Bankless DAO - Not Forking Around: The DAO Hack

If you have your blockchain basics figured out, then you’ll be well aware that data recorded onchain are considered to be immutable. The reason for this is twofold: there are numerous copies of the data held across the nodes in a distributed network, and each data ‘block’ is cryptographically linked to the one recorded before it, meaning that no one can alter the ‘chain’ of data without significant and likely futile effort.

Fork the RulesBut what happens when the community does ‘collectively authorize’ a change to the code? In 2016, in response to a smart contract exploit — now referred to as The DAO hack — influential members of the Ethereum community enacted a decision to alter not just transaction data but the underlying protocol. The dissent around this decision resulted in a fork of the blockchain. A ‘fork’ is a term common in open-source software development which means to take a copy of the original software and take it in a new direction, with or without the blessing of the original code creator. There are two types of forks: hard and soft, with the difference defined by the level of compatibility with existing code:

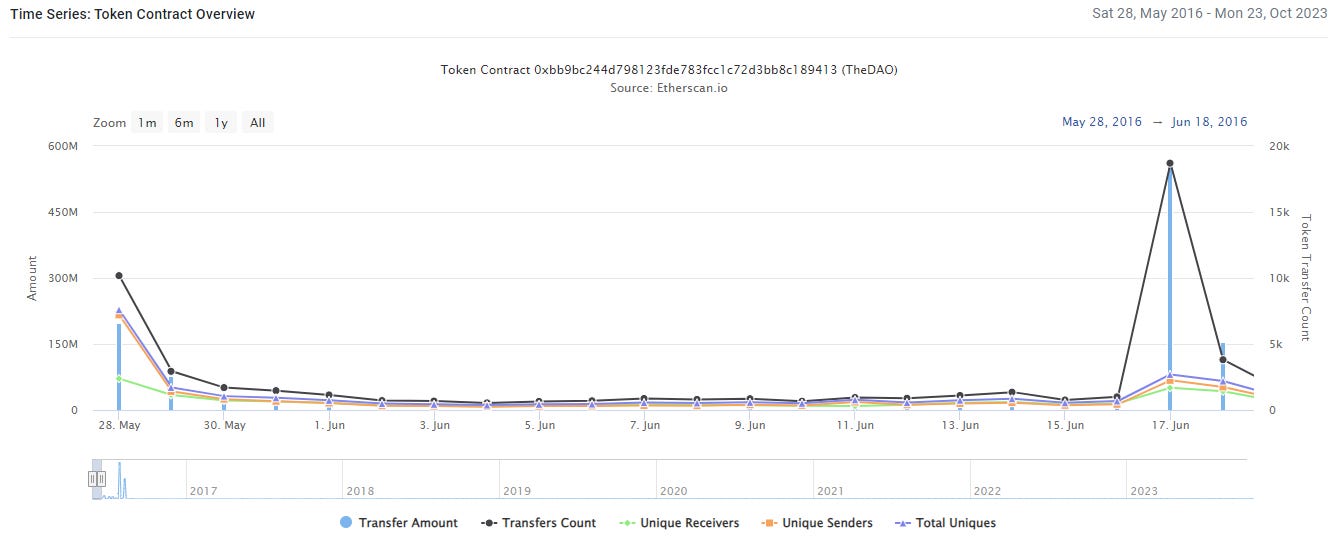

The decision to fork a blockchain is not taken lightly, but both hard and soft forks have happened with Ethereum and Bitcoin since their inception. Soft forks can occur for various reasons, including protocol upgrades and to patch security vulnerabilities, while, as with The DAO hack, hard forks typically result from ideological differences within the blockchain community. The DAO HackEtched in the history of the Ethereum blockchain is the story of The DAO, and the ‘hack’ that occurred not long after its formation. The DAO was the first of its kind — a decentralized autonomous organization whose proposals, voted on by The DAO token holders, were executed via a set of smart contracts once the designated approval threshold was reached. Unlike many of today’s DAOs, The DAO’s founder remained anonymous and unknown even to the community, and governance was driven entirely by the code. The DAO was formed as a decentralized investment fund that aimed to support various development projects on the Ethereum platform. In a relatively short time, it raised a vast amount of ether (ETH), making it one of the most significant crowdfunding efforts at the time. This article, written in May of 2016, says that $50 million worth of ether had been raised, but not long afterwards the figure reached $150 million. In June 2016, an unknown token holder exploited a flaw in the DAO’s smart contract code which enabled them to transfer a substantial portion of the invested ETH — around $60 million worth — to themselves.

Some in the community felt this was a hack; others were adamant that ‘code is law’. The person responsible for the exploit commented publicly, noting in an open letter dated June 18, 2016:

The DilemmaThe Ethereum community was faced with a dilemma. There were those who argued that the blockchain’s immutability should be upheld, and transactions, even those caused by hacks, should remain irreversible. However, a significant portion of the community believed that such a major hack could undermine trust in Ethereum, and the stolen funds should be returned to their rightful owners by altering the underlying code. After intense debate and discussion, the Ethereum community reached a consensus to perform an “irregular state change” which would essentially reverse the hack and return the stolen ETH. The Ethereum Foundation notes that the decision had 85% approval, yet some miners refused to accept the decision, saying the vote lacked neutrality, and continued on with the original Ethereum protocol. The DecisionThis decision led to the creation of two separate chains: Ethereum (ETH token), which continued with the hard-forked blockchain, and Ethereum Classic (ETC token), which remained on the original, unaltered chain. This article includes a helpful comparison of Ethereum and Ethereum Classic. The exploiter of The DAO’s smart contract asserted in the open letter that the hard fork would be the downfall of Ethereum:

Yet it hasn’t quite turned out that way, at least if market cap and volume are anything to go by. Ethereum Classic has continued to operate with the original proof-of-work consensus, while Ethereum has since completed The Merge which successfully implemented proof-of-stake. Ethereum Classic proudly claims its OG status but struggles against community perception that it is “some sort of copy-cat project trying to cash in on ETH’s success”:

Do Sour Grapes Stain?

Ethereum Classic’s website will tell you that it exists “in response to contract censorship on sister chain Ethereum™ (ETH) and to uphold and preserve the principle of Code is Law”. There is also a fascinating and detailed account of The DAO exploit on the Ethereum Classic website, which includes a statement that the hard fork was unnecessary because 70% of the funds had already been recovered using the same technique used to execute the original transfers:

It’s a thought-provoking read, given Ethereum’s growth since 2016, and the strong conviction shown by members of its community. While the authors of the account on the Ethereum Classic site acknowledge the two communities share the “same general ambition”, it’s clear that the split exposed an ideological rift. The Classic community believes the Ethereum Foundation used undue influence to achieve the hard fork in direct opposition to the values it purports to stand for. Whether the fork has left an indelible stain on the reputation of the Ethereum Foundation and the supporters of the move is debatable, but the event certainly has an immutable place in blockchain history. Author and Designer Bio trewkat is a writer, editor, and designer at BanklessDAO. She’s interested in learning about web3, with a particular focus on how best to communicate this knowledge to others. Editor Bio Hiro Kennelly is a writer, editor, and coordinator at BanklessDAO, an Associate at Bankless Consulting, and is now and forever a DAOpunk. BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence. This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains. Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here! More Like This The Byzantine Generals Problem, 51% Attacks, and Proof-of-Work by Jake and Stake Getting Smart About Smart Contract Vulnerabilities by Kornekt Betting It All On Ethereum by Alphadegen.eth |

Older messages

The Halfway Point | BanklessDAO Weekly Rollup

Saturday, October 21, 2023

Catch Up With What Happened This Week in BanklessDAO

DeSci Goes Bankless | State of the DAOs

Thursday, October 19, 2023

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

Understanding and Improving tlBANK Functionality | BanklessDAO Weekly Rollup

Thursday, October 19, 2023

Catch Up With What Happened This Week in BanklessDAO

Web3 Is Us | Bankless Publishing Recap

Thursday, October 19, 2023

Educational Web3 Content Shipped Directly to Your Inbox

Global Education in Action | BanklessDAO Weekly Rollup

Saturday, October 7, 2023

Catch Up With What Happened This Week in BanklessDAO

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏