The Signal - Victoria’s open secret

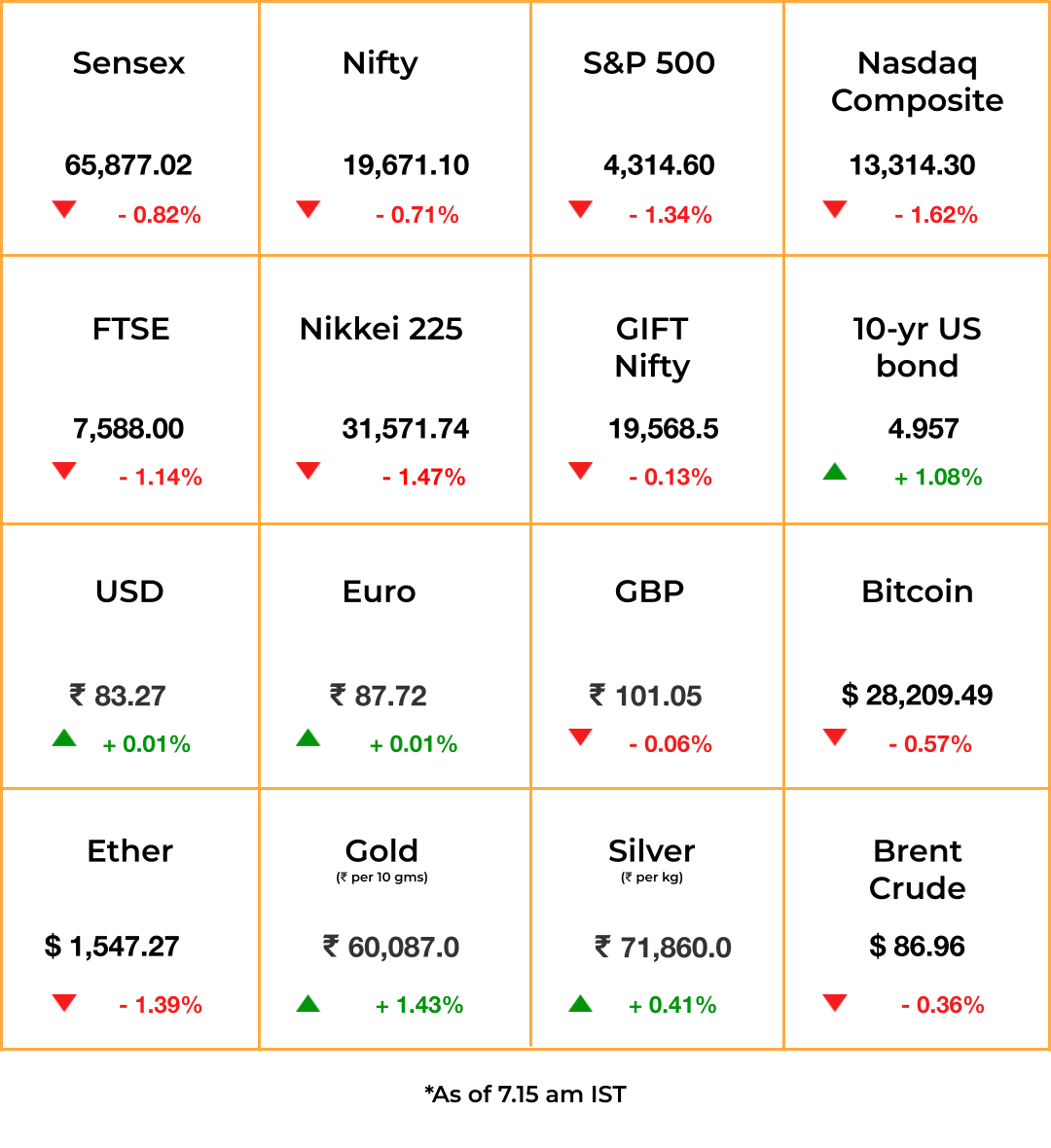

Victoria’s open secretAlso in today’s edition: Europe has the IT factor; What’s in Religare for the Burmans? Tudum report; Putin’s edgeGood morning! A Baba arrives in the US, gains followers, and embarks on a property-buying spree. Sound familiar? No, it’s not the script of Wild Wild Country. But a similar story is developing in Oakland, California. Swami Muktananda Paramahamsa’s foundation, Siddha Yoga Dham of America, has amassed massive land parcels in the city. Today, amidst a housing crisis, the foundation's mostly unused land is frustrating residents, The Oaklandside reports. Compounding the issue is the foundation’s tax exemptions as a non-profit entity, making it the perfect recipe for a new Netflix documentary. Roshni Nair, Jaideep Vaidya, and Adarsh Singh also contributed to today’s edition. We would like to know more about you. Participate in our annual survey by filling up this form. We’ll use your answers to tweak our products and make them more enjoyable for you. As always: you will remain anonymous. The Market SignalStocks & Economy: The Chinese economy’s stronger-than-expected rebound failed to enthuse investors enough to overcome fears of the Israel-Hamas conflict blowing up into a regional conflagration. Asian markets were awash in red in morning trade even as US President Joe Biden visited Israel in an effort to prevent the war from spreading. UK Prime Minister Rishi Sunak is expected to follow Biden. More than the war, however, the continuing global sell-off in government bonds is weighing on investors. US treasury yields are at 16-year highs, with the 10-year bond yield nearing the 5% mark. Indian equities are unlikely to be any different from their global peers, with the GIFT Nifty indicating a weak opening. James Sullivan, JPMorgan’s chief of Asia Pacific Equity Research, estimates that the Indian economy will double to $7 trillion by 2030. SOFTWARE SERVICESEuropean EquilibriumIndian software services companies are notching up more wins in Europe than their traditional playground, the United States. While bellwether TCS’ North American business expanded by just 0.1% from June to September, its European revenues rose 10.7%. Infosys followed with a 10.9% growth in Europe compared with 1.2% in North America. Europe’s market share rose for both companies as well as the other heavyweight, HCLTech. The three biggies have been beefing up operations in Eastern Europe, which gives them a time-zone advantage for near-shoring. When the Russian invasion began last year, HCLTech opened “walk in” camps in Poland and Romania to recruit fleeing Ukrainian techies. Infosys and TCS too actively tapped into Ukrainian talent. The strategy helped offset the slowdown across the Atlantic. Meanwhile, the other giant Wipro’s second-quarter revenue declined 2.3% sequentially, its third consecutive quarterly slide. FINANCIAL SERVICESThe Money Is In SpendingWhy only sell products when you can finance spending itself? This is now a hot strategy with business groups, be it Reliance, Bajaj, or Birla, all of which would love to own a bank but have to be content with non-banking finance companies. Now, the Burmans of Dabur want to feed the Indian consumer’s newfound hunger for credit and have zeroed in on financial services company Religare Enterprises (REL). The company was reeling after its founders, Malvinder Singh and Shivinder Singh, were jailed for stealing from it, but the REL management led by Rashmi Saluja turned it around. Now, the ~$1 billion insurance, broking, and housing finance services company is ripe for a takeover. For the Burmans, a larger financial play ties in with efforts to reorient their “boomer” Dabur Group towards millennials and Gen Z consumers who are at ease with credit. RETAILAngels Fear To Tread…

…where executives rush in (to rebrand). Iconic lingerie maker Victoria’s Secret (VS) has now realised this after spending two years rebranding. VS’ attempt to abandon the white-skinny-sexy aesthetic and embrace a more inclusive, feminist image has backfired. Sales this year are expected to drop 5% to $6.2 billion, lower than even 2020. RiRi-Kim K nexus: VS has been losing market share for years while upstarts like singer Rihanna’s Savage X Fenty and reality star Kim Kardashian’s Skims gain ground. In 2019, VS cancelled its iconic fashion show featuring its ‘angels’ just as Savage X Fenty released its hit fashion debut. That year, top executive Ed Razek left the firm after saying lingerie brands shouldn’t use trans- and plus-size models. Back to basics: To bring sales back to $7 billion a year, VS is relaunching swimwear and other apparel categories. Its new pitch: “sexiness can be inclusive”.

🎧 Victoria’s Secret is bringing sex back. Also in today’s episode: Free speech isn’t free on Elon Musk’s X/Twitter. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts. STREAMINGComing Soon: Coca-Cola Squid GameNetflix posted its best quarter for subscriber growth in years, adding nearly nine million subscribers for Q3 2023. It will now raise prices for users in the US, UK, and France. Interestingly, the streamer didn’t reveal much about progress in its ad tier. What we do know is that Netflix is working on new ad offerings, including title sponsorships for shows. It will also let you watch another episode ad-free provided you first sit through a bunch of 30- to 60-second ads. Brands can sponsor its live events too. Netflix will hope these strategies work, considering its nascent ad business is reportedly underperforming. Meanwhile, Amazon seems confident in Prime Video’s advertising prospects. It’s asking advertisers to commit $50 million-$100 million in 2024, per The Information. That’s more than what Netflix asked for when it launched its ad tier last year. However, Amazon might be late to the ad-supported streaming party. GEOPOLITICSRogues’ GalleryUS president Joe Biden landed in Tel Aviv for what was also to be an extended trip to Jordan. That summit was cancelled following the brutal bombing of a Gaza hospital that left over 500 civilians dead. Biden is now focusing on a show of support for Israel’s Netanyahu administration—one that’s unpopular. A local poll reveals that only 21% of Israelis want PM Netanyahu to stay on after the war. Across the continent, China and Russia doubled down on their “mutual trust” in challenging, among other things, a US-led world order. Vladimir Putin’s refusal to denounce Hamas underlines his growing estrangement from Israel. The relationship Russia-Israel once shared has come undone due to Moscow’s cosiness with Iran and Syria. For Putin, the war in West Asia is a welcome distraction from Ukraine. This war is also working in Iran’s favour. For now, the odds are overwhelmingly stacked against Biden. FYIAlternate current: Japanese automaker Suzuki Motor will position India as its first EV production hub, with a goal to export made-in-India EVs to Japan in 2025, Nikkei reports. Tareek pe tareek: Talks on the India-UK free trade deal—now in its 13th round of negotiations—are likely to slip into November, according to Bloomberg. Surf, with caution: OpenAI has officially launched internet browsing for ChatGPT, taking the chatbot a step closer to becoming a “multimedia generative search engine”; the company is also in talks to sell shares at a valuation of $86 billion, per Bloomberg Consolidation alert: IT major Wipro is merging five of its subsidiaries into Wipro Limited, without a change in shareholding patterns. Loan ranger: Bloomberg reports that HSBC has almost doubled the size of its loan arrangement for Stoke Park—Mukesh Ambani’s luxury real estate bet in the UK—from £60 million ($73 million) to £115 million. Win some, lose some: PhonePe reported consolidated revenue of ₹2,914 crore ($350 million) for FY23, up 77% from FY22; its operating loss increased to ₹1,755 crore from 1,612 crore for the same period. The words are ours: Universal Music has dragged AI startup Anthropic to court. The company alleges that Anthropic’s AI engine Claude generates lyrics similar to its artists’. THE DAILY DIGIT665 millionThe estimated number of undernourished people in the world by 2030, more than pre-Covid levels, according to a paper by a United Nations body. (The Economic Times) FWIWMoney man: Leonardo DiCaprio is investing in a sustainable luxury watch company. ID Genève is Switzerland’s first luxury watch company to be awarded a “B Corp” certification, which guarantees top-notch social and environmental standards. ID Genève stands out by crafting timepieces exclusively from recycled and reused materials, even harnessing solar power for steel melting and repurposing green waste for watch straps. Leo's investment aligns with his penchant for sleek, European, and under-25 tastes. 👀 Times are changing: US workers are finally doing the unimaginable. They’re cashing in their sick leave! Traditionally, not taking sick days was a point of pride, but post-pandemic, things are changing. Frequent illnesses and changing perspectives on work are driving this change. The younger generation is at the forefront. However, companies are unhappy due to unplanned absenteeism and added replacement costs, leading to increased expenses. Companies can’t do much; with record-high employment in the US, the fear of job loss has also diminished. Carpe diem! Auto save: Your Tesla will now save you from drowsiness. Well, sort of. The company is introducing a new feature called Driver Drowsiness Warning system. With it, the EV will “monitor facial characteristics as well as driving behaviour to determine patterns indicative of drowsiness”. If it detects drowsiness, the Tesla will display an alert message on screen and also make a sound. The feature is currently restricted to European users only. Did you enjoy today’s newsletter? We accept bouquets or brickbats, whatever you choose to send us, here. Join The Signal Forum on Telegram to know what The Signal community is reading and talking about through the day. Follow us on X and Instagram for fun stuff. Also check out our other newsletters, The Playbook and The Impression. |

Older messages

Why fintechs ❤️ banks

Wednesday, October 11, 2023

Also in today's edition: BYJU'S lender dodgeball; US-China's Gaza quandary; FTX's night of terror; Football has a 777 problem

Summer of discontent

Tuesday, October 10, 2023

Also in today's edition: Hello darkness, my foe; Gaza under siege; 'Tis election season; Bloodsuckers are having a ball

Disney’s Indian yard sale

Monday, October 9, 2023

Also in today's edition: Pedal to the medal; Inferno in Israel; 'Made in China' is here to stay; OpenAI chips in

Beauty and the beast

Saturday, October 7, 2023

Social media is raising a generation with self-perception issues and eco-anxiety.

The think tank that Kant

Friday, October 6, 2023

Also in today's edition: Reckoning for Indian reality TV; An Uttarakhand in Sikkim; Jindal's auto show; SBF goes to trial

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these