The Generalist - Capital: Zavain Dar, GP at Dimension

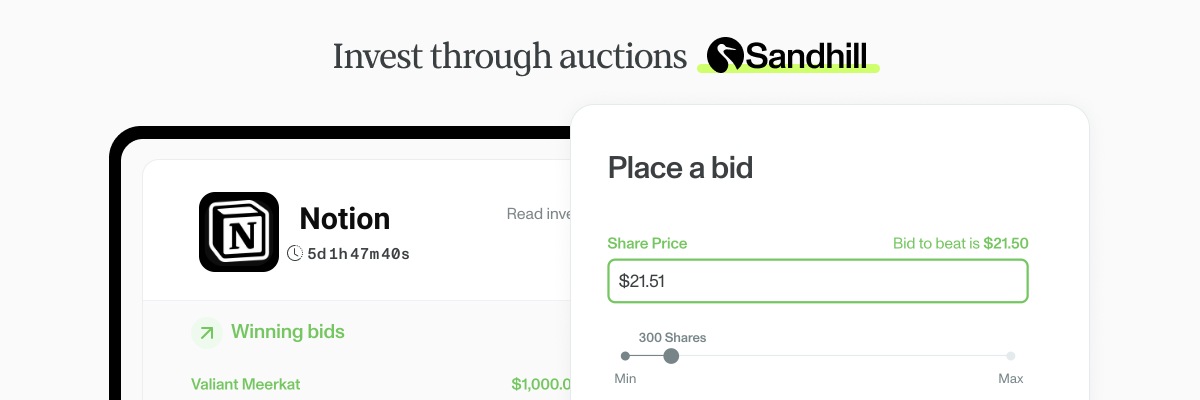

Friends, Part of the reason venture capital is such a compelling “game” is that there’s no right way to play it. Some firms succeed by taking an indexed approach, others by being selective. Some move quickly, sprinting to get a deal across the line, while others take their time. When a fresh pocket of heat emerges, many find it fruitful to chase after it while peers flee in the opposite direction. It is a game with no definitively right moves but many wrong ones. One in which the board moves, the players change, and conditions can shift from fair to treacherous. Although venture is a rich and varied sport, only some understand the intricacies of the differing strategies at work. You may see a firm’s name plastered across the news or spot their logo punctuating a startup’s website – yet know nothing of their strategy. How are they playing the game? And why have they chosen that method over the many others available? To answer those questions is not simply to sate one’s curiosity. It’s to understand how some of the most successful investors deliver exceptional returns to LPs, invest in innovation, and make their fortunes. For founders and investors (both current and future), grasping these dynamics has the potential to materially impact how you access and leverage capital. We’re kicking off a new mini-series to explore these ideas and give you clarity. It’s called “Capital.” In the coming months, we’ll share detailed tactical interviews with leading venture capitalists, both established and insurgent. How do different firms make decisions? How have they thought about portfolio construction? What do they do to protect against cognitive biases? And what is their source of investing edge? Below, you’ll find our inaugural edition featuring Zavain Dar, GP of Dimension Capital. For several reasons you’ll read about, Zavain is a fascinating starting point, sitting at the intersection of potent technological and scientific breakthroughs. His fund takes an opinionated and differentiated stance on the asset class. I hope you enjoy it. And if you’d like to see us do more editions of “Capital,” please send through a note! An ask: If you liked this piece, I’d be grateful if you’d consider tapping the ❤️ in the header above. This helps us understand which pieces you like most, and what we should do more of. Thank you! Brought to you by SandhillIPO season is back. Recent IPOs from companies like Instacart, Klaviyo, and Arm have opened the door to more startups going public in the coming months. Sandhill Markets opens up access for accredited individuals to invest in these institutional Pre-IPO deals like Stripe, Anthropic, Databricks and Epic Games. How does it work?

Bids for all of these start at $1. New auctions every week. This week's auction is Notion. Check auction prices here. Actionable insightsIf you only have a few minutes to spare, here’s what investors, operators, and founders should know about Zavain and Dimension’s approach to investing.

Venture capital can appear easy or hard, depending on your vantage. From one perspective, it’s a forgiving lark: a successful investor may only need to make one great investment out of fifty, provided that one is sufficiently world-bending. Few other professions make a virtue of a mere 2% hit rate. The Major League slugger that slumped to such a low would find themselves booted into retirement, while the slab-chinned hedge funder would be shunted into an elevator heaving a Bankers box. No other career allows you to be a rainmaker while creating such infrequent downpours. And yet, if it were easy, wouldn’t more people be better at it? Look at the averages, and the trickiness of the craft becomes clear. A comprehensive twenty-year study by Morgan Stanley strategists demonstrated that boring old public equities frequently outperform median VC funds; simply buying a Nasdaq index is a smarter, more profitable move than betting on a bottom-quartile fund. These are not the markers of a profession in which success arrives without sweat. It is entirely possible to devote yourself to this industry, to search and probe and bet and help for a couple of decades, and have nothing to show for your effort save a string of decaying logos. (And, helpfully, some management fees.) If venture investing is a difficult game after all, then investing in frontier technologies is playing on hard-mode. Not only does this adventurous capitalist have to search for extreme outliers like their peers, they must do so while battling fundamental scientific and technological risks. It’s exciting to back a company printing mammoth meat, designing tiny, blood-swimming robots, or a new defense against cancer, but doing so comes with added uncertainties. Is a startup’s approach even physically possible? When will we know? And how long will it take to commercialize? To succeed at this far-out edge of the asset class, an investor must have a dealmaker’s nose and an academic’s grip on the underlying science. Zavain Dar exemplifies the experience, curiosity, and intellectual honesty required to take on such a challenge. After receiving a Master’s in Computer Science from Stanford University, Zavain embarked on an impressive and admirably peripatetic career: working as an early employee at a startup that sold to Twitter, teaching a crypto class at his alma mater (in 2013, long before such a subject was en vogue), advising the Philadelphia 76er’s “moneyball” strategy, investing at Eric Schmidt’s Innovation Endeavors, rising to a general partner position at Lux, and co-founding Dimension Capital. The $350 million firm reflects its GP, combining scientific rigor with shrewd commercial instincts. Dimension’s ambition, rigor, and focus make it one of the most interesting emergent players in the ecosystem. It is a fitting choice for the first edition of “Capital,” a new interview series designed to dig into the details of a given investor. What is their fund’s approach? How does it create its edge? What heuristics do they use when evaluating founders? In today’s piece, we’ll explore these topics and many others, unpacking the difficulties and opportunities of investing at the frontier. Dimension’s strategyWhat do you see as Dimension’s edge?Fundamentally, we’ve designed the fund to capitalize on a specific, emerging opportunity: the growing interface of life sciences and technology – and the absence of capital serving it. Today, every life scientist at a top lab is well-versed in modern computing and artificial intelligence. They’re familiar with machine learning platforms like TensorFlow or PyTorch; they use software and data analytics to do their work. That wasn’t always the case. If you’d wandered down the halls of Stanford, Oxford, or MIT ten years ago, you wouldn’t have found many scientists who knew what a distributed system was or how to compile and run a sophisticated machine-learning model. Similarly, if you’d roamed around Microsoft’s R&D facilities, you probably wouldn’t have found many people thinking about biology or chemistry. Over the past decade, those two worlds – life sciences and tech – have started overlapping more and more. And yet, the capital market for those two disciplines remains very distinct. Firms either hunt for enterprise SaaS unicorns or back the next cure for Alzheimer’s – they don’t usually do both. Our intent with Dimension is to build a firm that speaks to and serves practitioners at both poles. By doing so, we hope to help rewrite the ecosystem’s value creation and capture measures. Why is investing at this intersection compelling?Historically, building companies in the life sciences has been extremely hard and capital-inefficient. The industry even has a name for it: “Eroom’s law,” which is “Moore’s law” spelled backward. While Gordon Moore’s dictum outlines accelerating technological progress, Eroom’s law describes the opposite. Specifically, it argues that drug discovery is becoming slower and more expensive over time despite progress elsewhere. For every incremental dollar spent trying to bring a new drug to market, the cost increases logarithmically. We believe that Eroom’s law can and will be broken. Life sciences companies built like software giants – emulating companies like Amazon and Netflix in their operational approaches – will create economies and efficiencies that we haven’t yet unlocked. Dimension focuses on investing in these companies. Not only do we think great innovations will come from this category of firms, we also think the rest of the market consistently undervalues them. The recent past provides a useful analogy. Between 2003 and 2008, the first cohort of SaaS companies, including modern-day giants like Salesforce, hit the public markets. Despite their radically different approach, this batch was consistently valued on the same milestones and benchmarks as their on-prem contemporaries. The result was a years-long gap where public market stakeholders weren’t sure what to make of them. That’s in spite of the fact that these firms were manifestly running and growing very differently. It took time for new economic metrics to be written for this type of enterprise. The folks that understood this mismatch – firms like Emergence Capital, for example – did exceptionally well. History is repeating itself in our sector. External market participants misunderstand the first cohort of public companies operating at the overlap between lab science and computation. There’s not yet a grasp on how these companies should be guided and built. As a firm, we see opportunity in that gap and have the conviction to underwrite for the future. How did you think about your fund size?We’re strong believers that your fund size is your strategy. So, before raising any capital, we spent a month together in New York, figuring out the right amount. Every day, Nan, Adam, and I would discuss where we were best strategically positioned to invest and how our fund size fit into our approach. We decided to focus on making a small number of mostly early-bets, with the latitude to make a few later-stage investments. Regardless of stage, we determined that every investment we made needed to be able to return multiples of the fund, with the far right tail performers hitting roughly $50 billion in enterprise value. We built a model to test our assumptions, think through our reserve strategy, and gauge what we needed to manage that portfolio over a decade. Through that process, we decided on a fund size of $300 million with a hard cap of $350 million. What we explicitly didn’t want to do was raise a fund just for the sake of it. We also didn’t want to pull in as much capital as possible. In the end, we were in the fortunate position of turning away money because taking in more would have forced us to change our strategy. Similarly, if we hadn’t been able to raise at least $225 million, I think we would have gone to our LPs and said, “Hey, look, we’re not hitting what we thought we would. The strategy we’re going to have to take is different from the one we pitched you on.” That would have been the intellectually honest thing to do. How do you think about portfolio construction?We are high-ownership and high-concentration investors. More often than not, we’re the largest equity owners on the cap table outside of the founding team. We aggressively double and triple down into our best-performing companies and expect most of the fund to be concentrated in the top positions. We’ll maintain sufficient reserves to invest in a company until (and sometimes through) an IPO. Because of that level of ownership, we’re also actively involved with the companies we back, occupying board seats. Beyond our approach to ownership and concentration, it’s worth saying that we have a flexible mandate. Although we focus on early-stage investments, we take a broad aperture. The current bear market has created unusual opportunities: spinouts from public companies, take privates, PIPEs, and public equities. We’re willing to assess these “special situations” because we believe in the strength of our thesis and see it play out across the continuum of a company’s lifecycle. It behooves us to be open to these opportunities – to know what companies are ready to be taken private and which players may have technological assets they aren’t sure what to do with. This flexibility is unique to Dimension – it’s not something our peers are comfortable with. How do you approach internal management?Walk into most firms on Sand Hill Road, and you can cut the political tension with a butter knife. That’s not to call out any single firm or individual; it’s just endemic in the asset class. Critically, that tension yields subpar experiences for entrepreneurs and degrades your decision-making. Our intent at Dimension is to forge a firm entirely devoid of that tension – one built on a culture of alignment, transparency, trust, and camaraderie. Because Nan, Adam, and I came up in the industry together and have known each other for so long, I think we feel confident in achieving that. Nan and I taught at Stanford together for four years and were roommates in Oakland. Adam and I met in 2014 and spent the better part of a decade as partners at Lux. Those experiences have created immense trust and respect between the three of us. It helps that the three of us are very different. We’re best friends and in each other’s pockets 24/7, but if you ask any of our entrepreneurs, they’d tell you that we’re wildly distinct people. That’s true on many levels: our demeanor, the questions we ask, how we guide internal debates. Those kinds of differences are additive to the firm. Generalist+If you’re obsessed with tech, venture capital, and the craft of investing: good news! Last week, we launched our brand new premium newsletter: Generalist+. Right now, we’re offering early bird pricing which means for just $19/month you’ll get access to the tactics, strategies, and wisdom of legendary investors and leading founders. Sign up today to lock in this discounted price: The life of a dealWhat does your sourcing process look like?First and foremost, we don’t spray and pray. We don’t do quotas. We’re not trying to find a certain number of potential investments every week so we can tick a box. To source the opportunities we’re most excited by, we do a few different things:

Ultimately, we focus on building a set of concentrated relationships. That allows us to guide people on the frontier of life sciences and technology, but selfishly, it allows them to guide us, too. That kind of relationship wouldn’t be possible if we were a spray and pray fund with hundreds of companies in our portfolio. How would you describe the team’s investing filters?Each of us has our own lens that we bring to the table. Nan, for instance, has a clarity of thought and cogency that is bar none of any investor I’ve ever met. While he’s highly competitive, you would never know it from the outside. He is not at all seduced by FOMO. He’s patient. He runs on his own timeline. His willingness to operate at his own pace allows him to make deductions and conduct diligence in a way that most investors find really, really difficult – especially over the last decade with the intense pressure to deploy quickly. Adam is supremely competitive and dialed into intel – a huge weapon for our portfolio. He also has the strongest scientific instincts I’ve ever seen. He’s just been right about scientific trends before they were obvious, over and over again. For example, in 2014, he founded a company called Kallyope to fight obesity by focusing on the gut-brain connection. Today, that company has multiple clinical molecules going after non-GLP-1 mechanisms and targets; essentially, they’ve identified contrarian methods to attack this issue and have made real progress against it. Adam’s done this several times, co-founding companies around cutting-edge scientific breakthroughs. What’s especially impressive to me is that these startups also show his eye for talent – he’s often partnered with up-and-coming professors and principal investigators (PIs) from “no-name” colleges that have gone on to become the top ten or fifteen researchers in their field. In short, Adam has an instinct for a true breakthrough and can triangulate what’s tractable on a venture timeline and budget. I don’t want to call it a black art, but none of it is spreadsheet-able. You’d have to ask the two of them what they think of me, but I’d say, computationally, I’ve been more right than wrong. And all three of us place a lot of emphasis on the entrepreneur. For firms in deeply technical disciplines, that’s rare. Speaking of founders, what traits do you look for?Creating a company with an enterprise value of $50 billion isn’t going to come from an incremental manager. It comes from a founder entrepreneur. In particular, I get excited by founders with the following traits:

Compared to these traits, analytical intelligence is less important – it’s more of a commodity. Which founders embody this archetype for you?A few come immediately to mind: Chris Gibson from Recursion, Viswa Colluru from Enveda, Cristóbal Valenzuela from Runway, Clém Delangue and Julien Chaumond from Hugging Face. The interesting thing is they’re all very different. There is a kind of je ne sais quoi about each of them – a sort of “when you know, you know” feeling that happens when you first meet them. You get the sense that there’s immense founder-company fit, and they’re doing what they’re meant to do. And, look, Dimension is highly technical and rigorous about our scientific underwriting. But you also need to solve for exceptional entrepreneurs tackling problems they’re built to take on. What does your diligence process look like?We’re detailed with the diligence we do – from multiple angles. Simon, our Research Director, is a critical part of that. As we talked about, his research team is on equal footing with the investing team and helps us make better decisions. When talking to a founder, we’ll incorporate insights and questions from the research team alongside our own. Ultimately, we’re high-touch with entrepreneurs and transparent about our questions. For example, we’re mid-flight with a founder right now. He’s fantastic – absolutely brilliant. And, to be honest, I don’t know if we’ll get there on the deal. But we’ve spent over ten hours with him across the team, and just this week, we sent over a doc with our open questions. It’s an example of the detailed, collaborative, and transparent process we like to run. How do you make decisions?When we were just starting Dimension, Nan, Adam, and I ran an analysis on all of our historical deals. It included sixty-plus deals over roughly a decade. We were somewhat surprised to discover that the best investments each of us made individually, the other two didn’t. That insight gave us the confidence to orient our decision-making around conviction rather than internal consensus. For a deal to make it across the line, only one of us has to believe in it. We think the most interesting and compelling decisions we’ve made are the ones that started with an absence of consensus. The landscapeWhat are the biggest mistakes you see investors make?Ultimately, an error of omission is the greatest mistake a venture investor can make. Easily. If you make bad investments and lose all your money, you’ve lost 1x. But if you miss out on a great investment, you could lose a 50x multiple of your fund. With errors of omission, I think investors often lean out when there’s real science or technology risk. Much of the industry is fairly incremental. Despite my focus on frontier tech, I notice this with myself, too. Whenever I’ve made a big mistake, it’s because I didn’t trust my excitement or deductions in the technological or scientific curves of progress. That resulted in misses. For example, I was friends with the founding team of OpenAI but didn’t think about an investment. There have also been times I’ve made an investment that has returned a fund but could have delivered even more if I’d leaned in with greater passion. The confidence to do that comes with time and experience. What “venture myth” should be debunked?I’m not sure if it’s a myth, but I think we’re seeing the type of person working as a VC scrutinized. Over the last decade, firms have hired a slew of people I would term “middle managers.” They’re closer to internal business development reps or product managers than investors. The incentives of the last run have elevated certain skill sets that now seem less valuable. How many Sand Hill Road firms have entire GP suites of people that built their reputation off of crypto or NFTs? Their LPs may now wonder, “Is there any real investing acumen here?” Where do you see the next big opportunities?I see opportunity in three broad categories:

PuzzlerRespond to this email for a hint.

Well played to Rohit K, Geoff N, Shashwat N, Jack B, Scott M, Rob N, and Jeffrey Y for answering our last riddle. As follows:

The answer? A radish. Until next time, Mario You're currently a free subscriber to The Generalist. For the full experience, upgrade your subscription. |

Older messages

Big news: Introducing Generalist+

Thursday, October 19, 2023

Today, we're unveiling our newest premium newsletter designed to make you a better investor.

What do venture capitalists do?

Thursday, October 5, 2023

A study from 1984 outlines the habits of Silicon Valley's capital class. How have they changed?

What to Watch in India

Thursday, September 28, 2023

Eight startups making waves in the world's most populous country.

A24: The Rise of a Cultural Conglomerate

Friday, September 22, 2023

The indie studio is behind some of Hollywood's biggest hits and critical darlings. It has designs on becoming media's answer to LVMH.

Modern Meditations: Rebecca Kaden (Union Square Ventures)

Sunday, September 17, 2023

The Union Square Ventures managing partner on stories, ancient structures, and technological salvation.

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏