Nuts and bolt-ons: Entain’s acquisitions

Nuts and bolt-ons: Entain’s acquisitionsEntain’s M&A examined, BetMGM ♥️ Angstrom, inside the deal – Thunderbite sale, NorthStar future +MoreGood morning. In this month’s edition of Deal Talk:

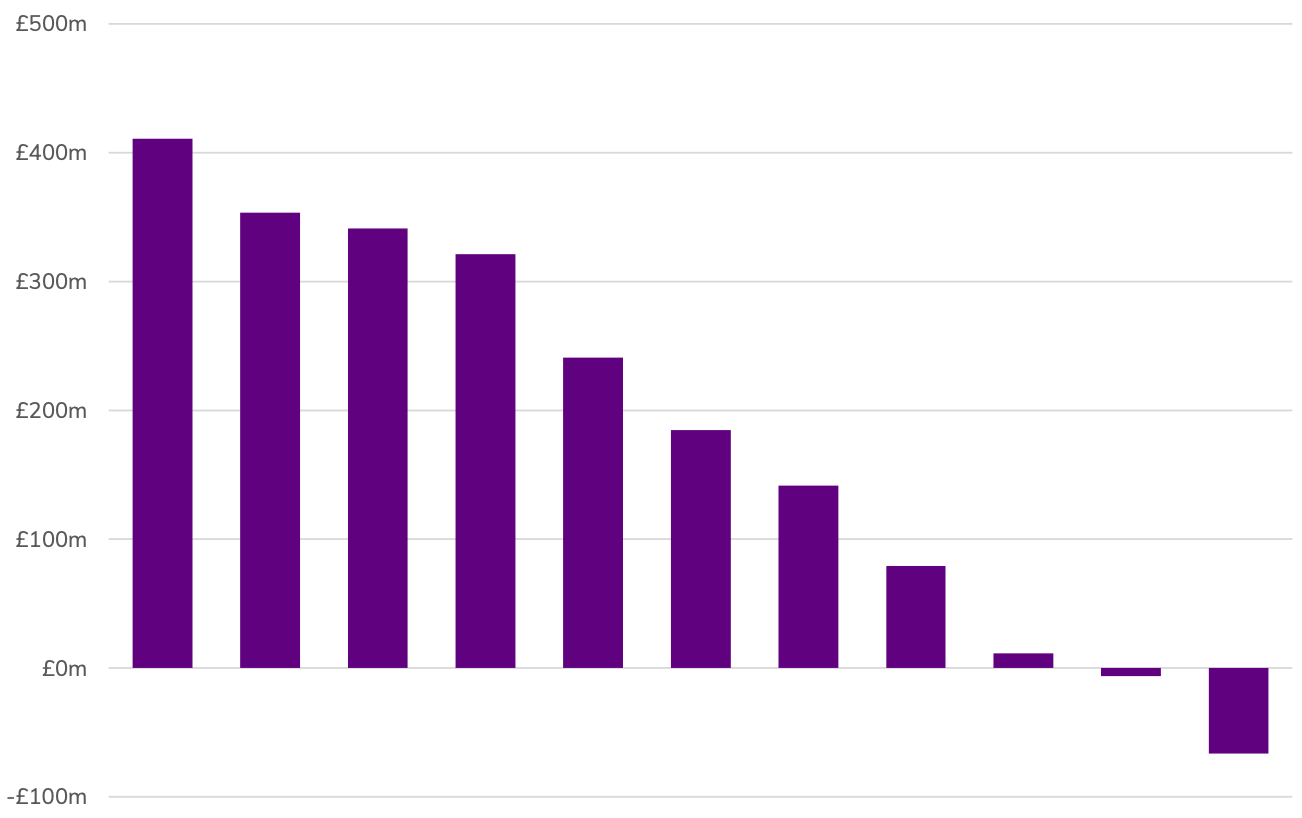

What I got to give will do you good. Entain’s bolt-onsA chart provided in its H1 earnings presentation gives some insight into how the company hopes its M&A strategy will play out. This one goes to 11: As part of its H123 slide deck, Entain revealed details of eleven deals it has completed in the past five years, which it said would add more than $4bn of value after three full years of ownership. Included in the small print of the chart were the transactions in question, but without the identifying return figures.

💰 Return on investment: Entain’s incremental M&A value ** SPONSOR’S MESSAGE ** Underdog: the most innovative company in sports gaming. At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan. Join us as we build the future of sports gaming. Visit https://underdogfantasy.com/careers Wheat and chaffI got a name for the winners in the world: A note on the slide said the incremental value was calculated using actual results or the most recent internal forecasts (for deals that are not three full years on from acquisition).

I want a name when I lose: So which are the losers? CEO Jette Nygaard-Andersen gave some hints on the call. She suggested that regulatory disruption was often a determining factor, adding that “very often it’s regulation coming later than we assumed”.

Naming names: Bearing these comments in mind – and having sense-checked with sources – E+M suggests the most obvious candidates for the poor performers are, in no particular order, Unikrn, Bet.pt, Impala, Sports Interaction/Avid Gaming, Neds and Crystalbet.

On the other side of the ledger, all but guaranteed to be sitting on the left-hand side of the table are the following:

The future is not yet written: It is important to note that with the majority of these deals, the three-year incremental value add is an estimate. Entain’s shareholders cannot be sure of there returns being promised by the deals at the left of the chart – and neither in truth can Entain.

BetMGM ♥️ AngstromBetMGM’s CEO says Entain has gone above and beyond in buying Angstrom. You shouldn’t have: Speaking during the Bank of America investor event held last week, BetMGM CEO Adam Greenblatt said Entain’s rollout of the new capability brought by recent acquisition Angstrom was “targeted at BetMGM for the next 12-18 months”.

Greenblatt noted that Entain was acting in its own best interest, and in that of its shareholders, because US OSB and iCasino was the “biggest game in town by far”.

Inside the dealE+M talks to Crispin Nieboer from Tekkorp, who advised on the sale of Thunderbite to Xtremepush. The customer engagement platform Xtremepush has augmented its offering to betting and gaming firms with the acquisition for an undisclosed amount of the marketing gamification platform.

Trade talks: The task with any sell-side transaction, Nieboer notes, is doing the leg-work around checking contracts, accounts and forecasts before trying to present the business to potential buyers. But as is the way with any business, it is a fluid process.

Recovery position: Nieboer notes that the global M&A environment has “somewhat” rebounded since the low point in the second half of last year and in comparison with the “blistering opaque” set in 2022. “We are seeing a bit of a recovery in our own industry,” he adds.

Leap and bound: It is the potential of using M&A as a springboard to accelerate the business in new markets that remains the top driver for corporates, Nieboer says.

The price of admission: Pricing is “still not quite where it was” for B2B and affiliates, Nieboer says, where valuations have fallen since Jan 2022. But B2C has “stayed pretty constant”.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Hit the NorthPlaytech’s recent comments regarding NorthStar Gaming will quiet fears over the Canadian operator’s future. With a little help from your friends: If shareholders at NorthStar Gaming were at all worried about the Ontario operator’s progress since launching in May22, then their fears might have been allied somewhat by Playtech CEO Mor Wewizer’s comments during his company’s H1 earnings call last week.

Weizer noted NorthStar was one of its structured agreements and that Playtech was “excited to see how this grows” as the company accelerates its growth in Ontario and across Canada.

The summer in transactionsLight & Wonder’s deal to buy the remaining slug of SciPlay it didn’t own was the headline move over the summer. The big deal: Light & Wonder finally got its man after it convinced the holders of the shares it didn’t already own in social gaming spin-off SciPlay to accept an offer pitched at $22.95 per share at an implied value of $2.5bn and an EV/EBITDA multiple of 11.7x.

Other deals this summer

Under the radar deal of the month: 888Africa is starting to make waves, announcing via social media that it has passed the 1m customer mark. Aiding its growth will be the acquisition of the Kenya and Zambia-licensed BetLion for an undisclosed sum. ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Hornbuckle: BetMGM’s UK launch ‘the best test’

Monday, September 11, 2023

MGM's aspirations, NFL promos examined, Better Collective fireside chat, startup focus – BetChill +More

‘ESPN wants to be No. 1,’ says Snowden

Friday, September 8, 2023

Penn's ESPN Bet hopes, DraftKings/BetMGM confident, Playtech's Caliente dilemma, Better Collective's latest buy +More

Appetite for disruption

Tuesday, September 5, 2023

Investor hunger, investor interview – Ben Clemes from HappyHour, growth company news +More

PointsBet hands over the keys

Friday, September 1, 2023

PointsBet US completion, lucky Las Vegas, GLP's Hard Rock deal, Rivalry's expectations +More

FanDuel’s OSB grip begins to loosen

Tuesday, August 29, 2023

Has DraftKings overtaken FanDuel in OSB? Plus, Propus Partners on English Premier League pricing +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these