Folius Ventures: Friend Tech Analysis Report

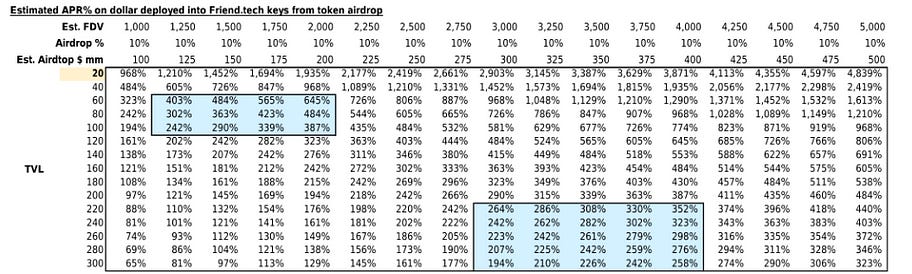

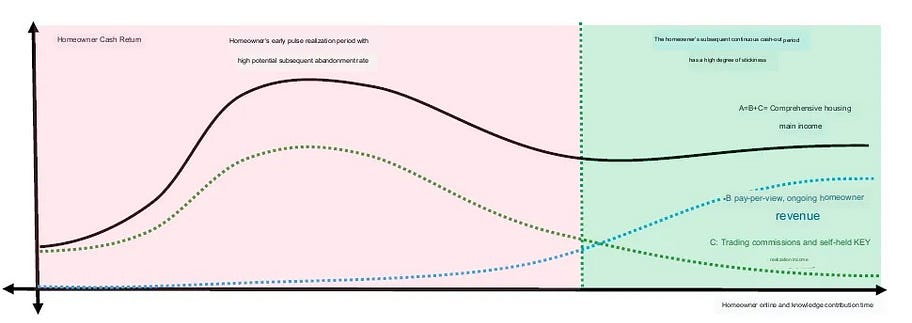

Author | Jason Kam, Folius Ventures Editor | WuBlockchain Folius Ventures has released an analysis report on Friend Tech, highlighting that the company currently refuses to engage with any VCs other than Paradigm. Mining is the only way to gain exposure to the company, with the final FDV estimated to be around $1.5 billion. There’s a pressing need to introduce a continuous payment mechanism; otherwise, a bi-directional death spiral could form. Provided that execution remains strong, at least two more DAU peak surges are anticipated, with robust airdrop expectations likely to sustain interest until January or February of 2024. There’s a significant risk that KEY could be classified as a security, and it’s entirely feasible that the company might decide not to issue any tokens in the end. Below is the content edited by WuBlockchain, with slight modifications. To read the original article:https://docsend.com/view/cn6axjcaxcy2kx3m Review of Friend.Tech’s Development Journey In just a month, standing on the shoulders of predecessors, Friend.Tech addressed industry pain points related to sharing and opportunistically achieved a cold start through speculative effects. The company solidified its growth prospects through rapid iteration and strategic collaboration with Paradigm. ● Product Stitching is Spot On: The choice of PWA (Progressive Web Apps) aligns well with lightweight social products. It gives a new context to old technology and crucially bypasses the App Store, which isn’t friendly to Web3. Additionally, integrating a Web2-like login mechanism reduces entry barriers. By binding to Twitter, they leveraged initial traffic for free. Cohesive design promotes liquidity movement, and the Base/OP Stack finds a good balance between minimum security and ultra-low cost for Social/small transactions. The maturity of USDC as an offshore dollar stitched everything together, allowing Friend.Tech to promote and convert smoothly under the limited Web3 infrastructure. It successfully achieves the business model of “CT for traffic acquisition and FT for monetization.” ● Addressing Pain Points to Some Extent: Within the Web3 community, be it X, Discord, WeChat, or TG, there’s no platform similar to Knowledge Planet or Get or expert consulting networks that allow for one-directional, low-noise, comfortable monetization of attention and knowledge based on cognitive payment. Friend.Tech has somewhat filled this market gap, making it possible to pay directly to industry individuals with the highest cognitive and money-making abilities. ● Overcoming Cold Start with Speculative Effects and Early KOL Strategy: In a period lacking industry narratives, Friend.Tech initially gained substantial traffic by directly paying Twitter KOLs cash and giving homeowners a 5% share of the profits from users purchasing Keys. User expectations for KOL appreciation and the wealth effect realized the project’s first cold start wave. The project’s airdrop expectations and potential to break circles also attracted a group of loyal users who continuously created content, maintaining the project’s DAU activity. ● Paradigm’s Secondary Rocket Boost: After the first wave of benefits slid, news of Paradigm, a leading industry institution, leading the investment laid a strong foundation for the project’s development. The future airdrop expectation is solidified, and the valuation is expected to increase significantly, implying that users’ willingness and the amount of investment will also increase substantially. The robust background of the investing company indicates that many small product and legal issues will likely be resolved, significantly reducing the risk of abandonment and boosting users’ willingness to use and invest. ● Rapid Iteration on the Right Path: As a product, Friend.Tech’s horizontal comparison within China/Asia-Pacific Web2 circles is subpar. Fortunately, they continuously iterate on the right path, emphasizing strong monetization for homeowners and ensuring users make money and enjoy a smooth experience. Considering features like refresh speed, reply function, cross-chain + deposit function, global comparison/ranking page, image function, and more, the team’s dedication to continuous improvement assures that the product will eventually meet the Web2 standard. Friend.Tech’s Points System and Airdrop Expectations Holding Keys and commenting have become akin to Pool2 mining, and they currently serve as the only means to gain exposure to Friend.Tech, which offers a high potential return rate. A significant reason for the current hype around Friend.Tech is due to its anticipated token issuance. For heavy participants, the perception is that every 1 point might convert to an airdrop token worth between $1 to $5, or according to the participation amount, offer a 200–500% APR or even more for mining: ● Friend.Tech will distribute 100 million points within 25 weeks. The general consensus is that these points represent a token airdrop, and they are strongly correlated with the total amount of Keys invested, the duration held, and in-app activity (opening, time spent, comments, etc.). ● As per the following table (not provided), if the final FDV (Fully Diluted Valuation) of Friend.Tech’s token issuance is 1.5Bn, with 10% allocated for airdrop, and the average TVL (Total Value Locked) over 25 weeks is 80mm, then the participants’ airdrop ratio will be equivalent to the TVL, resulting in an approximate annual airdrop rate of ~360%. ● Purchasing KEY, staying active, and product friction hinder the entry of substantial funds. However, we believe that as industry awareness grows, product iterations occur, financial facilities improve, and with the entrance of Silicon Valley, Asia-Pacific, and traffic-oriented individuals, the TVL and KEY price may significantly increase. ● It’s worth noting that currently, Friend.Tech is declining to engage with any VCs other than Paradigm. Hence, we believe this presents an opportunity primarily for retail investors and secondary funds, and mining might also be the only way to gain company exposure. Regarding PMF (Product-Market Fit) For the average professional, a quick realization of reputation can result in short-term gains of $1,000 — $10,000. Insights in private chats are now ubiquitous. ● Subscription Price = Selling Price * 0.9 — Buying Price * 1.1. In other words, once the price increases by 22%, users can subscribe for free. Based on this conversion formula, this is roughly equivalent to getting a “free ride” if the number of Keys holders increases by 10% after buying in. ● The final price should fall around the cost of multiple consultations by a single user, which is approximately 20% of the price (one in, one out). Based on the current Ethereum price and the industry consultation fee for hedge funds per hour (which is $500-$1,000), the number of KEYS for top-paid consultants should be about 150 –215, or the price of a single KEY should be around 1.4–3.0 Ethereum. Interestingly, this number of KEYS, with the premise that a single user can hold multiple KEYS, is roughly equivalent to Dunbar’s number of 150, which is the number of people one person can easily maintain in a small circle. Thus, we believe the design of this equation (S² /16000 * 1) is intentional. And the price of 1.5–3.0 Ethereum per person is what we think is the normal price for industry experts after the hype subsides. ● Public perception of reputation and professionalism will quickly drive the price to a reasonable range. The thrill of early discovery and profit keeps people engaged. A high share of profits allows influencers to quickly feel the thrill of income, further promoting the platform and accelerating the network effect. An influencer, purely through royalty, can earn at least $200 / $1,700 / $5,600 at the 50/100/150 KEY milestones. If they could hold 3 KEYS at a low price early on, selling at the 50/100/150 KEY milestones could earn an additional $750 / $3,000 / $6,750. For most professionals, the allure of quickly gaining $1,000-$10,000 is enough for them to participate and promote daily. ● Users might tend to hold and keep their tokens for the sake of getting something for free and maintaining a symbol of status. Additionally, we believe that the opportunity to capture the attention of industry top talent is extremely rare, and currently, the cost of reaching the attention of those at the top of power and cognition is very low. For those in need, the price they’re willing to pay for attention and feedback can be limitless, breaking the ceiling of what a KEY can achieve. However, providing continuous cash flow to influencers might be a challenge in the long run and needs to be addressed. Initial Burst of Revenue vs. Subsequent Revenue Issues Friend.Tech must introduce a continuous payment mechanism, as a decline in KEY + token prices in subsequent cycles and users abandoning the platform could trigger a death spiral. Continuing from the previous page, we believe that Friend.Tech will inevitably face challenges in the later stages, including inflated pricing by property owners, reluctance by users to sell saturated KEYS, and a lack of purchasing willingness from potential users due to insufficient funds. This could lead to a continuous cash flow deficiency. After realizing initial profits through royalty fees and one-time KEY sales, property owners are likely to face sustainability issues. We believe that for Web2 traffic hubs and mid-to-high-end professionals, Friend.Tech must introduce a continuous pay-per-use model for both external and internal users: ● We believe its design needs to incorporate differentiated pricing for those with and without KEYS, a referral link/profit-sharing mechanism for KEY holders, and appropriate free disclosures based on unlocking time or other methods, to achieve effective and continuous monetization for property owners. ● If this cannot be smoothly implemented, we expect that once the user base reaches saturation, the user attrition rate will increase dramatically as KEYS and tokens are sold off. This, in turn, will further impact the prices of KEYS and tokens, resulting in a mutual death spiral. Peak DAU (Daily Active Users) We anticipate that, given strong execution, Friend.Tech might still experience at least two more DAU peaks. After this, the product must establish sufficient network effects and quality. Potential participants ● Silicon Valley VCs + Silicon Valley entrepreneur community: radiating through Paradigm and current Web3 individuals. ● Numerous VCs, founders, opinion leaders, coin traders, and tech individuals in the Asia-Pacific region: radiating from West to East + the wealth effect. ● Professionals from all industries, especially niche high-net-worth categories: through the company’s continuous business expansion and paying GTM fees. Attracting opinion leaders with cash and tokens is crucial. ● Web3 native liquidity funds directly allocated to capture airdrop opportunities: We believe that when general liquidity funds can purchase KEYs like an ETF and directly enjoy potential airdrops, a large influx of funds will occur. ● The continuous wealth effect accompanying newcomers + TVL will increase token valuation, attracting more funds from existing users. We believe strong airdrop expectations will keep the product’s popularity until January-February 2024. Necessary feature additions ● Free previews: Increase potential user purchase intent + enhance discovery opportunities. ● Richer multimedia experience: especially videos and live broadcasts. ● Global page: Discover local quality content and help influencers drive traffic; advertising opportunities can be considered but are not mandatory. ● Referral rewards: Adding profit-sharing will allow influencers to monetize more quickly and effectively. ● Extra encrypted or paid content in groups: assist influencers in continuous monetization. ● Product details — Can imitate WeChat + Telegram, such as voting, same post reactions, pinned content, etc. ● Stronger transaction scenarios, like sending KEYS, directly guiding whitelist or token/NFT purchases, etc. ● Greatly reduce the barriers for users to join and deposit/withdraw funds. ● Significantly improve product fluidity. ● Delve into bonding curves and introduce multiple curves, while considering continuous incentives for active + token-holding users post-token issuance. ● Consider designs similar to LP Pool to reduce the barrier for users buying KEYS. Bonding Curves Still Have Room for Improvement The team has made good trade-offs in terms of simplicity, and we expect Paradigm to further refine it. Currently, the Friend.Tech product form is pure and straightforward: The simple bonding curve is easy to understand and suitable for high-value KOLs (Key Opinion Leaders) who bring real money. However, it also has its limitations — as the user persona expands, not every user is suitable for this type, and even KOLs need to segment their own users. We believe that by giving users a few choices (e.g., 3–4 types of curves) and implementing them in a simple way, Friend.Tech can reach a larger TAM (Total Addressable Market): ● Monetization style, fixed-price KEYs: Fixed price instead of x², most (e.g., 90%) instead of 5% of the revenue goes to the room owner. In this way, key holders can expand to tens of thousands, similar to platforms like OnlyFans. Through the utility adjustment of the key, it can generalize more rapidly. ● Strong knowledge paywall, S-curve priced KEYs: Price converges after marginal users (similar to S-curve) instead of x², stabilizing the acquisition cost for most later-stage users while accommodating early speculative users, more suitable for expert talents. ● Event-driven, multi S-curve priced KEYs: Similar to the above, but with growth potential after breaking through various user count bottlenecks. Suitable for celebrity room owners and can be paired with Referral Links to drive spontaneous user promotions, thus breaking through plateaus in pricing. Fortunately, Paradigm’s expertise in mechanism design and mathematics can be of great assistance to the Friend.Tech team. Maximizing Points If the logic for allocating KEYs is to maximize Points, then room owners who have high traffic, high stickiness, high net worth, and are deeply invested in the product in the long term may be the most suitable. The expectation of airdrops gives KEYs value beyond knowledge consultation and identity recognition. If we assume that the final token airdrop is strongly correlated with Points, the purpose of allocation should be to maximize the acquisition of Points every week. While the team can make minor adjustments to the equation every week, we boldly predict that its conversion method is likely to be: In-app activity (own + others) * KEY total asset price (own + others) * KEY holding duration. In light of this, before this formula is adjusted, the general guidelines for maximizing weekly points may be: ● The product should be opened frequently, and voices should be raised in one’s own and other groups. At the same time, the KEY room owner one holds should be an active user. ● One should prioritize room owners with ample funds, as their ETH is likely to be converted to KEY, thus increasing weight; one should also prioritize users with high total asset prices. ● It’s worth noting that buying highly active KOLs at a low price early on is not easy. Therefore, for users with ample funds and their own traffic, buying a large amount of their own KEYs immediately might be one of the best strategies to boost parameters. ● Given that holding duration should be one of the weights, plus the approximately 20% fee for entering and exiting, the best strategy might be to buy early and hold long-term users who are most willing to deeply cultivate the product, rather than frequently buying and selling. Thus, carefully choosing obviously indispensable or deeply involved room owners, rather than those who just follow the trend, may be a better option. ● Therefore, from an allocation perspective, a room owner with high traffic, high stickiness, high net worth, and a clear reason and desire to develop their brand in the product over the long term should be the best choice for long-term holding to maximize Points. Interestingly, such users should have also obtained decent Points in the past four weeks, so this can perhaps serve as a screening criterion. Risks As a social niche product with a strong financial attribute, Friend.Tech has many risks on its development path: ● The project might end up not issuing tokens, or the airdrop could be unprecedentedly small: Therefore, for participants, joining earlier and strictly controlling the loss of ETH over multiple cycles is crucial. ● The risk of premature collapse if the product doesn’t break into the mainstream: The product already has high coverage in Web3. If it doesn’t expand further, all assets risk devaluation. ● High transaction fees: 10% fees for both buying and selling are substantial. If the product growth slows down and the base grows, this might cause significant dissatisfaction. ● The significant risk of KEY being defined as a security in terms of regulation: This risk is ineliminable and relies on the legal team of Paradigm and the company’s ingenious design. ● Enormous product execution risks: During the company’s growth, because of its strong financial ties, every feature update and continuous rapid iteration/issue resolution carries a massive risk of collapse. The team needs to handle everything stably. Furthermore, the product is still below Web2 standards, offering a poor user experience. If this doesn’t improve, user retention might become an issue. ● Inevitable financial cycles brought about by fluctuations in DAU and price: KEY, due to airdrop expectations, changes in user entry speed, and its price, will be volatile and cyclical. This includes a significant risk of permanent loss, and the team must manage expectations and iterate stably within these cycles. ● Long-term retention risks: Once the initial hype dies down, Friend.Tech might become a niche product due to the high KEY prices for the general public, failing to support the expected high FDV. The failures of Clubhouse and many niche social products are cautionary tales. ● Risks associated with private keys and Web3 asset security: Wallets based on custodial mechanisms and smart contracts inherently carry hacking risks. ● Team anonymity risks: The team has no actual responsibility to users. While this risk has been somewhat mitigated by Paradigm’s involvement, the reputational risks associated with a semi-anonymous founding team remain. ● Content risks: This type of content platform obviously carries a high risk of violating any country’s laws. As the platform grows, it will inevitably face many audit and regulatory challenges. The team needs immense patience and preparation to handle these. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Coinbase Founder's Top 10 Focus Areas and Their Representative Projects

Monday, September 11, 2023

Author: defioasis Note: This article is for information sharing only and does not endorse the projects mentioned. It has no financial interest in the projects. Following Paradigm's announcement of

Asia's weekly TOP10 crypto news (Sep 4 to Sep 10)

Sunday, September 10, 2023

Author:0xMingyue Editor:Colin Wu 1. Singapore's Weekly Summary 1.1 Singapore's New President: Cryptocurrency is Purely Speculative and Somewhat Wild link On September 4th, the newly appointed

Weekly Project Updates: Arbitrum Initiates Short-Term Incentive Program Proposal, Solana Hosts Million-Dollar Hack…

Saturday, September 9, 2023

1. Ethereum's Weekly Summary a. Vitalik: Centralization of Nodes Is Among Ethereum's Foremost Challenges link On September 5th, according to Cointelegraph, Ethereum co-founder Vitalik Buterin

WuBlockchain Weekly: Tether Emerges as the 22nd Largest Holder of US Treasury Bonds Globally, Binance Russia Execu…

Friday, September 8, 2023

1. Tether Holdings Accumulates $72.5 Billion in US Treasury Bonds, Ranks as the 22nd Largest Holder Globally link On September 5th, Paolo Ardoino, the Chief Technology Officer of Tether, tweeted that

VC Monthly Report, the amount of funding saw a slight recovery, while the number continued to reach new lows, with…

Thursday, September 7, 2023

Author: WuBlockchain According to statistics from RootData, there were a total of 73 publicly announced investment projects in the cryptocurrency VC space in August, representing a 6% decrease compared

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏