WuBlockchain - What kind of DApp do we need?

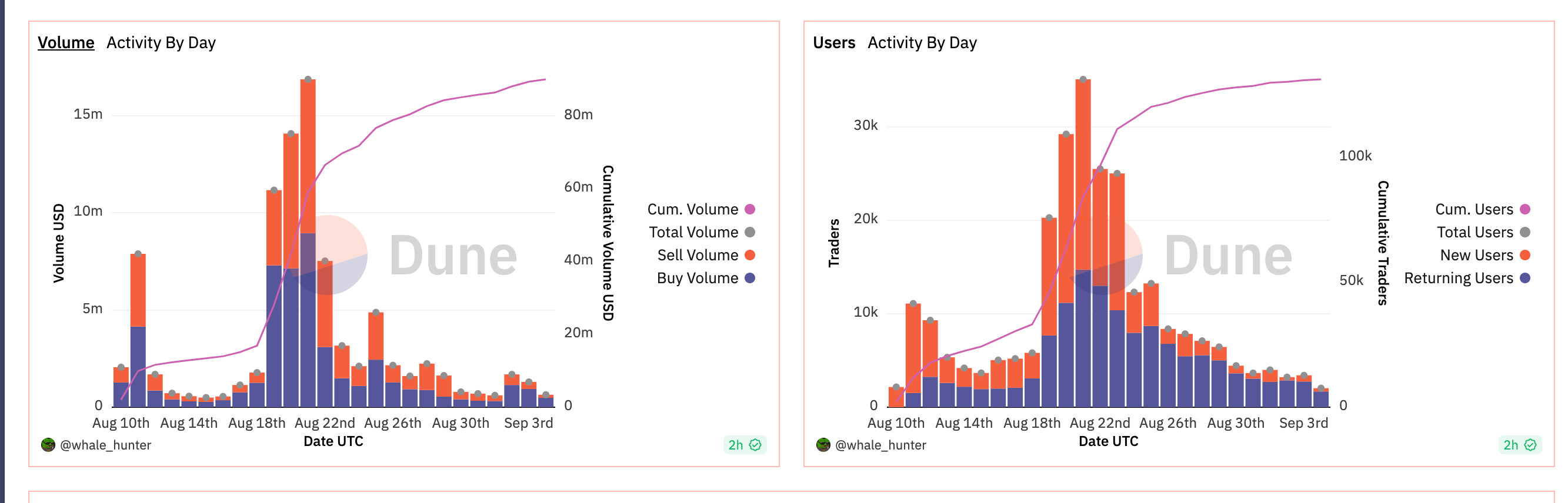

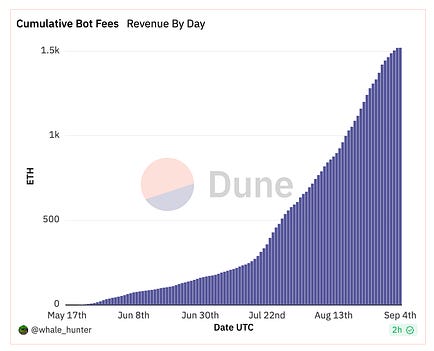

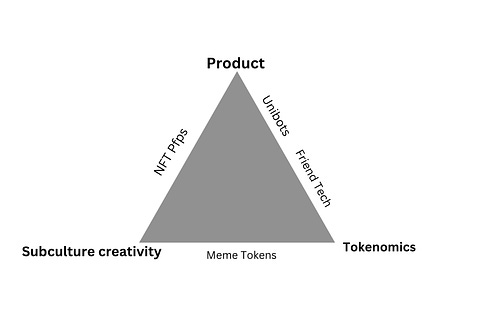

Author: OFR XIN Source: https://www.noweb3.ai/p/what-kind-of-dapp-do-we-need?utm_source=profile&utm_medium=reader2 If you are a rational and neutral investor, please admit, we don’t need more infra projects. —At least at this moment. Current infra can sustain us to the next bull run or maybe even the next next bull, if there is one. Scalability - we have Solana, legitimacy- ETH L2 Rollups and incoming zkEVMs; Decentralization- Ethereum L1; Composability - Cosmos or Polkadot. We possess all the necessary elements for the creation of applications, including hundreds of Raas or AppChain services. However, the question remains: Where are the killer apps? Last cycle, we have DeFi saved our ass, AMM Dex + Pooled lending + Yield farming ignited thousands of Dapps with tweaks in mechanism to copy to different chains. What kind of Dapps will be the saviors this time? Here is what I’ve found. Let's dive in. 1.Meme coins Meme coins such as $Pepe or $Bitcoin(HarryPotterObamaSonic10Inu) are awesome innovations during the bear market. They have given rise to a culture of degens and a more equitable token mechanism compared to VC-backed tokens with billion-dollar valuations and over-hyped strategies that are likely to experience a dump in the coming days. In a way, some of the major infrastructure projects could even be seen as meme tokens, created specifically for venture capitalists to alleviate their fear of missing out on large infrastructure investments that they missed in the previous cycle. Creating a cultural symbol that can spread like a virus is always a challenging task, with no set template to follow. To become a successful meme creator, one should possess a thorough understanding of the degen subculture, as well as a keen sense of artistic design. Furthermore, using tokens with no "intrinsic" value poses a challenge to growing the community. In my opinion, meme coins have become another cultural phenomenon that has gained traction in the crypto world, following the popularity of NFT PFPs. 2.Friend. tech (abbreviated as ”FT” in the following) FT is often referred to as a social product in most analyses. However, I consider it a financial product based on Twitter's (or X's) user network. It didn't create a new social network or introduce any new communication paradigm, like how IM did with SNS in Web 2.0. We can create a product formulation that incorporates token monetization into Twitter's social network value if you agree with my assessment. Essentially, we would be tokenizing Twitter ahead of its own token launch. Based on the first principle, we can develop more Twitter-based token products with different product formats. Recently, a team proposed a product called "Tip coin" which aligns with this principle. 3.Telegram bots Unibots originated from a simple idea that many teams have likely explored. However, it stands out from other products with similar initiatives in two key aspects: Unibots launched new features catering to meme traders, including limit orders, copy trades, and private mempools. While many teams are touting their "intent-centric" concept, Unibots has already put the concept into daily use millions of times. Additionally, their token design is carefully crafted with a fair launch model that maximizes community interest and aligns token value directly with revenue. It is important to note that Unibots leveraged Telegram's user base, which is considered essential for any player in the crypto industry. What can we conclude from the above example? If we consider Product, Subculture Creativity, and Tokenomics as a triangle (as many metaphors in crypto‘s jargon), successful projects typically possess two of the three elements. However, for a project to attain widespread adoption and long-term viability, all three are recommended. Meme tokens have sparked a subculture craze and feature a well-designed token mechanism, but currently lack an available product. The FT has a strong approach to product launches and a well-designed token system for bootstrapping. However, it doesn't embody any specific subculture. Unibots has successfully launched a great product, and the token model aligns well with it. However, the project has yet to establish its own distinctive subculture. What are the products and builders I’m expecting?

Based on these criteria, I expect more DApp builders to join the DApp building community. I don't want to label it as just another buzzword or category. If I had to, I might refer to it as "TwitterFi", "TelegramFi", or "MemeFi", using the universal nomenclature of the crypto industry. In some of the more contentious areas, like Onchain Gaming or Autonomous World, I believe there is significant potential for talented individuals to create highly successful products. However, I also have concerns that the learning curve for non-hardcore crypto gamers may be too steep. I would be interested in collaborating with builders from Onchain Gaming to explore more accessible ways of onboarding users, while also considering proper tokenomics. I am genuinely surprised that there hasn't been more discussion around token design within the Onchain Gaming communities. The best Timing to invest in Web3 is - Now!

Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Asia's weekly TOP10 crypto news (Sep 11 to Sep 17)

Sunday, September 17, 2023

Author:0xMingyue Editor:Colin Wu 1. Hong Kong's Weekly Summary 1.1 Vitalik Questions the Sustainability of Hong Kong's Cryptocurrency Friendliness link On the 14th of September, Vitalik Buterin

WuBlockchain Weekly: CoinEx Faces Cyberattack, FTX Coin Selling Rules, Binance US Announces Layoffs and Top10 News

Sunday, September 17, 2023

1. US August Unadjusted CPI at 3.7%, Core CPI at 4.3% link In August, the seasonally adjusted CPI in the United States rose by an annualized rate of 3.7%, slightly exceeding expectations of 3.6%. This

Weekly Project Updates: opBNB Mainnet Launches, Polkadot Chinese Community Ceases Operations, Friend Tech Records …

Sunday, September 17, 2023

1. Ethereum's Weekly Summary a. Ethereum's Holesky Testnet Officially Launched link On September 15th, the Ethereum Holesky testnet was set to officially launch, with a scale twice that of the

Folius Ventures: Friend Tech Analysis Report

Tuesday, September 12, 2023

Folius Ventures has released an analysis report on Friend Tech, highlighting that the company currently refuses to engage with any VCs other than Paradigm. Mining is the only way to gain exposure to

Coinbase Founder's Top 10 Focus Areas and Their Representative Projects

Monday, September 11, 2023

Author: defioasis Note: This article is for information sharing only and does not endorse the projects mentioned. It has no financial interest in the projects. Following Paradigm's announcement of

You Might Also Like

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask