[Report] Coin Metrics’ State of the Network: Issue 229

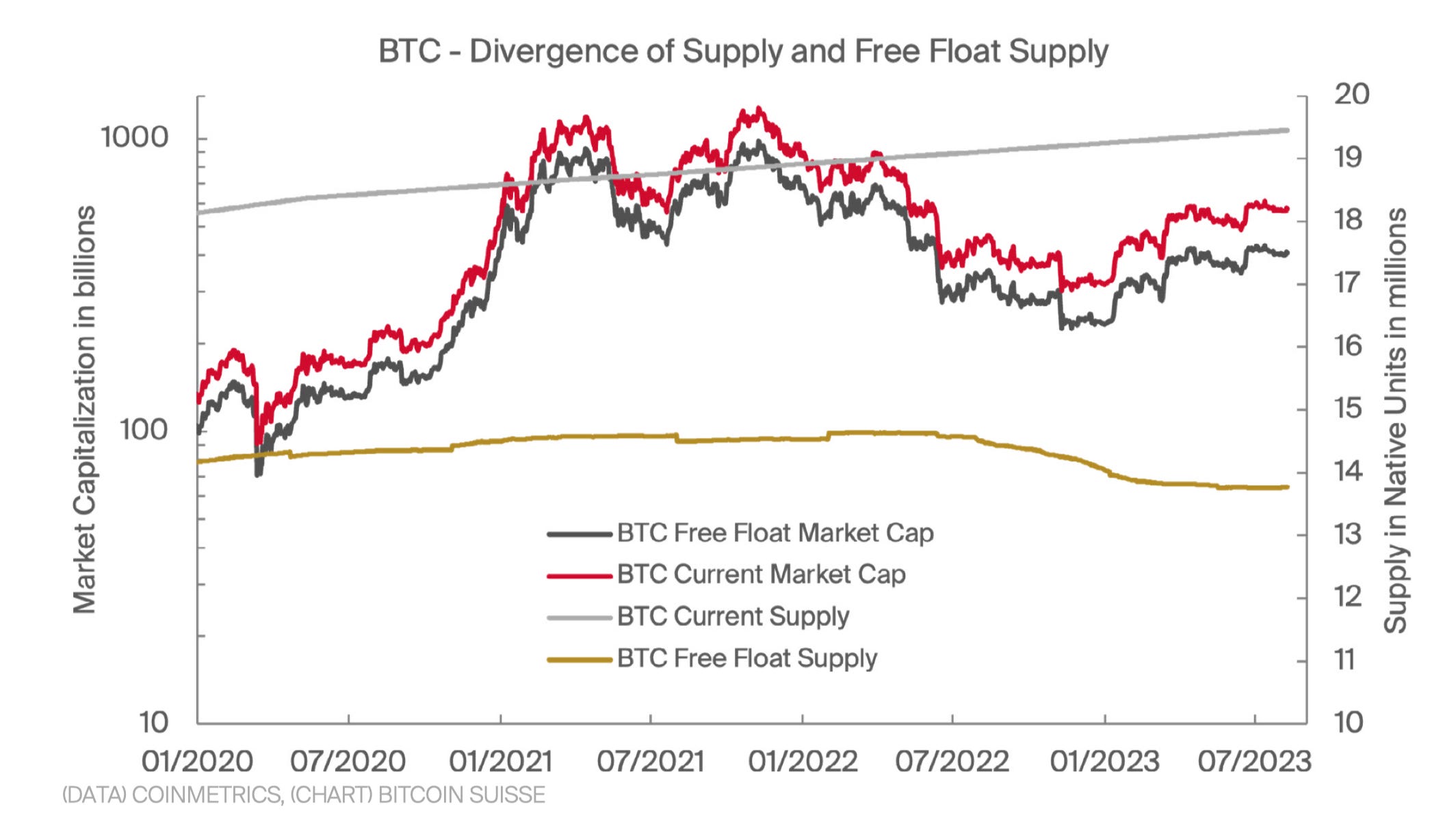

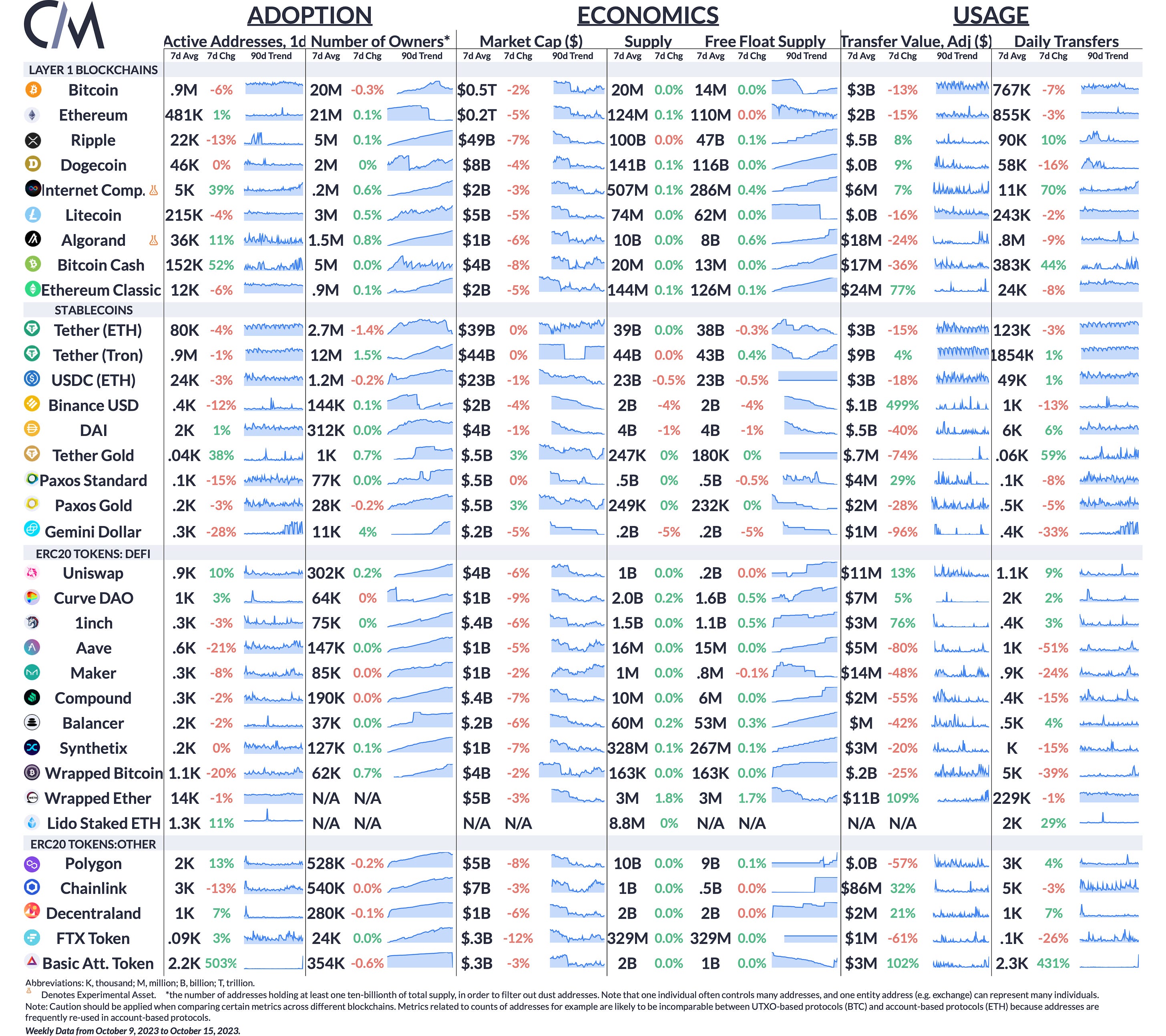

[Report] Coin Metrics’ State of the Network: Issue 229Coin Metrics ⨉ Bitcoin Suisse—Exploring Supply TransparencyGet the best data-driven crypto insights and analysis every week: Exploring Supply TransparencyBy Coin Metrics ⨉ Bitcoin Suisse In an industry as dynamic and boundary-defying as digital assets, the confluence of two leading research teams—each hailing from a different corner of the globe, just like how decentralized networks operate—marks an occasion for both celebration and intellectual intrigue. This partnership between an institutional focused U.S.-based crypto analytics firm, Coin Metrics, and Bitcoin Suisse, a Swiss stalwart deeply embedded in the innovative spirit of Crypto Valley, manifests the borderless nature of digital assets, affirming them as a truly global asset class. Our collaboration is one that draws upon our respective strengths; the data-driven approach of Coin Metrics meshes harmoniously with the market acumen and decade-long historical perspective provided by Bitcoin Suisse. With Bitcoin Suisse steering the research outline, conceptual framework, and token selection, and Coin Metrics providing high-caliber datasets and metrics, we have turned our collective attention to a topic of increasing relevance: token supply transparency and its relationship to liquidity. For the first time in financial history, the transparent architecture of public blockchains allows us to track the flow of funds between crypto wallets in real-time, offering unprecedented insights into supply dynamics and liquidity at multiple dimensions and granularities. What follows is the fruit of this synergistic endeavor; we trust you will find it as enlightening as we found the process of its creation. Highlighting Supply LiquidityOne of the key insights explored in this report centers on the insights provided by Coin Metrics Free Float Supply metric, which can be used to understand the proportion of an asset’s liquid supply. We apply this framework to offer insights on how a bullish catalyst can manifest across various digital assets, determining the comparative advantage of assets based on their supply liquidity. Source: Coin Metrics Network Data & Bitcoin Suisse The partnership between Coin Metrics and Bitcoin Suisse marks a significant step forward in enhancing our understanding of the digital assets space. This research provides insights into the relationship between token supply transparency and liquidity, a topic of paramount importance to the evolving dynamics of the cryptocurrency market. If you would like to read the full report you can find it here. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin's active addresses held steady at 9M, while Ethereum experienced a 24% surge in active addresses, both against a backdrop of relatively flat prices. The on-chain activity for Bitcoin, as highlighted by its daily transfers, saw a 7% reduction, while daily transfers for Ethereum increased by 10%. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Circle's Silver Lining: Unpacking USDC's Supply Drop in an Era of Rising Rates

Tuesday, October 10, 2023

Circle & USDC in an Era of Rising Rates

Coin Metrics’ State of the Network: Issue 227

Tuesday, October 3, 2023

A data-driven overview of the events from Q3 2023

Coin Metrics’ State of the Network: Issue 226

Tuesday, September 26, 2023

Tuesday, September 26th, 2023

Coin Metrics’ State of the Network: Issue 225

Tuesday, September 19, 2023

A Glimpse into Coinbase through Coin Metrics' Data

Coin Metrics’ State of the Network: Issue 224

Tuesday, September 12, 2023

One Year Since The Merge

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏