Reviewing the Rise of BASE Network: On-Chain Marketing May Become the Best Approach

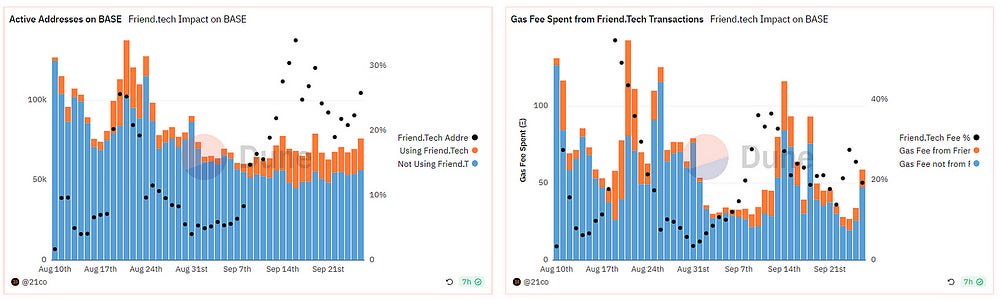

Author: defioasis Since its launch at the end of July, the L2 network Base, built by Coinbase and based on Optimistic Rollup, has accumulated $7 million in transaction fees, surpassing the majority of other L2 networks during the same period. The on-chain TVL (Total Value Locked) exceeds $540 million, nearly equalling the combined values of zkSync Era and StarkNet, thus becoming the third-largest L2 network following Arbitrum and Optimism. As a public chain with minimal airdrop expectations, it has achieved greater success in a shorter time compared to chains driven by potential airdrop farming. In this landscape of one-click chain launches and reliance on potential airdrop drives, Base’s experience seems to present another possibility in the development of public chains. Looking back at the development over the past three months, Base has experienced at least four significant events that are worthy of being recorded in history. (1) Launching Without Preliminary Announcement, Relying on Memecoin to Ignite Social Media At the end of July, the Base mainnet was quietly launched. However, the public did not learn about this news through official media releases, but rather through discussions on various social accounts and communities about the substantial increase in Base’s first Memecoin, BALD. On the evening of July 30th, around 25,000 ETH were deposited into the Base network, with over 10,000 flowing into the BALD/WETH liquidity, showing more than half of the entire network’s funds were circulating in this Memecoin, demonstrating its powerful ability to attract investment. At that time, the market value of BALD once approached $100 million, surging by tens of thousands of times. However, amidst this huge surge, the development team lost its direction, withdrawing a large amount of liquidity the next day, which led to a sharp decline in BALD. This act was no less than a provocation to the majority of users of this newborn network. This was followed by a massive search on social media for the identities of the team behind BALD, suspected to be individuals closely related to the bankrupt FTX/Alameda, or even SBF himself. Although it ended in failure, BALD undoubtedly brought immense exposure to the newly born Base. (2) Venture Capital-Backed Super dApp Surpassing Public Chains The failure of BALD and the subsequent collapse of other Memecoins driven by BALD temporarily labeled Base with concerns over ecosystem quality until the emergence of the super social app, friend tech, a week later. Integrated with Twitter, it relied on innovative personal social value transactions and invitation systems to quickly become popular in major communities, at one point making invitations highly sought after. On August 10th, the Base network experienced over 100,000 daily active users for the first time, reaching 136,000, with 42,000 new users joining. However, simplistic functions and poor user experience led to a rapid loss of users after a short-lived interest. Just when it was thought that it would silently exit the historical stage, friend tech made a high-profile return with seed round financing from crypto venture capital Paradigm, coupled with the first round of point distributions for potential airdrops, causing original users to quickly return and once again setting off a trend on social media, attracting more new users. The joining of celebrities such as Chen Jiaxing, the President and CEO of famous startup incubator Y Combinator, and FaZe Banks, the founder of American esports club FaZe Clan, along with the exponential growth of friend tech’s MEV bots, have brought more high-quality traffic and reputation to this young social network, friend tech, and the newborn public chain, Base. Base has achieved excellent results in the L2 network, but the application based on Base, friend tech, has far surpassed the Base network itself. Data from DeFiLlama shows that as of September 27th, Base captured $1.93 million and earned $1.06 million in September; whereas, in the same period, friend tech captured $21.74 million in fees, earning $10.87 million, ten times that of the Base network itself, becoming a super app protocol that can stand alongside Bitcoin and Uniswap. Currently, active users of friend tech account for about 25%-30% of the Base network, and the transaction Gas consumption is about 20%-40% of the Base network, sufficiently illustrating the impact of super apps on public chains. (Source: https://dune.com/21co/friendtech-analysis) (3) DeFi Flywheel, Boosting TVL to New Heights On August 31st, Velodrome, the largest DEX protocol on Optimism, deployed a new forked DEX named Aerodrome on the Base network. Less than 2 days after its launch, the TVL of Aerodrome once reached $200 million, accounting for 50% of the total Base TVL. Aerodrome inherited Velodrome V2 and improved the defects of Solidly Ve (3,3). The Aerodrome team offered close to 7% of AERO emission incentives to the AERO-USDC LP Pool by controlling veAERO, and at the time of launch, the circulation of AERO was limited, and the overall scale of the LP Pool was small. The high LP returns attracted liquidity providers to purchase the scarce AERO on the market, further increasing its scarcity, thereby driving a substantial increase in AERO prices. The price increase, in turn, allowed liquidity providers to gain higher returns, forming a positive flywheel, thus attracting a large amount of external liquidity to the Aerodrome protocol and the Base network in a short time. Although over time, AERO has fallen into and has yet to escape the negative feedback spiral of ve (3,3), and the TVL of Aerodrome has also fallen by more than 50% from its peak, it still has a locked-in value of $97 million, making it the largest DeFi protocol on the Base network, accounting for about 18%. The negative feedback spiral of Ve (3,3) has a solution on Velodrome on Optimism, which is to increase the lock-in rate through incentives from the Optimism Foundation’s OP. Whether this method is applicable on the Base network, which lacks token incentives, remains to be observed. (4) Pioneering the OP Stack Precedent, Sharing Revenue with Optimism Collective To ensure that the open-source OP Stack and the announced products supporting Base obtain sustainable funding, thereby creating a virtuous cycle within the ecosystem, Base announced on August 25th a deep cooperation with Optimism Collective. It will contribute 2.5% of the total income from Base sequencers to Optimism Collective or, after deducting the cost of data submissions to L1, 15% of the profits Base obtains from L2 transactions, whichever yields higher shared revenue. Base will also actively participate in the governance of Optimism Collective. As part of the contribution, within the next six years, Base has the opportunity to earn up to 2.75% of the OP supply and commits that the voting rights in Optimism Collective will never exceed 9% of the total voting supply at any time. This undoubtedly sets a precedent for deep ecological binding between L2 networks based on OP Stack and their builder, Optimism, potentially allowing more OP Stack-based networks to share revenue with Optimism in the future, forming a vast pan-OP Stack ecosystem. Reflections on the Development Journey of Base (1) On-chain Marketing Will Become the Best Marketing Method in the Future Marketing methods need to guide users into the next phase, ultimately achieving the desired conversion. The discovery of Base mainnet didn’t come from official marketing, but rather from countless community on-chain detectives tracing blockchain data, pursuing the wealth effect on-chain, and utilizing social influence to radiate to more ordinary users. BALD is a model example of on-chain marketing. On-chain detectives first noticed the unofficial opening of the Base mainnet, leading to the birth of the first on-chain token and a FOMO as funds poured into Memecoin. Through community and social influence, users were step by step attracted to pay attention and inject funds into the Base network, ultimately bringing a grand surge for players in less than one day. If relying only on ordinary official marketing rhetoric, it would be hard for such a network, with almost no airdrop expectations and amid the prevalence of L2, to generate such a love/hate Memecoin and to bring such immense traffic to the network launch. (2) Building Super dApps for the Network Despite criticisms of friend tech’s high fee extraction and value growth curve model, it is undeniable that friend tech has created a unique social race by converting user-owned social data into tradable social assets. Under the new model, friend tech attracted investment from paradigm, who are adept at betting on innovative branch races, thereby further attracting social influencers and celebrities to join. Learning from another paradigm investment, Blur, they implemented a point incentive system for potential airdrops, continuously improved features, and sustained positive growth in the dApp, ultimately benefiting the Base network itself. With super apps, Base has shifted the pursuit of airdrops from the network to network dApps, achieving a win-win-win situation. The affinity between friend tech and Base seems not to be accidental. Soon after Racer, the founder of friend tech, launched the social app Stealcam in March this year, it received high praise from Jesse Pollak, Base’s chief core developer, on social media. This may have laid the groundwork for the birth of friend tech on the Base network. (3) From chain Rivalry to chain Collaboration There seems to be a significant competitive relationship between most chains, such as the battle for legitimacy between EVM chains and non-EVM chains, the scalability path conflict between rollups and Validiums and Optimiums, and the L2 leadership struggle between Arbitrum and Optimism. Unlike chains backed by luxurious VC and massive funding, Base adopts a much lower stance. The cooperation with Optimism breaks the prejudice of “hostility” among L2 and absorbs the fork from Optimism’s largest DEX to become Base’s largest TVL protocol, sharing profits with Optimism and participating widely in governance innovatively. Perhaps the collaboration between Base and Optimism will bring more 1+1>2 effects in the future. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Global Crypto Mining News in September: Three Major New Bitcoin Mining Machines, All Below 20J/T

Tuesday, October 3, 2023

1. Bitmain has announced the newest models of the S21 Antminer, the S21 HYD hashrate 335T with an efficiency ratio of 16J/T and the S21 hashrate 200T with an efficiency ratio of 17.5J/T. Bitmain says

VC Sep. Report, the amount of funding reach new lows

Monday, October 2, 2023

Author: WuBlockchain According to RootData statistics, there were a total of 77 publicly announced investment projects in the cryptocurrency VC sector in September, representing a 3% increase compared

Asia's weekly TOP10 crypto news (Sep 25 to Oct 1)

Sunday, October 1, 2023

On September 29th, the Hong Kong Securities and Futures Commission (SFC) website released multiple lists pertaining to virtual asset trading platforms.

Weekly Project Updates: Celestia Genesis Airdrop, Walmart NFT toys for sale, GMX Submits Funding Application for 1…

Saturday, September 30, 2023

1. Celestia Genesis Airdrop link On September 26th, the modular blockchain Celestia announced that the genesis block for its first modular data availability network is expected to launch later this

WuBlockchain Weekly: Binance Completely Exits Russia, MicroStrategy Acquires Over 5,000 More BTC, Mixin Suffers At…

Friday, September 29, 2023

1. MicroStrategy Announces Purchase of 5445 BTC for $147 Million link On September 25th, MicroStrategy announced an additional purchase of approximately $147.3 million, acquiring 5445 BTC at an average

You Might Also Like

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏