In-Depth Analysis of USDV: A Community-Driven New RWA Stablecoin

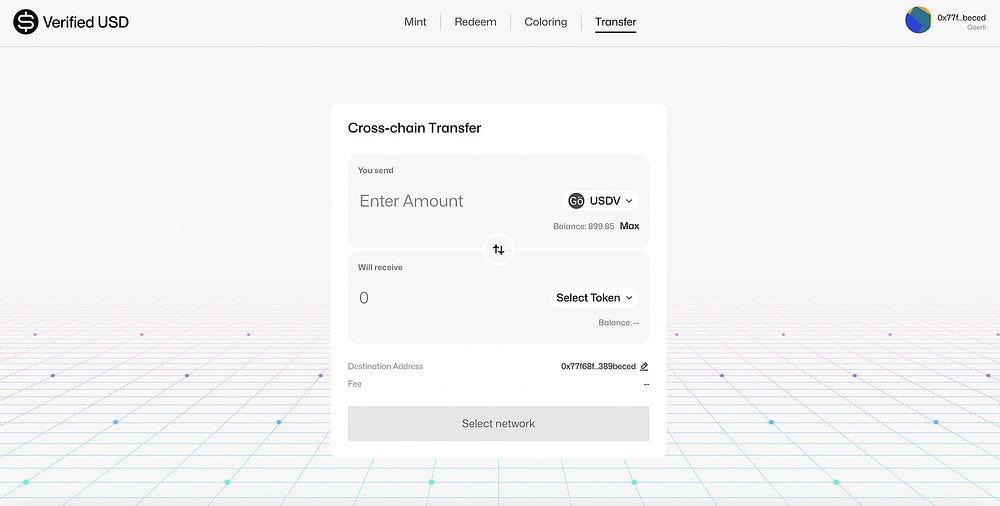

Author: Wade Stablecoins are the “crown jewels” of the crypto industry. How will the new stablecoin USDV, issued by the Verified USD Foundation, impact the industry? Can it stand out among the many contenders vying for the crown? Data shows that the current market capitalization of stablecoins has reached $125.1 billion, accounting for 8.7% of the total cryptocurrency market cap. However, the industry has not had smooth sailing, experiencing events such as the collapse of UST since 2022, a brief depegging of USDC, and strict regulation of BUSD and PYUSD. While the market’s demand for stablecoins continues to grow, so do the requirements for their stability and transparency. At the same time, the industry lacks an on-chain algorithm capable of tracking token demand generated by CeFi or DeFi applications, leaving stablecoin projects unable to fairly reward those who generate demand and contribute to the ecosystem. To address this issue, USDV, launched by the Verified USD Foundation, opts for a solution that tracks token demand and rewards ecosystem contributors. Introduction to USDV USDV is a community-driven stablecoin backed by U.S. short-term Treasury bill tokens as reserve assets, introduced by the non-profit Verified USD Foundation. It is also a native all-chain stablecoin using the ERC-20 standard, integrated with the LayerZero universal fungible token (OFT) standard. Its reserve asset is the STBT, a tokenized RWA issued by Matrixport Group under the Matrixdock brand, and is the second-largest short-term U.S. Treasury bill token on the Ethereum blockchain. According to official sources, STBT was chosen as the reserve asset for USDV for several reasons, including its “risk-free” nature, flexibility in redemption, stability, and high transparency. STBT is an ERC-1400 standard token, issued and redeemed by Matrixdock, and its transfer and trading are restricted to authorized account holders through a contract whitelist mechanism. In terms of minting and redemption, eligible USDV minters can deposit K STBT into the Vault contract and receive K USDV_X from a designated recipient account. For redemption, the minter deposits K USDV_X into the official USDV website, and the corresponding amount of STBT is unlocked. Features and Advantages As mentioned earlier, to address the issue of unfairly rewarding contributors who generate demand and contribute to the ecosystem, USDV uses the ColorTrace algorithm, an innovative value attribution mechanism created by LayerZero Labs. This mechanism allows verified community contributors to securely and transparently earn rewards from on-chain reserve assets through blockchain technology. It aims to reward those who make efforts in promoting the widespread adoption of USDV while allowing USDV to circulate freely as a fungible token within the ecosystem. The entire process is conducted transparently on the blockchain through USDV’s smart contracts. This system revitalizes the traditional stablecoin domain by rewarding contributors in the ecosystem, expanding and innovating use cases, and addressing the issue of insufficient incentives for participants. Besides its unique value attribution mechanism, USDV’s characteristics are also reflected in the following aspects: 1. Asset Security USDV ensures a high level of security by using STBT (short-term U.S. Treasury bill tokens) as its reserve asset. STBT also achieves bankruptcy isolation through the structure of a special purpose orphan entity reducing counterparty risk; STBT holders have the first priority in the liquidation of the physical asset pool. Even in the most extreme cases, such as Matrixport’s bankruptcy, the value of STBT is still guaranteed by the asset pool, and the corresponding assets can be redeemed after liquidating these securities. USDV is issued on-chain by the non-profit Verified USD Foundation, which holds legal ownership of all reserve assets. The value of the reserve assets will always be equal to or greater than the USDV in circulation. 2. Price Stability USDV’s price stability is achieved in two ways: first, users can always exchange USDV and STBT at a 1:1 ratio. Since STBT is pegged 1:1 with the US dollar, USDV is not subject to market pricing risks. As the initial reserve asset, STBT, entirely composed of highly liquid short-term U.S. Treasury bills and reverse repurchase agreements, ensures quick liquidation in times of liquidity demand. Considering the potential value decline of these bonds in extreme situations, the value of STBT could be affected. USDV will add more short-term safe reserve assets to maintain or increase the liquidity of the underlying reserve assets, thereby avoiding depegging. 3. Real-Time On-Chain Transparency Compared to centralized stablecoins, which publish their reserve assets monthly or quarterly, USDV’s reserve assets can be verified at any time. The minting nodes corresponding to STBT can be found on the official STBT website, ensuring asset transparency and the sovereignty of corresponding minters. In contrast, centralized stablecoins are limited in transparency, as their reserve verification often relies on third-party audits, leading to information delays and a lack of transparency. 4. Attracting Traditional Monetary Investors USDV is more attractive to traditional financial investors seeking low-risk investment opportunities due to its asset stability, transparency, and regulatory compliance. Particularly, the STBT mechanism behind USDV creates a direct link with traditional financial markets. This design not only lowers the entry barrier but also boosts the confidence of traditional investors in the cryptocurrency market. 5. Accessibility and Compatibility USDV’s ERC-20 standard ensures compatibility with a wide range of blockchain ecosystems, including various decentralized applications (DApps) and exchanges. Upon release, it will be usable on Ethereum, BSC, Avalanche, Arbitrum, and Optimism, with the technical capability to interoperate across over 40 L1 and L2 chains, and will continue to expand. Additionally, USDV complies with LayerZero’s OFT standard. Compared to traditional wrapped assets for cross-chain or using centralized exchanges for cross-chain, this standard ensures that USDV can bridge between different chains without liquidity concerns, making it safer, more efficient, and more user-friendly. This wide accessibility and compatibility make USDV highly accessible on multiple platforms and applications, providing convenience to users. Can transfer USDV between different chains on the USDV transfer page. 6. Community-Driven Ecosystem USDV emphasizes community participation and the joint construction of the ecosystem. Through reward mechanisms and open development strategies, USDV encourages community members to participate in building and maintaining the ecosystem. Community contributors have more freedom to maintain and develop the ecosystem, achieving a win-win for both contributors and USDV users. USDV’s fair and open reward distribution mechanism will also attract more community contributors and applications, forming a positive flywheel for the USDV ecosystem. This community-driven approach, compared to some other centralized stablecoins, may more easily stimulate the vitality and creativity of the community. The naturally growing ecosystem model is also an innovation in the current stablecoin industry development. Conclusion In terms of security, USDV has set up three safeguards to ensure the stability and safety of its assets. Firstly, it uses tokenized “risk-free” U.S. short-term Treasury bills and repurchase agreements as its underlying asset reserves, ensuring the stability of its assets. Secondly, by maintaining a 1:1 exchange ratio between USDV and STBT and dynamically adjusting the total supply of STBT and total net asset value daily, additional safe reserve assets can be added apart from STBT, ensuring the price stability of USDV even in the rare extreme cases of sharp fluctuations in U.S. Treasury bill prices. Lastly, the design of STBT and USDV through a special purpose orphan entity minimizes counterparty risk, ensuring the legal ownership and priority liquidation rights of USDV holders over USDV reserve assets. In terms of transparency, real-timeasset proofs and on-chain records provided by Chainlink ensure high transparency of assets, avoiding information delays. In terms of usability, USDV complies with ERC-20 and OFT standards, being immediately usable on major public chains upon launch, with the technical capability to interoperate across over 40 L1 and L2 chains, and is expected to have high usage scenarios in various DeFi projects, mainstream exchanges, wallets, OTC traders, etc. Additionally, USDV’s community incentive and value attribution mechanisms will promote and encourage more participants to engage in ecosystem construction and maintenance. This community-driven ecosystem will further enhance its attractiveness. Although there are many stablecoin issuers currently, considering USDV’s advantages in asset security, price stability, high transparency, and community-driven mechanisms, USDV’s ecosystem layout and application may gain a certain advantage. Whether it can grow and develop further will depend on more breakthroughs in application scenarios. References: 1、 https://etherscan.io/token/0x530824da86689c9c17cdc2871ff29b058345b44a 2、https://matrixdock.gitbook.io/matrixdock-docs/ 3、https://stbt.matrixdock.com/ 4、https://platform.arkhamintelligence.com/explorer/token/short-term-t-bill-token 5、 https://defillama.com/stablecoins 6、 https://docs.usdv.money/docs/what-is-usdv/faq 7、 https://twitter.com/USDV_Money/followers_you_follow Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

CEX Data in Oct, volume increased by over 40%, while traffic increased by 16%

Monday, November 13, 2023

According to statistics gathered by the WuBlockchain: For October, the spot trading volume of major exchanges rose by 57.5% month-on-month, hitting a new high since April of this year. The top three in

Asia's weekly TOP10 crypto news (Nov 6 to Nov 12)

Sunday, November 12, 2023

Author:0xMingyue Editor:Colin Wu 1. SBI to Launch ¥100 Billion Yen Fund for Investment in Web3 and Emerging Companies link On November 9th, according to CoinPost citing Nikkei News, the Japanese

Weekly Project Updates: Ordinals Gain Momentum, Starknet Forms DeFi Committee, Ava Labs Conducts Large-Scale Layof…

Saturday, November 11, 2023

1. Bitcoin On-Chain Inscriptions Sentiment Heats Up a. November 7th Bitcoin Ordinals Market Sees Trading Volume Surpass $15.3 Million link According to the @domodata data panel, on November 7th, the

WuBlockchain Weekly: BlackRock Submits Application for Ethereum Spot ETF, Binance Launches Web3 Wallet, Poloniex F…

Friday, November 10, 2023

0. Breaking News: Poloniex Exchange Owned by Justin Sun Attacked link On November 10th, according to Peckshield monitoring, Poloniex exchange, owned by Justin Sun, was suspected of being hacked, with

A Quick Look at the 11 Projects in the First Batch of the Elite Accelerator SpringX

Thursday, November 9, 2023

During the four weeks of the first announcement of SpringX, a total of 243 valid applications from global entrepreneurs were received. Among them, 74 projects passed the initial screening by three fund

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏