Investors Are Dropping Bonds & Buying Bitcoin?

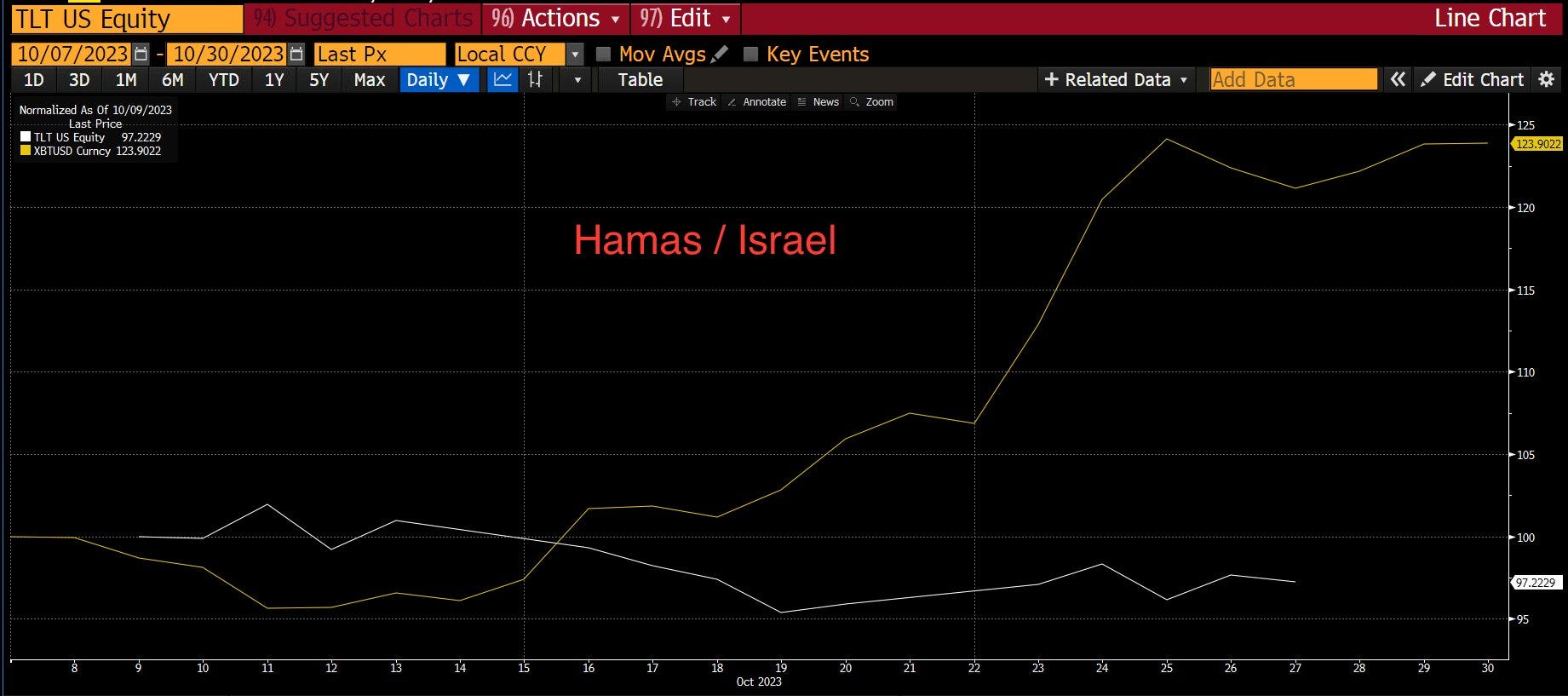

Today’s letter is brought to you by Trust & Will!Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy. Their mission is to make estate planning simple, affordable, and inclusive. All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements. To investors, The idea of safe haven assets is not new. These are assets that should retain or increase their value during times of uncertainty. Historically, US Treasuries have served as the ultimate safe haven because the bond came with a fixed rate of return if held to maturity and the only way you would not be paid back your principal is if the US government defaulted. Given the low likelihood of this situation, investors have been pouring capital into US Treasuries for decades whenever things got shaky in financial markets. But something weird has been happening over the last two years—US Treasuries are starting to lose their appeal as a safe haven asset. If this trend continues, it will force investors to recalibrate how they think about risk, safe havens, and capital allocation. For example, Arthur Hayes points out that TLT - the US Treasury ETF - is down approximately 16% since Russia invaded Ukraine and the same ETF is down about 3% since Hamas killed hundreds of civilians in Israel. US Treasuries being down in value weeks or months after these geopolitical events would not necessarily be noteworthy if all asset prices were down collectively. You could blame the macro market conditions, certain actions from the Federal Reserve, or claim that investors were spooked across the board. That is not what has happened though. At the same time that US Treasuries are falling in value during uncertainty, bitcoin continues to rise in value. These two assets have decoupled and investors appear to be treating bitcoin as the safe haven asset. In a way, investors are dumping bonds to buy bitcoin. Since the Russia/Ukraine conflict started, bitcoin has appreciated around 50%. Since the Hamas/Israel conflict started, bitcoin is up about 24%. Not only is bitcoin up materially on both time frames, but remember that bitcoin has appreciated at the same time that TLT has gone down. This development is surprising enough that people across the market are starting to verbalize their surprise. Mohamed El-Erian, the Chief Economic Adviser at Allianz, recently was on CNBC and said the following about US Treasuries losing their safe haven status:

El-Erian also pointed out that bitcoin and US equities appear to be the beneficiaries of this trend change, which each asset class becoming more of a safe haven in the minds of investors. In my opinion, US equities will always have a bid in the market. It goes back to the idea of Warren Buffett’s famous line: “Never bet against America.” Whether Buffett is right or wrong, an entire generation of investors are going to heed that advice. The more interesting conversation is around bitcoin. Why is a “risk asset” going up in value during times of uncertainty and tight monetary policy? The simple answer is that investors are starting to recognize that bitcoin is not a risk asset at all. In fact, these professional investors are actually warming up to the idea that bitcoin is the ultimate safe haven asset. As I wrote in March 2021, bitcoin already proved to be the best safe haven asset coming through the first 12 months of the pandemic crisis. But many people, including some of the smartest investors in the market, brushed this price performance off as an anomaly. It is getting harder to do that with each passing day. Take Blackrock CEO Larry Fink as the prime example. He previously said bitcoin was an “index of money laundering,” but has changed his tune in recent months and recently stated that bitcoin was a flight to quality. Fink is not an insane anon on the internet. He is the leader of the world’s largest money manger. So why is Larry Fink and the rest of the financial industry waking up to bitcoin’s role as the ultimate safe haven asset? Bitcoin provides certainty and predictability regardless of what is happening in the world. Whether there is peace or war, and whether we are in loose or tight monetary regimes, bitcoin will continue to produce 900 bitcoin per day until the next halving. At that point, bitcoin will produce 450 bitcoin per day for the next ~ 4 years. This level of predictability is foreign to financial markets because the legacy system has become a reactive cesspool of guessing and human error. On top of the certainty that bitcoin provides through its monetary policy, the decentralized protocol also allows anyone to audit the system at any time. This real-time audibility is increasing in importance as financial markets become more uncertain. If I asked you to confirm how much money has been printed by any central bank in the last 24 months, how would you do it with 100% confidence? You can’t. Drop bonds, buy bitcoin. This was previously something that was parroted by the hardcore bitcoin community, but it appears to have permeated into traditional finance and the global financial market. These large financial institutions, coupled with pensions/endowments/foundations, hold trillions of dollars in bonds. If that capital was to flow in a different direction, it would be catastrophic for the United States and an asset like bitcoin would have to re-price at substantially higher levels. The Editorial Board at the Financial Times recently wrote about the decreasing interest in bonds:

Let’s not get ahead of ourselves though. Ultimately, assets benefit or suffer from a confidence game. Capital flows suggest investors are decreasing their trust in Treasuries and increasing their trust in bitcoin. This phenomenon will be worth watching over the coming years. It could mark one of the most significant changes to financial markets in the last few decades. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin. Will Clemente is the co-founder of Reflexivity Research. In this conversation, we talk about bitcoin, why the price has gone up, ETF speculation, various metrics, bitcoin halving, and more. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here Will Clemente Breaks Down Data Suggesting Bitcoin Bear Market Is Over Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Millions Finally Realize Bitcoin Is Certainty In A World Of Chaos

Tuesday, October 24, 2023

Listen now (7 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

US Consumers Are Economic Punching Bags

Monday, October 23, 2023

Listen now (4 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

Podcast app setup

Friday, October 20, 2023

Open this on your phone and click the button below: Add to podcast app

The National Debt Should Fear A Recession

Thursday, October 19, 2023

Listen now (5 mins) | Today's letter is brought to you by Sidebar! Ready to accelerate your career? As we all know, navigating a big career transition is hard to do. It's one thing to set a

Will We See Interest Rates Cut Aggressively Soon?

Thursday, October 19, 2023

Listen now (4 mins) | Today's letter is brought to you by Trust & Will! Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these