Jagger announced their forthcoming album, Hackney Diamonds, yesterday in London along with their new song, “Angry.” At 76, 79, and 80, respectively, the Stones are just one example of how the makeup of the workforce is grayer than you might think:

- Last year, 650,000 Americans over 80 were still working, up 18% from the previous decade, according to data from the Census Bureau.

- There will be twice as many 75-year-old+ workers in 2030 than in 2020, due in part to the aging baby boomer generation, the Bureau of Labor Statistics estimates.

Can’t get no retirement: Apropos of the new album, Wood told the AP that hanging it up would be “impossible” because “you’ve got to keep playing.” The sentiment is shared among artists—Willie Nelson (90), Bob Dylan (82), and Smokey Robinson (83) are still touring—as well as political leaders like President Joe Biden (80) and Mitch McConnell (81), and business giants like Warren Buffett, who recently turned 93.

Mark your calendar…Hackney Diamonds hits record stores (if there still are any) on October 20 and includes collaborators like Lady Gaga and Stevie Wonder.—CC

|

|

Francis Scialabba

Stat: In a heist worthy of Danny Ocean, thieves in Spain operating under cover of darkness last week managed to make off with 50,000 liters of a precious commodity: olive oil. In addition to being delicious, the stolen oil was worth 500,000 euros. Thefts of Rachel Ray’s favorite ingredient (and of olives themselves) have increased since a major drought caused poor harvests, sending prices skyrocketing. The cost of a bottle of olive oil at Spanish supermarkets has jumped 15% since July, according to Bloomberg.

Quote: “We’re not at war. We are not seeking to be at war, but we have to be able to get this department to move with that same kind of urgency because the PRC isn’t waiting.”

The Department of Defense is the latest to get in on the AI craze. The government plans to spend hundreds of millions of dollars to create a large network of “small, smart, cheap” drones and other tech backed by artificial intelligence systems that can work on land, in the air, and at sea to stay competitive with China, Deputy Secretary of Defense Kathleen Hicks said this week. Let’s hope this never devolves into a HAL 9000 situation.

Read: Americans are losing faith in the value of college. Whose fault is that? (New York Times)

|

|

-

Elon Musk borrowed $1 billion from SpaceX right around the time he bought Twitter, the WSJ reports.

-

WeWork plans to renegotiate nearly all of its leases and pull out of “unfit and underperforming locations” in an effort to stay afloat.

-

Demand for mortgages fell to its lowest level since December 1996 last week, despite a slight dip in rates.

-

Bill Gates, or at least his foundation, bought $95 million worth of Anheuser-Busch stock last quarter even as Bud Light lost its spot as America’s top-selling beer.

-

Spanish soccer star Jenni Hermoso filed a sexual assault complaint with prosecutors over the unwanted post-victory kiss at the World Cup from now-suspended national soccer federation President Luis Rubiales.

|

|

Brew Mini: Knowing your yoga poses could give you a leg up (pun intended) in today’s Mini. Neal completed it in 1:48…can you beat that?

Three headlines and a lie

Three of these headlines are real and one is faker than someone who claims to be the real Dr. Doolittle. Can you spot the odd one out?

-

3-legged bear breaks into Florida home, drinks White Claw

-

Hurricane Idalia blows flamingos as far as Ohio

-

He fought to keep an emotional support emu at his home—and won

-

An octopus was taught to open an iPad app

|

|

We made up the one about the octopus.

Word of the Day

Today’s Word of the Day is: “apropos,” which means with regard to. Thanks to Constanza Cabrera, from Mendoza, New Jersey, for suggesting a word so…apropos (its other meaning is appropriate to the situation). Submit another Word of the Day here.

|

|

|

✢ A Note From Fidelity

Investing involves risk, including risk of loss.

Fidelity and Morning Brew are independent entities and are not legally affiliated.

“Financial Communications Society” 05/04/2023 Fresh Invest Season 3, Gold Medal for Corporate Retail within Branded Content: Audio. https://thefcs.org/portfolio-awards/2023-brochure.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

|

|

|