Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #365

What's 🔥 in Enterprise IT/VC #365The new era in venture and race to be first: Inception Investing - what does it mean and why pre-seed ain't first any moreWow, that was lots of fun! I’ve been investing at the earliest stages of enterprise venture for 27 years and have been witnessing a sea change in early stage venture and in particular, what it truly means to be a founder’s first partner.

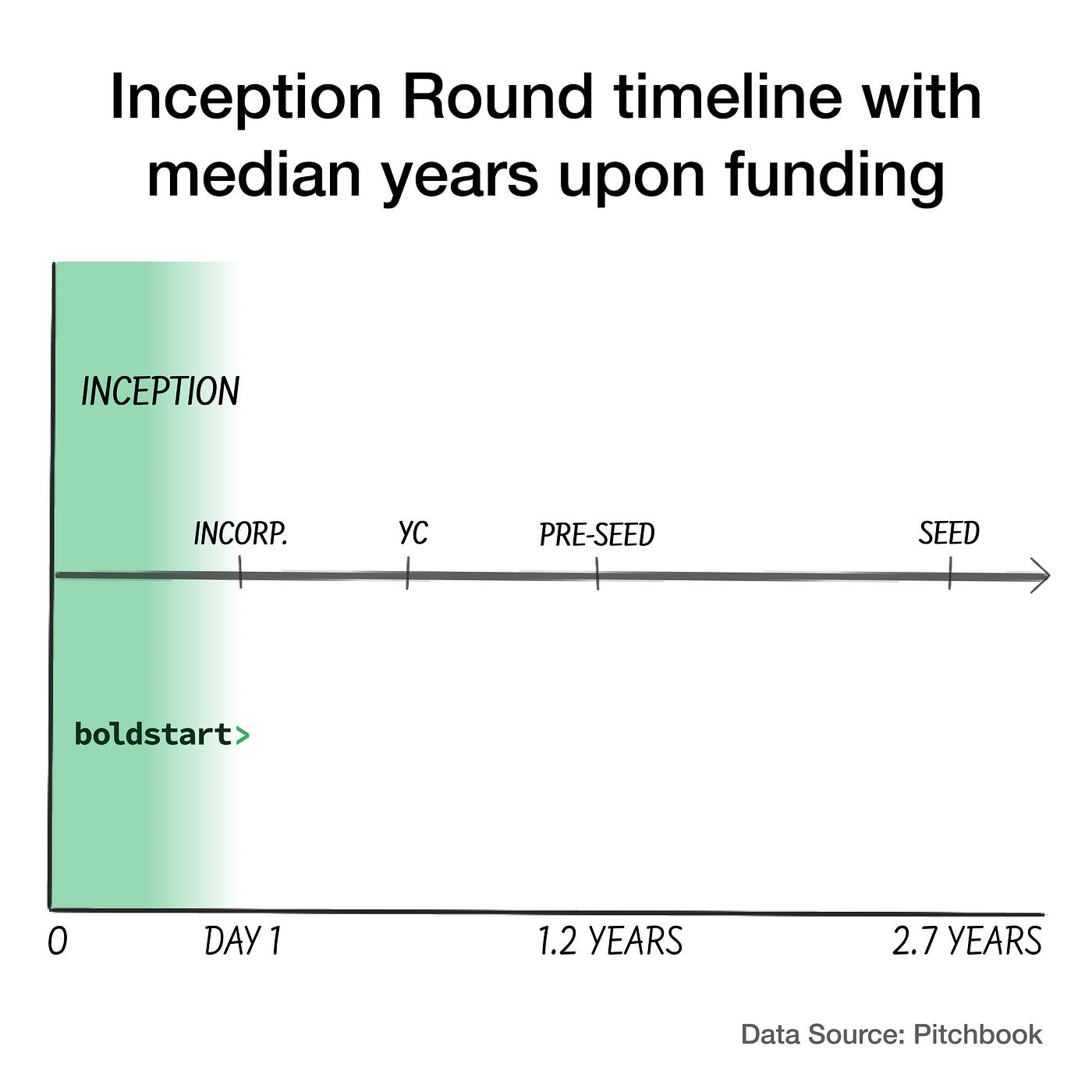

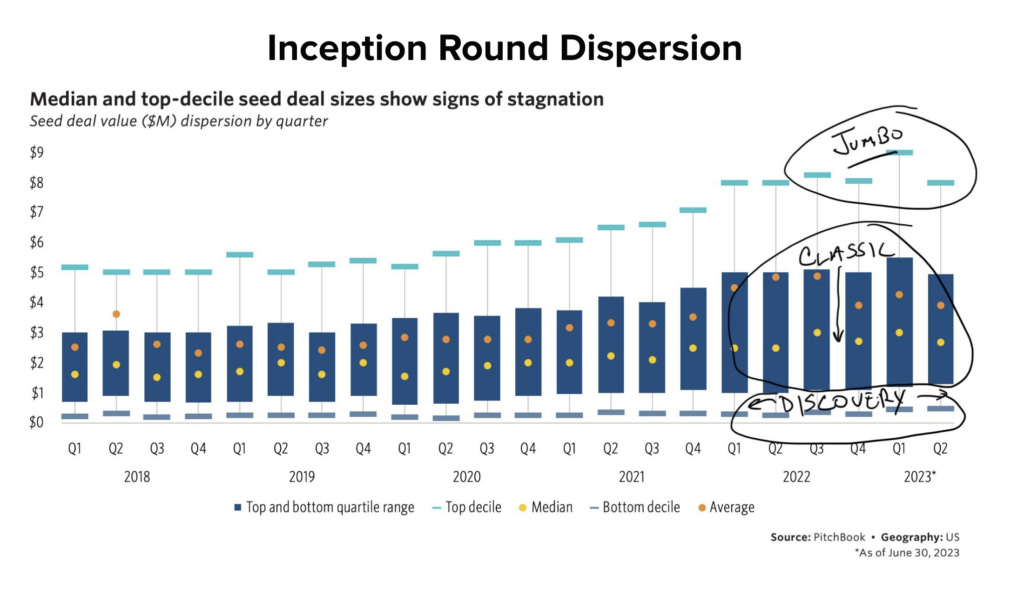

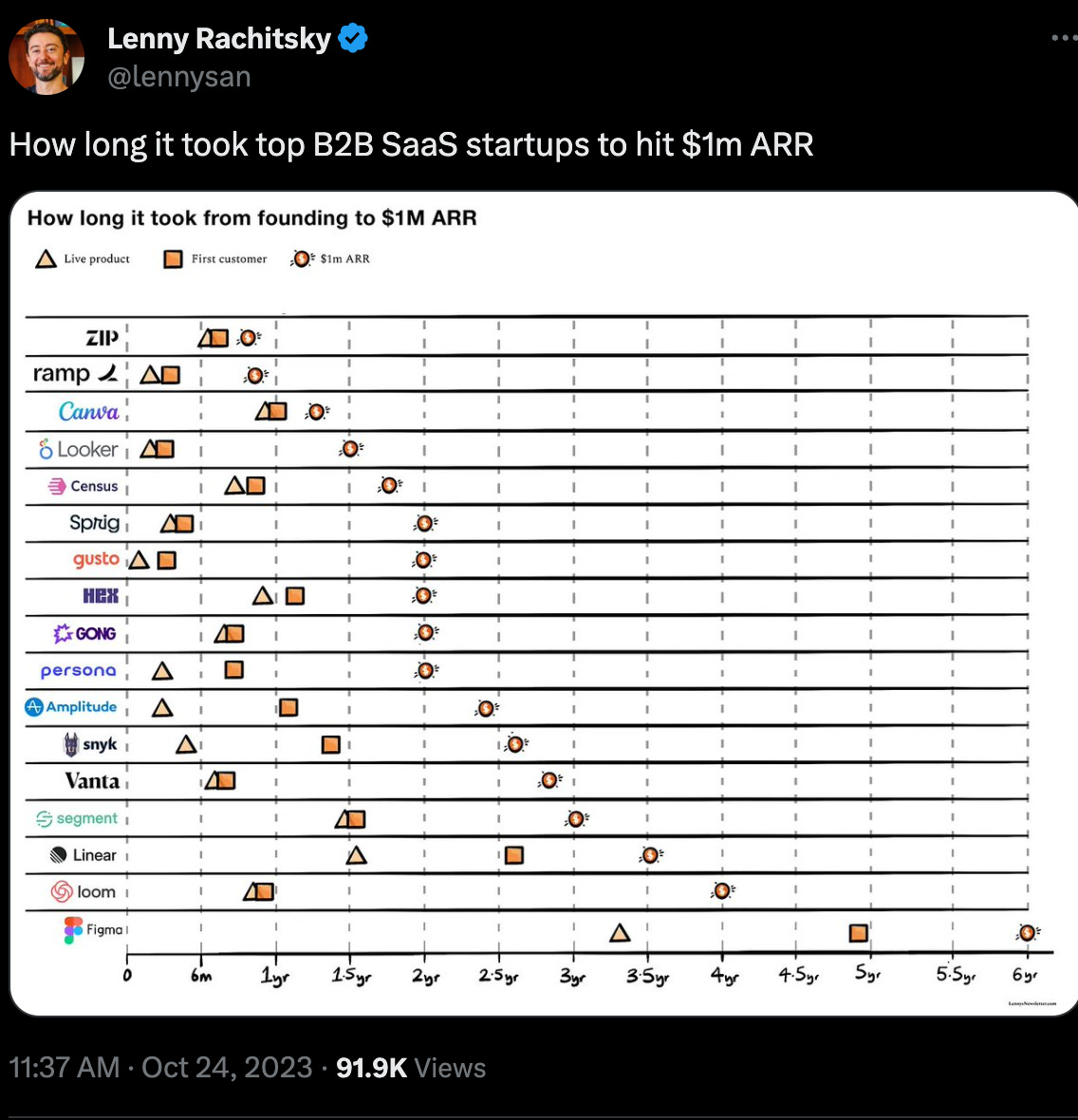

Harry did a masterful job challenging me in the interview and then breaking down the 7 lessons from the podcast in a 🧵 here in case you want the highlights. Inception investing is the most competitive area of VC at the moment which means in order to win one must compete with angels, pre-seed firms, seed funds, and multi-stage firms in the 3 types of rounds. For those who are unfamiliar with the dynamic I’m talking about, let’s discuss how we got here and what “Inception Investing” actually is. First, growth is mostly dead and many of the largest funds have pointed their 💰 war chests earlier and earlier because well, the pricing is much lower than buying into growth, and one can be relatively insulated from economic factors for the next 2 years while founders are in build mode. In addition, earning spots on cap tables as funds got larger and continued backing up the 🚚 in winners made it harder for later stage investors to get meaningful ownership. Hence the race to be first also encompasses the need to get pole position for the future. Looking at the data, pole position used to be Pre-Seed, but frankly Pitchbook says the median age of companies funded at Pre-Seed is now 1.2 years old. That’s really not the beginning. Also, I can’t with a straight face call a 3rd time founder building his/her 3rd company in same domain raising $10M at idea stage a pre-seed round. I mean what’s the next round for this founder, a seed round? In that scenario, Pre-Seed just doesn’t have the right connotation for a 3rd-time founder who can and will raise much more. Also would you call 2 founders raising $20M a pre-seed round? What, are they going to raise a $50M seed next? What’s needed is a new definition for what first is. Let’s call these “Inception Rounds”. “Inception Investing” means engaging with founders well before they incorporate, helping them battle test and iterate those ideas, helping them pre-sell some of the initial hires, and leading those rounds upon company formation so founders can run fast out of gates and not spend months trying to raise capital. It’s been happening for quite some time and is not constrained by any dollar amount. Here’s timeline showing where Inception Rounds really happen in green, and also the median age of companies upon raising rounds. This is not incubating, since that’s not scalable unless that is all you do like folks at Atomic who are great at it. This is pre-accelerator since, well, you have to be incorporated to join, and this is pre-Pre-Seed. There are 3 kinds of Inception rounds I regularly see: Discovery Rounds: <$2MThese are usually reserved for first-time founders who are exploring new sectors like WASM, who just need a bit of funding to hire their first few folks and iterate on some ideas. Discovery rounds typically graduate to a Classic or Jumbo round. This is the right size for a “Pre-Seed” fund, but it seems like many Pre-Seed firms still want a product before funding. Perhaps this is the byproduct of raising institutional capital? Classic Rounds: $3–5MA Classic round is generally for a first or second-time founder who usually can raise more but understands necessity is the mother of invention. They choose to be more constrained and lean to move faster, setting a lower bar for next round success. This is where most Seed firms play, but the median age for startups raising a Seed is 2.7 years — far from Inception stage. Jumbo Rounds: >$6MThese rounds are almost always for a seasoned repeat founder with a prior exit, building their next company. Many times, it can be iteration #2 or #3 of the same idea, reinventing an existing market with a huge TAM. When multi-stage firms meet founders and markets like this, they are ready to SUPERSIZE the Classic round. This is also known as the classic multi-stage, Billion Dollar Fund round. The race to be firstI ❤️ founders who prefer capital constraints, but sometimes you must also be able to do a few Jumbos for those special founders. This is the new race to be first — finding those special people, working with them well before incorporation, and arming them with capital to run fast. Founders who are thinking about starting companies need one place to go to avoid all this confusion of going to a Pre-Seed fund, Seed fund, multi-stage or whatever. They need someone who can iterate with them, give them the confidence to incorporate, and know that when they become a legal entity they have the right amount of capital they need to succeed from the beginning. They will also need to partner with a fund with the right size who is big enough to lead any of these rounds, but also small enough that they get 1:1 attention — which means firms with concentrated portfolios. This is happening across the board, especially as many $1B+ funds are creating programs to help founders start. But let’s face it — while it’s an amazing way for these firms to leverage brands built over decades, it’s really just a programmatic way to put option checks into lots of companies, and no great founder wants to be someone’s option. For better or worse, the cat’s out of bag: look at the dispersion of round sizes as firms from Pre-Seed, Seed, and $1B+ compete and in world of multiple compression. First is clearly the best place to be. This dispersion went from $300k-$5m in 2018 and almost doubled to $300k-$9M. This is not going back, and everyone must adapt! (I also posted on Twitter/X if interested in some of the comments/discussion) If you’re a technical founder thinking about starting a developer first, enterprise infra, or SaaS co, please do reach out. Also check out our resources page and our Dev First Founder Toolkit for how to accelerate your path on day 1 (first day of incorporation) to PMF. There are lots of nuances here but over the next couple of months I hope to share how to pick the right Inception Investor and how to start fast out of gates from Inception and upon funding at Incorporation. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

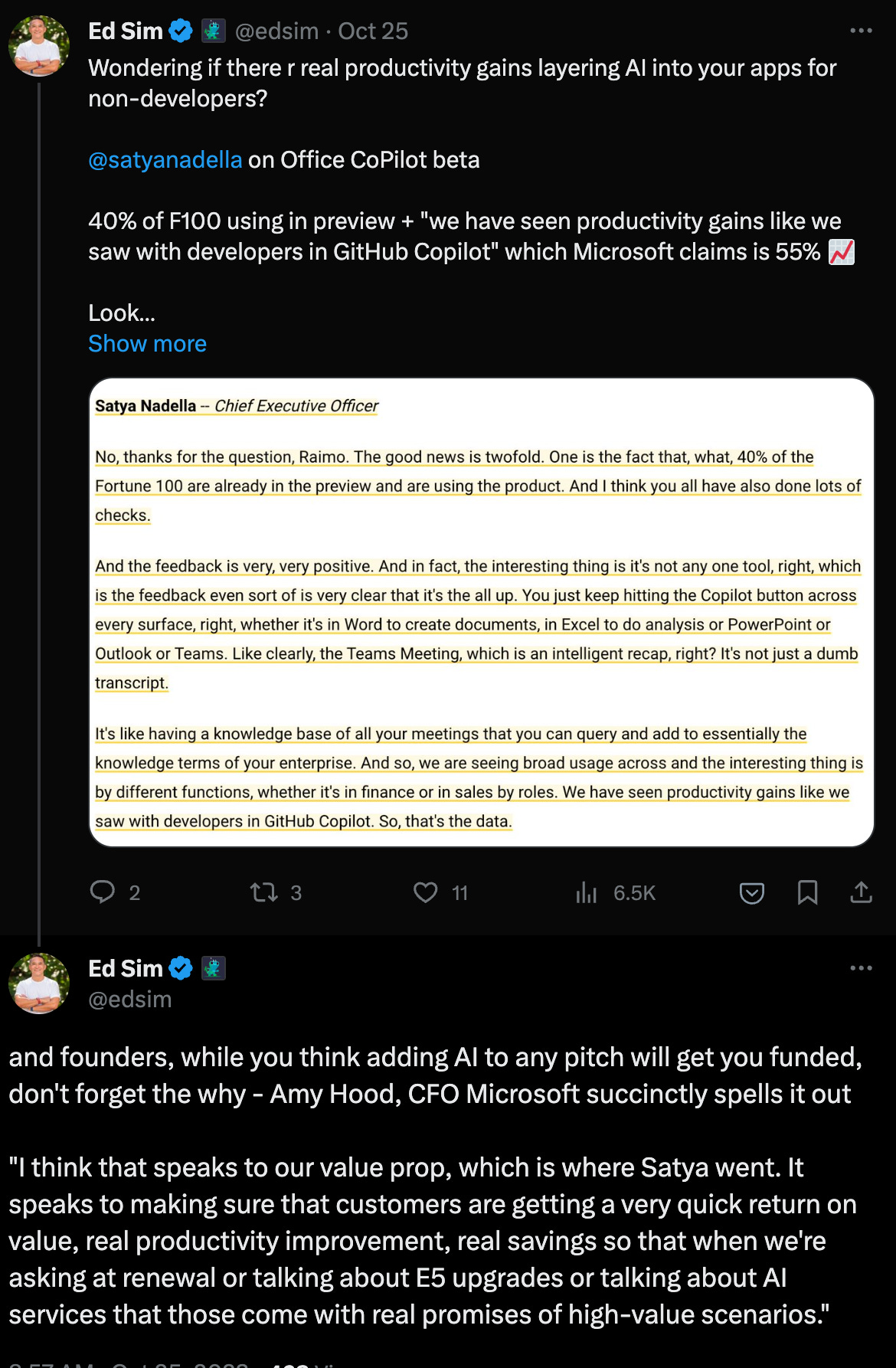

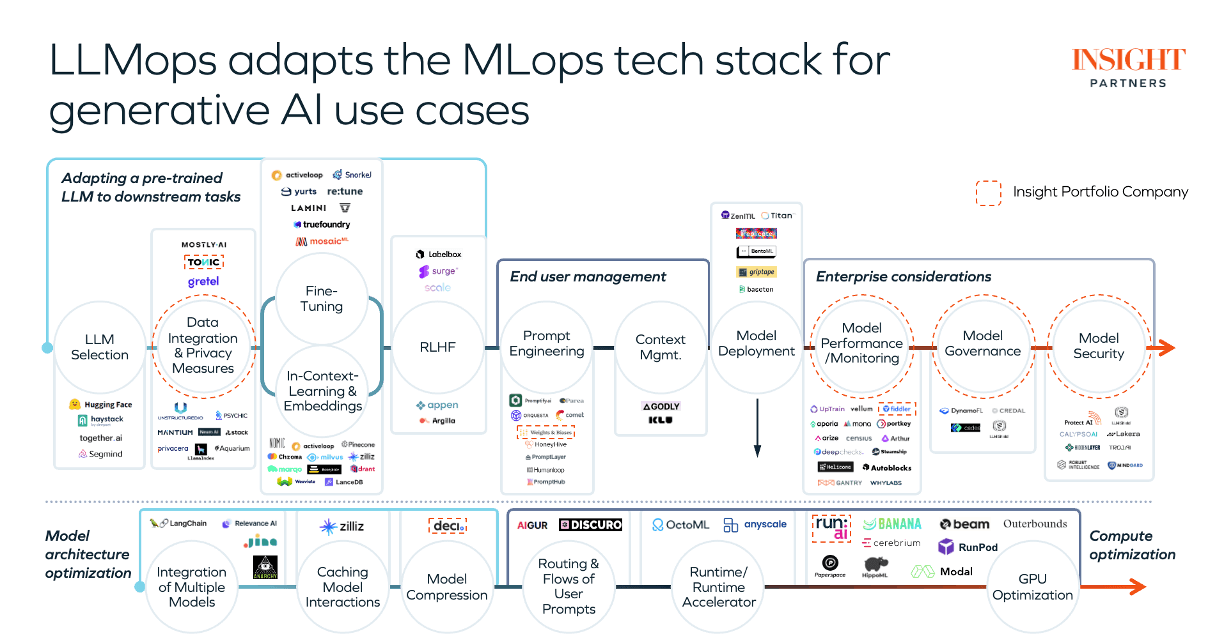

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #364

Saturday, October 21, 2023

🤯 Enterprise software spend to cross $1 Trillion, reaccelerating 📈 to 13.8% from 12.9%

What's 🔥 in Enterprise IT/VC #363

Thursday, October 19, 2023

Thoughts + 🙏🏼 on 🇮🇱 ... b4 regularly scheduled programming: Loom exit, seed valuations...

What's 🔥 in Enterprise IT/VC #362

Saturday, October 7, 2023

What's ahead in Q4 from LPs and VCs (Origins Podcast) - more shutdowns?, hard choices for seed funds?, net new company funding 🔥, default 1st 10 in office, TVPI vs. DPI

What's 🔥 in Enterprise IT/VC #361

Saturday, September 30, 2023

PLG, PLS, Sales led 🤯 - enough acronyms, build a product, sell it efficiently

What's 🔥 in Enterprise IT/VC #360

Saturday, September 23, 2023

IPOs, Splunk for $28B, mega funding rounds + M&A - are we back or is this just a mirage?

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏