Earnings+More - Billion-dollar babies

This month’s issue of Deal Talk is devoted to the market leaders in the US sports-betting and iCasino space and asks the question: to what extent does the fact of DraftKings and FanDuel moving towards profitability change the nature of the market?

You've got the world but baby, at what price? The turning pointA hugely significant moment has been reached in the development of the US sports-betting and iCasino market. Wall of money: The tilt toward profitability in the US market has finally arrived and confidence levels in the predictions for what this means for the market leaders in particular are increasing, not least within the companies themselves.

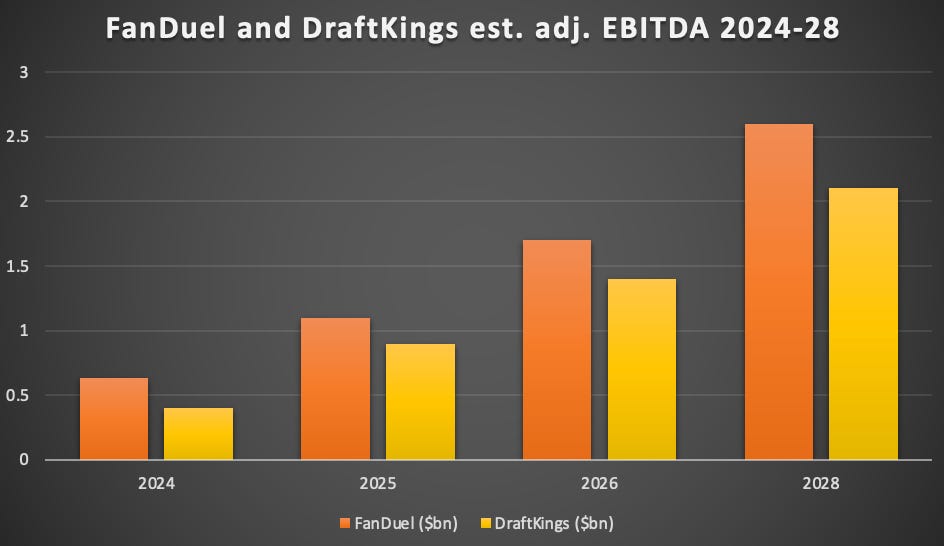

Finger in the air: Analysts who follow Flutter are yet to forecast FanDuel beyond 2025. But, using the crude measure of the percentage increases at DraftKings, E+M has filled in the gaps for 2026 and 2028 at ~$1.7bn and $2.6bn respectively. 🤑 FanDuel and DraftKings makin’ bones Weighing machine: For all the short-termism that comes with assessing quarterly earnings statements and monthly state-by-state data, there is an emerging sense of clarity over the profits that will soon be produced by the top two in the market.

Overs/unders: Similarly, last week’s investor event saw the analysts praising what the team at Macquarie said was the “stronger profit story” being told by the company. Moreover, given DraftKings’ record of under-promising and over-delivery, the forecasts are likely on the conservative side.

Unveiling the Costly Truth: Half of Your Sports Betting Campaign Budget Is Lost to Advertising Fraud. In the high-stakes arena of sports betting, a startling reality looms…. Up to 50% of your digital marketing investment could be vanishing into thin air due to invalid traffic and advertising fraud, never translating into valuable customer conversions. Across the industry, marketing teams are hemorrhaging millions due to the absence of robust ad fraud measures. TrafficGuard stands at the forefront, collaborating with over 30 top-tier sports betting and iGaming companies, addressing the budget-draining scourge of bots, bonus abuse, and invalid clicks head-on. Discover how TrafficGuard is reshaping the game for sports betting enterprises: Learn More: https://www.trafficguard.ai/protect/industry/sports-betting Tipping the scalesSweeney Todd: The scale of the success of FanDuel and DraftKings is already having an effect on the rest of the market and that will be amplified in the next few years. Analysts at Regulus noted recently that, while the path for a challenger “looks credible”, with the top two fighting hard for top spot the market is likely to go through “an even more competitive phase”.

Wave of mutilation: The next “wave of competition”, to use DraftKIngs CEO Jason Robins’ words, comes from ESPN Bet, Fanatics and, to an extent, bet365. As the team at EKG wrote last week, these names come with “scale ambitions, deep war chests, competitive product and increasingly sophisticated operations”. Spend, spend spend: But it is already clear that FanDuel and DraftKings have the means to spend as much as, if not more than, each other and all of the competition should they so desire. “They are both definitely set up for success domestically,” says Josh Swissman, managing director at GMA Consulting. “They can reinvest more than their competitors in their product and offering.”

Yet, even with the likelihood that each of the market leaders will be using some of their excess profits to throw their weight around in the market, that won’t account for all of the cash flow each will be generating. Here, their options over what to do next differ. The options…… for FanDuelHand on delever: Hoarding cash might not be an option for FanDuel. It has to answer to its parent Flutter, which has net debt of ~£2.8bn and might look to use some of the proceeds from FanDuel’s success to pay an element of that down. “The shareholders will be delighted to see the cash come through and deleverage the balance sheet,” says one investment source. When two become one: But complicating matters for the company is the looming US dual listing, due to be completed in Q124. The aim of the move is to broaden the US investor base and, thereby, to also achieve a better valuation within the whole for the US operation.

… for DraftKingsBrass in pocket: On the investor event call, CFO Jason Park said DraftKings would be exiting this year with “north of” $1.2bn of cash and on the Q3 earnings call a week earlier, one of the analysts asked a question that “just has never come up until now”, namely what the company planned to do with its growing cash resources.

Split opinion: Sources are split on whether buybacks will be a route DraftKings explores soon. “I do not expect either DK or FD to return cash to shareholders in the next year or two,” said one investment advisor. “I would guess they have investment opportunities with high enough return expectations that make more sense.”

Burning ambition: An option that DraftKings and its ambitious CEO and top management team are likely to pursue is M&A and, given the share price performance this year, this could be sooner rather than later. “The shine has come back,” says one investment adviser. “Jason [Robins] for sure is going to try and do deals [now] he can raise capital again.” 🔥 DraftKings has enjoyed a stellar share price performance in 2023 Vote of confidence: The performance is important not only because it shows investor faith in the prospects for what remains the leading pure-play listed online gaming entity has returned. It also signals that DraftKings can once again contemplate using its re-energised paper in any prospective transaction.

But sources also believe it is likely DraftKings will look internationally for significant enough deals. “Thirty-eight states on the geography slide of the investor deck is great but putting a few stars on international markets is what analysts are going to want to see in the coming years,” says Williams.

Over the horizon: Further afield, Europe would be the obvious next stopping-off point. The recent news story with regard to DraftKings being in some way interested in 888 – at the time of what turned out to be the farrago surrounding the FS Gaming bid to install Kenny Alexander as CEO – were dismissed by one source as being nothing more than “a chat that would have gone nowhere”.

Be quiet, Mt. Heart Attack: There are plenty of other options and with the potential of there being very little competition, with Entain having sworn off bolt-on acquisitions and Flutter likely to be busy with its corporate re-housing. Names mentioned include the CVC-owned Tipico in Germany, Superbet (if the company opted to sell instead of seek a listing) and the Blackstone-owned Cirsa.

Propus Partners is a consultancy business specialising in sports betting with a specific focus on trading, trading technology, product, operations and the supplier marketplace. Since launch in 2017, Propus has worked with clients across five continents, including operators, platforms, feed providers, regulators, data rights holders and sporting organisations. The month in transactionsMars attacks: The biggest deal of the month came with Lottomatica’s winning bid for SKS365, which values the target at €639m. The Italian-facing operator had been the subject of a bidding battle, with Playtech (publically) and Flutter (rumored) among the parties vying to snap up the company behind the PlanetWin365 brand.

Affiliate dealsMaking a play: Needle-moving M&A is taking place in the gaming affiliate sector and, naturally, it was sector leader Better Collective that once more led the way with its €176m cash-and-shares deal for Toronto-listed sports media and gaming affiliate business Playmaker Capital.

Get your rocks off: The next day GiG snapped up KaFe Rocks for a total of €15m upfront, with a further €20m to be paid in four installments over the next two years with an earnout element included. KaFe Rocks is expected to generate revenues of €23m in 2024 and an adj. EBITDA margin of 45%, equating to ~€10.4m and giving the deal a multiple of ~3.6x. Shedding: Meanwhile, in news this morning, Catena Media continued the offloading of its European baggage with the sale of its Italy-facing online sports-betting and iCasino assets for €19.8m to two separate buyers.

Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Rumors swirl over PointsBet bid

Monday, November 20, 2023

Takeover rumors, New Jersey October, Vegas GP, Flutter fundamentals, startup focus – Comparasino +More

ESPN Bet’s ‘extremely strong start’

Friday, November 17, 2023

ESPN's first day, Affiliate futures, DraftKings reaction, earnings in brief +More

Robins: ‘Biggest challenge is not to mess up’

Tuesday, November 14, 2023

DraftKings profit projection, Genius' vision thing, Endeavor's OpenBet boost + More.

FanDuel flexes New York muscles

Monday, November 13, 2023

November data, the week ahead – DK and ESPN Bet, analyst takes – slots, startup focus – BetComply +More

Snowden: ESPN Bet ‘opportunity of the century’

Friday, November 10, 2023

Snowden at ESPN Edge, Wynn Macau bounce, Super Group earnings, MGM analyst reaction +More

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these