FTX Case Update: How Are The Tokens Valued?

Author: Elven A recent court filing revealed the details of FTX's crypto holdings. The presentation provides an overview of substantial payments made by the company, once the biggest global crypto exchange, to senior executives, including its founder, Sam Bankman-Fried, before its November bankruptcy filing. And an assessment of the value of the various asset classes currently held by FTX. The value of cryptocurrencies held by FTX is critical to FTX's creditors, yet as seen in the documents, the value of some of FTX's cryptocurrency holdings is hard to put a value on. Elven, a leading accounting platform for crypto assets, gives an interpretation from the court filing that might be helpful to investors and crypto firms to learn from:

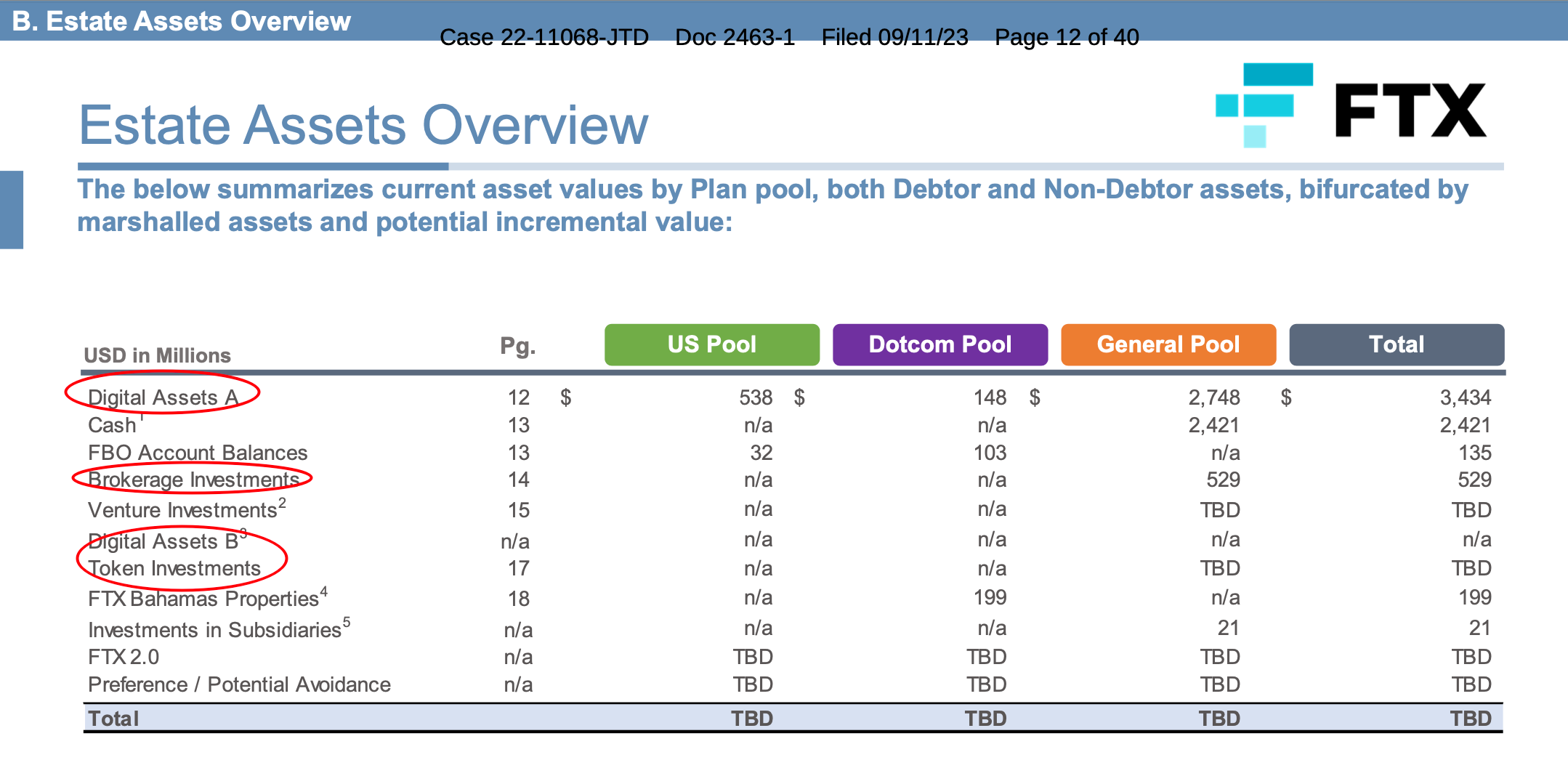

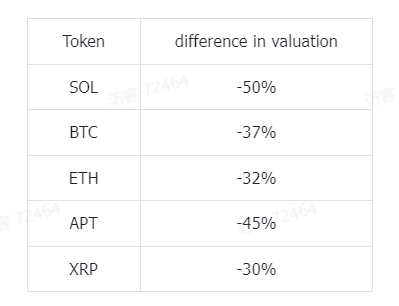

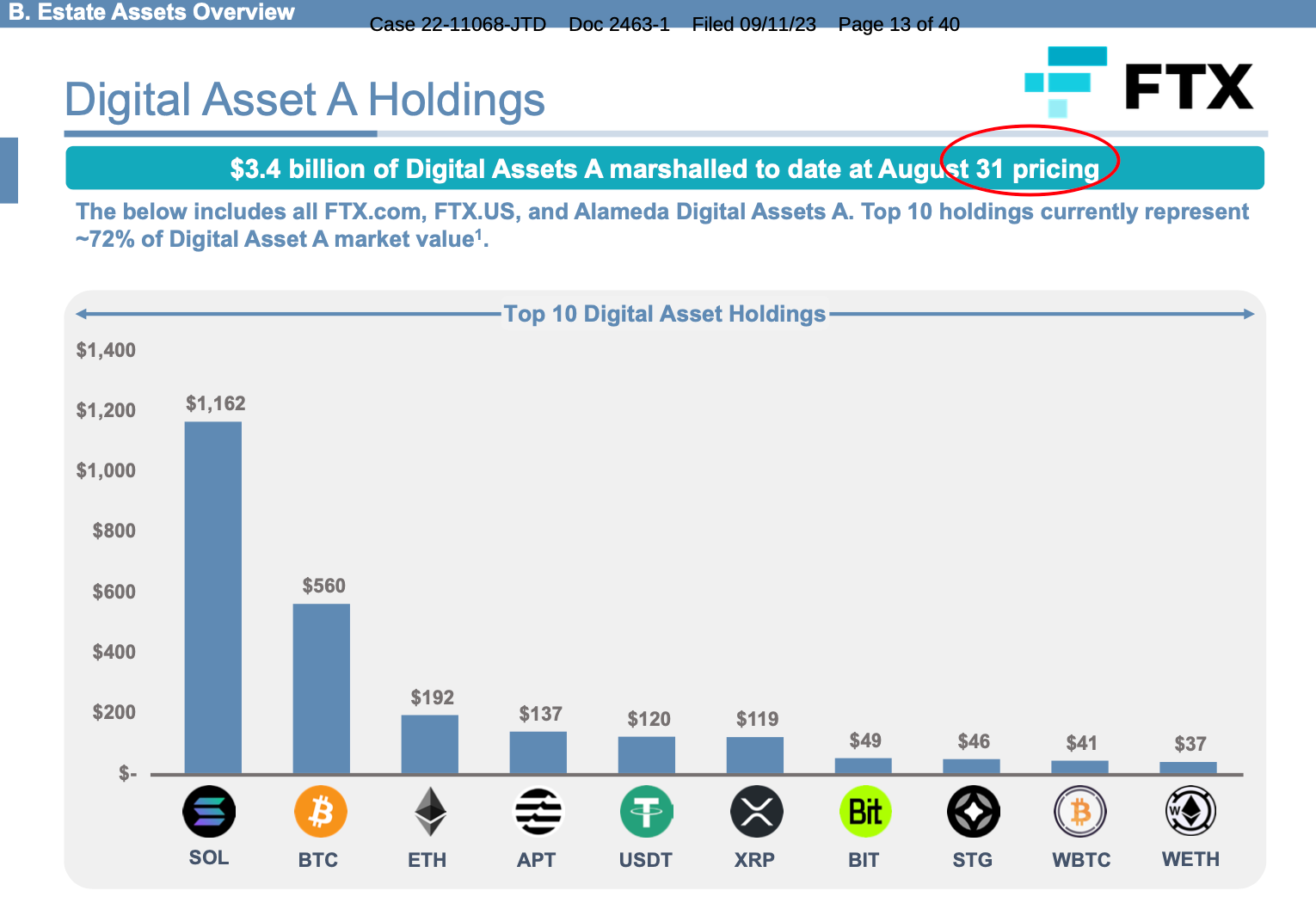

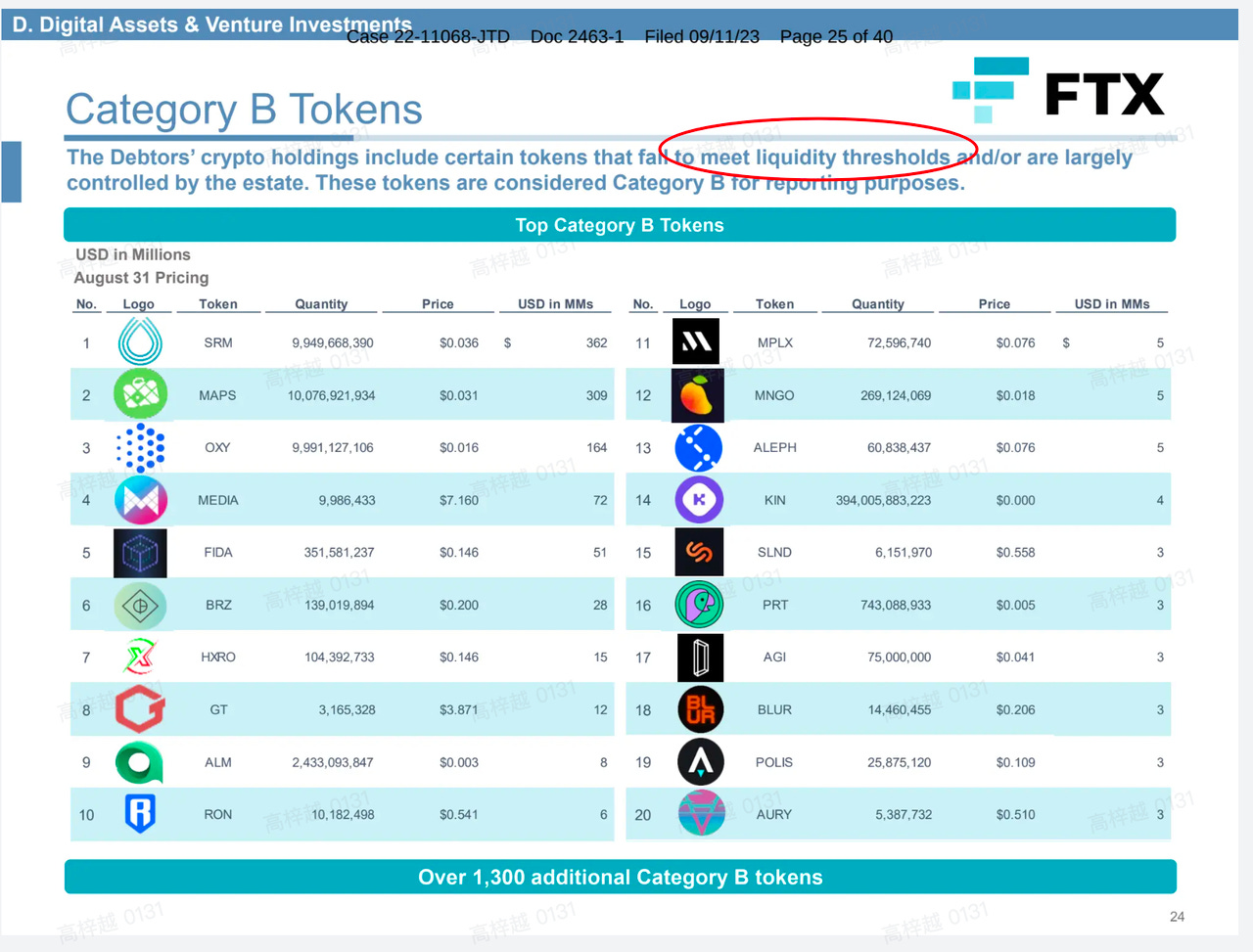

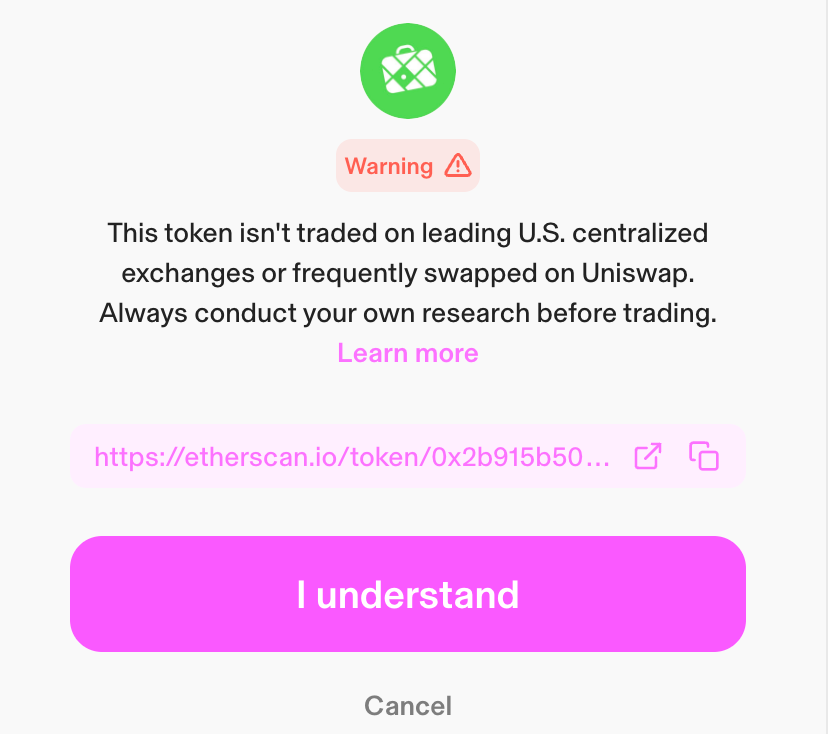

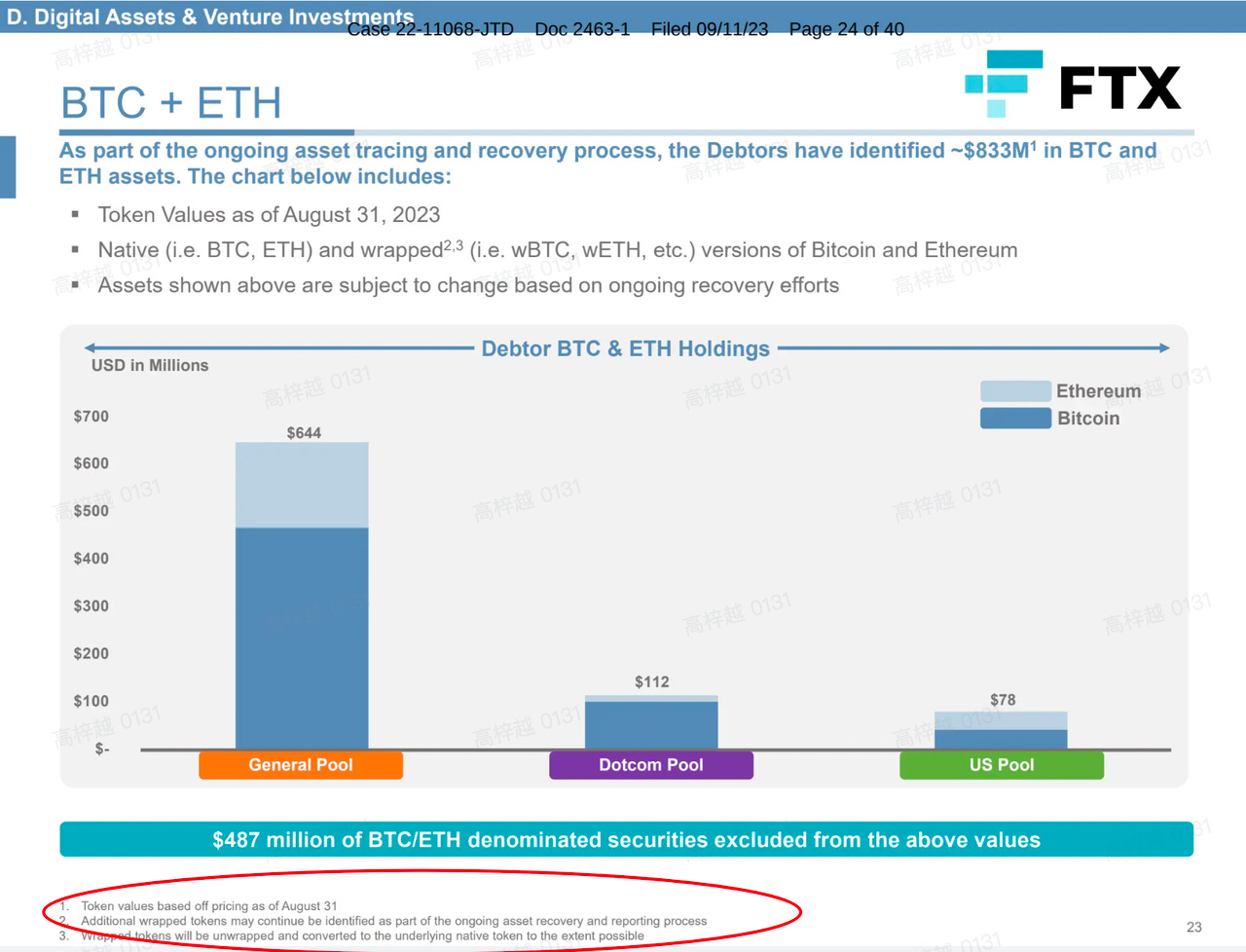

How many crypto assets are held by FTX? As of August 31, FTX held a total of $3.4 billion in crypto assets, consisting primarily of $1.16 billion in SOL, $560 million in BTC, $192 million in ETH, $137 million in APT, $120 million in USDT, $119 million in XRP, $49 million in BIT, $46 million in STG, $41 million in WBTC, and $37 million in WETH. Besides that, FTX holds other illiquid tokens, crypto-related brokerage investments, and venture investments. The chart shows that only 'Digital assets A' and 'Brokerage Investments' are listed with the exact valuation. The valuation of 'Digital Asset B' and 'Token Investment' is to be determined due to their illiquidity. For 'Digital Asset A Holdings', their valuation is based on the price on August 31st. That introduces the critical method of evaluating crypto assets: Fair Value Measurement. What is Fair Value Measurement According to ASC (Accounting Standard Codification) 820-10-20. Fair Value is 'The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.' Fair value measurement will replace the impairment method for crypto assets in this new proposed ASU (accounting standard update) from FASB (Financial Accounting Standards Board). Crypto assets will be listed separately on the balance sheet and measured at fair value, with changes in fair value included in net income. At the same time, holders of large amounts of a particular type of crypto asset must disclose their holdings in annual and interim financial reports. For example, if you bought 1 Bitcoin at the price of $20,000 on Day 1 and it drops to $15,000 on Day 2, you must record a loss of $5,000. If the price is raised to $25,000 on Day 3, you still have to record a $5,000 loss under the impairment method. However, with fair value measurement, you will record a gain of $10,000 on Day 3. Comment from Elven The valuation of crypto assets will be reflected more precisely under fair value measurement. If FTX uses the impairment method (which is not required for the filing), the valuation of crypto assets will be much less than the current result. The chart shows the difference of FTX's top holdings in valuation between the impairment method and the fair value method. How does liquidity influence the valuation of crypto assets? The second key point in the Overview is that crypto assets have been divided into 'Type A' and 'Type B' based on a specific liquidity threshold. Let's use Uniswap as another example. When users want to trade the top 2 'Category B Tokens', warnings are sent to indicate lake of liquidity and risk of false valuation. And the standard is 'traded on leading U.S. centralized exchanges.' Comment from Elven Consideration of liquidity is important. Although the standard of liquidity is not expressed explicitly in the filing, we can look into the three-level fair value hierarchy in accordance with ASC 820-10-35-37:

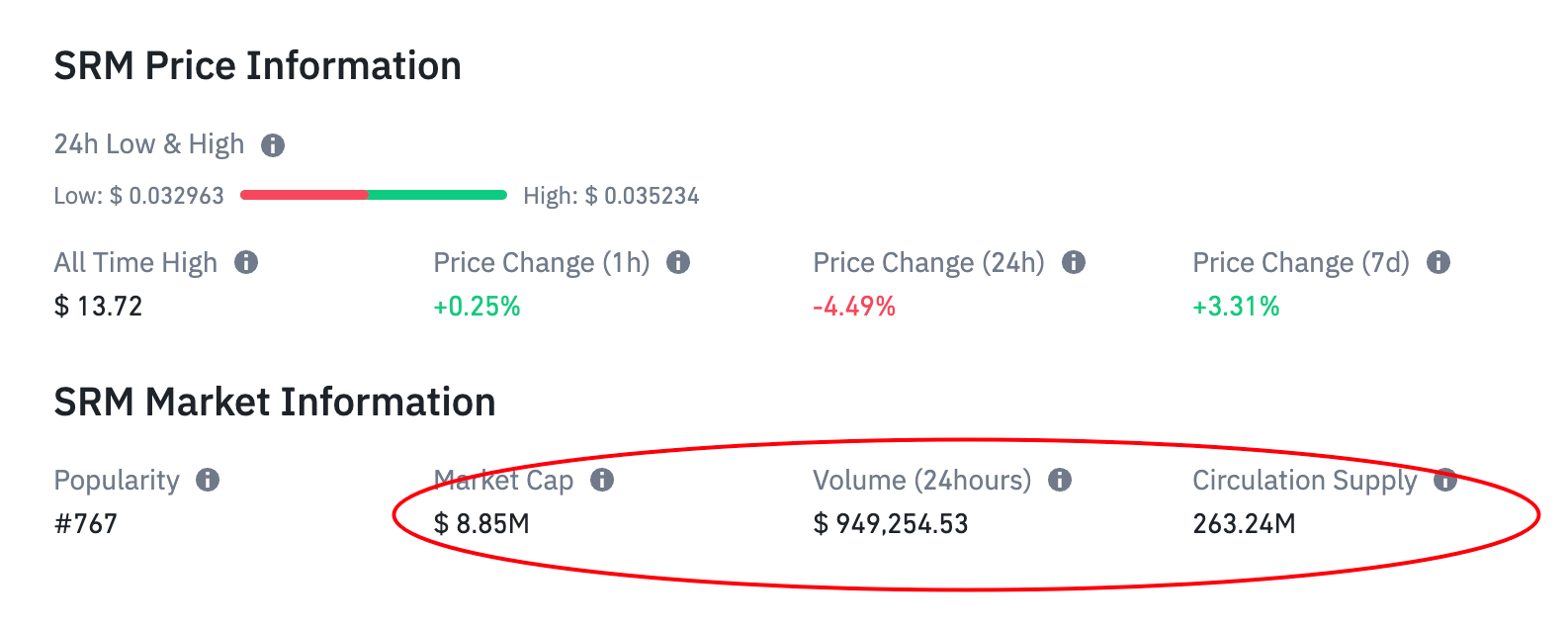

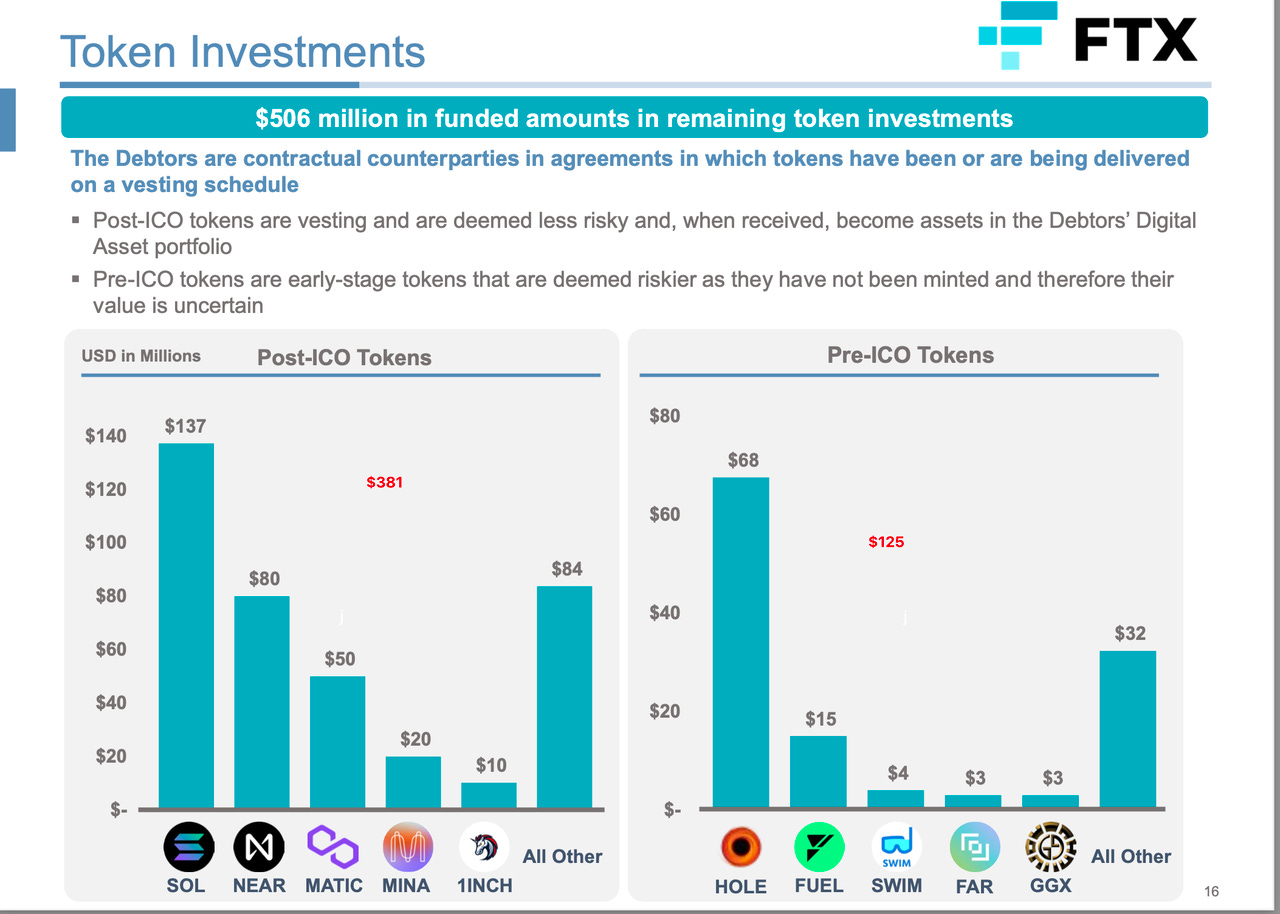

ASC 820 prioritizes observable data from active markets, placing measurements using only those inputs in the highest level of the fair value hierarchy (Level 1). So, the key variable is the existence of an active market. According to ASC 820-10-20, the definition of active market is a market in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis. For scenarios like FTX case, we recommend looking at the market volume and the holdings of exact tokens. For example, as for SRM tokens, the trading volume takes around 10% of the market cap. It looks like the token is actively traded. However, the current circulation supply of SRM is much less than FTX's holding quantity (263M v.s. 9949M). That means the daily volume of the total market is around 0.2% of FTX's holdings! This problem is called 'Blockage'. It can be characterized as a specific type of liquidity discount relevant to large holders of a particular asset. We could define the 'blockage rate' as the ratio of token holding to market circulation supply. A large blockage rate reflects that the market can not absorb the holding at the current value. Different discount levels could be put on different blockage rates, to ensure that the fiat assets obtained when the corresponding assets are actually disposed of are close to the estimate. How are pre-ICO tokens valued? The third key point is token investment. It mentioned that 'the cost basis of $506M should not serve as a proxy for recoverable value', introducing another important concept: cost-basis. What is cost basis and why it matters The cost basis refers to the initial purchase price when obtaining crypto assets. For instance, if you acquired one bitcoin on Day 1 for USD 20,000, your cost basis would be set at USD 20,000. The cost basis forms the foundation for computing profits and losses. The computation follows a straightforward formula: Cost Basis - Sale Price (Fair Market Value) = Gain/Loss Although recording the cost basis for a specific coin is relatively uncomplicated, the complexity arises when you have to manage different lots (the one bitcoin you acquired is a 'Lot') in different platforms. Determining which cost basis to apply for calculating the gain or loss can become challenging when you decide to sell your crypto assets. It's possible that choosing one lot causes gain while another causes loss. In FTX's case, token investments are divided into post-ICO and pre-ICO. Let's use the HOLE token as an example. FTX invested $68m for a given share of the token, so $68m is the cost-basis of FTX's HOLE token. However, the fair value (which is the 'recoverable value' in the filling) of the owned HOLE token might be much lower than $68m because of its illiquidity. Comment from Elven There is no available market data and related quoted prices for pre-ICO tokens. In this scenario, the income approach, which is based on future cash/token flows to the token holder, would be a possible method. It can prove particularly useful in token valuation, where prices are influenced by non-market activities such as SAFT. There are three key elements in the income approach:

For example, in this report given by Henley & Partners, the intrinsic value of Ethereum is evaluated by income approach. Transaction fees and new token issuance within a 20-year period estimate the future yearly income. When the discount rate is given by 13%, the intrinsic value would be $2,725. On the other hand, if we use a 19.19% discount rate, the implied price per ETH would be $1,349. Different assumptions will lead to a large difference in token valuation. The same approach is used by RxR research in this article. As we can see, different estimations of the three key elements would greatly influence the income approach, especially when the ecosystem behind the token is not as robust as Ethereum. Brokerage and Wrapped Tokens There are other valuable details in the report:

Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Full Transcript of Former Alibaba CSO Ming Zeng's Speech: AGI and Cryptocurrency - A Promising Future

Wednesday, September 27, 2023

Author: Ming Zeng Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=6&id=18555#backTop This article is the full transcript of the keynote speech titled "The

In-Depth Analysis of the Friend.tech Economic Model: Game Theory, Expected Value, and Demand Curves

Tuesday, September 26, 2023

Author: Loki Source: https://mirror.xyz/lokiz.eth/w1WKevEM3AAHaS-eDXIiRPU0DtzY6TCiQ_a8eX3tlIA I. How to Create a Successful Ponzi Social Product The Friend.tech economic model seems straightforward: 1.

TaxDAO’s Response to Committee on Finance on the Taxation of Digital Assets

Monday, September 25, 2023

Author: TaxDAO On July 11, 2023, the US Senate Committee on Finance released a letter seeking answers from the digital asset community and other interested parties on appropriate treatment under

Asia's weekly TOP10 crypto news (Sep 18 to Sep 24)

Sunday, September 24, 2023

Author:0xMingyue Editor:Colin Wu 1. Hong Kong's Weekly Summary 1.1 Hong Kong SFC: JPEX Listed on Unlicensed Firms and Suspicious Websites List Since July Last Year link On September 19th, the Hong

Weekly Project Updates: Arbitrum Reboots Odyssey, Optimism Announces Third Airdrop, OpenSea Set to Launch Creator …

Saturday, September 23, 2023

1. Arbitrum Announces Odyssey Reboot on September 26th link On September 20th, Arbitrum announced that it will relaunch Odyssey on September 26th. Arbitrum Odyssey, in collaboration with Galxe, will

You Might Also Like

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏