Earnings+More - DraftKings leads the way

DraftKings leads the wayAll change at the OSB top, More DK wins, LVS revenue boost, 888 slump, G2E analyst takes +More

That's when I fell for the leader of the pack. DraftKings No.1Overall online market share leadership passes to DraftKings. No.1 in heaven: DraftKings was the overall market leader in online gambling in the US for the first time, achieving ~31% market share in August across OSB and iCasino combined vs. erstwhile market leader FanDuel’s ~30%, according to the analysts at EKG.

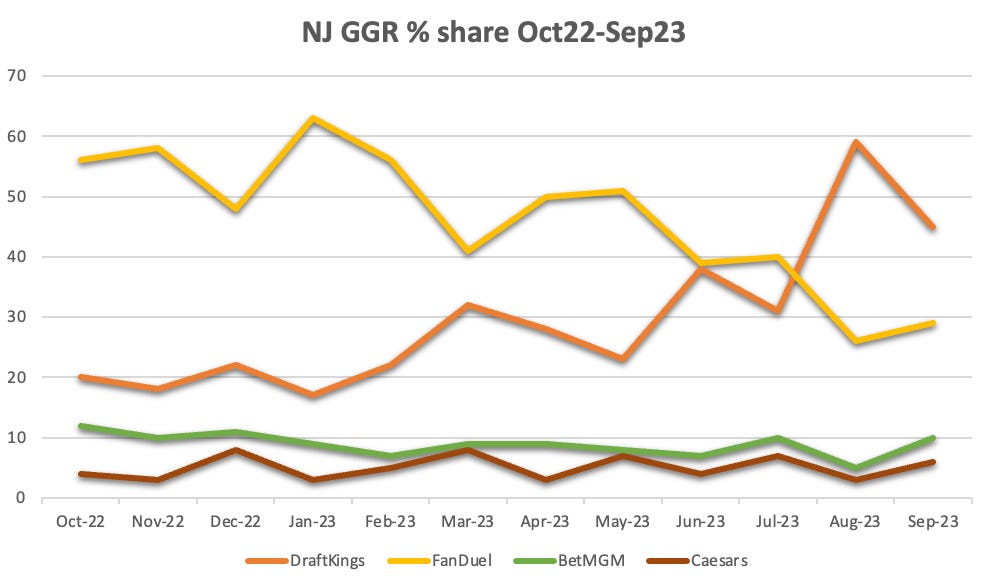

🩳 🚶DraftKings maintains sports-betting GGR lead in New Jersey Getting better all the time: The EKG team attributed DraftKings’ success in grabbing overall market share in part to the acquisition of Golden Nugget, a solid product and, what they argued, is a significant improvement in its operational execution that allows the company to “capture more value on a per-customer basis”.

Green initiative: Speaking of new entrants… House of mouse: Earlier this week Disney provided a peek into the financials at ESPN as a standalone business for the first time. Cut to the chase – earnings are going backwards, down 20% in the first 9 months of FY23. ** SPONSOR’S MESSAGE ** Calling all sportsbooks! Are you:

Stop falling behind your competitors! Matchbook pricing and brokerage service is your connection to the sharpest pricing and global liquidity, helping you to manage risk and fortify your margins. Matchbook pricing is proven to be resistant to market changes. Matchbook B2B, because the best price is for everyone. Find out more at http://www.matchbook.com/promo/b2b or email b2b@matchbook.com Sands balmWith ‘stellar’ assets, Las Vegas Sands puts the case for Macau growth. I'ma say all the words inside my head: Addressing market fears over the trajectory in China’s gambling enclave, CEO Rob Goldstein said the question was how quickly the market got to $35bn-$40bn of marketwide GGR “and beyond”.

Move to where the puck is going: Goldstein said the “beauty” of the LVS business model as it pertains to customer segments was the company had “plenty of capacity to [cater for] everyone”. “We will move to the market,” he added.

Trading slump888 confirmed the details of its late September profit warning showing an across-the-board decline in trading. Wide of the mark: The size of the task that lies ahead for new CEO Per Wideström, who formally began in his role on Monday, was evident in the detail of the Q3 downturn in business, which cited regulatory headwinds as a factor in the 10% decline in revenues.

Analyst takes: Peel Hunt said that with revenue growth, synergy extraction and cash flow on the horizon, they believed FT23 would “prove to have been the turnaround year for 888”.

** SPONSOR’S MESSAGE ** EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 200+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs. EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets. Earnings in briefRank: The UK casino-to-bingo-to-online operator said in a trading statement that revenues rose 11% YoY to £180m, led by a 13% improvement in the Grosvenor venues business to £84.2m. London NGR rose 8%, while NGR for the rest of the country was up 16%.

Monarch Casino & Resort: Market share gains in Black Hawk weren’t enough to offset the competitive pressures on the Reno properties, as revenue slipped 1% to $133m while adj. EBITDA came in at $49.2m. Analyst takesG2E takeaways: The “consistent story” from Las Vegas last week was the consumer remained healthy, M&A was likely to pick up, albeit with the well-documented issues around interest rates and equity value, while Las Vegas remained strong, according to the team at Wells Fargo.

Churchill Downs: The team at JMP said Churchill Downs would benefit from the decision of the Virginia Supreme Court to reinstate the ban on skill-gaming machines. Noting Churchill Downs runs HRMs in the state, they suggested there was an “incremental opportunity to capture play”. DatalinesArizona: August OSB GGR was down 23% to $21.4m on flat handle at $358m. Pennsylvania: OSB in September was down 12% to $66m on handle that rose 12.5% to $726m; iCasino GGR rose 41% to $159m. New Jersey: B&M GGR was down 2% to $245m, while sports-betting GGR rose 14% to $112m and iGaming GGR was up 21% to $164m. Massachusetts: Casino GGR came in at $90.4m for September, down 4.2% YoY; sports-betting GGR hit $51m on $512.2m in handle. ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. NewslinesCanadian gaming outfit Gateway Casinos, which runs 31 properties across the country, is seeking a buyer, according to Bloomberg, which said the company had hired Morgan Stanley and Macquarie Group to find potential investors at the $2bn mark. On rotation: The NFL plans to include Las Vegas in a rotation of regular Super Bowl hosts – even before the booming sports market hosts its first league title game, according to Front Office Sports. Trading in Elys Game Technology shares has been suspended after the company received written notice from Nasdaq over the failure of the company’s common stock to maintain a minimum closing bid price of $1.00.

Mansion will close all B2C operations for its Casino.com and MansionCasino.com brands, effective as of October 26.

Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

BetMGM re-ups its promo spend

Thursday, October 19, 2023

Maryland data, MGM 'blip', G2E down rounds warning, startup focus – Units +More

Fantasy threads the needle

Thursday, October 19, 2023

Daily fantasy sports market analysis, the latest analyst takes +More

Something changed: MGM and Entain in the spotlight

Tuesday, October 10, 2023

Assessing the chances of a deal between MGM and Entain, Q3 transactions review, SKS365 runners and riders +More

Talk of the town: G2E gets under way

Monday, October 9, 2023

G2E preview, Florida fail, Luckbox calls B2C halt, startup focus – We The Bookie +More

Playtech’s tequila crisis

Friday, October 6, 2023

Caliplay deal goes before court, MGM hack losses, sector slowdown, Kambi shares uptick, Ohio data +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these