VC Sep. Report, the amount of funding reach new lows

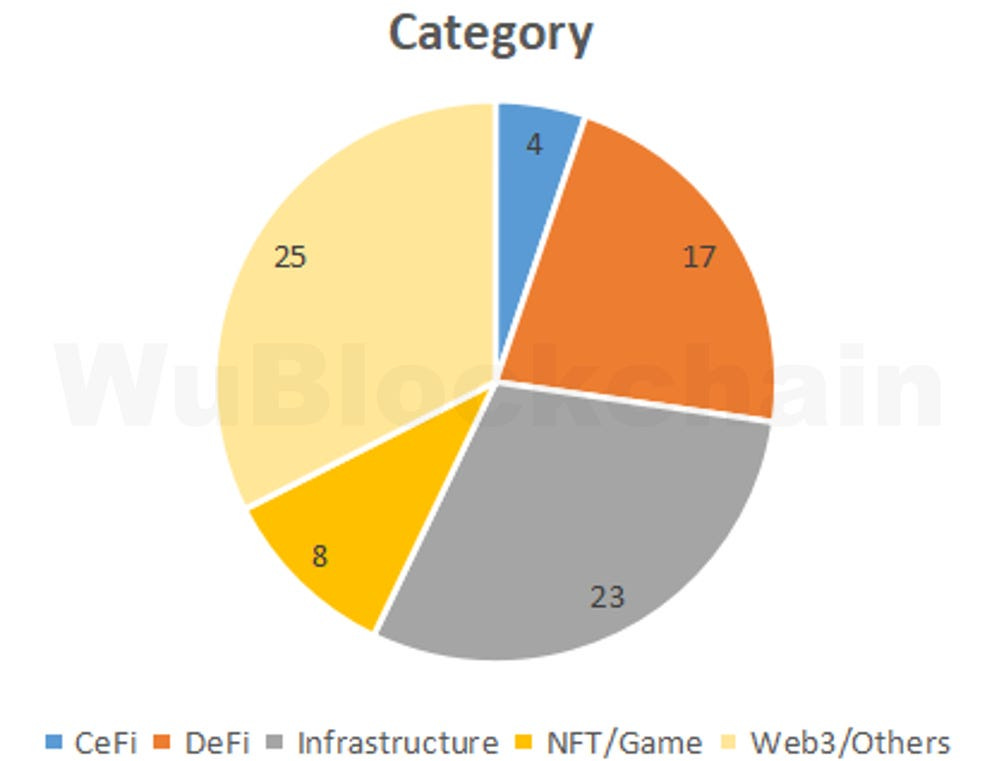

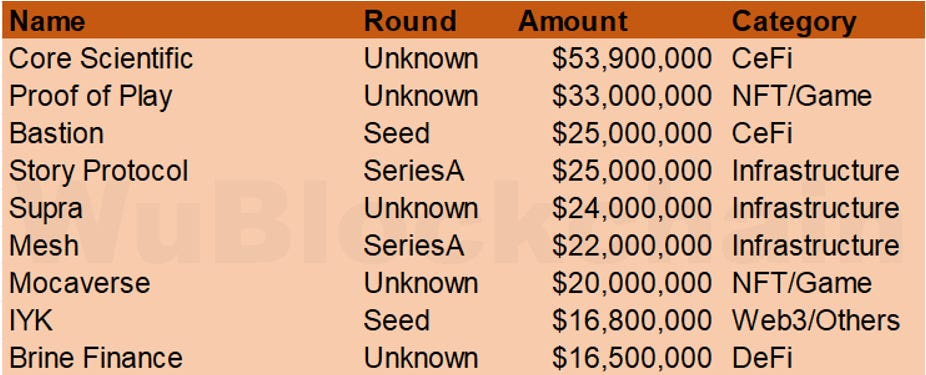

Author: WuBlockchain According to RootData statistics, there were a total of 77 publicly announced investment projects in the cryptocurrency VC sector in September, representing a 3% increase compared to August 2023 (which had 75 projects) and a 44% decrease compared to September 2022 (which had 138 projects). Please note that not all financings are disclosed in the same month, so the numbers mentioned above may increase in the future. Here is the breakdown of the projects by primary industry categories: In September, among various segments in the cryptocurrency market: Infrastructure projects accounted for approximately 30% of the financing. DeFi projects accounted for approximately 22%. CeFi projects accounted for approximately 4%. NFT and GameFi projects accounted for approximately 10%. The total funding raised in September was $510 million, which is a 24% decrease compared to August 2023 (which had $670 million) and a 72% decrease compared to September 2022 (which had $1.84 billion). Notable rounds exceeding $16 million include: Bitmain announced that it will provide 27,000 Bitmain S19J XP 151 TH Bitcoin mining machines to the bankrupt Bitcoin mining company Core Scientific in exchange for $231 million in cash and $539 million worth of Core Scientific common stock. Bitmain also signed a new hosting agreement with Core Scientific to support Bitmain’s mining operations. Blockchain gaming startup Proof of Play raised $33 million in seed financing with lead investors Greenoaks and a16z, with participation from Balaji Srinivasan and others. Proof of Play’s first game, “Pirate Nation,” a social role-playing game, was released in beta in December of the previous year. Cryptocurrency startup Bastion completed a $25 million seed round with a16z crypto as the lead investor and participation from Nomura Group’s Laser Digital Ventures and Robot Ventures, among others. Bastion offers cryptocurrency custody and related services, with its initial team including regulatory and compliance executives from cryptocurrency exchanges like Kraken. On-chain intellectual property protocol Story Protocol announced the completion of a $25 million Series A financing round, led by a16z crypto, with participation from Hashed, Endeavor, Samsung Next, Foresight Ventures, Dao5, Insignia Venture Partners, and others. With this funding and the $29.3 million raised in May of the same year, Story Protocol’s total financing exceeds $54 million. Story Protocol is a protocol for creating, managing, and licensing new intellectual property on the blockchain. Oracle project Supra secured $24 million in financing, with investors including Animoca, Coinbase Ventures, HashKey, and others. Supra is reportedly helping facilitate the large-scale migration from Web2 to Web3 through enhanced oracle services, cross-chain communication protocols, and cutting-edge consensus mechanisms. Cryptocurrency transfer and payment services startup Mesh raised $22 million in a Series A round with Money Forward as the lead investor and participation from Galaxy, Samsung Next, Streamlined Ventures, and others. Mesh plans to use the new funding to further develop its deposit, payment, and expense tools and support the launch of its products. Mesh, founded by Bam Azizi and Adam Israel in 2020, has raised a total of $32 million to date. Animoca Brands announced that its NFT series, Mocaverse, received a commitment of $20 million in financing, led by CMCC Global. The new funds will be used to advance project product development and promote Web3 adoption. Animoca Brands raised $20 million by issuing new common shares at a price of AUD 4.50 per share and also granted free attached utility token warrants to investors in this round, with a 1:1 USD conversion rate. Web3 startup IYK raised $16.8 million in seed funding, with A16z Crypto as the lead investor and other participants including 1kx, Collabcurrency, Lattice Capital, and gmoney. According to its website, IYK is a participant in a16z Crypto Startup School, an accelerator program by the venture capital giant that typically invests $500,000 in participating startups in exchange for 7% equity. IYK aims to help brands, musicians, and creators create digital physical experiences. DEX (Decentralized Exchange) project Brine Fi announced that it raised $16.5 million in a round of investment led by Pantera Capital, valuing the project at $100 million. StarkWare Ltd and others also participated. Brine Fi, supported by StarkWare, is a non-custodial decentralized order book that was opened to traders in May. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Asia's weekly TOP10 crypto news (Sep 25 to Oct 1)

Sunday, October 1, 2023

On September 29th, the Hong Kong Securities and Futures Commission (SFC) website released multiple lists pertaining to virtual asset trading platforms.

Weekly Project Updates: Celestia Genesis Airdrop, Walmart NFT toys for sale, GMX Submits Funding Application for 1…

Saturday, September 30, 2023

1. Celestia Genesis Airdrop link On September 26th, the modular blockchain Celestia announced that the genesis block for its first modular data availability network is expected to launch later this

WuBlockchain Weekly: Binance Completely Exits Russia, MicroStrategy Acquires Over 5,000 More BTC, Mixin Suffers At…

Friday, September 29, 2023

1. MicroStrategy Announces Purchase of 5445 BTC for $147 Million link On September 25th, MicroStrategy announced an additional purchase of approximately $147.3 million, acquiring 5445 BTC at an average

FTX Case Update: How Are The Tokens Valued?

Thursday, September 28, 2023

Author: Elven A recent court filing revealed the details of FTX's crypto holdings. The presentation provides an overview of substantial payments made by the company, once the biggest global crypto

Full Transcript of Former Alibaba CSO Ming Zeng's Speech: AGI and Cryptocurrency - A Promising Future

Wednesday, September 27, 2023

Author: Ming Zeng Source: https://www.wu-talk.com/index.php?m=content&c=index&a=show&catid=6&id=18555#backTop This article is the full transcript of the keynote speech titled "The

You Might Also Like

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡ incentive → click → sale

Saturday, March 8, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: World Network Launches Chat Feature, Zora Set to Introduce Its Native Token, and Trump Ann…

Saturday, March 8, 2025

Sam Altman's blockchain project, World Network, has launched World Chat, a “mini-app” integrated into the World App wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Treasury Secretary Scott Bessent hints at future US Bitcoin reserve acquisition plans

Friday, March 7, 2025

Federal government considers expanding Bitcoin holdings without taxpayer funds; official discussions underway in Washington. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

NFT & Gaming - 🦁 Loaded Lions’s LION went live and was the top gainer on CoinGecko; Trump-owned company DTTM Oper…

Friday, March 7, 2025

Loaded Lions's LION token went live on the Cronos and Solana. Trump-owned company filed a trademark for a metaverse and NFT marketplace. Hamster Kombat introduced a Layer-2 blockchain on TON ͏ ͏ ͏

WuBlockchain Weekly: Trump Officially Signs Executive Order for U.S. National Bitcoin Reserve, White House Hosts C…

Friday, March 7, 2025

David Sacks, the “Crypto Tsar” and the White House's AI and Crypto Affairs Chief in the United States, tweeted that Trump has signed an executive order to establish a strategic Bitcoin reserve. ͏ ͏

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask